- United Kingdom

- /

- Construction

- /

- AIM:RNWH

Unveiling Fonix And 2 Other Undiscovered Gems In The UK

Reviewed by Simply Wall St

As the UK's FTSE 100 and FTSE 250 indices experience downward pressure due to weak trade data from China, investors are increasingly cautious about companies linked to global economic trends. In this challenging environment, identifying stocks with strong fundamentals and potential for resilience becomes crucial; Fonix and two other lesser-known UK companies may offer such opportunities amidst broader market uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| M&G Credit Income Investment Trust | NA | 17.28% | 15.80% | ★★★★★★ |

| B.P. Marsh & Partners | NA | 29.42% | 31.34% | ★★★★★★ |

| Andrews Sykes Group | NA | 2.15% | 4.93% | ★★★★★★ |

| London Security | 0.22% | 10.13% | 7.75% | ★★★★★★ |

| Globaltrans Investment | 8.54% | 5.28% | 22.11% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| VH Global Sustainable Energy Opportunities | NA | 18.30% | 20.03% | ★★★★★★ |

| FW Thorpe | 5.89% | 11.97% | 12.07% | ★★★★★☆ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

| Goodwin | 52.21% | 9.26% | 13.12% | ★★★★★☆ |

Let's review some notable picks from our screened stocks.

Fonix (AIM:FNX)

Simply Wall St Value Rating: ★★★★★★

Overview: Fonix Plc offers mobile payments and messaging services, along with managed services for sectors like media, charity, gaming, and e-mobility in the UK, with a market cap of £233.09 million.

Operations: With a market cap of £233.09 million, Fonix Plc generates revenue primarily from facilitating mobile payments and messaging services, amounting to £76.09 million. The company's financial performance is characterized by its net profit margin trend over recent periods.

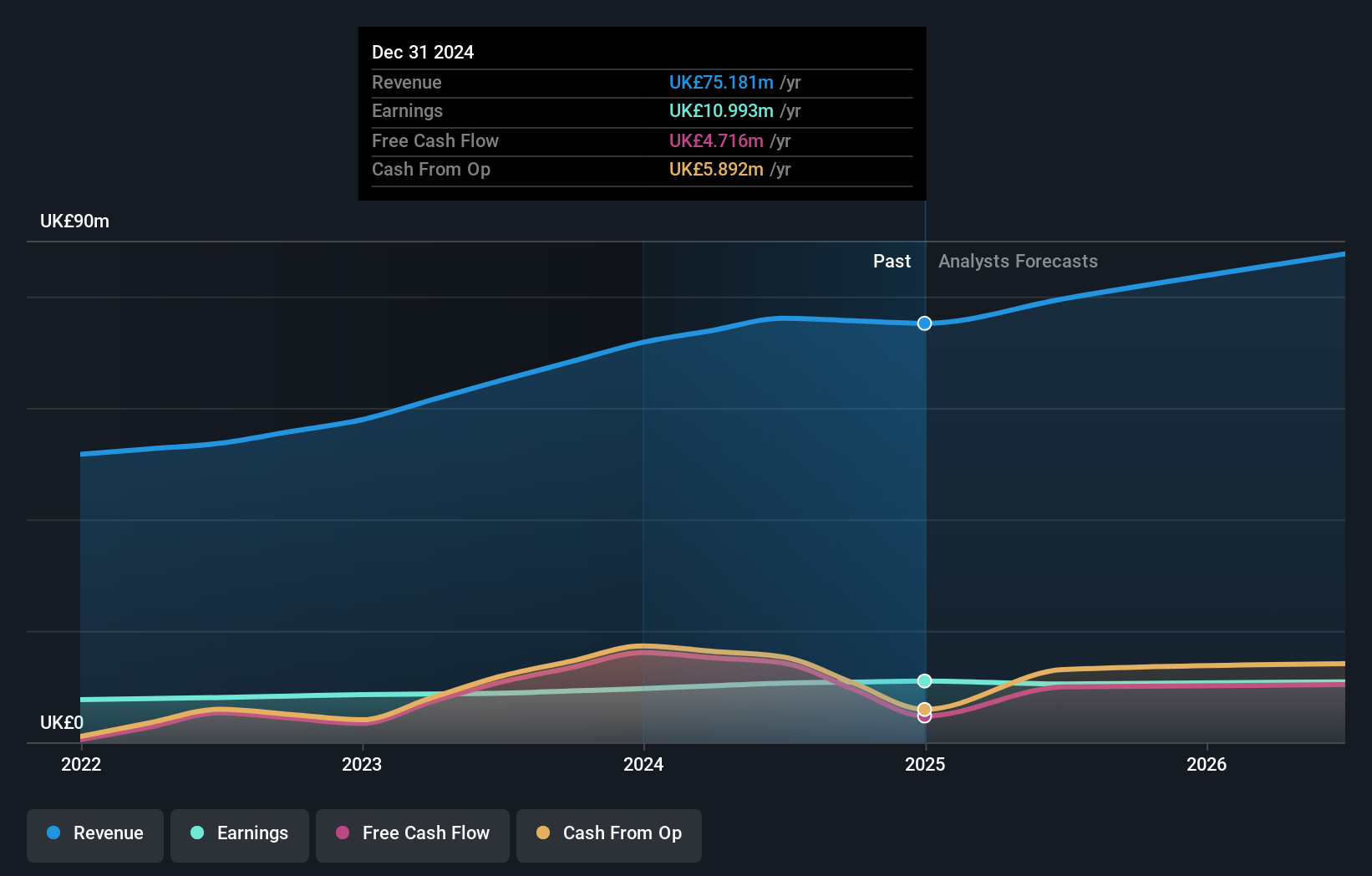

Fonix, a nimble player in the UK market, has demonstrated robust financial health with no debt over the past five years. Its earnings surged by 20.7% last year, outpacing the industry average of -2%. The company reported sales of £76.09 million and net income of £10.62 million for FY24, reflecting solid performance. Fonix's free cash flow reached £14.24 million as of June 2024, indicating strong liquidity management. Looking ahead, earnings are projected to grow at 2.24% annually, while a proposed final dividend underscores its commitment to returning value to shareholders.

- Click here and access our complete health analysis report to understand the dynamics of Fonix.

Examine Fonix's past performance report to understand how it has performed in the past.

Renew Holdings (AIM:RNWH)

Simply Wall St Value Rating: ★★★★★☆

Overview: Renew Holdings plc is a UK-based contractor specializing in engineering services and specialist building, with a market capitalization of approximately £838.86 million.

Operations: Revenue primarily stems from engineering services (£910.83 million) and specialist building (£84.80 million). The engineering services segment significantly outweighs the specialist building in terms of revenue contribution.

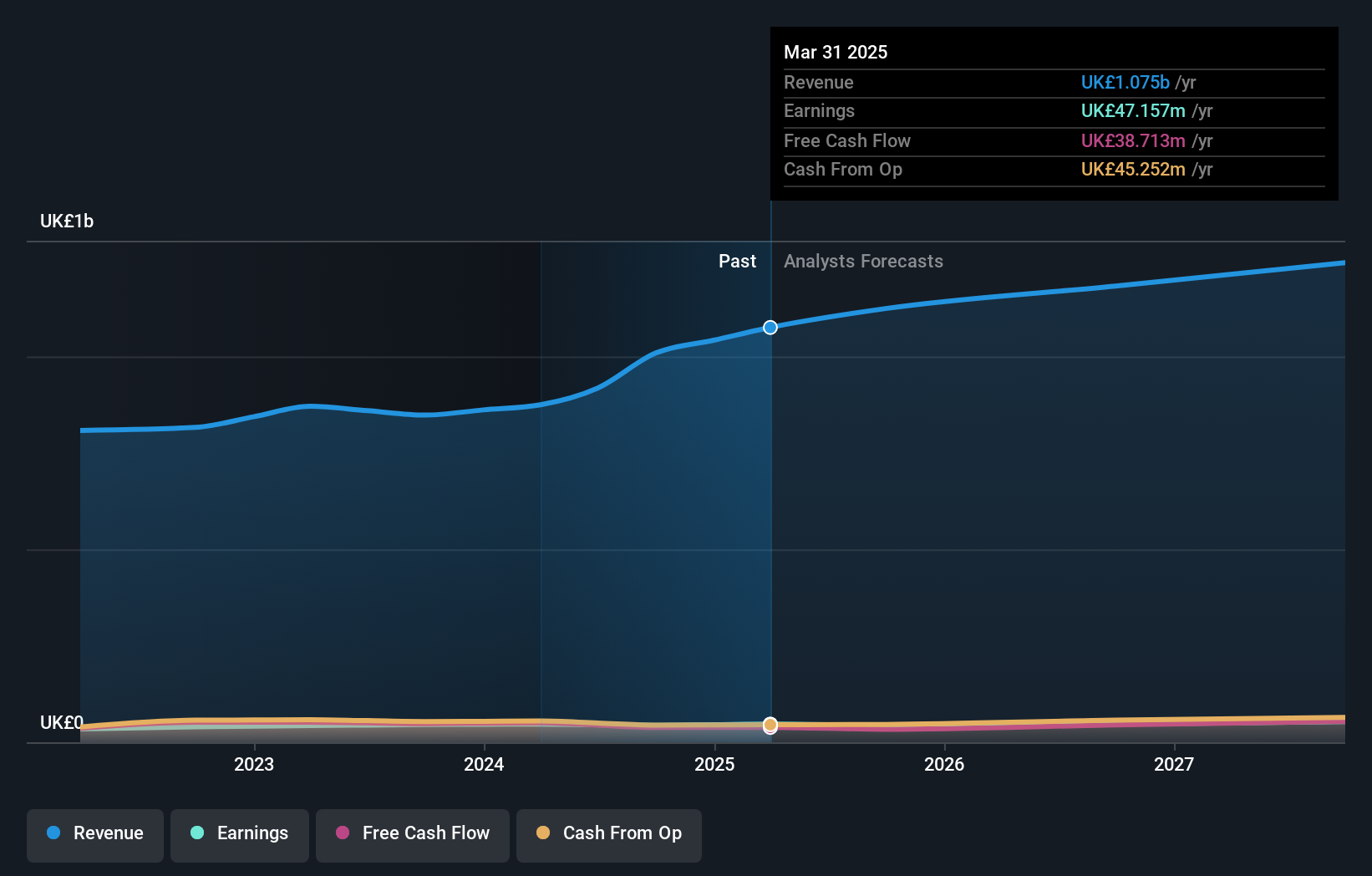

Renew Holdings, a UK-based construction company, showcases strong fundamentals with no debt and an impressive annual earnings growth of 18% over the past five years. Despite trailing slightly behind the industry's 18.7% growth rate last year with its own at 13%, it remains a solid performer. The firm is trading at about 21% below its estimated fair value, suggesting potential upside for investors. Its high-quality earnings and consistent free cash flow generation indicate robust financial health, while recent changes in office address to Leeds reflect ongoing operational adjustments without impacting core business stability.

- Delve into the full analysis health report here for a deeper understanding of Renew Holdings.

Assess Renew Holdings' past performance with our detailed historical performance reports.

Senior (LSE:SNR)

Simply Wall St Value Rating: ★★★★★☆

Overview: Senior plc is a company that designs, manufactures, and sells high-technology components and systems for major original equipment manufacturers in the aerospace, defense, land vehicle, and power and energy sectors globally, with a market cap of £611.67 million.

Operations: Senior generates revenue primarily from its Aerospace segment (£651.10 million) and Flexonics segment (£333 million). The company's cost structure includes central costs and eliminations amounting to -£1.50 million.

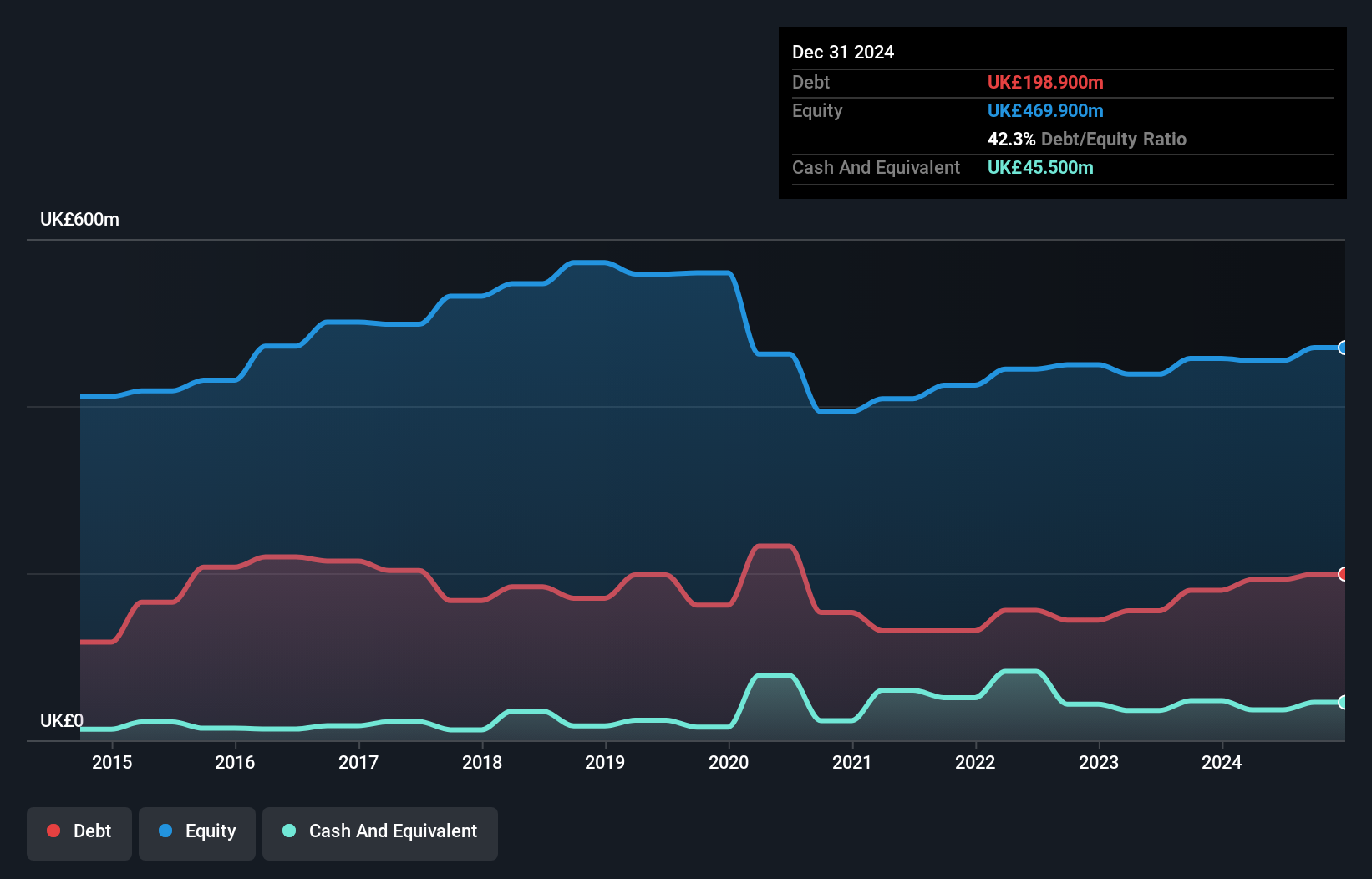

Senior plc, a notable player in the Aerospace & Defense sector, is trading at 30.3% below its estimated fair value, suggesting potential upside. The company boasts high-quality past earnings and has achieved a robust 40.1% growth in earnings over the past year, outpacing industry averages of 34.9%. With a net debt to equity ratio at a satisfactory 34.4%, financial stability appears solid despite an increase from 35.5% to 42.4% over five years. Interest payments are well-covered by EBIT at 3.1x coverage, indicating effective debt management strategies are in place for this promising entity.

- Navigate through the intricacies of Senior with our comprehensive health report here.

Gain insights into Senior's past trends and performance with our Past report.

Turning Ideas Into Actions

- Gain an insight into the universe of 76 UK Undiscovered Gems With Strong Fundamentals by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:RNWH

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives