- United Kingdom

- /

- Insurance

- /

- LSE:PHNX

UK Stocks That Might Be Priced Below Their Estimated Value

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 index experiencing declines due to weak trade data from China and its impact on global economic sentiment. As investors navigate these turbulent conditions, identifying stocks that may be undervalued becomes crucial, as they could offer potential opportunities amidst broader market uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Eurocell (LSE:ECEL) | £1.55 | £3.04 | 49% |

| On the Beach Group (LSE:OTB) | £2.32 | £4.59 | 49.5% |

| Informa (LSE:INF) | £7.858 | £15.47 | 49.2% |

| JD Sports Fashion (LSE:JD.) | £0.7982 | £1.53 | 48% |

| Victrex (LSE:VCT) | £9.65 | £18.30 | 47.3% |

| AstraZeneca (LSE:AZN) | £118.08 | £217.85 | 45.8% |

| Likewise Group (AIM:LIKE) | £0.185 | £0.37 | 49.9% |

| Vanquis Banking Group (LSE:VANQ) | £0.585 | £1.13 | 48.4% |

| TI Fluid Systems (LSE:TIFS) | £1.968 | £3.75 | 47.5% |

| Kromek Group (AIM:KMK) | £0.0565 | £0.11 | 49.8% |

Below we spotlight a couple of our favorites from our exclusive screener.

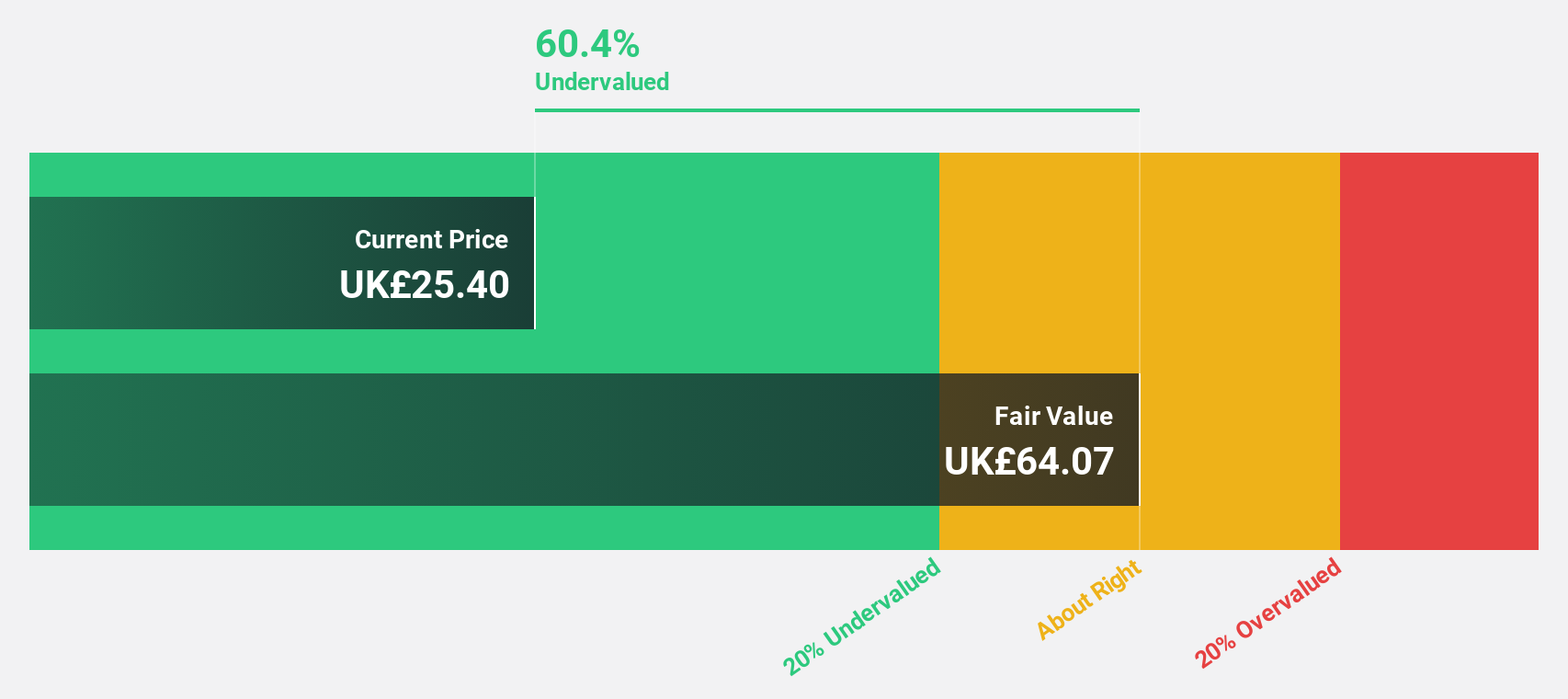

Bellway (LSE:BWY)

Overview: Bellway p.l.c., along with its subsidiaries, operates in the homebuilding sector across the United Kingdom and has a market capitalization of approximately £2.77 billion.

Operations: The company's revenue is primarily derived from its UK House Building segment, which generated £2.38 billion.

Estimated Discount To Fair Value: 18.6%

Bellway is trading at £23.38, below its estimated fair value of £28.73, indicating potential undervaluation based on cash flows. While earnings are forecast to grow significantly at 21.3% annually, revenue growth is expected to be moderate at 9.7%, outpacing the UK market's average but trailing behind more aggressive targets. Despite a low return on equity forecast and profit margins declining from last year, analysts anticipate a stock price increase of 33.6%.

- Our expertly prepared growth report on Bellway implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of Bellway.

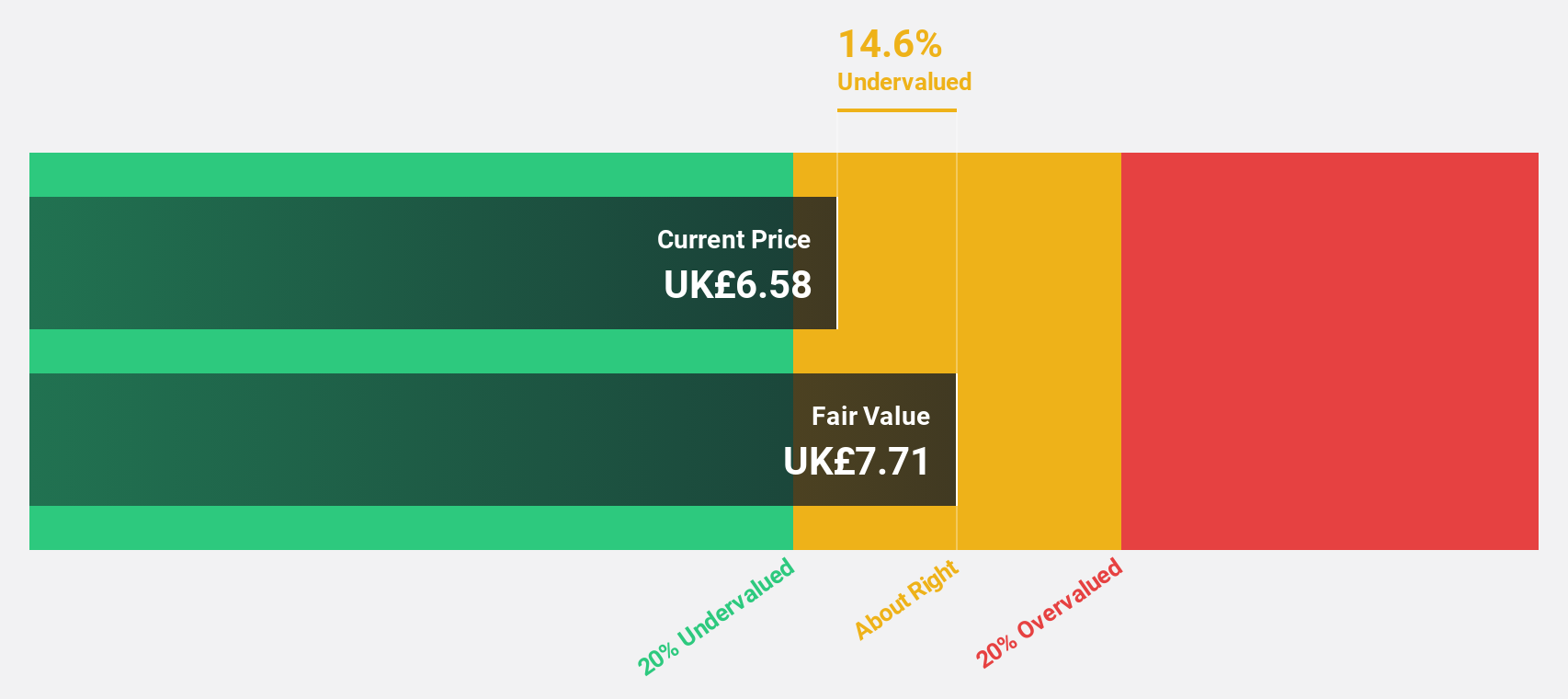

Phoenix Group Holdings (LSE:PHNX)

Overview: Phoenix Group Holdings plc operates in the long-term savings and retirement business in Europe, with a market cap of approximately £5.77 billion.

Operations: The company's revenue segments include With-profits (£429 million), Europe and Other (£659 million), Pensions & Savings (£1.16 billion), and Retirement Solutions (£3.92 billion).

Estimated Discount To Fair Value: 27.8%

Phoenix Group Holdings is trading at £5.78, significantly below its estimated fair value of £8, highlighting potential undervaluation based on cash flows. Despite a reported net loss of £1.09 billion for 2024, the company is forecast to become profitable in three years with high return on equity projections. However, revenue is expected to decline by 25.9% annually over the next three years, and the dividend yield of 9.47% isn't well covered by earnings.

- Insights from our recent growth report point to a promising forecast for Phoenix Group Holdings' business outlook.

- Dive into the specifics of Phoenix Group Holdings here with our thorough financial health report.

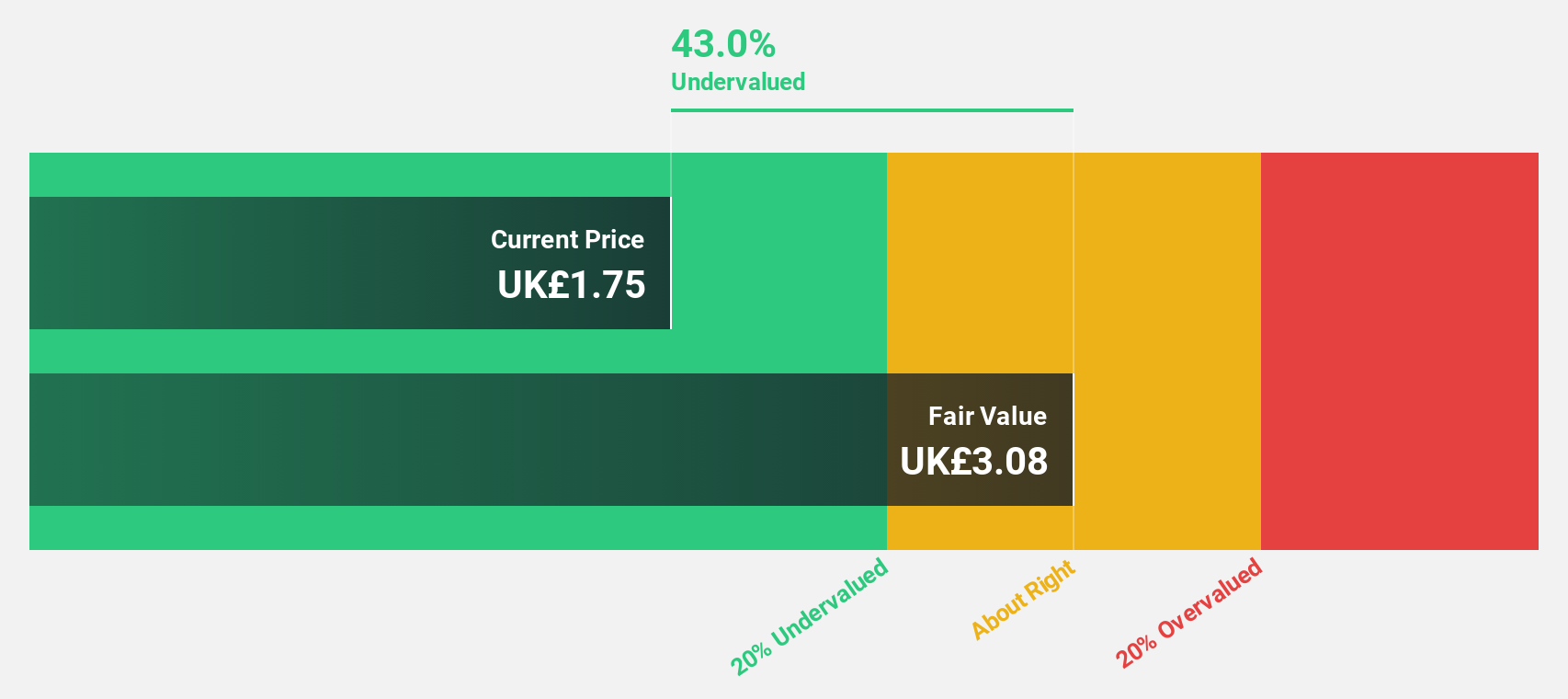

Deliveroo (LSE:ROO)

Overview: Deliveroo plc operates an online food delivery platform across several countries including the United Kingdom, Ireland, and France, with a market cap of approximately £1.82 billion.

Operations: The company's revenue primarily comes from the operation of its on-demand food delivery platform, generating £2.07 billion.

Estimated Discount To Fair Value: 42.5%

Deliveroo, trading at £1.24, is significantly below its estimated fair value of £2.16, suggesting undervaluation based on cash flows. The company reported a net income of £2.9 million for 2024, reversing a prior net loss and showing improved profitability prospects with earnings forecast to grow 66.79% annually. Deliveroo's revenue growth outpaces the UK market and recent buyback plan expansion to £250 million further enhances shareholder value potential amidst positive financial momentum.

- Our growth report here indicates Deliveroo may be poised for an improving outlook.

- Click to explore a detailed breakdown of our findings in Deliveroo's balance sheet health report.

Make It Happen

- Investigate our full lineup of 60 Undervalued UK Stocks Based On Cash Flows right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:PHNX

Phoenix Group Holdings

Operates in the long-term savings and retirement business in Europe.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives