- United Kingdom

- /

- Healthcare Services

- /

- LSE:IDHC

Undiscovered Gems With Strong Fundamentals In United Kingdom December 2025

Reviewed by Simply Wall St

The United Kingdom's stock market has recently experienced a downturn, with the FTSE 100 and FTSE 250 indices closing lower amid disappointing trade data from China, highlighting ongoing challenges in global economic recovery. As the market navigates these turbulent waters, investors may find opportunities by focusing on stocks with strong fundamentals that can withstand external pressures and offer potential for long-term stability.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Goodwin | 24.30% | 12.58% | 22.87% | ★★★★★★ |

| B.P. Marsh & Partners | NA | 42.17% | 45.70% | ★★★★★★ |

| Andrews Sykes Group | NA | 2.01% | 5.12% | ★★★★★★ |

| BioPharma Credit | NA | 7.73% | 7.94% | ★★★★★★ |

| Georgia Capital | NA | 2.23% | 16.34% | ★★★★★★ |

| Vectron Systems | NA | 2.48% | 28.82% | ★★★★★★ |

| Nationwide Building Society | 282.42% | 9.69% | 21.24% | ★★★★★☆ |

| FW Thorpe | 2.12% | 10.94% | 13.25% | ★★★★★☆ |

| Distribution Finance Capital Holdings | 9.37% | 48.09% | 66.49% | ★★★★★☆ |

| Foresight Environmental Infrastructure | NA | -24.80% | -27.25% | ★★★★★☆ |

Here's a peek at a few of the choices from the screener.

Foresight Environmental Infrastructure (LSE:FGEN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Foresight Environmental Infrastructure, operating under the fund management of John Laing Capital Management Limited, focuses on investments in environmental infrastructure with a market cap of £420.85 million.

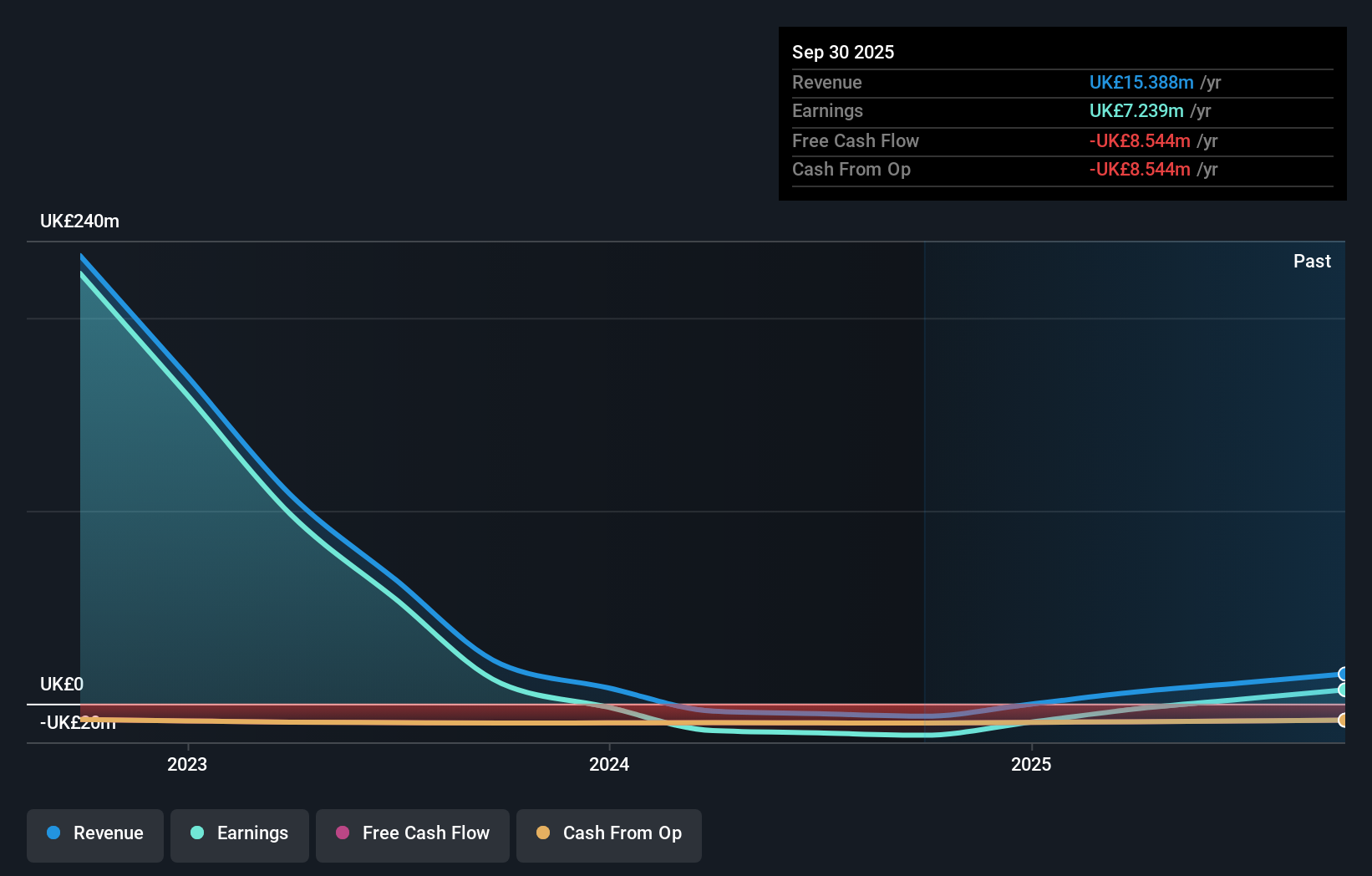

Operations: Foresight Environmental Infrastructure generates revenue primarily from its investments in environmental infrastructure, amounting to £15.39 million. The company's market cap stands at £420.85 million.

Foresight Environmental Infrastructure, a smaller player in its field, has shown impressive financial progress recently. The company reported a net income of £9.54 million for the half-year ending September 2025, bouncing back from a loss of £0.54 million the previous year. Over the past year, it repurchased 38 million shares for £29.71 million, indicating confidence in its market position and potential growth trajectory. Additionally, with no debt on its books over the last five years and high-quality earnings reported, Foresight seems well-positioned to continue delivering value to shareholders through dividends and buybacks alike.

Integrated Diagnostics Holdings (LSE:IDHC)

Simply Wall St Value Rating: ★★★★★☆

Overview: Integrated Diagnostics Holdings plc is a consumer healthcare company offering medical diagnostics services, with a market cap of $392.40 million.

Operations: Integrated Diagnostics Holdings generates revenue primarily through medical diagnostics services. The company reported a gross profit margin of 50.5% in the most recent period, reflecting its ability to manage costs relative to sales effectively.

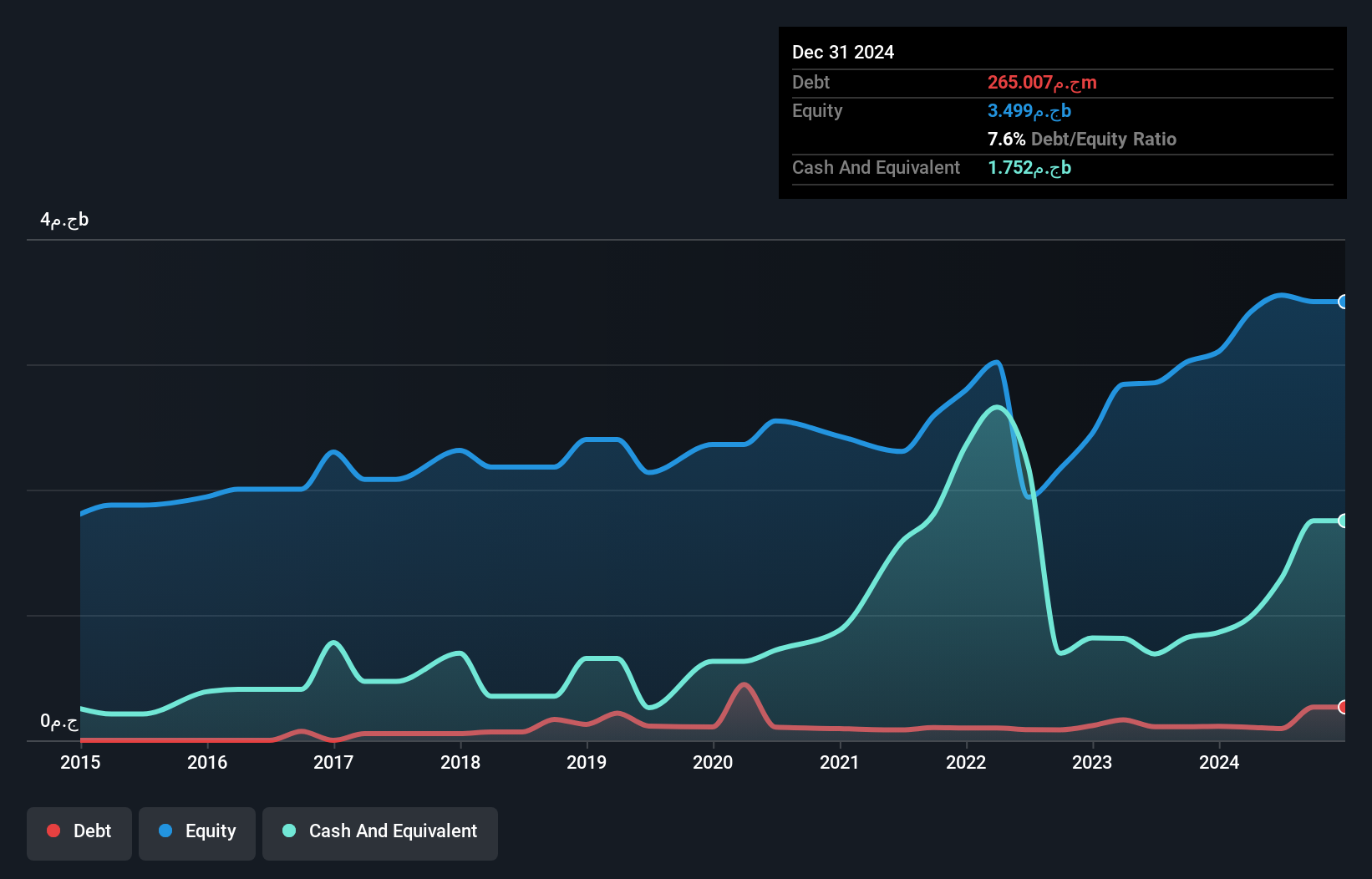

IDH, a notable player in the healthcare sector, has seen its earnings soar by 34.3% over the past year, outpacing the industry average of 9%. The company's strategic expansion in Egypt and Saudi Arabia is likely driving this growth, with a focus on radiology services enhancing its market position. Despite an increase in debt to equity from 4.1% to 4.7% over five years, IDH holds more cash than total debt, reducing financial risk. Trading at a significant discount of 75.4% below estimated fair value suggests potential upside for investors as it continues to capitalize on regional opportunities.

ME Group International (LSE:MEGP)

Simply Wall St Value Rating: ★★★★★★

Overview: ME Group International plc operates, sells, and services a range of instant-service equipment in the United Kingdom with a market cap of £596.80 million.

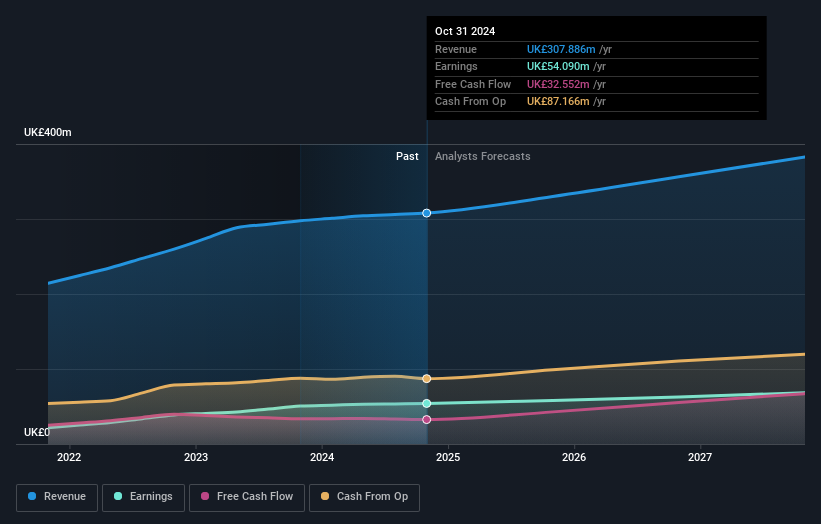

Operations: The primary revenue stream for ME Group International comes from its Personal Services segment, generating £311.32 million.

ME Group International seems to be a compelling investment opportunity with its earnings growing at 31% annually over the past five years. The company has significantly reduced its debt to equity ratio from 50.2 to 19.8, indicating improved financial health. Trading at about 60% below fair value, it presents an attractive valuation compared to industry peers. The company's EBIT covers interest payments by a robust margin of 30 times, reflecting strong operational efficiency. With expected revenue between £311 million and £318 million for the fiscal year ending October 2025, ME Group appears well-positioned for continued growth in the consumer services sector.

Key Takeaways

- Click here to access our complete index of 56 UK Undiscovered Gems With Strong Fundamentals.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:IDHC

Integrated Diagnostics Holdings

Operates as a consumer healthcare company that provides medical diagnostics services to patients.

Undervalued with high growth potential and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)