- United Kingdom

- /

- Building

- /

- AIM:ALU

3 UK Dividend Stocks With Up To 5.2% Yield For Your Portfolio

Reviewed by Simply Wall St

As the UK market grapples with global economic challenges, notably the impact of weak trade data from China on indices like the FTSE 100, investors are increasingly looking for stability and income through dividend stocks. In times of uncertainty, selecting stocks with strong dividend yields can provide a reliable stream of income while potentially offering some cushion against market volatility.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Pets at Home Group (LSE:PETS) | 5.84% | ★★★★★★ |

| Keller Group (LSE:KLR) | 3.14% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 3.35% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 7.49% | ★★★★★☆ |

| Man Group (LSE:EMG) | 6.01% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 4.65% | ★★★★★☆ |

| Plus500 (LSE:PLUS) | 5.85% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 7.18% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 3.81% | ★★★★★☆ |

| James Latham (AIM:LTHM) | 6.42% | ★★★★★☆ |

Click here to see the full list of 62 stocks from our Top UK Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Alumasc Group (AIM:ALU)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The Alumasc Group plc, along with its subsidiaries, is engaged in the manufacture and sale of building products, systems, and solutions across various regions including the United Kingdom, Europe, North America, the Middle East, and the Far East; it has a market cap of £115.62 million.

Operations: Alumasc Group's revenue is derived from three main segments: Water Management (£48.32 million), Building Envelope (£37.60 million), and Housebuilding Products (£14.81 million).

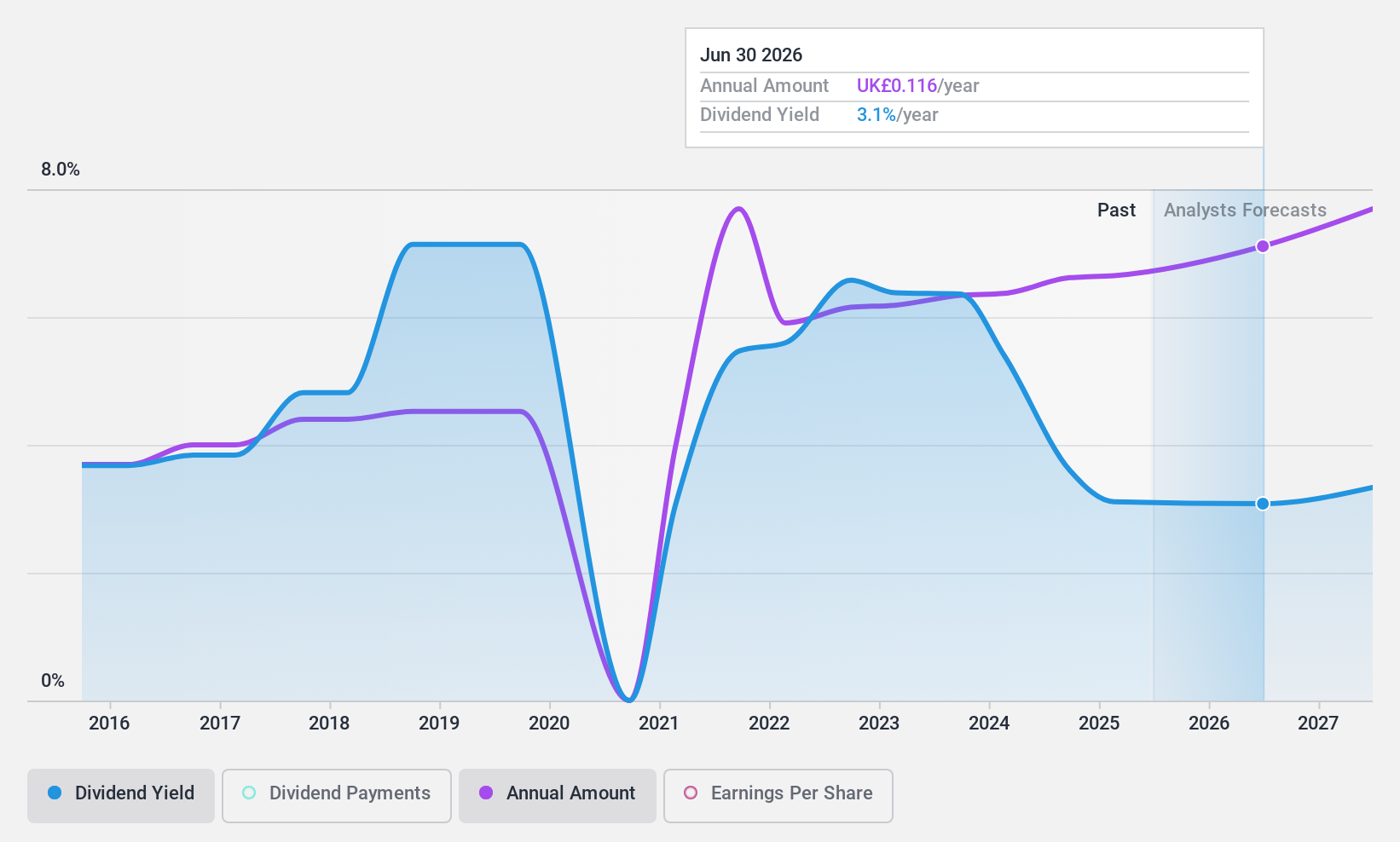

Dividend Yield: 3.3%

Alumasc Group recently declared a final dividend of 7.3 pence per share, reflecting its efforts to enhance shareholder returns despite a historically volatile dividend track record. While the company's dividends are well-covered by both earnings and cash flows, with payout ratios of 44.2% and 36.9% respectively, its yield remains modest compared to top UK payers. Strategic leadership changes aim to bolster operational efficiency and growth prospects, potentially stabilizing future dividends.

- Get an in-depth perspective on Alumasc Group's performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that Alumasc Group is trading behind its estimated value.

Brooks Macdonald Group (AIM:BRK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Brooks Macdonald Group plc offers investment and wealth management services to private clients, pension funds, professional intermediaries, and trustees in the UK and Channel Islands, with a market cap of £262.20 million.

Operations: Brooks Macdonald Group's revenue is primarily derived from its UK Investment Management segment, generating £113.71 million, and its International segment, contributing £19.91 million.

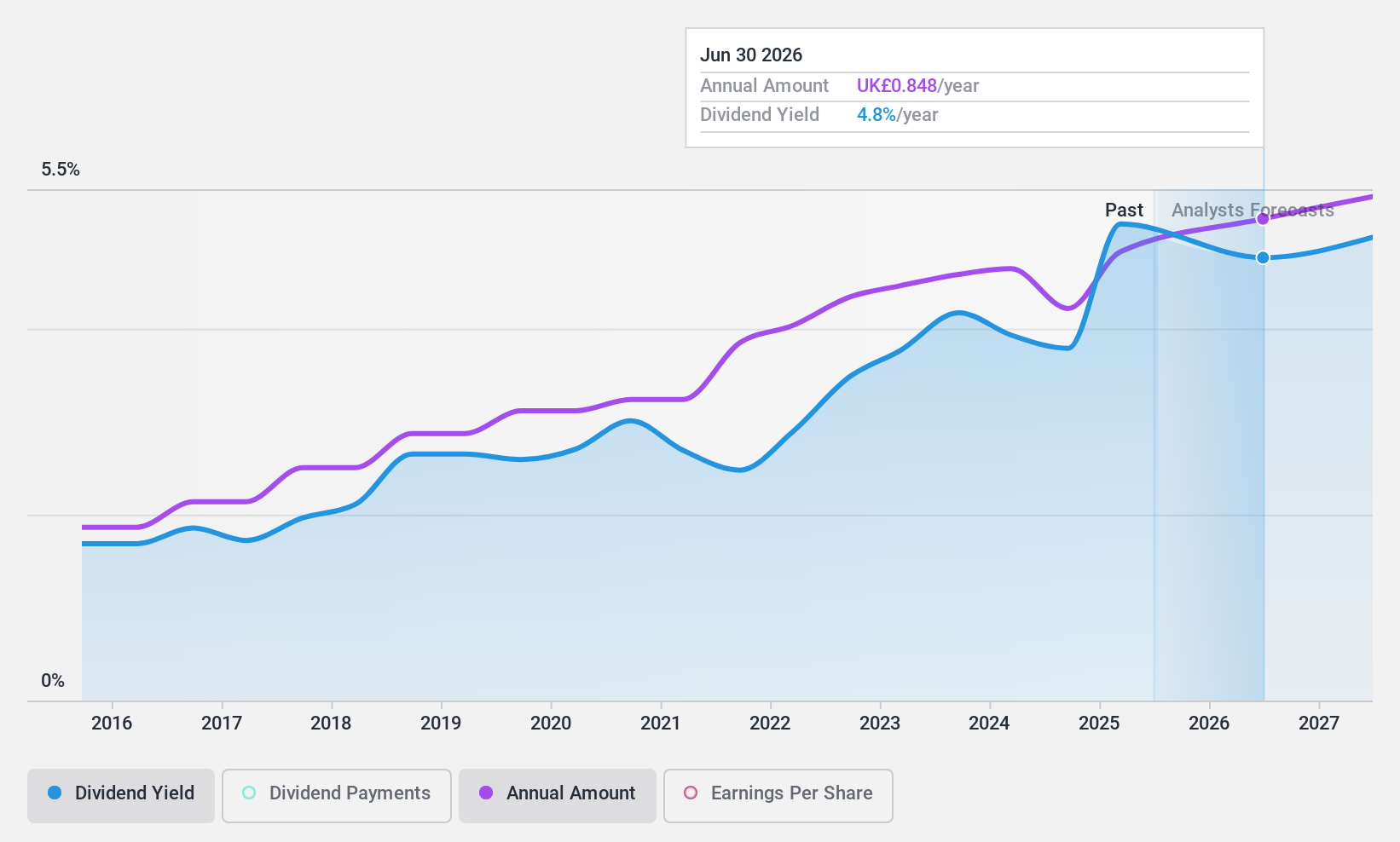

Dividend Yield: 4.8%

Brooks Macdonald Group's dividend payments, though stable and growing over the past decade, are not well covered by earnings due to a high payout ratio of 194.5%. However, the cash payout ratio is more sustainable at 35.8%, indicating dividends are supported by cash flows. Despite a lower profit margin this year and trading below estimated fair value, recent board changes could impact future strategic direction and potentially influence dividend sustainability.

- Click to explore a detailed breakdown of our findings in Brooks Macdonald Group's dividend report.

- Our valuation report unveils the possibility Brooks Macdonald Group's shares may be trading at a premium.

Lloyds Banking Group (LSE:LLOY)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Lloyds Banking Group plc, along with its subsidiaries, offers a variety of banking and financial services both in the United Kingdom and internationally, with a market cap of approximately £33.52 billion.

Operations: Lloyds Banking Group generates its revenue through diverse segments, including retail banking, commercial banking, insurance and wealth management services.

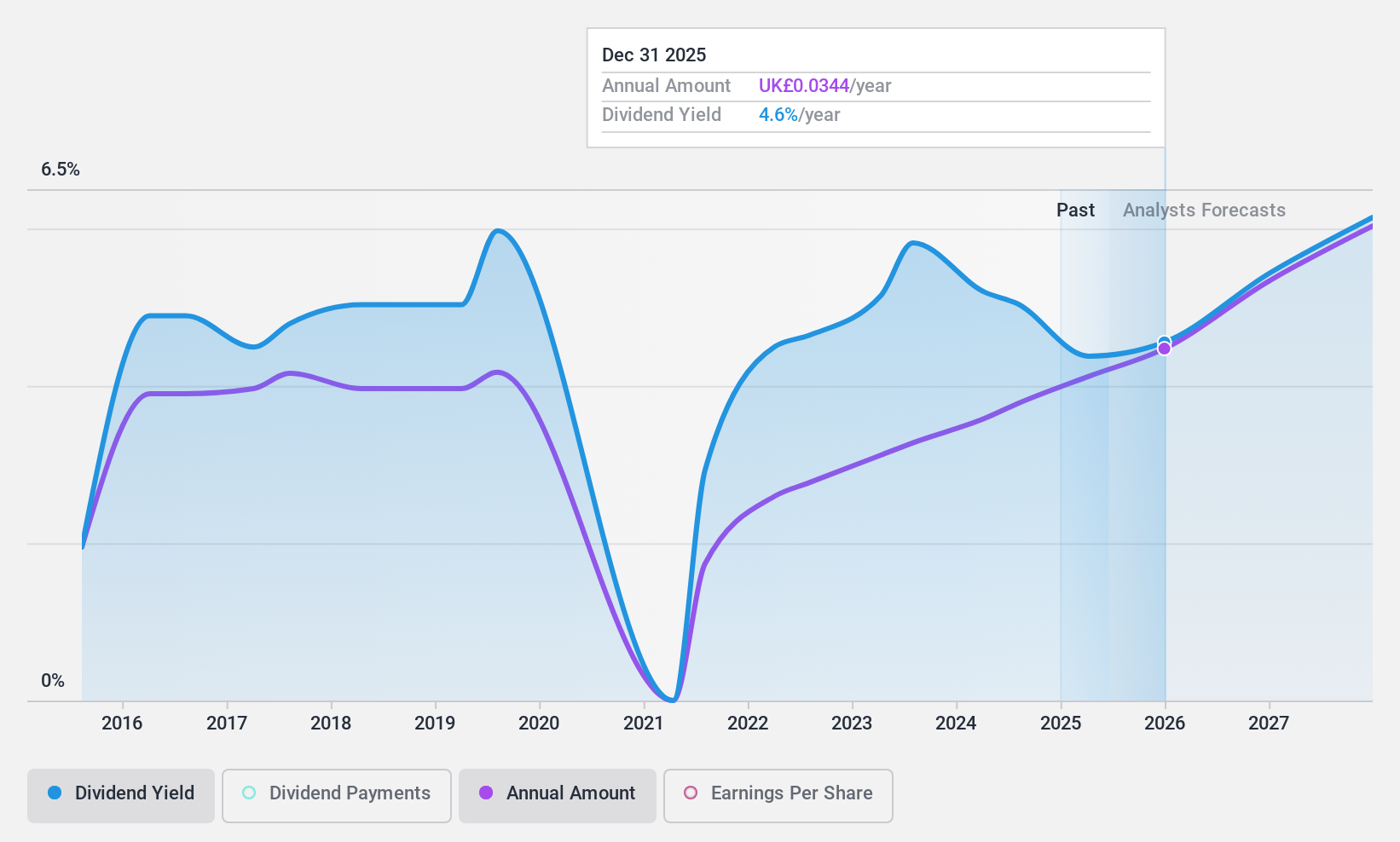

Dividend Yield: 5.2%

Lloyds Banking Group's dividends are well covered by earnings, with a current payout ratio of 41.5% and forecasted to be 48.5% in three years, suggesting sustainability. Despite past volatility, dividend payments have grown over the last decade. The stock trades at a significant discount to its estimated fair value, presenting potential value opportunities for investors. Recent fixed-income offerings totaling $3 billion may influence future financial strategies and impact dividend stability indirectly.

- Unlock comprehensive insights into our analysis of Lloyds Banking Group stock in this dividend report.

- The valuation report we've compiled suggests that Lloyds Banking Group's current price could be quite moderate.

Next Steps

- Access the full spectrum of 62 Top UK Dividend Stocks by clicking on this link.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:ALU

Alumasc Group

Manufactures and sells building products, systems, and solutions in the United Kingdom, Europe, North America, the Middle East, the Far East, and internationally.

Flawless balance sheet, good value and pays a dividend.