- United Kingdom

- /

- Diversified Financial

- /

- AIM:LIT

Litigation Capital Management Limited's (LON:LIT) 26% Jump Shows Its Popularity With Investors

Litigation Capital Management Limited (LON:LIT) shares have had a really impressive month, gaining 26% after a shaky period beforehand. Unfortunately, despite the strong performance over the last month, the full year gain of 5.0% isn't as attractive.

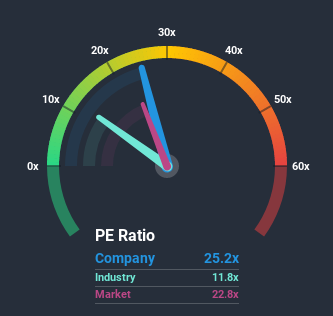

After such a large jump in price, Litigation Capital Management may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 25.2x, since almost half of all companies in the United Kingdom have P/E ratios under 22x and even P/E's lower than 13x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

Recent times haven't been advantageous for Litigation Capital Management as its earnings have been falling quicker than most other companies. It might be that many expect the dismal earnings performance to recover substantially, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Litigation Capital Management

Is There Enough Growth For Litigation Capital Management?

The only time you'd be truly comfortable seeing a P/E as high as Litigation Capital Management's is when the company's growth is on track to outshine the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 42%. This has erased any of its gains during the last three years, with practically no change in EPS being achieved in total. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Looking ahead now, EPS is anticipated to climb by 99% during the coming year according to the four analysts following the company. That's shaping up to be materially higher than the 18% growth forecast for the broader market.

In light of this, it's understandable that Litigation Capital Management's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Litigation Capital Management shares have received a push in the right direction, but its P/E is elevated too. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Litigation Capital Management's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

You need to take note of risks, for example - Litigation Capital Management has 2 warning signs (and 1 which is a bit unpleasant) we think you should know about.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a P/E below 20x.

If you’re looking to trade Litigation Capital Management, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Litigation Capital Management, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:LIT

Litigation Capital Management

Provides dispute finance and risk management services in Australia and the United Kingdom.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives