- United Kingdom

- /

- Hospitality

- /

- LSE:WTB

Do These 3 Checks Before Buying Whitbread plc (LON:WTB) For Its Upcoming Dividend

Regular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see Whitbread plc (LON:WTB) is about to trade ex-dividend in the next 3 days. Typically, the ex-dividend date is one business day before the record date which is the date on which a company determines the shareholders eligible to receive a dividend. The ex-dividend date is an important date to be aware of as any purchase of the stock made on or after this date might mean a late settlement that doesn't show on the record date. Accordingly, Whitbread investors that purchase the stock on or after the 26th of May will not receive the dividend, which will be paid on the 1st of July.

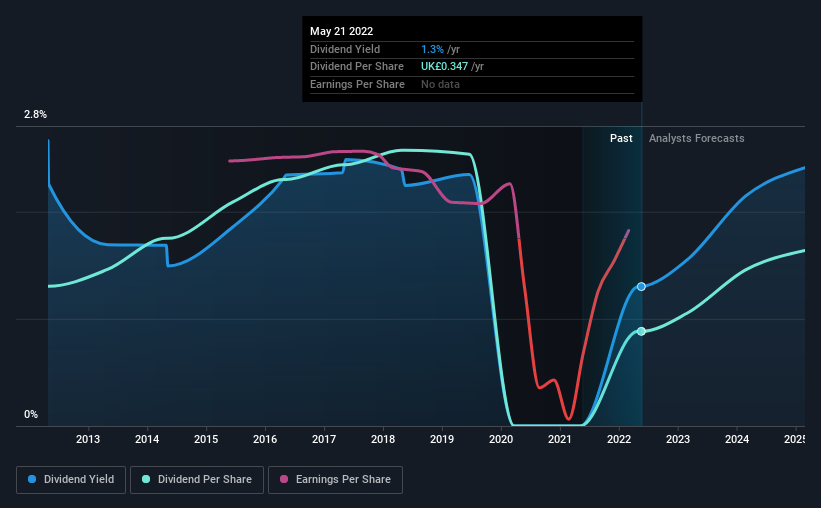

The company's next dividend payment will be UK£0.35 per share, on the back of last year when the company paid a total of UK£0.35 to shareholders. Looking at the last 12 months of distributions, Whitbread has a trailing yield of approximately 1.3% on its current stock price of £26.67. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. So we need to investigate whether Whitbread can afford its dividend, and if the dividend could grow.

Check out our latest analysis for Whitbread

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. Whitbread distributed an unsustainably high 165% of its profit as dividends to shareholders last year. Without extenuating circumstances, we'd consider the dividend at risk of a cut.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Companies with falling earnings are riskier for dividend shareholders. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. Whitbread's earnings have collapsed faster than Wile E Coyote's schemes to trap the Road Runner; down a tremendous 38% a year over the past five years.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. Whitbread's dividend payments per share have declined at 3.8% per year on average over the past 10 years, which is uninspiring. While it's not great that earnings and dividends per share have fallen in recent years, we're encouraged by the fact that management has trimmed the dividend rather than risk over-committing the company in a risky attempt to maintain yields to shareholders.

Final Takeaway

Is Whitbread worth buying for its dividend? Earnings per share are in decline and Whitbread is paying out what we feel is an uncomfortably high percentage of its profit as dividends. It's not that we hate the business, but we feel that these characeristics are not desirable for investors seeking a reliable dividend stock to own for the long term. These characteristics don't generally lead to outstanding dividend performance, and investors may not be happy with the results of owning this stock for its dividend.

Although, if you're still interested in Whitbread and want to know more, you'll find it very useful to know what risks this stock faces. For example, we've found 1 warning sign for Whitbread that we recommend you consider before investing in the business.

A common investing mistake is buying the first interesting stock you see. Here you can find a full list of high-yield dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if Whitbread might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:WTB

Whitbread

Operates hotels and restaurants in the United Kingdom, Germany, and internationally.

Adequate balance sheet average dividend payer.