- United Kingdom

- /

- Hospitality

- /

- LSE:OTB

We're Not Very Worried About On the Beach Group's (LON:OTB) Cash Burn Rate

There's no doubt that money can be made by owning shares of unprofitable businesses. For example, although Amazon.com made losses for many years after listing, if you had bought and held the shares since 1999, you would have made a fortune. But while the successes are well known, investors should not ignore the very many unprofitable companies that simply burn through all their cash and collapse.

Given this risk, we thought we'd take a look at whether On the Beach Group (LON:OTB) shareholders should be worried about its cash burn. In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

Check out our latest analysis for On the Beach Group

How Long Is On the Beach Group's Cash Runway?

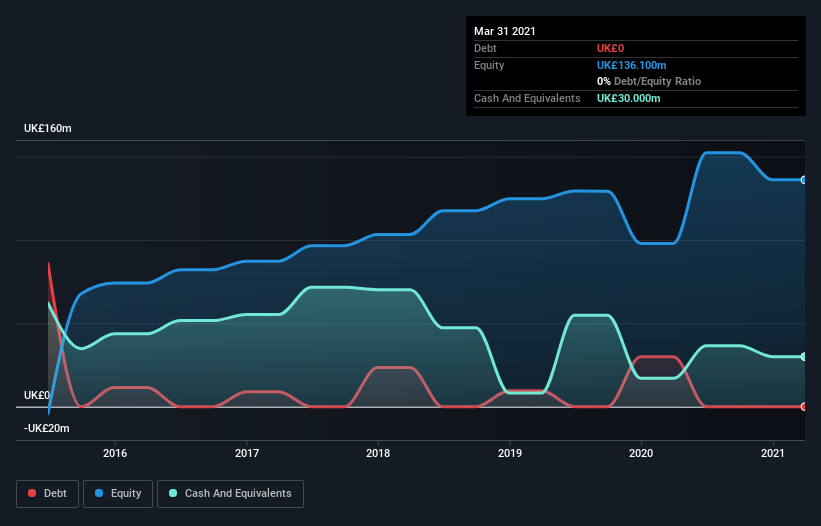

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. As at March 2021, On the Beach Group had cash of UK£30m and no debt. Looking at the last year, the company burnt through UK£21m. That means it had a cash runway of around 18 months as of March 2021. Importantly, though, analysts think that On the Beach Group will reach cashflow breakeven before then. In that case, it may never reach the end of its cash runway. You can see how its cash balance has changed over time in the image below.

How Well Is On the Beach Group Growing?

It was quite stunning to see that On the Beach Group increased its cash burn by 327% over the last year. If that's not bad enough, it actually saw operating revenue decrease by a whopping 83% over the last year, suggesting the company is going through some sort of dangerous transition. Considering these two factors together makes us nervous about the direction the company seems to be heading. Clearly, however, the crucial factor is whether the company will grow its business going forward. So you might want to take a peek at how much the company is expected to grow in the next few years.

Can On the Beach Group Raise More Cash Easily?

Since On the Beach Group can't yet boast improving growth metrics, the market will likely be considering how it can raise more cash if need be. Companies can raise capital through either debt or equity. Many companies end up issuing new shares to fund future growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Since it has a market capitalisation of UK£403m, On the Beach Group's UK£21m in cash burn equates to about 5.1% of its market value. Given that is a rather small percentage, it would probably be really easy for the company to fund another year's growth by issuing some new shares to investors, or even by taking out a loan.

Is On the Beach Group's Cash Burn A Worry?

It may already be apparent to you that we're relatively comfortable with the way On the Beach Group is burning through its cash. In particular, we think its cash burn relative to its market cap stands out as evidence that the company is well on top of its spending. Although we do find its increasing cash burn to be a bit of a negative, once we consider the other metrics mentioned in this article together, the overall picture is one we are comfortable with. There's no doubt that shareholders can take a lot of heart from the fact that analysts are forecasting it will reach breakeven before too long. Based on the factors mentioned in this article, we think its cash burn situation warrants some attention from shareholders, but we don't think they should be worried. Taking an in-depth view of risks, we've identified 2 warning signs for On the Beach Group that you should be aware of before investing.

Of course On the Beach Group may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:OTB

On the Beach Group

Operates as an online retailer of short haul beach holidays under the On the Beach brand name in the United Kingdom.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Moving from "Science Fiction" to "Science Fact" – A Bullish Valuation Case

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026