When SSP Group plc (LON:SSPG) reported its results to September 2020 its auditors, KPMG LLP - Klynveld Peat Marwick Goerdeler could not be sure that it would be able to continue as a going concern in the next year. This means that, based on the financial results to that date, the company arguably should raise capital, or otherwise strengthen the balance sheet, as soon as possible.

Given its situation, it may not be in a good position to raise capital on favorable terms. So it is suddenly extremely important to consider whether the company is taking too much risk on its balance sheet. The biggest concern we would have is the company's debt, since its lenders might force the company into administration if it cannot repay them.

See our latest analysis for SSP Group

What Is SSP Group's Net Debt?

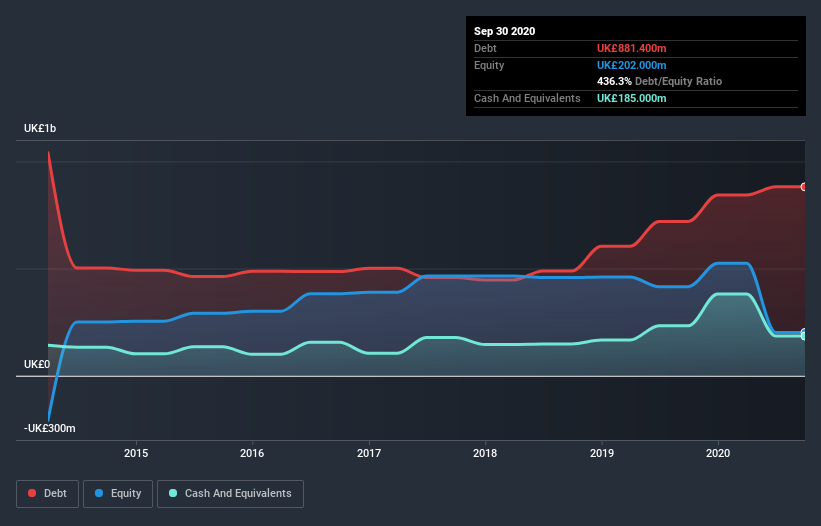

As you can see below, at the end of September 2020, SSP Group had UK£881.4m of debt, up from UK£720.1m a year ago. Click the image for more detail. However, it does have UK£185.0m in cash offsetting this, leading to net debt of about UK£696.4m.

A Look At SSP Group's Liabilities

The latest balance sheet data shows that SSP Group had liabilities of UK£879.5m due within a year, and liabilities of UK£1.84b falling due after that. On the other hand, it had cash of UK£185.0m and UK£91.4m worth of receivables due within a year. So it has liabilities totalling UK£2.44b more than its cash and near-term receivables, combined.

When you consider that this deficiency exceeds the company's UK£1.84b market capitalization, you might well be inclined to review the balance sheet intently. Hypothetically, extremely heavy dilution would be required if the company were forced to pay down its liabilities by raising capital at the current share price. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if SSP Group can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Over 12 months, SSP Group made a loss at the EBIT level, and saw its revenue drop to UK£1.4b, which is a fall of 49%. To be frank that doesn't bode well.

Caveat Emptor

While SSP Group's falling revenue is about as heartwarming as a wet blanket, arguably its earnings before interest and tax (EBIT) loss is even less appealing. Indeed, it lost a very considerable UK£317m at the EBIT level. When we look at that alongside the significant liabilities, we're not particularly confident about the company. We'd want to see some strong near-term improvements before getting too interested in the stock. Not least because it burned through UK£135m in negative free cash flow over the last year. So suffice it to say we consider the stock to be risky. We prefer to avoid a company after its auditor has expressed any uncertainty about its ability to continue as a going concern. That's because companies should always make sure the auditor has confidence that the company will continue as a going concern, in our view. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. For instance, we've identified 3 warning signs for SSP Group (2 make us uncomfortable) you should be aware of.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you decide to trade SSP Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About LSE:SSPG

SSP Group

Operates food and beverage outlets in North America, Europe, the United Kingdom, Ireland, the Asia Pacific, Eastern Europe, the Middle East, and internationally.

High growth potential with proven track record.