- United Kingdom

- /

- Capital Markets

- /

- AIM:AGFX

Earnings Not Telling The Story For Argentex Group PLC (LON:AGFX)

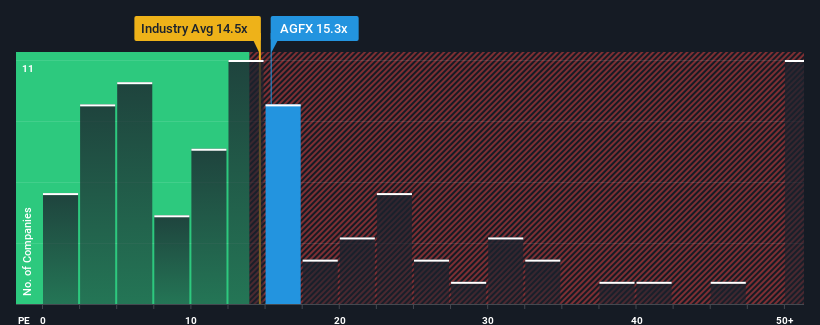

It's not a stretch to say that Argentex Group PLC's (LON:AGFX) price-to-earnings (or "P/E") ratio of 15.3x right now seems quite "middle-of-the-road" compared to the market in the United Kingdom, where the median P/E ratio is around 14x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Argentex Group certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

View our latest analysis for Argentex Group

How Is Argentex Group's Growth Trending?

The only time you'd be comfortable seeing a P/E like Argentex Group's is when the company's growth is tracking the market closely.

If we review the last year of earnings growth, the company posted a terrific increase of 34%. As a result, it also grew EPS by 15% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of earnings growth.

This is in contrast to the rest of the market, which is expected to grow by 7.5% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's curious that Argentex Group's P/E sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. They may be setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

The Bottom Line On Argentex Group's P/E

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Argentex Group revealed its three-year earnings trends aren't impacting its P/E as much as we would have predicted, given they look worse than current market expectations. Right now we are uncomfortable with the P/E as this earnings performance isn't likely to support a more positive sentiment for long. If recent medium-term earnings trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Before you settle on your opinion, we've discovered 1 warning sign for Argentex Group that you should be aware of.

If you're unsure about the strength of Argentex Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:AGFX

Argentex Group

Provides currency risk management, payment, and alternative banking solutions in the United Kingdom, the Netherlands, the United Arab Emirates, and Australia.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives