- United Kingdom

- /

- Diversified Financial

- /

- LSE:PAG

Impax Asset Management Group And 2 Other Premier UK Dividend Stocks

Reviewed by Simply Wall St

As the FTSE 100 shows signs of optimism with expectations of an ECB rate cut and overall positive movements in global markets, investors are keenly watching how these dynamics influence various sectors. In this context, understanding what constitutes a resilient dividend stock becomes crucial, especially considering the current economic landscape and market conditions.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Record (LSE:REC) | 8.00% | ★★★★★★ |

| Keller Group (LSE:KLR) | 3.60% | ★★★★★☆ |

| Impax Asset Management Group (AIM:IPX) | 6.22% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 7.26% | ★★★★★☆ |

| Plus500 (LSE:PLUS) | 5.98% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 3.63% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 3.56% | ★★★★★☆ |

| Rio Tinto Group (LSE:RIO) | 6.21% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 4.08% | ★★★★★☆ |

| Hargreaves Services (AIM:HSP) | 6.43% | ★★★★★☆ |

Click here to see the full list of 58 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Impax Asset Management Group (AIM:IPX)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Impax Asset Management Group Plc is a publicly owned investment manager specializing in sustainable investment solutions, with a market capitalization of approximately £567.52 million.

Operations: Impax Asset Management Group Plc generates its revenue from providing sustainable investment management services.

Dividend Yield: 6.2%

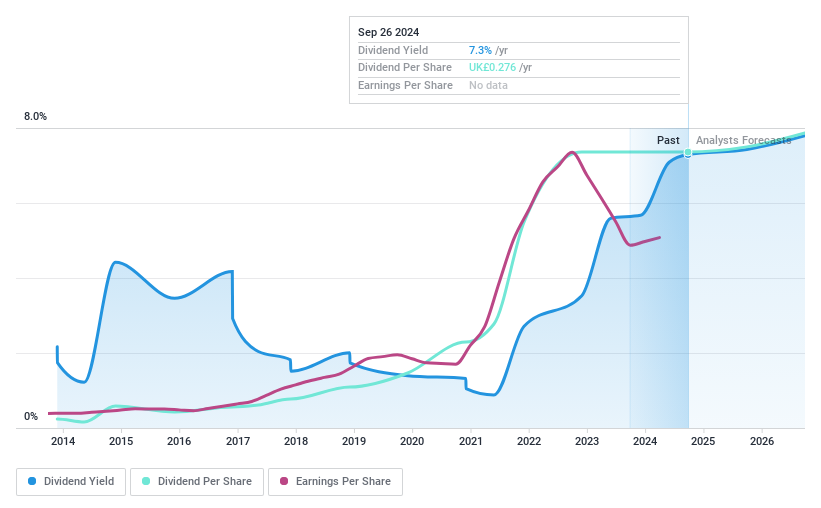

Impax Asset Management Group has demonstrated a mixed track record in dividend reliability, with volatile payments over the past decade. However, recent financials show an improving scenario: dividends are well-covered by both earnings and cash flows, with a payout ratio of 86.8% and cash payout ratio at 70.1%. The firm's recent interim dividend was maintained at 4.7 pence per share, indicating stability amidst modest earnings growth of 11.74% forecasted annually. Despite trading below its estimated fair value by 51.1%, investors should be cautious of its historical dividend inconsistencies.

- Dive into the specifics of Impax Asset Management Group here with our thorough dividend report.

- The analysis detailed in our Impax Asset Management Group valuation report hints at an deflated share price compared to its estimated value.

Paragon Banking Group (LSE:PAG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Paragon Banking Group PLC operates in the United Kingdom, offering a range of financial products and services, with a market capitalization of approximately £1.57 billion.

Operations: Paragon Banking Group PLC generates revenue primarily through mortgage lending and commercial lending, contributing £272.80 million and £139.60 million respectively.

Dividend Yield: 5%

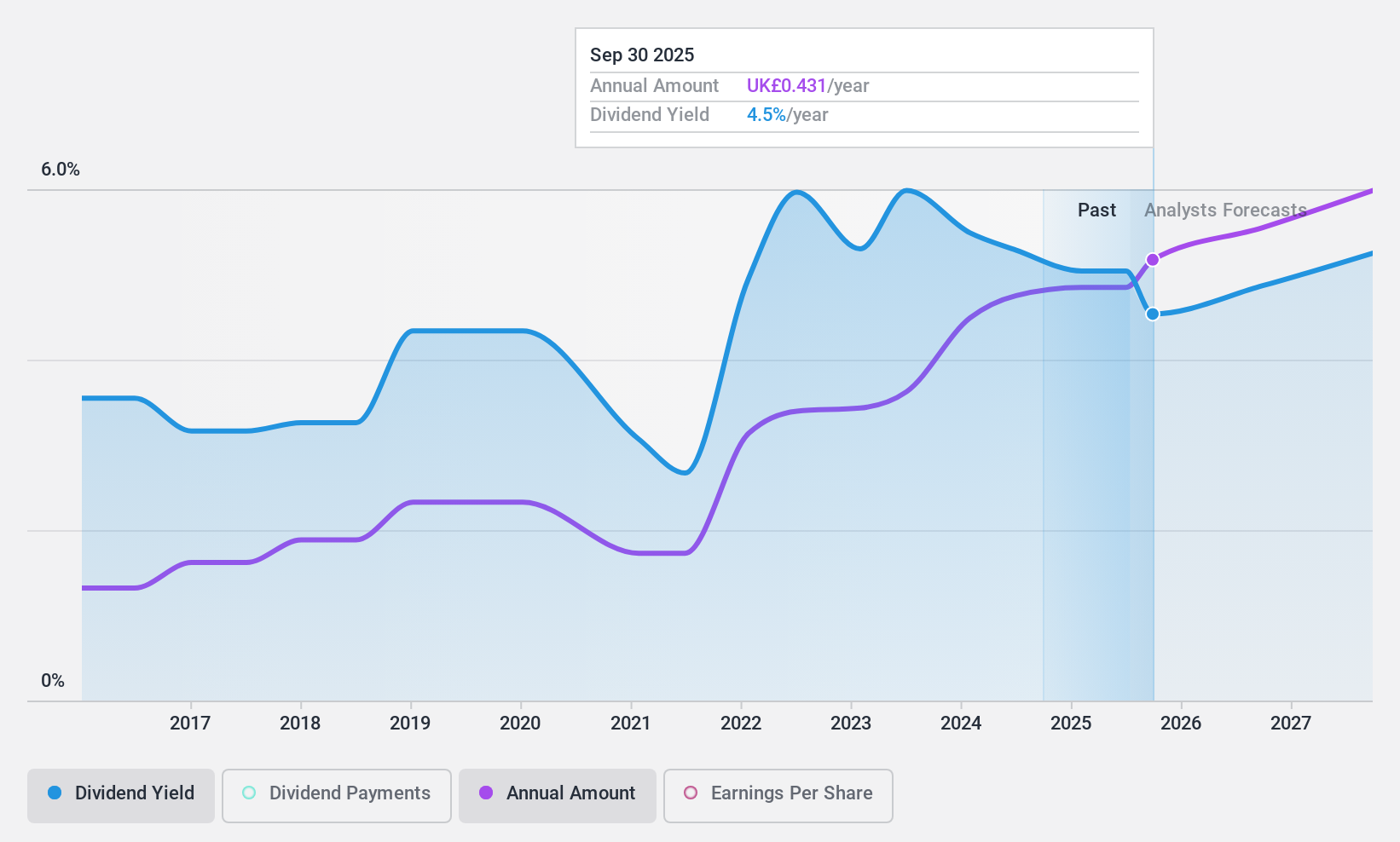

Paragon Banking Group's dividend sustainability is supported by a payout ratio of 54.5% and a low cash payout ratio of 3.6%, indicating strong coverage by both earnings and cash flows. Despite this, dividends have shown volatility over the past decade, with significant annual fluctuations exceeding 20%. Recent financial results reveal a substantial increase in net income to £81.9 million from £37.9 million year-over-year, potentially bolstering future dividend stability. However, its current dividend yield at 4.95% remains below the top UK payers' average of 5.56%.

- Unlock comprehensive insights into our analysis of Paragon Banking Group stock in this dividend report.

- Our expertly prepared valuation report Paragon Banking Group implies its share price may be lower than expected.

Stelrad Group (LSE:SRAD)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Stelrad Group PLC is a company that manufactures and distributes radiators across the UK, Ireland, Europe, Turkey, and other international markets, with a market capitalization of approximately £156.01 million.

Operations: Stelrad Group PLC generates £308.19 million from its core business of radiator manufacturing and distribution.

Dividend Yield: 6.2%

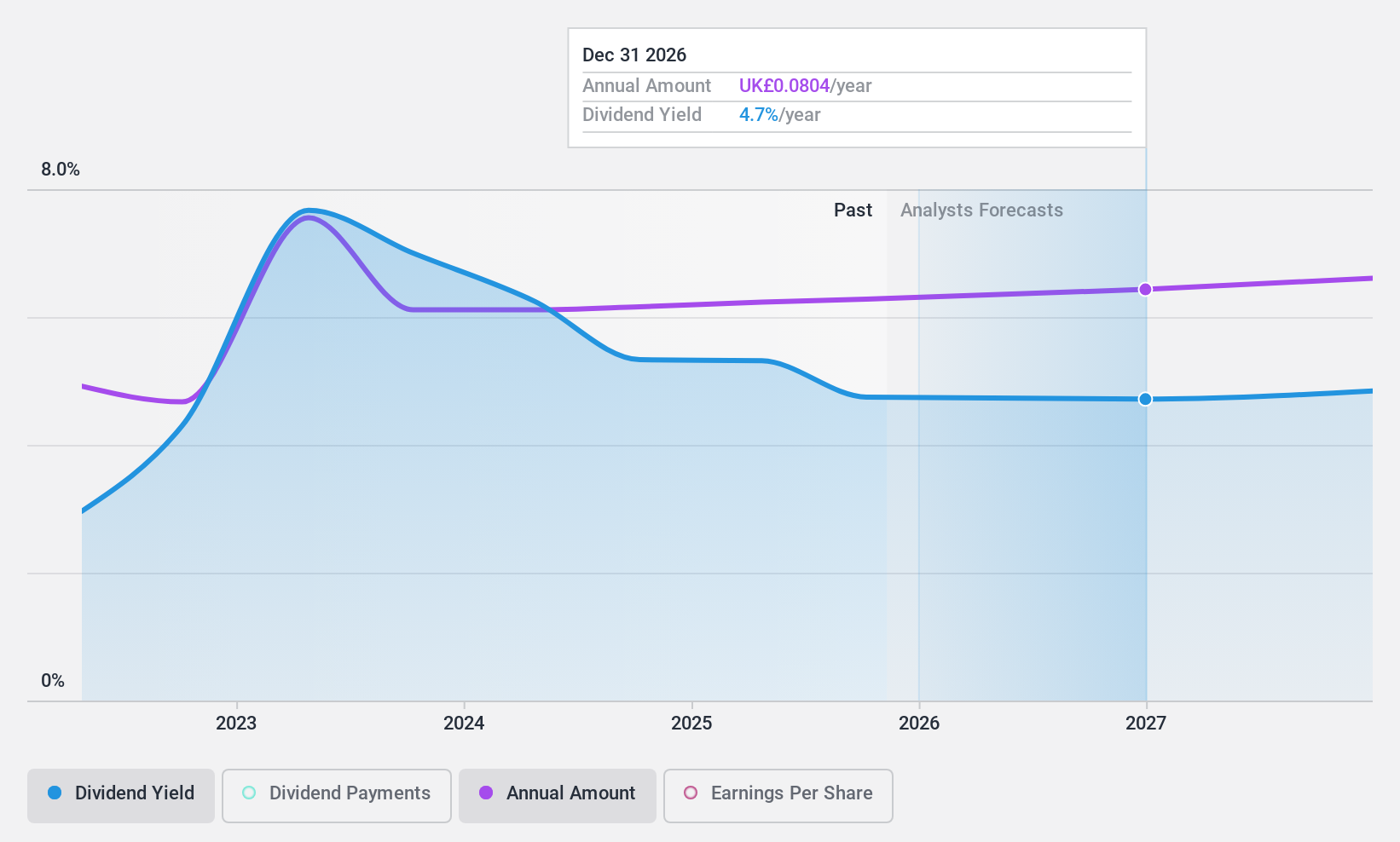

Stelrad Group PLC, with a dividend yield of 6.24%, ranks in the top 25% of UK dividend payers. The company's recent declaration of a final dividend of £0.0472 per share underscores its commitment to shareholder returns, supported by a substantial increase in net income to £15.42 million from £4.31 million year-over-year and earnings growth forecast at 12.12% annually. However, its short history of dividends and past payment volatility indicate potential concerns about the reliability and growth stability of future dividends.

- Click here to discover the nuances of Stelrad Group with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that Stelrad Group is trading behind its estimated value.

Key Takeaways

- Explore the 58 names from our Top Dividend Stocks screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:PAG

Paragon Banking Group

Provides financial products and services in the United Kingdom.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives