- United Kingdom

- /

- Specialized REITs

- /

- LSE:BYG

3 UK Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 index experiencing a decline due to weak trade data from China, highlighting concerns about global economic recovery. In such an environment, dividend stocks can offer stability and potential income for investors looking to navigate uncertain markets.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| James Latham (AIM:LTHM) | 6.10% | ★★★★★★ |

| Keller Group (LSE:KLR) | 3.28% | ★★★★★☆ |

| Impax Asset Management Group (AIM:IPX) | 8.51% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 3.25% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 8.46% | ★★★★★☆ |

| Man Group (LSE:EMG) | 6.20% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 4.19% | ★★★★★☆ |

| Plus500 (LSE:PLUS) | 6.28% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 3.89% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 6.94% | ★★★★★☆ |

Click here to see the full list of 62 stocks from our Top UK Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Big Yellow Group (LSE:BYG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Big Yellow Group is the UK's leading brand in self-storage, with a market cap of £2.11 billion.

Operations: Big Yellow Group generates revenue primarily through the provision of self-storage and related services, amounting to £203.01 million.

Dividend Yield: 4.2%

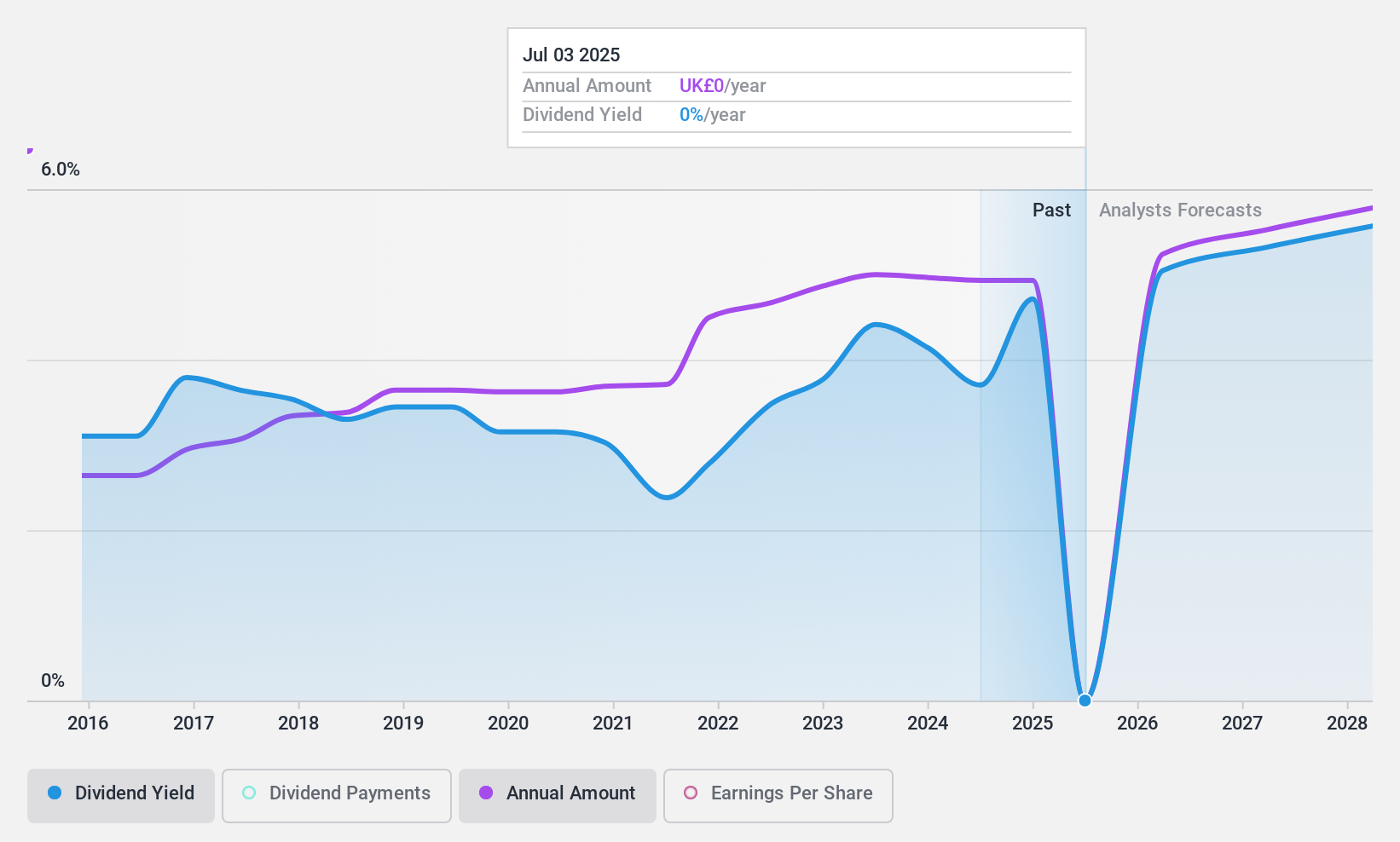

Big Yellow Group's recent performance highlights a stable dividend, with an interim payout of 22.6 pence per share, maintaining its Property Income Distribution status. Despite a lower yield of 4.19% compared to top UK dividend payers, the dividends are well-covered by earnings and cash flow, with payout ratios around 77%. The company's earnings have grown significantly over the past year and are expected to benefit from increased occupancy and operational efficiencies in the future.

- Dive into the specifics of Big Yellow Group here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that Big Yellow Group is priced lower than what may be justified by its financials.

4imprint Group (LSE:FOUR)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: 4imprint Group plc operates as a direct marketer of promotional products across North America, the United Kingdom, and Ireland, with a market capitalization of £1.43 billion.

Operations: The company's revenue segments consist of $1.33 billion from North America and $25 million from the UK & Ireland.

Dividend Yield: 3.3%

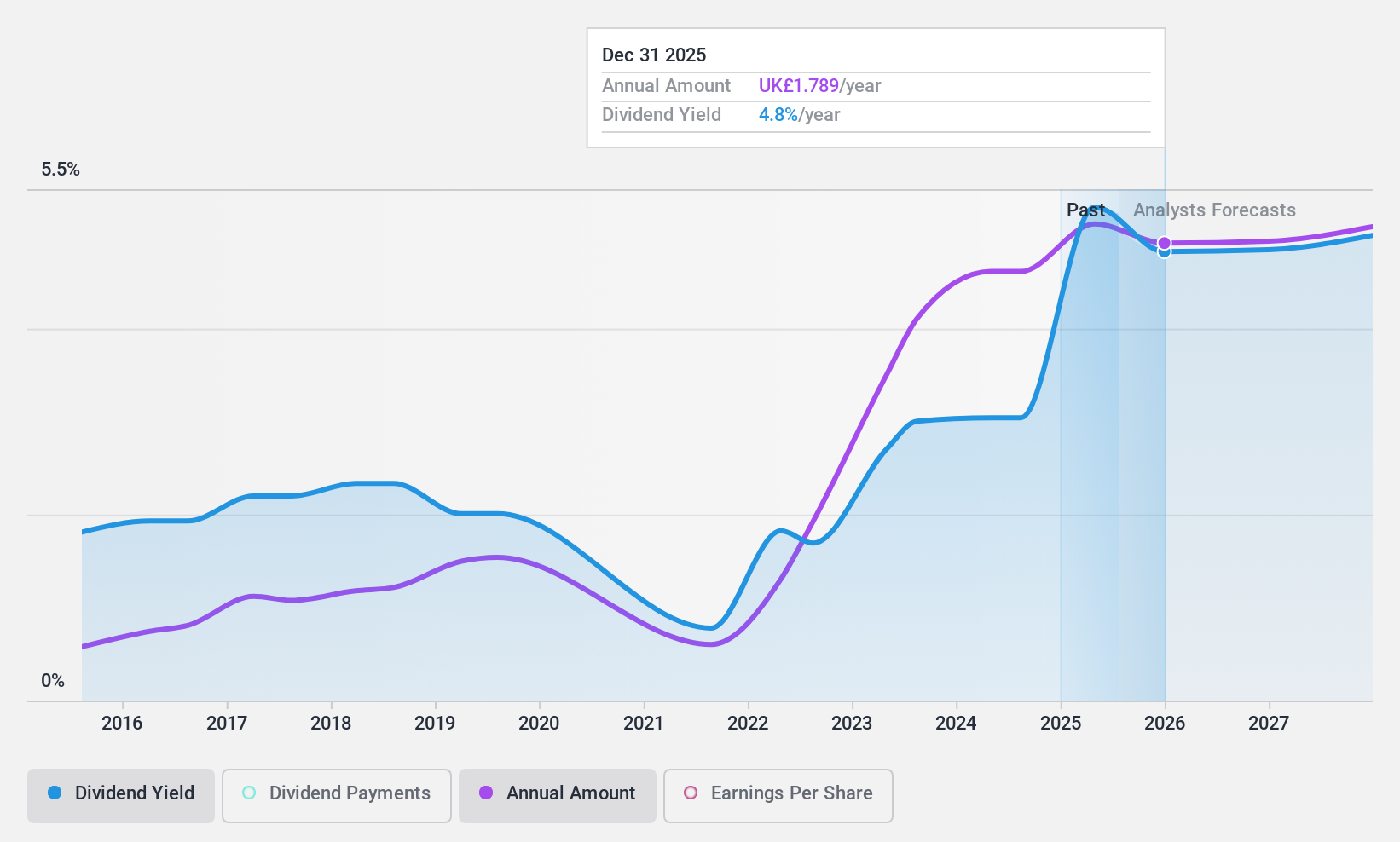

4imprint Group's dividend payments have been reliable and growing steadily over the past decade, supported by a sustainable payout ratio of 58.1% from earnings and 54.4% from cash flows. Although its 3.25% yield is lower than top UK dividend payers, the stock trades at a significant discount to fair value, suggesting potential upside. Recent updates include expected full-year revenue around $1.37 billion and an upcoming CFO transition with Michelle Brukwicki's appointment in December 2024.

- Click here to discover the nuances of 4imprint Group with our detailed analytical dividend report.

- The valuation report we've compiled suggests that 4imprint Group's current price could be quite moderate.

Whitbread (LSE:WTB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Whitbread plc operates hotels and restaurants in the United Kingdom, Germany, and internationally, with a market cap of £5.05 billion.

Operations: Whitbread plc generates revenue from its Accommodation, Food and Beverage segment, totaling £2.96 billion.

Dividend Yield: 3.5%

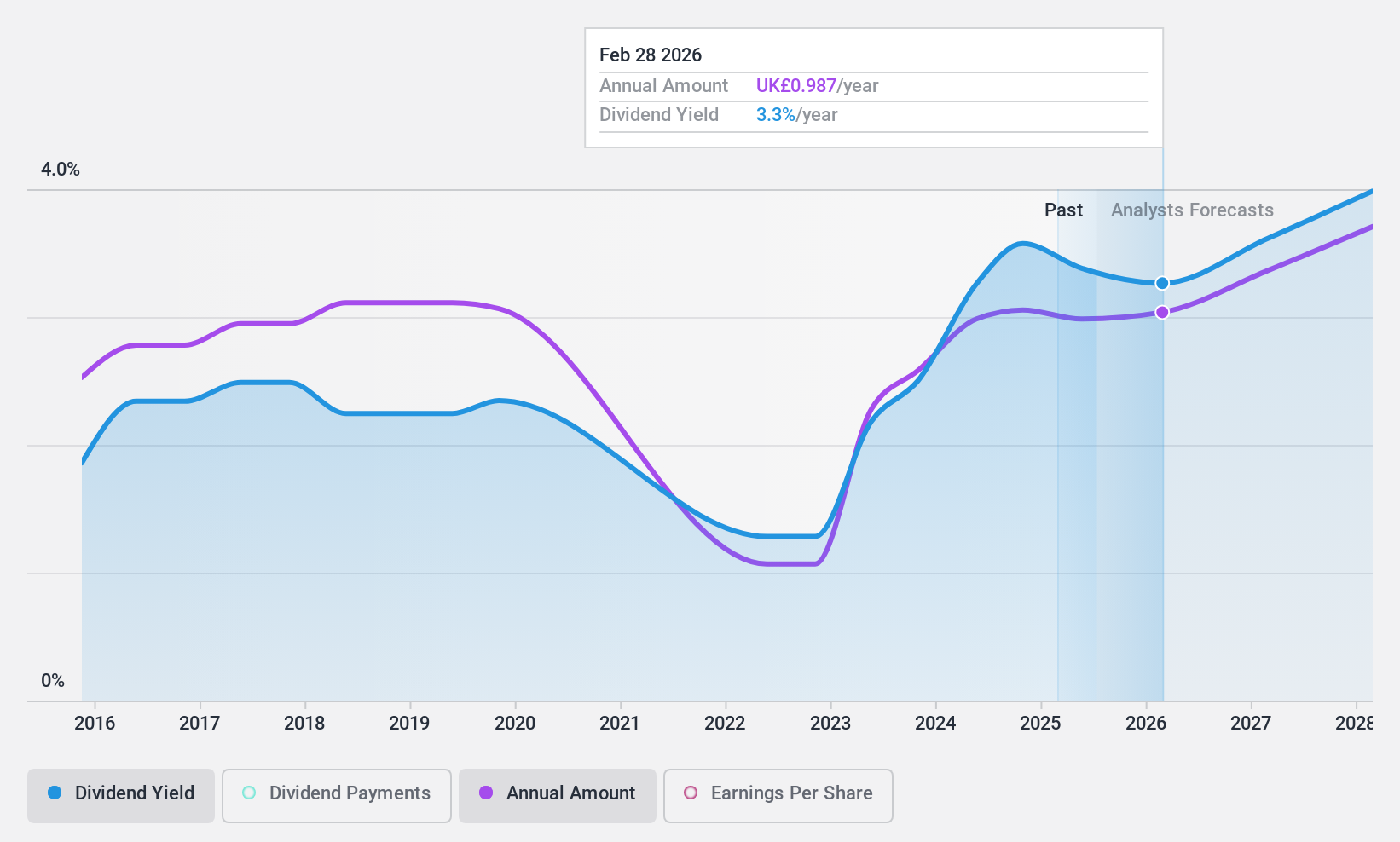

Whitbread's dividend, though increased by 7% recently, has been volatile over the past decade. The payout ratio of 77.1% is covered by earnings and cash flows (62.2%), but profit margins have declined from last year. Despite a lower yield of 3.45% compared to top UK payers, the stock trades at a discount to fair value with potential price appreciation noted by analysts. Recent share buybacks reflect confidence in future performance improvements as outlined in their Five-Year Plan.

- Delve into the full analysis dividend report here for a deeper understanding of Whitbread.

- Our expertly prepared valuation report Whitbread implies its share price may be lower than expected.

Turning Ideas Into Actions

- Navigate through the entire inventory of 62 Top UK Dividend Stocks here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Big Yellow Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:BYG

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives