- United Kingdom

- /

- Hospitality

- /

- LSE:ROO

FRP Advisory Group And 2 Other UK Penny Stocks Worth Watching

Reviewed by Simply Wall St

The UK market has been experiencing fluctuations, with the FTSE 100 index recently closing lower due to weak trade data from China, highlighting global economic interdependencies. In such a climate, investors often look towards smaller companies for potential growth opportunities. While the term "penny stocks" may seem outdated, it still captures the essence of investing in smaller or less-established companies that can offer significant value when backed by strong fundamentals and robust financial health.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Polar Capital Holdings (AIM:POLR) | £4.965 | £478.61M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.972 | £153.33M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.70 | £422.49M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £1.976 | £744.58M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.405 | £178.93M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £3.58 | £68.28M | ★★★★☆☆ |

| Luceco (LSE:LUCE) | £1.17 | £180.45M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £3.48 | £346.11M | ★★★★☆☆ |

| Tristel (AIM:TSTL) | £3.975 | £189.58M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £1.99 | £141.97M | ★★★★★☆ |

Click here to see the full list of 445 stocks from our UK Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

FRP Advisory Group (AIM:FRP)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: FRP Advisory Group plc, with a market cap of £340.62 million, offers business advisory services to companies, lenders, investors, individuals, and other stakeholders through its subsidiaries.

Operations: The company generates £147.1 million in revenue from its specialist business advisory services segment.

Market Cap: £340.62M

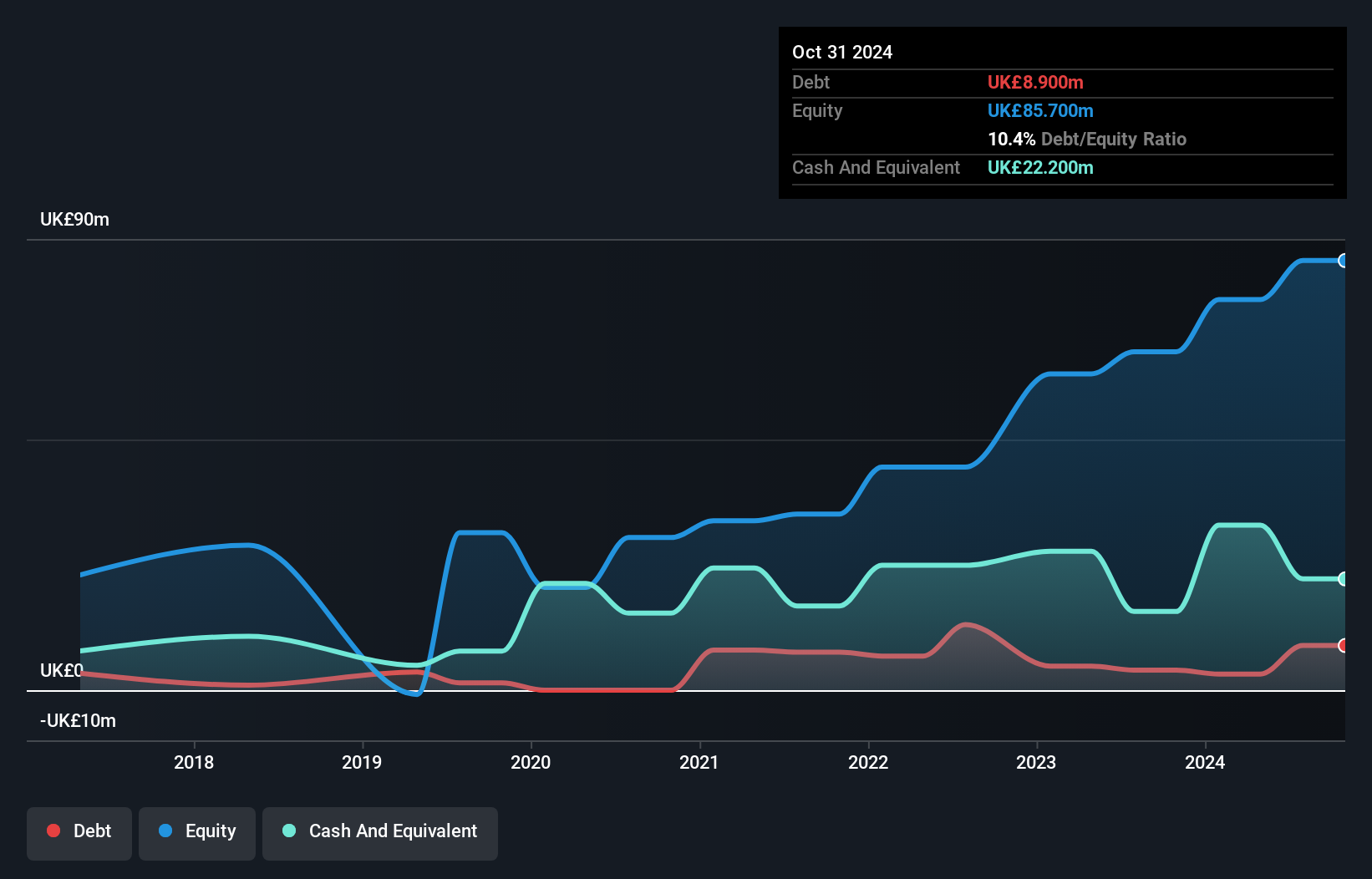

FRP Advisory Group, with a market cap of £340.62 million, shows robust financial health and growth potential. The company reported significant earnings growth of 68.6% over the past year, surpassing industry averages, and maintains high-quality earnings with strong net profit margins at 17.9%. Its cash position exceeds total debt, indicating solid liquidity management. Recent revenue for the half-year was £77.6 million, up from £58.7 million in the prior year, driven by both organic and inorganic growth through acquisitions in key service areas. However, shareholders have experienced dilution over the past year due to an increase in shares outstanding by 6.9%.

- Dive into the specifics of FRP Advisory Group here with our thorough balance sheet health report.

- Gain insights into FRP Advisory Group's future direction by reviewing our growth report.

Polar Capital Holdings (AIM:POLR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Polar Capital Holdings plc is a publicly owned investment manager with a market cap of £478.61 million.

Operations: The company generates revenue of £212.74 million from its investment management business.

Market Cap: £478.61M

Polar Capital Holdings, with a market cap of £478.61 million, demonstrates solid financial fundamentals in the investment management sector. The company reported half-year revenue of £103.5 million and net income of £16.65 million, reflecting improved profit margins from 19% to 19.7%. It trades at a significant discount to its estimated fair value and exhibits high-quality earnings with strong Return on Equity at 33.6%. The firm is debt-free, enhancing its financial stability, while seasoned management and board members further support operational strength. However, the dividend yield may not be fully covered by earnings, indicating potential sustainability concerns.

- Navigate through the intricacies of Polar Capital Holdings with our comprehensive balance sheet health report here.

- Gain insights into Polar Capital Holdings' outlook and expected performance with our report on the company's earnings estimates.

Deliveroo (LSE:ROO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Deliveroo plc operates an online food delivery platform across several countries, including the UK and UAE, with a market cap of £1.94 billion.

Operations: The company generates £2.04 billion from its on-demand food delivery platform operations.

Market Cap: £1.94B

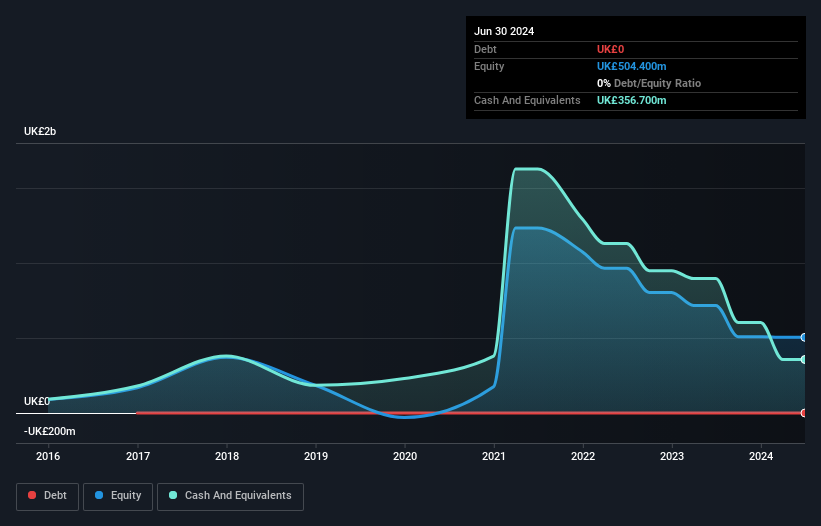

Deliveroo plc, with a market cap of £1.94 billion, recently joined the FTSE All-Share and FTSE 250 indices, signaling increased recognition in the market. The company became profitable last year and forecasts suggest robust earnings growth of 43.58% annually. It trades at a discount to its estimated fair value and has no debt, enhancing financial stability. Deliveroo's short-term assets comfortably cover both short and long-term liabilities, although recent results were impacted by a significant one-off gain of £38 million. Management is experienced but Return on Equity remains low at 9.9%, indicating room for improvement in profitability metrics.

- Click here to discover the nuances of Deliveroo with our detailed analytical financial health report.

- Understand Deliveroo's earnings outlook by examining our growth report.

Key Takeaways

- Click through to start exploring the rest of the 442 UK Penny Stocks now.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:ROO

Deliveroo

A holding company, operates an online food delivery platform in the United Kingdom, Ireland, France, Italy, Belgium, Hong Kong, Singapore, the United Arab Emirates, Kuwait, and Qatar.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives