- United Kingdom

- /

- Biotech

- /

- LSE:BSFA

Frenkel Topping Group And 2 Other UK Penny Stocks To Watch For Growth

Reviewed by Simply Wall St

The UK stock market has recently faced challenges, with the FTSE 100 index closing lower due to weak trade data from China, highlighting global economic uncertainties. Amid these broader market fluctuations, investors often seek opportunities in smaller companies that might offer unique growth prospects. Penny stocks, though an outdated term, continue to attract attention for their potential value and growth opportunities when backed by strong financials. In this context, we will explore several UK penny stocks that may stand out for their financial strength and long-term potential.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Polar Capital Holdings (AIM:POLR) | £4.955 | £477.59M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.27 | £855.25M | ★★★★★★ |

| Shoe Zone (AIM:SHOE) | £1.525 | £70.5M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.80 | £377.93M | ★★★★☆☆ |

| Supreme (AIM:SUP) | £1.75 | £204.07M | ★★★★★★ |

| Serabi Gold (AIM:SRB) | £0.93 | £70.43M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.45 | £355.58M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.30 | £200.5M | ★★★★★☆ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.437 | $254.04M | ★★★★★★ |

| Tristel (AIM:TSTL) | £4.325 | £206.09M | ★★★★★★ |

Click here to see the full list of 472 stocks from our UK Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Frenkel Topping Group (AIM:FEN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Frenkel Topping Group Plc, with a market cap of £55.91 million, operates in the United Kingdom offering independent financial advisory, discretionary fund management, and financial services through its subsidiaries.

Operations: Frenkel Topping Group does not report specific revenue segments.

Market Cap: £55.91M

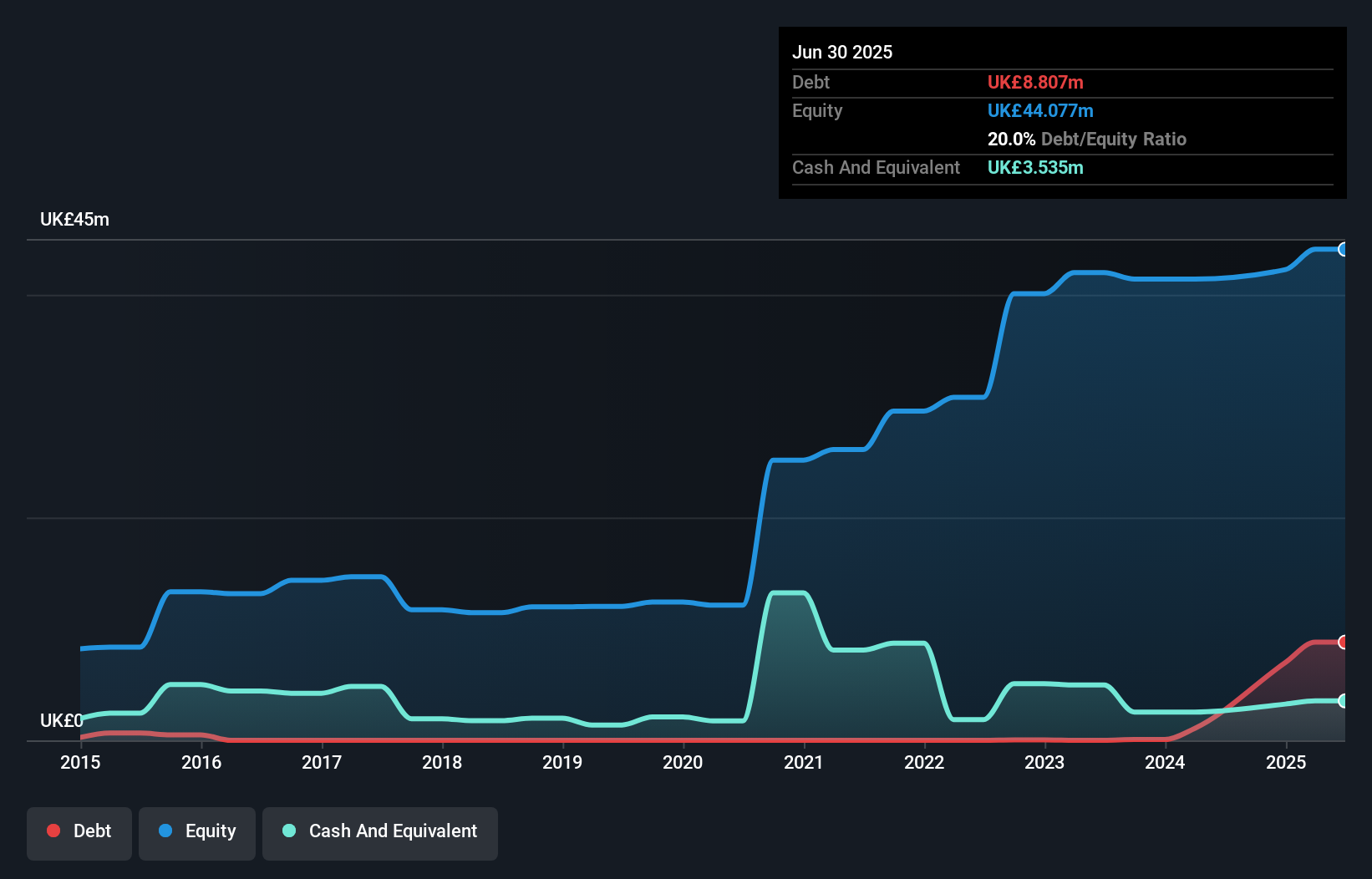

Frenkel Topping Group Plc, with a market cap of £55.91 million, reported half-year sales of £17.87 million and net income of £1.07 million, showing a decline from the previous year’s figures. The company is debt-free and has experienced management and board teams, but its return on equity is low at 3.1%. Recent financial results were impacted by a significant one-off loss of £1.4 million. Despite negative earnings growth over the past year, earnings are forecasted to grow significantly in the future. Short-term assets comfortably cover both short- and long-term liabilities.

- Unlock comprehensive insights into our analysis of Frenkel Topping Group stock in this financial health report.

- Explore Frenkel Topping Group's analyst forecasts in our growth report.

Primorus Investments (AIM:PRIM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Primorus Investments plc is a private equity firm that focuses on buyout investments in small and mid-cap companies, with a market cap of £5.59 million.

Operations: The company generates its revenue primarily through investments in businesses, amounting to £3.21 million.

Market Cap: £5.59M

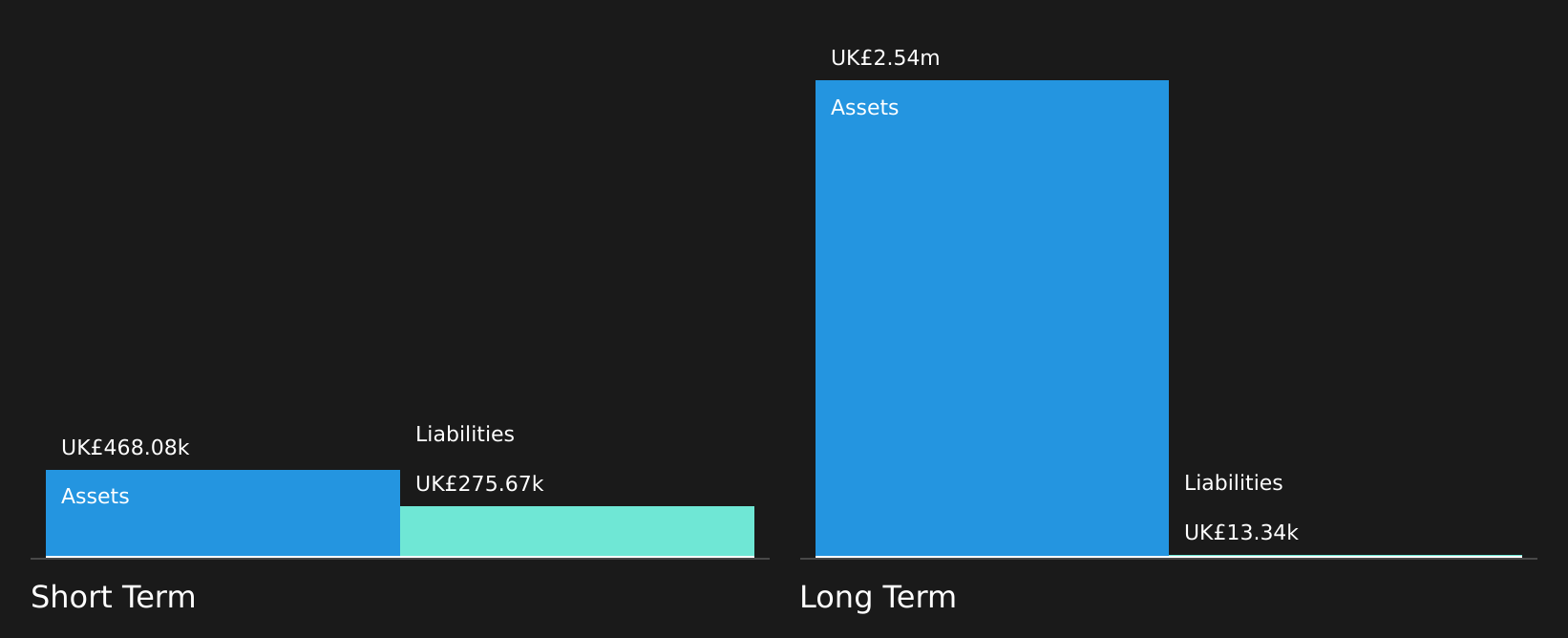

Primorus Investments plc, with a market cap of £5.59 million, focuses on buyout investments in small and mid-cap companies. Despite its lack of significant revenue (£3M), the company has recently turned profitable, which complicates comparisons to industry growth rates. Its share price has been highly volatile over the past three months but shows stable weekly volatility compared to most UK stocks. Primorus is debt-free and boasts a seasoned board with no recent shareholder dilution. While it has high non-cash earnings, its Return on Equity remains low at 15.8%. The company's Price-To-Earnings ratio (6x) suggests it could be undervalued in the UK market context.

- Click to explore a detailed breakdown of our findings in Primorus Investments' financial health report.

- Learn about Primorus Investments' historical performance here.

BSF Enterprise (LSE:BSFA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: BSF Enterprise Plc currently does not have significant operations and has a market cap of £3.88 million.

Operations: Currently, there are no reported revenue segments for this company.

Market Cap: £3.88M

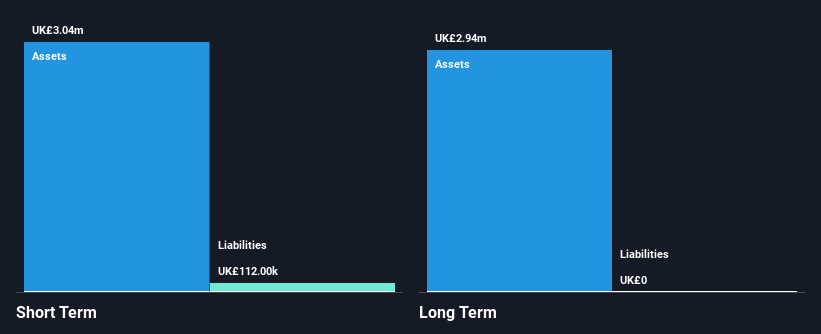

BSF Enterprise Plc, with a market cap of £3.88 million, is a pre-revenue company and currently unprofitable. Its Return on Equity is negative at -42.8%, reflecting its lack of profitability. The company has no debt and maintains sufficient short-term assets (£1.6M) to cover both short-term (£250.1K) and long-term liabilities (£57K). Despite high weekly volatility (11%), BSF's share price has been stable compared to other UK stocks over the past year. The management team and board are experienced, with average tenures of 2.4 years and 4.7 years respectively, indicating seasoned leadership amidst financial challenges.

- Get an in-depth perspective on BSF Enterprise's performance by reading our balance sheet health report here.

- Assess BSF Enterprise's previous results with our detailed historical performance reports.

Next Steps

- Gain an insight into the universe of 472 UK Penny Stocks by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BSF Enterprise might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:BSFA

BSF Enterprise

Develops and commercializes cutting-edge tissue-engineered solutions.

Flawless balance sheet moderate.