- United Kingdom

- /

- Luxury

- /

- LSE:COA

3 UK Stocks That May Be Priced Below Their Estimated Value In May 2025

Reviewed by Simply Wall St

As the United Kingdom's FTSE 100 index faces pressure from weak trade data out of China and global economic uncertainties, investors are closely monitoring opportunities within the market. In such a challenging environment, identifying stocks that may be undervalued can provide potential for growth, as these companies might be priced below their estimated intrinsic value despite broader market fluctuations.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| QinetiQ Group (LSE:QQ.) | £4.26 | £7.67 | 44.4% |

| Begbies Traynor Group (AIM:BEG) | £0.936 | £1.68 | 44.2% |

| AstraZeneca (LSE:AZN) | £101.34 | £191.58 | 47.1% |

| Aptitude Software Group (LSE:APTD) | £2.91 | £5.20 | 44% |

| On the Beach Group (LSE:OTB) | £2.80 | £5.00 | 44% |

| Duke Capital (AIM:DUKE) | £0.2825 | £0.54 | 47.9% |

| ECO Animal Health Group (AIM:EAH) | £0.64 | £1.28 | 49.9% |

| Vistry Group (LSE:VTY) | £6.238 | £11.36 | 45.1% |

| Deliveroo (LSE:ROO) | £1.747 | £3.22 | 45.7% |

| Crest Nicholson Holdings (LSE:CRST) | £1.97 | £3.84 | 48.7% |

Let's dive into some prime choices out of the screener.

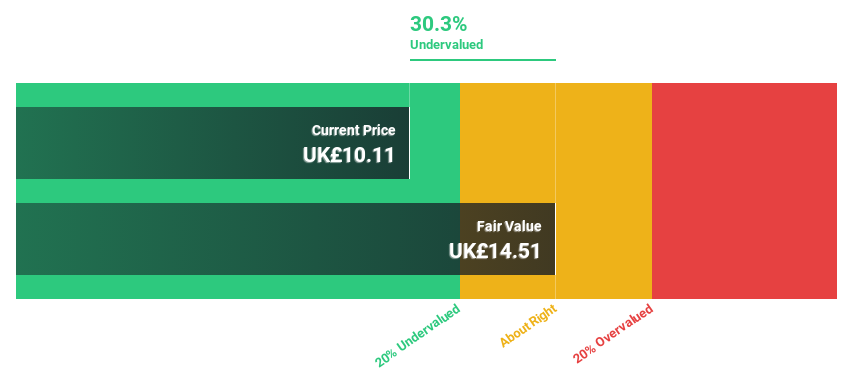

Burford Capital (AIM:BUR)

Overview: Burford Capital Limited offers legal finance products and services globally, with a market cap of £2.32 billion.

Operations: Burford Capital Limited generates revenue through its global provision of legal finance products and services.

Estimated Discount To Fair Value: 24.5%

Burford Capital appears undervalued, trading 24.5% below its estimated fair value of £14.08. Recent earnings show a substantial turnaround with a net income of US$30.93 million in Q1 2025, compared to a loss the previous year. Earnings are forecasted to grow significantly at 28.1% annually, outpacing the UK market's 14.2%. However, revenue growth is expected to be moderate at 12.6%, and return on equity remains low at an anticipated 10.2%.

- Our comprehensive growth report raises the possibility that Burford Capital is poised for substantial financial growth.

- Take a closer look at Burford Capital's balance sheet health here in our report.

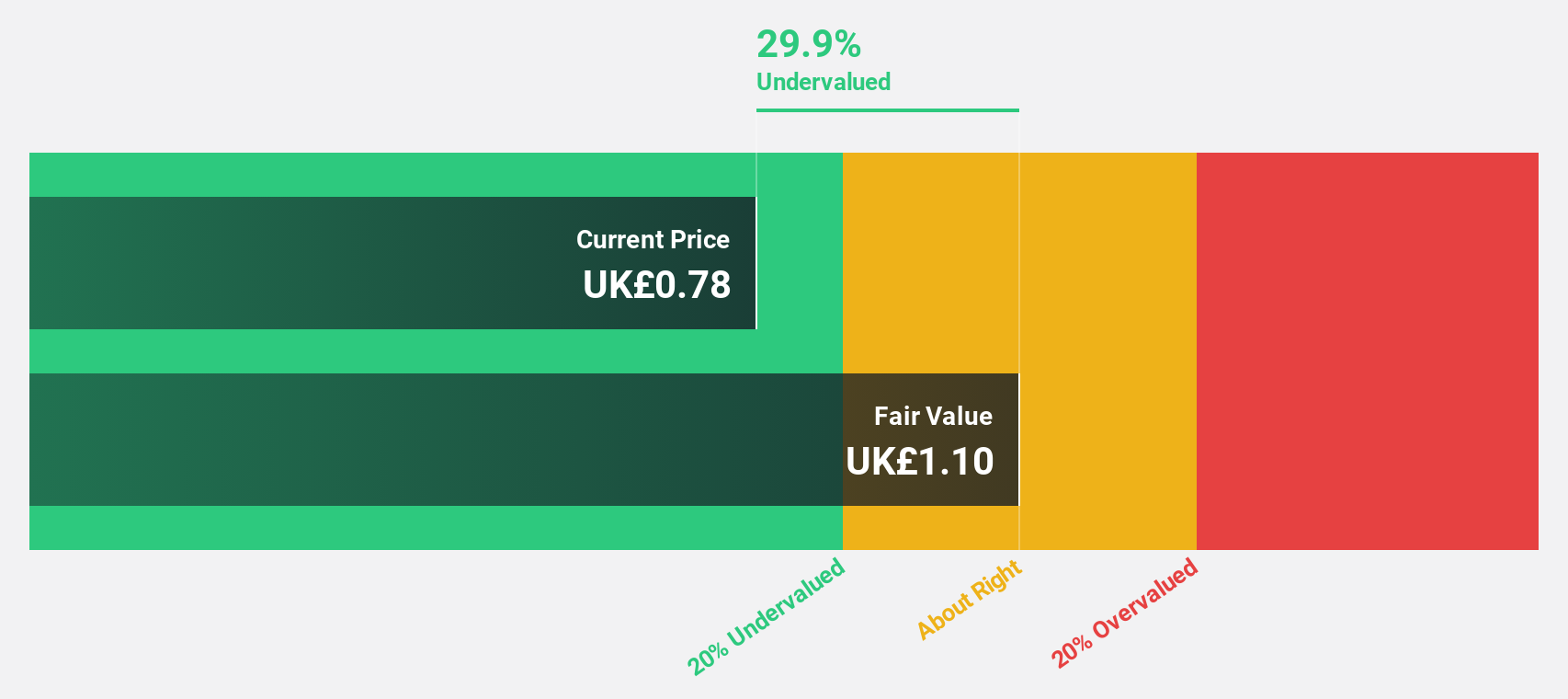

Coats Group (LSE:COA)

Overview: Coats Group plc, with a market cap of £1.17 billion, operates globally in the manufacturing of threads, structural components for apparel and footwear, and performance materials.

Operations: The company's revenue segments include $769.80 million from apparel, $403.50 million from footwear, and $327.60 million from performance materials.

Estimated Discount To Fair Value: 36.7%

Coats Group is trading 36.7% below its estimated fair value of £1.16, highlighting potential undervaluation based on cash flows. The company's strategic exit from non-core operations in the Americas Yarns business is expected to enhance EBIT margins and generate modest cash inflow, aligning with its focus on core growth areas. Despite unstable dividends and high debt relative to operating cash flow, earnings are projected to grow faster than the UK market at 18.1% annually.

- The analysis detailed in our Coats Group growth report hints at robust future financial performance.

- Dive into the specifics of Coats Group here with our thorough financial health report.

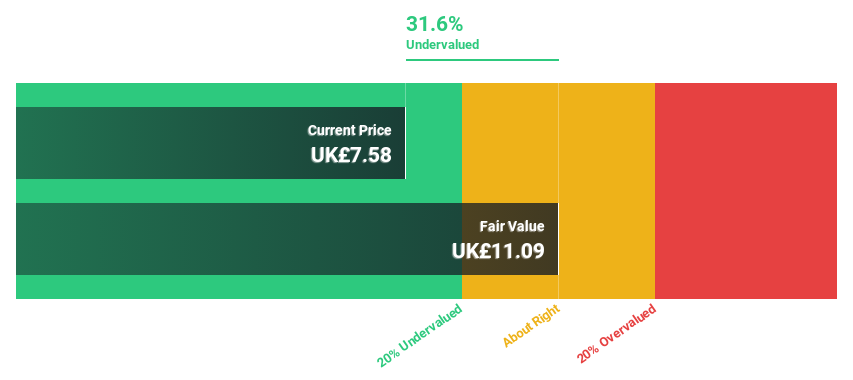

Entain (LSE:ENT)

Overview: Entain Plc is a sports-betting and gaming company with operations in the UK, Ireland, Italy, other parts of Europe, Australia, New Zealand, and internationally, boasting a market cap of approximately £4.48 billion.

Operations: The company's revenue is derived from several segments, including CEE (£488 million), UK&I (£2.05 billion), and International (£2.57 billion).

Estimated Discount To Fair Value: 21.3%

Entain is trading 21.3% below its estimated fair value of £8.91, suggesting potential undervaluation based on cash flows. Recent CEO appointment of Stella David might stabilize leadership amidst strategic shifts. Despite a dividend yield not well covered by earnings, the company expects revenue growth to outpace the UK market at 4.2% annually and forecasts significant earnings growth over the next three years, indicating a transition towards profitability and enhancing its investment appeal.

- Our earnings growth report unveils the potential for significant increases in Entain's future results.

- Click here and access our complete balance sheet health report to understand the dynamics of Entain.

Taking Advantage

- Unlock more gems! Our Undervalued UK Stocks Based On Cash Flows screener has unearthed 47 more companies for you to explore.Click here to unveil our expertly curated list of 50 Undervalued UK Stocks Based On Cash Flows.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Coats Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:COA

Coats Group

Engages in thread manufacturing, structural components for apparel and footwear, and performance materials worldwide.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives