- United Kingdom

- /

- Metals and Mining

- /

- AIM:BHL

UK Penny Stocks To Keep An Eye On In December 2024

Reviewed by Simply Wall St

The UK market has been experiencing fluctuations, with the FTSE 100 index recently closing lower due to weak trade data from China, highlighting global economic interdependencies. In such a climate, investors often seek opportunities in smaller or newer companies that may offer growth potential despite broader market challenges. While the term "penny stocks" might seem outdated, these stocks can still represent significant opportunities when backed by strong financials and strategic positioning.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Tristel (AIM:TSTL) | £3.775 | £180.04M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.97 | £153.01M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.12 | £798.74M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.54 | £67.51M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £1.1775 | £100.6M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.298 | £200.19M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.40 | £178.29M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £4.23 | £420.7M | ★★★★☆☆ |

| Serabi Gold (AIM:SRB) | £1.15 | £87.09M | ★★★★★★ |

| Impax Asset Management Group (AIM:IPX) | £2.455 | £313.69M | ★★★★★★ |

Click here to see the full list of 468 stocks from our UK Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Bradda Head Lithium (AIM:BHL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Bradda Head Lithium Limited, with a market cap of £5.08 million, focuses on the exploration and development of lithium deposits and resources in the United States through its subsidiaries.

Operations: Currently, Bradda Head Lithium Limited does not report any revenue segments.

Market Cap: £5.08M

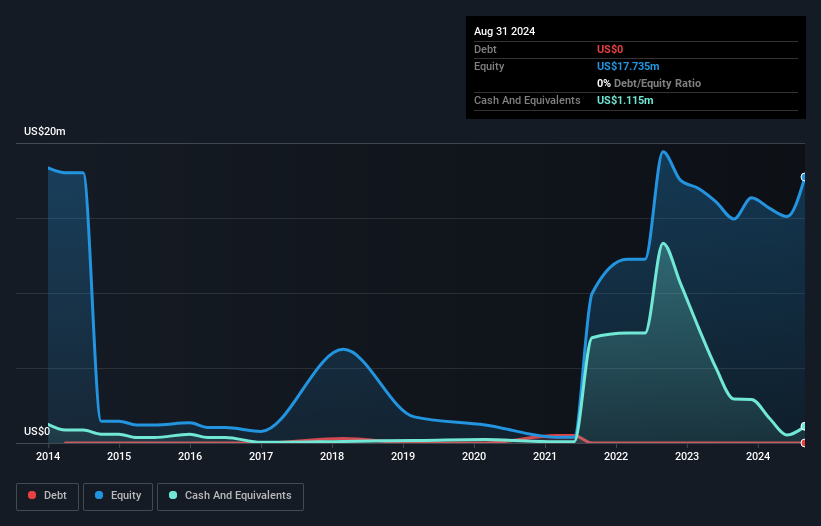

Bradda Head Lithium Limited, with a market cap of £5.08 million, is pre-revenue and focuses on lithium exploration in the U.S. The company recently reported a net income of US$2.18 million for the half-year ending August 2024, marking profitability after previous losses. Significant developments include approved drilling permits at their San Domingo project and promising surface sample results from new targets like Ruby Soho, which show high lithium oxide concentrations up to 3.57%. Despite these prospects, Bradda Head's management team lacks extensive experience, averaging only 1.8 years in tenure, which may impact strategic execution as they advance their projects.

- Dive into the specifics of Bradda Head Lithium here with our thorough balance sheet health report.

- Review our historical performance report to gain insights into Bradda Head Lithium's track record.

Seed Innovations (AIM:SEED)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Seed Innovations Limited is a venture capital firm focusing on early-stage investments with a market cap of £3.18 million.

Operations: The company's revenue segment includes Financial Services - Closed End Funds, which reported a revenue of -£0.48 million.

Market Cap: £3.18M

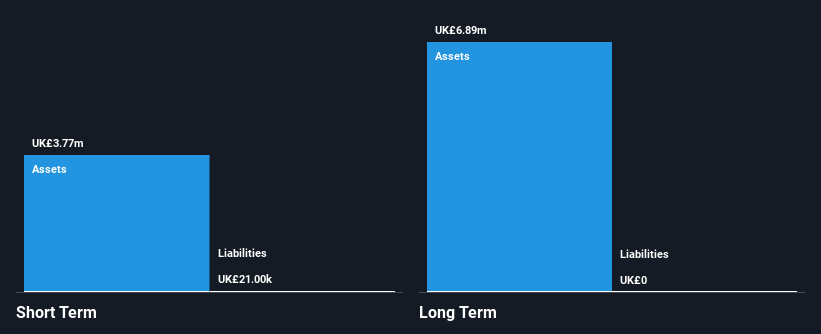

Seed Innovations Limited, with a market cap of £3.18 million, is pre-revenue and has reported a net loss of £0.753 million for the half-year ending September 2024, an improvement from the previous year's loss of £1.42 million. Despite being unprofitable, Seed Innovations benefits from having no debt and sufficient cash runway exceeding three years due to positive free cash flow growth. The company's experienced board and management team provide stability with average tenures of 5.9 and 5.3 years respectively. Short-term assets significantly cover liabilities (£3.8M vs £21K), enhancing its financial resilience amidst ongoing losses.

- Unlock comprehensive insights into our analysis of Seed Innovations stock in this financial health report.

- Explore historical data to track Seed Innovations' performance over time in our past results report.

Transense Technologies (AIM:TRT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Transense Technologies plc develops and supplies specialist sensor systems across various regions including the United Kingdom, North America, South America, Australia, and Europe, with a market cap of £27.40 million.

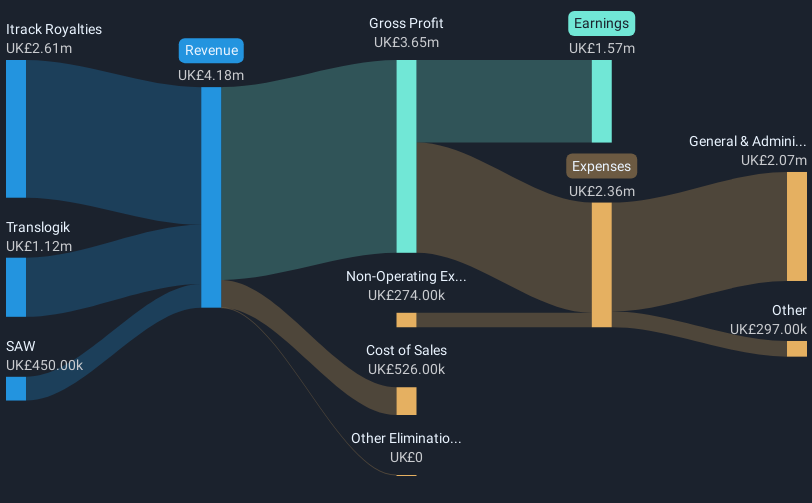

Operations: The company's revenue is derived from three segments: SAW (£0.45 million), Translogik (£1.12 million), and Itrack Royalties (£2.61 million).

Market Cap: £27.4M

Transense Technologies, with a £27.40 million market cap, has demonstrated steady financial health and growth potential. The company is debt-free, boasting a high return on equity of 28.1% and short-term assets (£3.1M) comfortably covering liabilities (£593K). Recent earnings show revenue growth to £4.18 million, with net income rising to £1.57 million for the year ending June 2024. A strategic partnership with TIRETASK GmbH aims to enhance its Translogik segment by offering an integrated tyre management solution across key markets like the UK and North America, potentially expanding its revenue streams further in these regions.

- Navigate through the intricacies of Transense Technologies with our comprehensive balance sheet health report here.

- Evaluate Transense Technologies' historical performance by accessing our past performance report.

Summing It All Up

- Jump into our full catalog of 468 UK Penny Stocks here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bradda Head Lithium might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:BHL

Bradda Head Lithium

Engages in the exploration and development of lithium deposits and resources in the United States.

Flawless balance sheet and good value.

Market Insights

Community Narratives