- United Kingdom

- /

- Aerospace & Defense

- /

- LSE:SNR

Uncovering Three Undiscovered Gems in the United Kingdom Market

Reviewed by Simply Wall St

As the United Kingdom's FTSE 100 index faces downward pressure due to weak trade data from China and declining commodity prices, investors are increasingly turning their attention to smaller, potentially undervalued companies that may offer growth opportunities amid broader market challenges. In this context, identifying stocks with strong fundamentals and resilience in adverse economic conditions becomes crucial for those looking to uncover hidden gems within the UK market.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| M&G Credit Income Investment Trust | NA | 17.28% | 15.80% | ★★★★★★ |

| Andrews Sykes Group | NA | 2.15% | 4.93% | ★★★★★★ |

| Doric Nimrod Air Two | NA | -4.17% | 58.05% | ★★★★★★ |

| London Security | 0.22% | 10.13% | 7.75% | ★★★★★★ |

| B.P. Marsh & Partners | NA | 29.42% | 31.34% | ★★★★★★ |

| VH Global Energy Infrastructure | NA | 18.30% | 20.03% | ★★★★★★ |

| Rights and Issues Investment Trust | NA | -3.68% | -4.07% | ★★★★★★ |

| FW Thorpe | 5.89% | 11.97% | 12.07% | ★★★★★☆ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

| Goodwin | 52.21% | 9.26% | 13.12% | ★★★★★☆ |

We're going to check out a few of the best picks from our screener tool.

Fonix (AIM:FNX)

Simply Wall St Value Rating: ★★★★★★

Overview: Fonix Plc operates in the United Kingdom, offering mobile payments and messaging services along with managed services for sectors such as media, charity, gaming, and e-mobility, with a market cap of £225.40 million.

Operations: Fonix Plc generates revenue primarily through facilitating mobile payments and messaging, amounting to £76.09 million. The company's net profit margin is a key financial metric to consider when evaluating its profitability.

Fonix, a nimble player in the UK market, showcases robust financial health with no debt over the past five years and high-quality earnings. The company reported earnings growth of 20.7% last year, outpacing the industry average of 10.8%. Recent results highlight a net income rise to £10.62 million from £8.8 million previously, alongside sales reaching £76.09 million up from £64.92 million last year. Fonix's dividend strategy is appealing too, with a proposed final dividend of 5.7 pence per share contributing to an annual payout totaling £8.24 million if approved by shareholders this November.

- Click here to discover the nuances of Fonix with our detailed analytical health report.

Gain insights into Fonix's past trends and performance with our Past report.

Ocean Wilsons Holdings (LSE:OCN)

Simply Wall St Value Rating: ★★★★★★

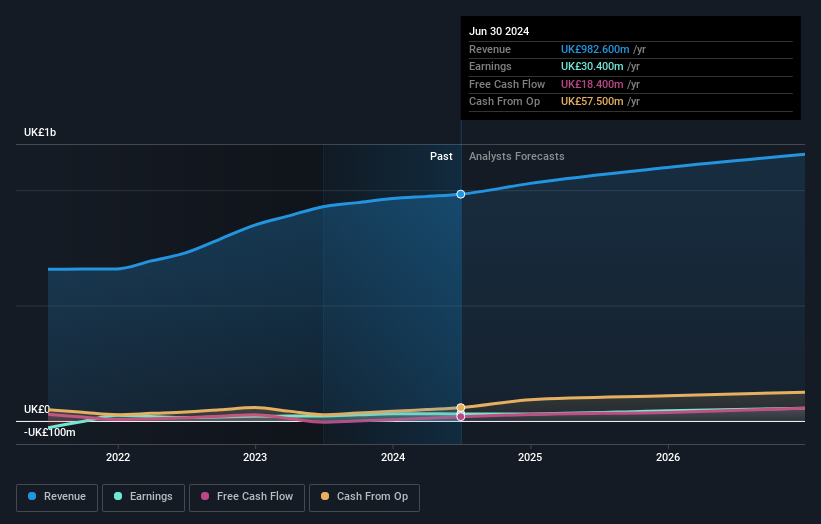

Overview: Ocean Wilsons Holdings Limited is an investment holding company that provides maritime and logistics services in Brazil, with a market capitalization of £463.26 million.

Operations: The company's primary revenue stream comes from its maritime services in Brazil, generating $519.35 million.

Ocean Wilsons Holdings, a smaller player in the UK market, boasts a price-to-earnings ratio of 9.5x, which is notably below the UK average of 16.3x. The company has seen impressive earnings growth of 32.7% over the past year, surpassing its industry peers at 9.9%. A significant one-off gain of US$28.8M has influenced its recent financial results, adding complexity to its earnings quality narrative. With more cash than total debt and interest payments well-covered by EBIT at 4.6x coverage, Ocean Wilsons appears financially sound while offering potential for future growth with forecasted annual earnings increase of nearly 4.8%.

- Dive into the specifics of Ocean Wilsons Holdings here with our thorough health report.

Evaluate Ocean Wilsons Holdings' historical performance by accessing our past performance report.

Senior (LSE:SNR)

Simply Wall St Value Rating: ★★★★★☆

Overview: Senior plc is a company that designs, manufactures, and sells high-technology components and systems for major original equipment manufacturers across the aerospace, defense, land vehicle, and power and energy sectors globally, with a market capitalization of £657.40 million.

Operations: The company generates revenue primarily from its Aerospace segment, contributing £651.10 million, and its Flexonics segment, adding £333 million. The net profit margin is not specified in the available data.

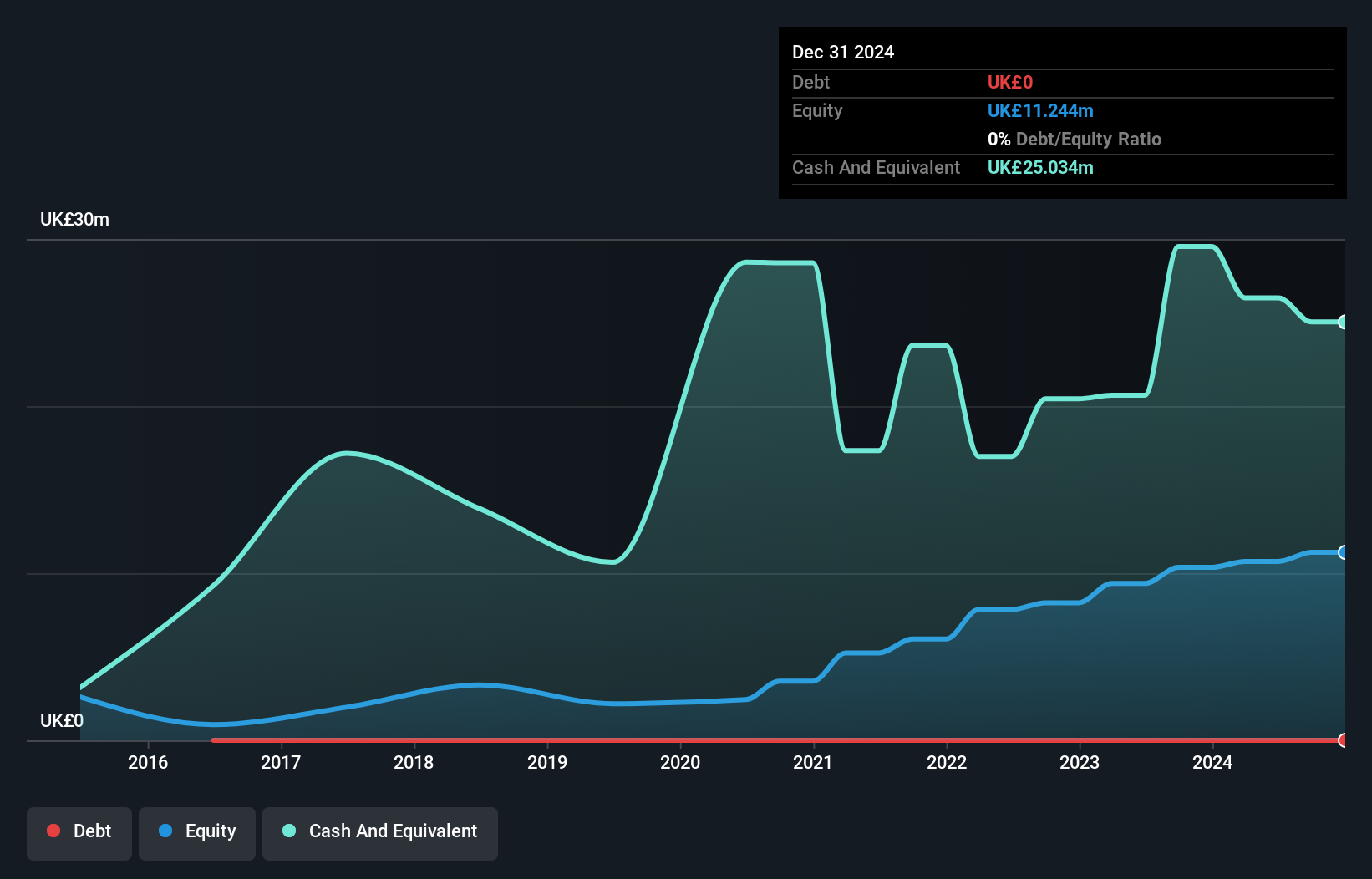

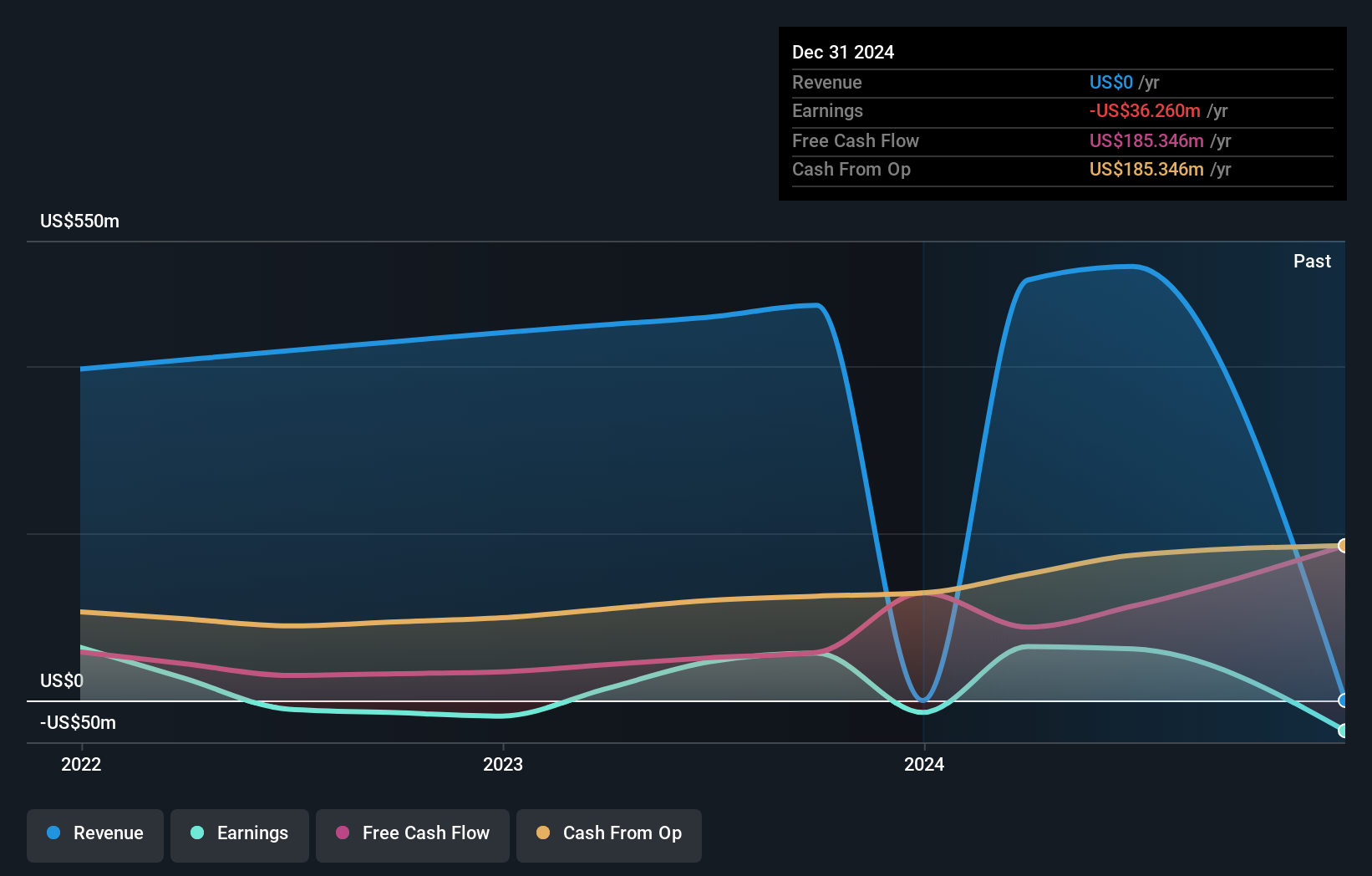

Despite its small size, Senior plc is making waves in the aerospace and defense sectors. Over the past year, earnings surged by 40%, outpacing industry growth. The company's debt to equity ratio rose from 35.5% to 42.4% over five years, yet remains satisfactory with a net debt to equity of 34.4%. Trading at nearly 25% below estimated fair value suggests potential upside for investors seeking value plays. With well-covered interest payments at an EBIT coverage of 3.1 times and positive free cash flow, Senior seems poised for continued financial stability under new CFO Alpna Amar starting May 2025.

- Take a closer look at Senior's potential here in our health report.

Gain insights into Senior's historical performance by reviewing our past performance report.

Taking Advantage

- Explore the 69 names from our UK Undiscovered Gems With Strong Fundamentals screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:SNR

Senior

Designs, manufactures, and sells high-technology components and systems for the principal original equipment manufacturers in the aerospace, defense, land vehicle, and power and energy markets in the United States, the United Kingdom, and internationally.

Undervalued with solid track record.