- United Kingdom

- /

- Diversified Financial

- /

- AIM:LIT

It's Unlikely That Litigation Capital Management Limited's (LON:LIT) CEO Will See A Huge Pay Rise This Year

CEO Patrick Moloney has done a decent job of delivering relatively good performance at Litigation Capital Management Limited (LON:LIT) recently. This is something shareholders will keep in mind as they cast their votes on company resolutions such as executive remuneration in the upcoming AGM on 15 November 2022. However, some shareholders may still be hesitant of being overly generous with CEO compensation.

View our latest analysis for Litigation Capital Management

How Does Total Compensation For Patrick Moloney Compare With Other Companies In The Industry?

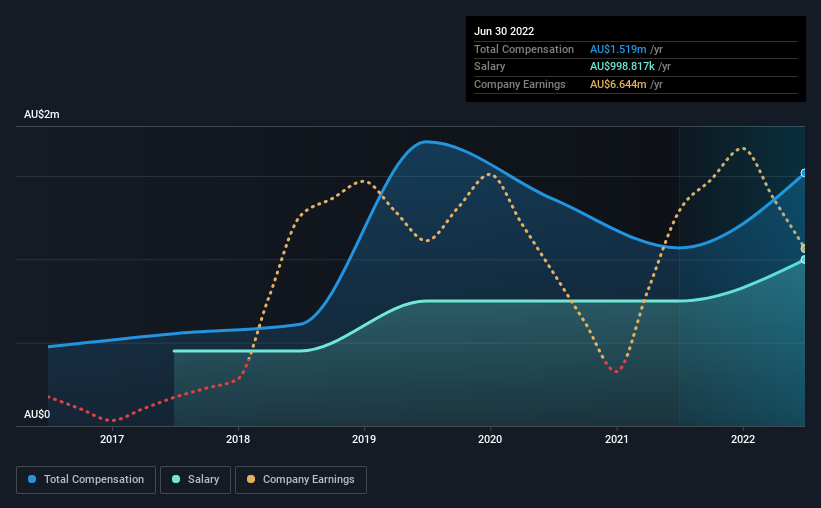

According to our data, Litigation Capital Management Limited has a market capitalization of UK£88m, and paid its CEO total annual compensation worth AU$1.5m over the year to June 2022. That's a notable increase of 42% on last year. Notably, the salary which is AU$998.8k, represents most of the total compensation being paid.

For comparison, other companies in the industry with market capitalizations below UK£175m, reported a median total CEO compensation of AU$826k. This suggests that Patrick Moloney is paid more than the median for the industry. Moreover, Patrick Moloney also holds UK£8.6m worth of Litigation Capital Management stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2022 | 2021 | Proportion (2022) |

| Salary | AU$999k | AU$750k | 66% |

| Other | AU$520k | AU$318k | 34% |

| Total Compensation | AU$1.5m | AU$1.1m | 100% |

On an industry level, roughly 64% of total compensation represents salary and 36% is other remuneration. Our data reveals that Litigation Capital Management allocates salary more or less in line with the wider market. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Litigation Capital Management Limited's Growth Numbers

Litigation Capital Management Limited has reduced its earnings per share by 14% a year over the last three years. It achieved revenue growth of 28% over the last year.

Investors would be a bit wary of companies that have lower EPS On the other hand, the strong revenue growth suggests the business is growing. It's hard to reach a conclusion about business performance right now. This may be one to watch. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Litigation Capital Management Limited Been A Good Investment?

With a total shareholder return of 0.2% over three years, Litigation Capital Management Limited has done okay by shareholders, but there's always room for improvement. As a result, investors in the company might be reluctant about agreeing to increase CEO pay in the future, before seeing an improvement on their returns.

In Summary...

Some shareholders will be pleased by the relatively good results, however, the results could still be improved. We still think that some shareholders will be hesitant of increasing CEO pay until EPS growth improves, since they are already paid higher than the industry.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. That's why we did our research, and identified 2 warning signs for Litigation Capital Management (of which 1 shouldn't be ignored!) that you should know about in order to have a holistic understanding of the stock.

Switching gears from Litigation Capital Management, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:LIT

Litigation Capital Management

Provides dispute finance and risk management services in Australia and the United Kingdom.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives