- United Kingdom

- /

- Medical Equipment

- /

- AIM:NIOX

December 2024 UK Penny Stocks To Watch Closely

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 index experiencing declines due to weak trade data from China, highlighting global economic interdependencies. Despite these broader market pressures, certain investment opportunities remain attractive. Penny stocks, often associated with smaller or newer companies, continue to offer potential for growth when backed by strong financials. In this article, we explore several UK penny stocks that exhibit promising financial strength and could present valuable opportunities for investors seeking diversification and potential returns.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.115 | £796.86M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.926 | £146.07M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.52 | £67.13M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £1.16 | £99.11M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.31 | £202.04M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.35 | £171.93M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £3.85 | £382.91M | ★★★★☆☆ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.4395 | $255.49M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £4.12 | £472M | ★★★★★★ |

| Impax Asset Management Group (AIM:IPX) | £2.45 | £313.05M | ★★★★★★ |

Click here to see the full list of 472 stocks from our UK Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Impax Asset Management Group (AIM:IPX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Impax Asset Management Group Plc is a publicly owned investment manager with a market cap of £313.05 million.

Operations: The company generated £170.11 million in revenue from its investment management activities.

Market Cap: £313.05M

Impax Asset Management Group Plc, with a market cap of £313.05 million, has shown resilience despite recent earnings declines. The company reported £170.11 million in revenue for the year ending September 2024, though net income decreased to £36.48 million from the previous year. Impax remains debt-free and its short-term assets significantly exceed both short and long-term liabilities, indicating solid financial health. However, its dividend sustainability is questionable as it represents 87% of adjusted profit. The management team is experienced with an average tenure of 13.9 years, but the board's relative inexperience may pose governance challenges moving forward.

- Click here to discover the nuances of Impax Asset Management Group with our detailed analytical financial health report.

- Examine Impax Asset Management Group's earnings growth report to understand how analysts expect it to perform.

Netcall (AIM:NET)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Netcall plc is involved in the design, development, sale, and support of software products and services both in the United Kingdom and internationally, with a market cap of £174.20 million.

Operations: The company generates £39.06 million in revenue from its software products and services segment.

Market Cap: £174.2M

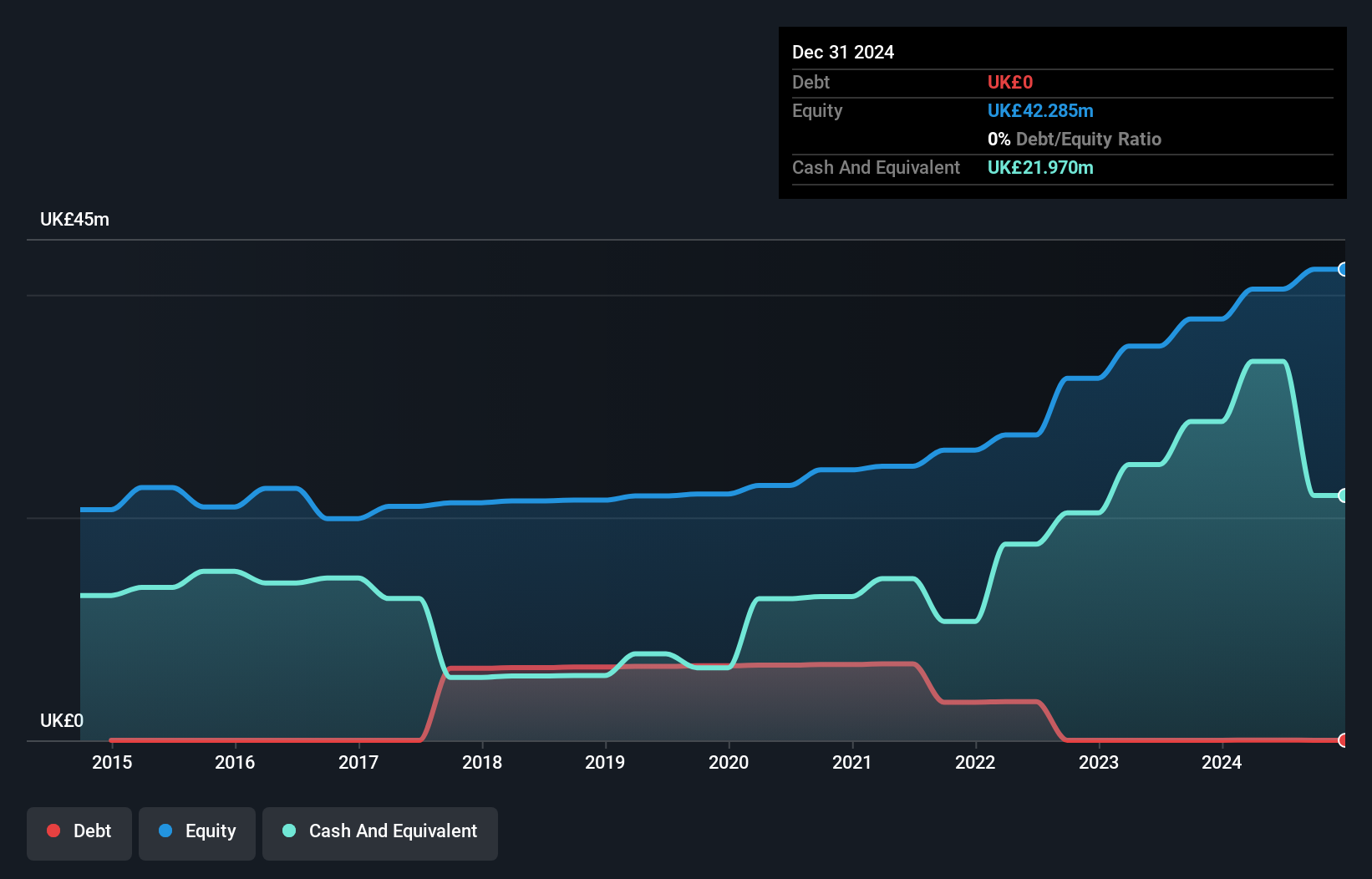

Netcall plc, with a market cap of £174.20 million, has demonstrated solid financial performance in the software sector. The company reported increased revenue of £39.06 million and net income of £5.85 million for the year ending June 2024, reflecting improved profit margins from 11.7% to 15%. Despite a low return on equity at 14.5%, its debt is well covered by operating cash flow, and it holds more cash than total debt, indicating robust liquidity management. Shareholders experienced some dilution with shares outstanding increasing by 2.4%, but the board and management team bring considerable experience to navigate future growth opportunities effectively.

- Navigate through the intricacies of Netcall with our comprehensive balance sheet health report here.

- Learn about Netcall's future growth trajectory here.

NIOX Group (AIM:NIOX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: NIOX Group Plc specializes in the design, development, and commercialization of medical devices for measuring fractional exhaled nitric oxide (FeNo) globally, with a market cap of £251.52 million.

Operations: The company's revenue is derived entirely from its NIOX® segment, amounting to £39 million.

Market Cap: £251.52M

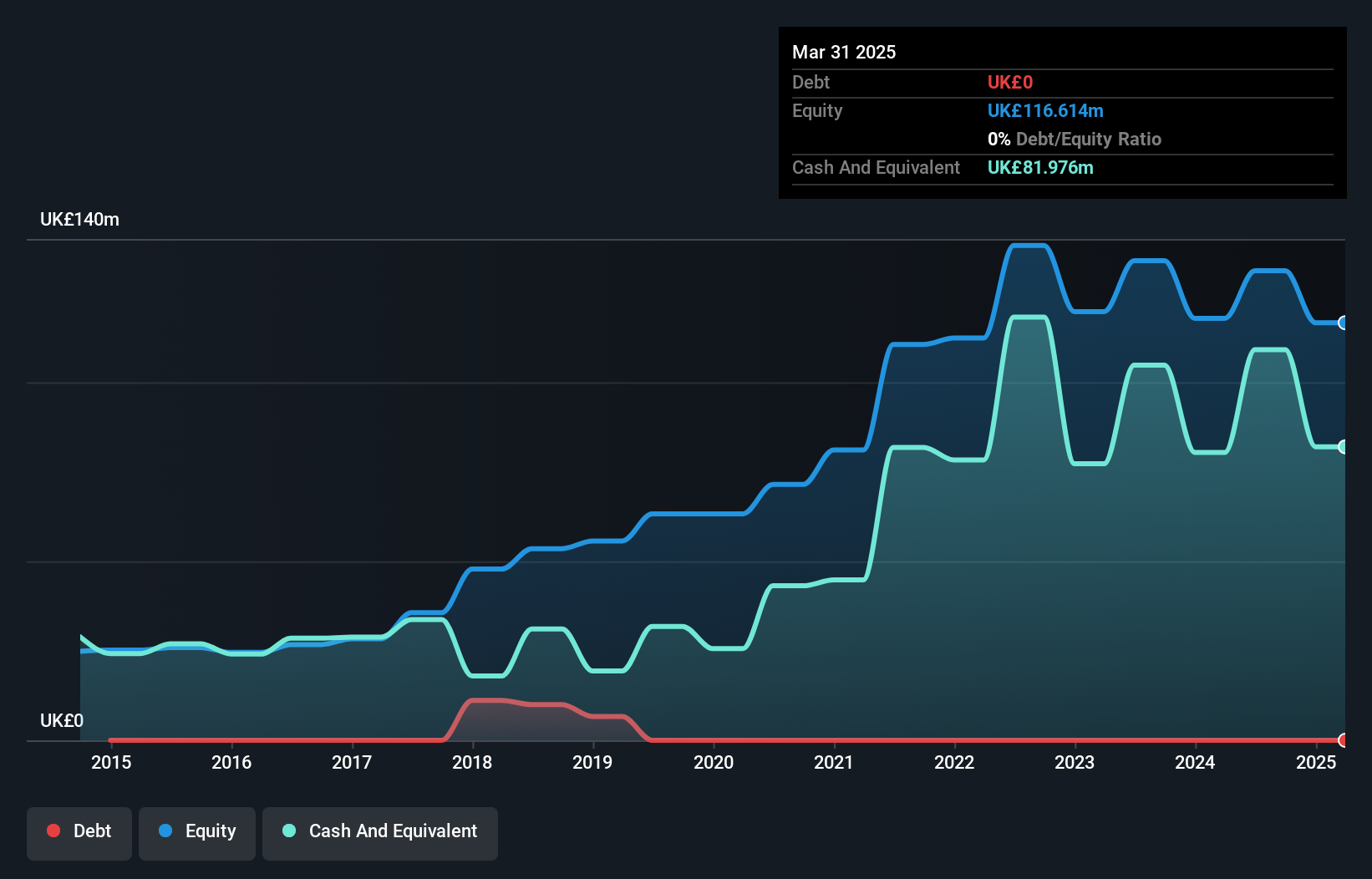

NIOX Group, with a market cap of £251.52 million and revenue of £39 million from its NIOX® segment, has shown stable financial performance. The company is debt-free and boasts improved net profit margins, currently at 28.2%. Its management team and board are experienced, with an average tenure exceeding industry norms. Although its return on equity is low at 13.4%, short-term assets significantly cover both short-term and long-term liabilities. Recently completing a buyback of 26,250,000 shares for £21 million indicates confidence in its valuation, trading below estimated fair value by 39.5%.

- Jump into the full analysis health report here for a deeper understanding of NIOX Group.

- Understand NIOX Group's earnings outlook by examining our growth report.

Next Steps

- Take a closer look at our UK Penny Stocks list of 472 companies by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NIOX Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:NIOX

NIOX Group

Engages in the design, development, and commercialization of medical devices for the measurement of fractional exhaled nitric oxide (FeNo) worldwide.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives