- United Kingdom

- /

- Capital Markets

- /

- LSE:BRK

3 UK Dividend Stocks To Watch With Up To 8.4% Yield

Reviewed by Simply Wall St

Amidst the recent downturn in the FTSE 100, driven by weak trade data from China and declining commodity prices, investors are increasingly looking towards dividend stocks for stability and income. In such uncertain times, a good dividend stock can offer consistent returns through regular payouts, providing a cushion against market volatility.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Impax Asset Management Group (AIM:IPX) | 7.49% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 8.85% | ★★★★★☆ |

| Man Group (LSE:EMG) | 6.40% | ★★★★★☆ |

| Plus500 (LSE:PLUS) | 6.37% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 6.76% | ★★★★★☆ |

| DCC (LSE:DCC) | 3.90% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 3.65% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 3.50% | ★★★★★☆ |

| Pets at Home Group (LSE:PETS) | 4.23% | ★★★★★☆ |

| James Latham (AIM:LTHM) | 5.75% | ★★★★★☆ |

Click here to see the full list of 58 stocks from our Top UK Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Alumasc Group (AIM:ALU)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The Alumasc Group plc, with a market cap of £108.94 million, manufactures and sells building products, systems, and solutions across the United Kingdom and various international markets including Europe, North America, the Middle East, and the Far East.

Operations: The Alumasc Group plc's revenue is derived from three main segments: Water Management (£48.32 million), Building Envelope (£37.60 million), and Housebuilding Products (£14.81 million).

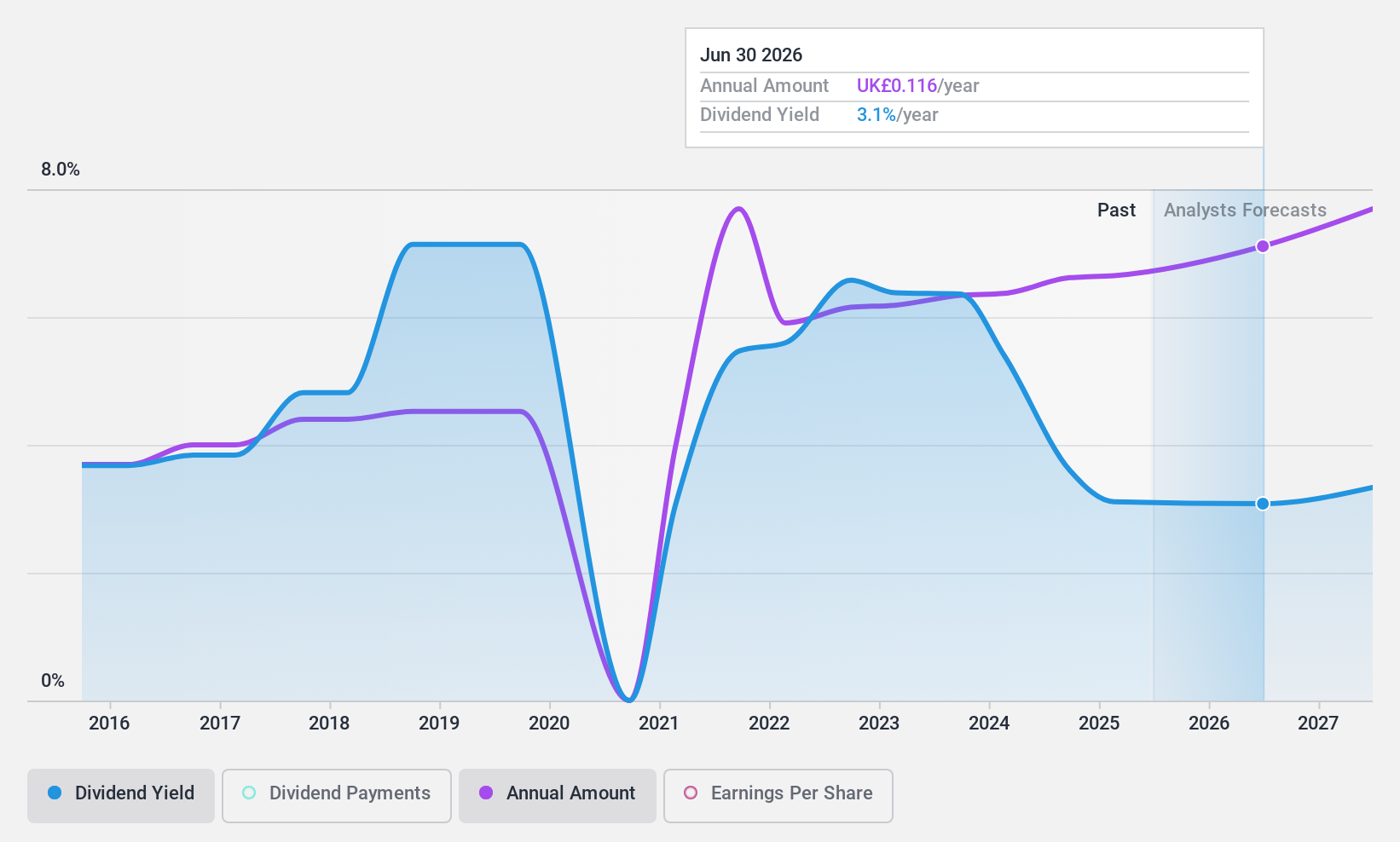

Dividend Yield: 3.5%

Alumasc Group recently declared a final dividend of 7.3 pence per share, reflecting a modest increase from the previous year. Despite this growth, its dividend history has been volatile and somewhat unreliable over the past decade. However, dividends are well-covered by both earnings and cash flows, with payout ratios of 44.2% and 36.9%, respectively. Alumasc's earnings grew by £2.15 million to £8.75 million last year, supporting its capacity to maintain current dividend levels despite market volatility concerns.

- Click here to discover the nuances of Alumasc Group with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Alumasc Group is priced lower than what may be justified by its financials.

Brooks Macdonald Group (AIM:BRK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Brooks Macdonald Group plc offers investment and wealth management services to private clients, pension funds, professional intermediaries, and trustees in the UK and Channel Islands, with a market cap of £288.98 million.

Operations: Brooks Macdonald Group plc generates revenue from its UK Investment Management (including Financial Planning) segment, amounting to £113.71 million, and its International segment, contributing £19.91 million.

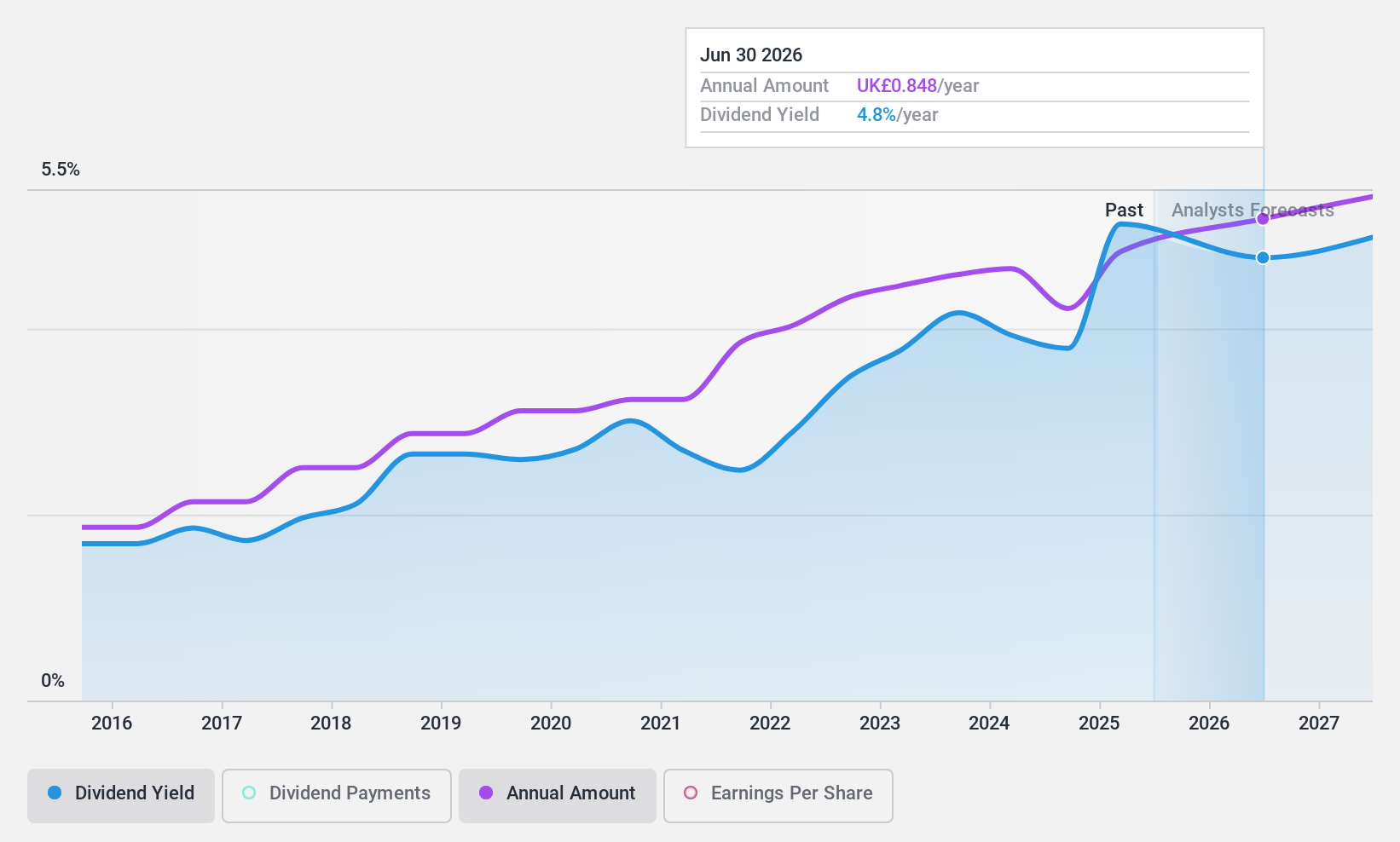

Dividend Yield: 4.3%

Brooks Macdonald Group's dividends have been stable and growing over the past decade, with a recent 4.0% increase to 78 pence per share for the year. However, its high payout ratio of 194.5% indicates dividends are not well covered by earnings, though cash flows provide better coverage with a low cash payout ratio of 35.7%. Recent profit margins fell significantly from last year, and executive changes include Katherine Jones as incoming CFO.

- Delve into the full analysis dividend report here for a deeper understanding of Brooks Macdonald Group.

- In light of our recent valuation report, it seems possible that Brooks Macdonald Group is trading beyond its estimated value.

Somero Enterprises (AIM:SOM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Somero Enterprises, Inc. designs, assembles, remanufactures, sells, and distributes concrete leveling, contouring, and placing equipment both in the United States and internationally with a market cap of £152.72 million.

Operations: Somero Enterprises, Inc. generates revenue of $113.69 million from its Construction Machinery & Equipment segment.

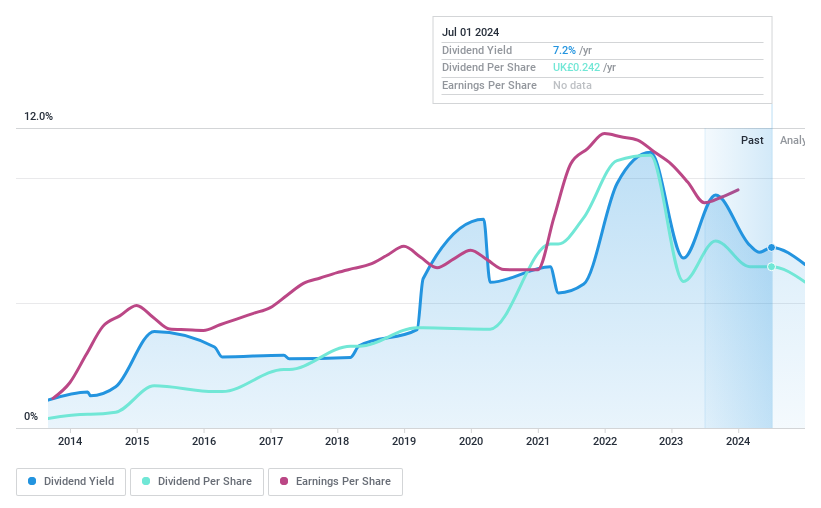

Dividend Yield: 8.5%

Somero Enterprises' dividend yield of 8.48% ranks in the top 25% among UK dividend payers, but its sustainability is questionable due to a high cash payout ratio of 104.3%. Despite a reasonably low earnings payout ratio of 49.6%, dividends are not well covered by free cash flows and have been volatile over the past decade. Recent financials show decreased sales and net income for H1 2024, with an interim dividend declared at $0.08 per share, totaling $4.4 million.

- Click here and access our complete dividend analysis report to understand the dynamics of Somero Enterprises.

- The analysis detailed in our Somero Enterprises valuation report hints at an deflated share price compared to its estimated value.

Where To Now?

- Unlock more gems! Our Top UK Dividend Stocks screener has unearthed 55 more companies for you to explore.Click here to unveil our expertly curated list of 58 Top UK Dividend Stocks.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brooks Macdonald Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:BRK

Brooks Macdonald Group

Through its subsidiaries, provides a range of investment and wealth management services to private clients, pension funds, professional intermediaries, and trustees in the United Kingdom, and the Channel Islands.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives