- United Kingdom

- /

- Electrical

- /

- AIM:PHE

Top UK Penny Stocks To Consider In October 2024

Reviewed by Simply Wall St

Over the past 7 days, the UK market has dropped 1.4%, but it has risen by 12% over the last year, with earnings forecast to grow by 14% annually. In such a climate, identifying stocks with strong financials and growth potential is key for investors looking to capitalize on emerging opportunities. Penny stocks, though considered a somewhat outdated term, still represent an intriguing investment area where smaller or newer companies can offer significant value and growth prospects when backed by sound financial health.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| FRP Advisory Group (AIM:FRP) | £1.235 | £307.76M | ★★★★★★ |

| Tristel (AIM:TSTL) | £4.00 | £183.45M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.11 | £794.96M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.065 | £405.78M | ★★★★☆☆ |

| Polar Capital Holdings (AIM:POLR) | £5.06 | £477.11M | ★★★★★★ |

| Supreme (AIM:SUP) | £1.515 | £170.25M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.488 | £229.49M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.54 | £196.12M | ★★★★★☆ |

| Impax Asset Management Group (AIM:IPX) | £3.865 | £468.35M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.4225 | £121.47M | ★★★★★★ |

Click here to see the full list of 471 stocks from our UK Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Litigation Capital Management (AIM:LIT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Litigation Capital Management Limited offers dispute finance and risk management services in Australia and the United Kingdom, with a market cap of £128.61 million.

Operations: The company's revenue is divided between its Group’s Fund Structures, generating A$51.42 million, and its Litigation Capital Management operations, contributing A$47.95 million.

Market Cap: £128.61M

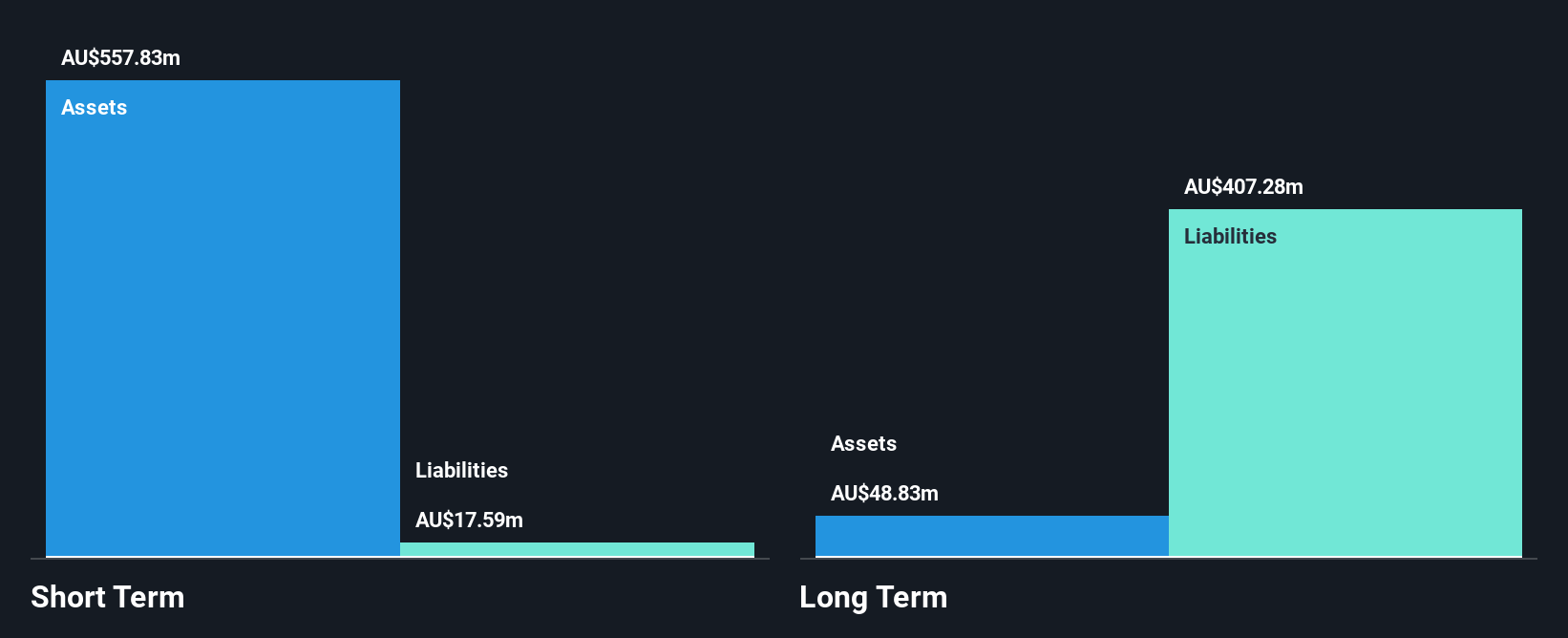

Litigation Capital Management Limited, with a market cap of £128.61 million, has shown mixed performance as a penny stock. Despite having strong short-term assets (A$548.3M) that cover both its short and long-term liabilities, the company experienced a significant drop in earnings growth over the past year (-59.6%). Revenue for the full year ended June 30, 2024, was A$50.99 million compared to A$72.78 million previously, reflecting challenges in maintaining profitability amidst increasing debt levels and lower net profit margins than last year. However, its management team is seasoned with an average tenure of 4.1 years and has not diluted shareholders recently.

- Click here and access our complete financial health analysis report to understand the dynamics of Litigation Capital Management.

- Evaluate Litigation Capital Management's prospects by accessing our earnings growth report.

PowerHouse Energy Group (AIM:PHE)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: PowerHouse Energy Group Plc designs facilities to convert non-recyclable waste into electricity, heat, and gases like hydrogen and methane, operating in the UK and internationally with a market cap of £46.16 million.

Operations: Currently, there are no reported revenue segments for PowerHouse Energy Group.

Market Cap: £46.16M

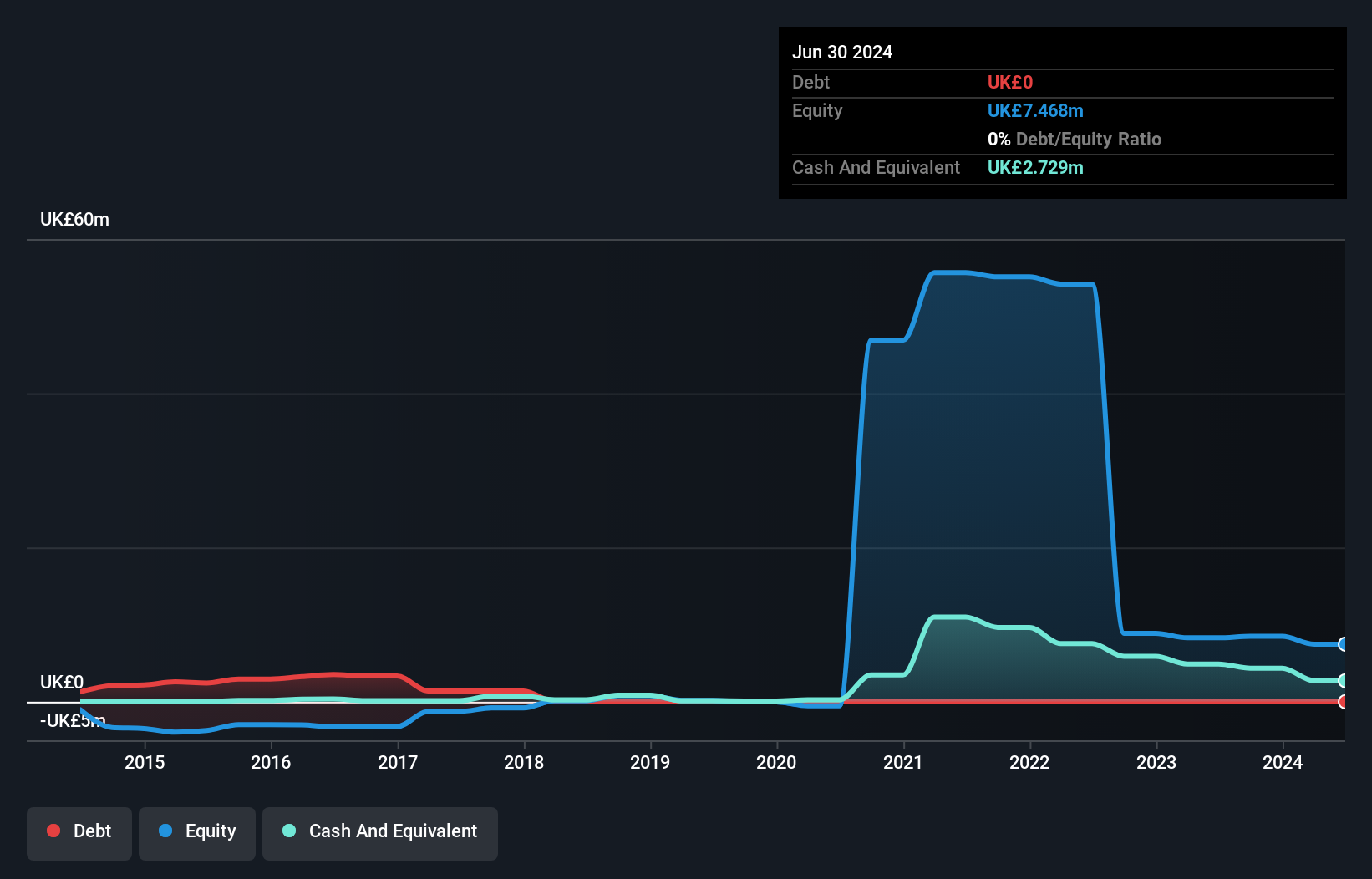

PowerHouse Energy Group, with a market cap of £46.16 million, remains a pre-revenue company in the waste-to-energy sector. Despite having short-term assets (£3.2M) that exceed its liabilities (£457.2K), it faces challenges with less than one year of cash runway and increasing losses over the past five years at 28.9% per annum. Recent earnings for H1 2024 show sales of £385K but a net loss of £1.17 million, highlighting ongoing profitability issues amidst high share price volatility and an inexperienced board with an average tenure of 2.6 years, although management is more seasoned at 3.3 years.

- Take a closer look at PowerHouse Energy Group's potential here in our financial health report.

- Understand PowerHouse Energy Group's track record by examining our performance history report.

ZOO Digital Group (AIM:ZOO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: ZOO Digital Group plc offers cloud-based localisation and digital distribution services across the United Kingdom, India, and the United States, with a market cap of £33.28 million.

Operations: The company's revenue is derived from three primary segments: Localisation ($27.25 million), Media Services ($11.91 million), and Software Solutions ($1.48 million).

Market Cap: £33.28M

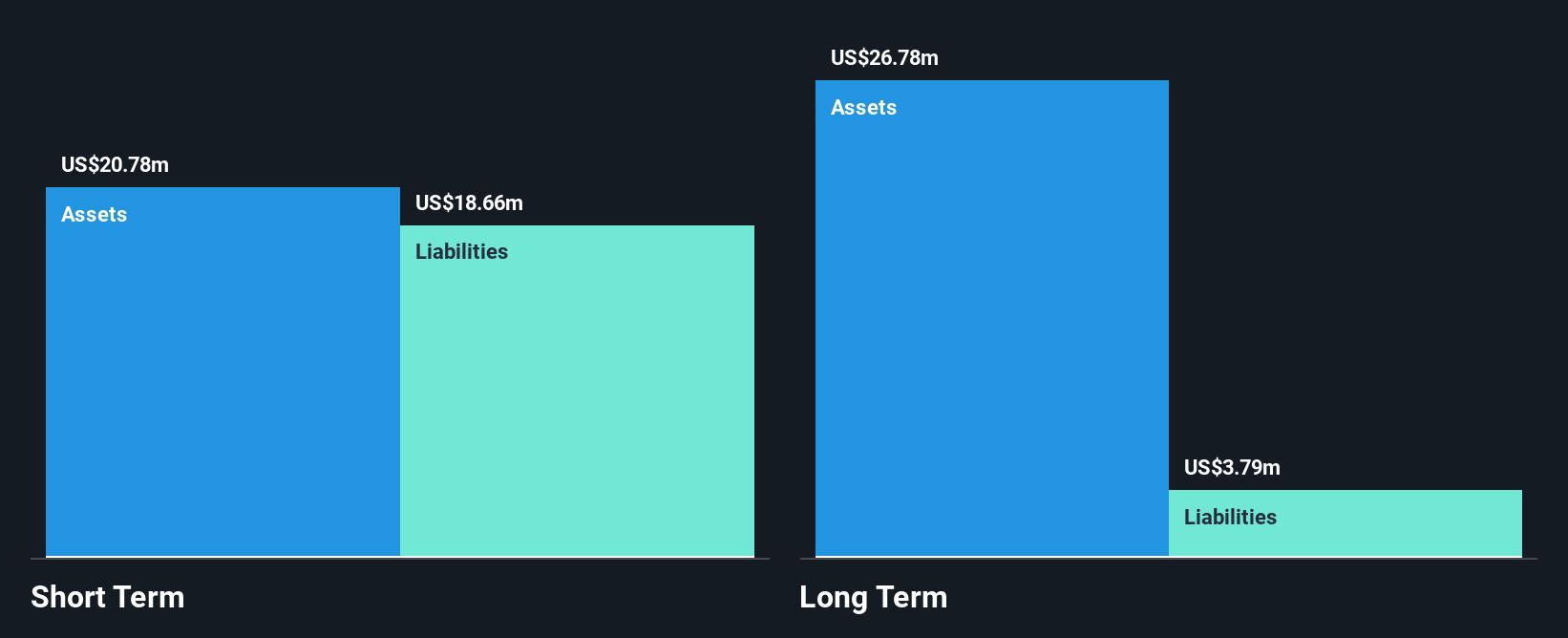

ZOO Digital Group, with a market cap of £33.28 million, is currently unprofitable and has seen its net losses increase over the past five years by 34.7% annually. Despite this, it operates with more cash than debt and maintains short-term assets ($19.4M) that surpass both short-term ($17.1M) and long-term liabilities ($4.3M). The company recently reported a significant drop in sales to US$40.63 million for the year ending March 2024 from US$90.26 million previously, resulting in a net loss of US$21.93 million compared to prior profits of US$8.23 million.

- Click here to discover the nuances of ZOO Digital Group with our detailed analytical financial health report.

- Assess ZOO Digital Group's future earnings estimates with our detailed growth reports.

Next Steps

- Embark on your investment journey to our 471 UK Penny Stocks selection here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:PHE

PowerHouse Energy Group

Designs non-recyclable waste regeneration facilities to produce electricity, heat, and gases comprising hydrogen and methane in the United Kingdom and internationally.

Moderate with adequate balance sheet.

Market Insights

Community Narratives