- United Kingdom

- /

- Hospitality

- /

- LSE:HSW

Top UK Penny Stocks To Watch In August 2025

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 index closing lower due to weak trade data from China, highlighting the interconnectedness of global economies. In such fluctuating markets, identifying strong investment opportunities becomes crucial. Penny stocks, though a somewhat outdated term, still represent potential growth avenues when backed by solid financials and fundamentals.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.54 | £508.28M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £3.17 | £256.1M | ✅ 5 ⚠️ 2 View Analysis > |

| FDM Group (Holdings) (LSE:FDM) | £1.228 | £134.24M | ✅ 2 ⚠️ 4 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.41 | £44.36M | ✅ 4 ⚠️ 3 View Analysis > |

| RWS Holdings (AIM:RWS) | £0.854 | £315.79M | ✅ 5 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.70 | £277.66M | ✅ 4 ⚠️ 1 View Analysis > |

| Alumasc Group (AIM:ALU) | £3.60 | £129.47M | ✅ 4 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.16 | £184.37M | ✅ 4 ⚠️ 2 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.775 | £10.67M | ✅ 2 ⚠️ 3 View Analysis > |

| Samuel Heath & Sons (AIM:HSM) | £3.35 | £8.49M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 298 stocks from our UK Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

eEnergy Group (AIM:EAAS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: eEnergy Group Plc operates as a digital energy services company in the United Kingdom and Ireland, with a market cap of £17.62 million.

Operations: The company generates revenue of £29.10 million from its Energy Services segment.

Market Cap: £17.62M

eEnergy Group Plc, with a market cap of £17.62 million, reported half-year sales of £10.07 million, showing growth from the previous year despite remaining unprofitable with a net loss of £1.52 million. The company has sufficient cash runway for over three years and possesses more cash than total debt, but its short-term assets (£12.8M) fall short of covering short-term liabilities (£14M). While the share price has been highly volatile recently and earnings are forecasted to grow significantly, the management team is relatively inexperienced with an average tenure of 0.8 years.

- Take a closer look at eEnergy Group's potential here in our financial health report.

- Understand eEnergy Group's earnings outlook by examining our growth report.

Hostelworld Group (LSE:HSW)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Hostelworld Group plc is an online travel agent specializing in the hostel market across Europe, the United States, Asia, Africa, and Oceania, with a market cap of £141.73 million.

Operations: The company generates revenue primarily through providing software and data processing services, amounting to €92.3 million.

Market Cap: £141.73M

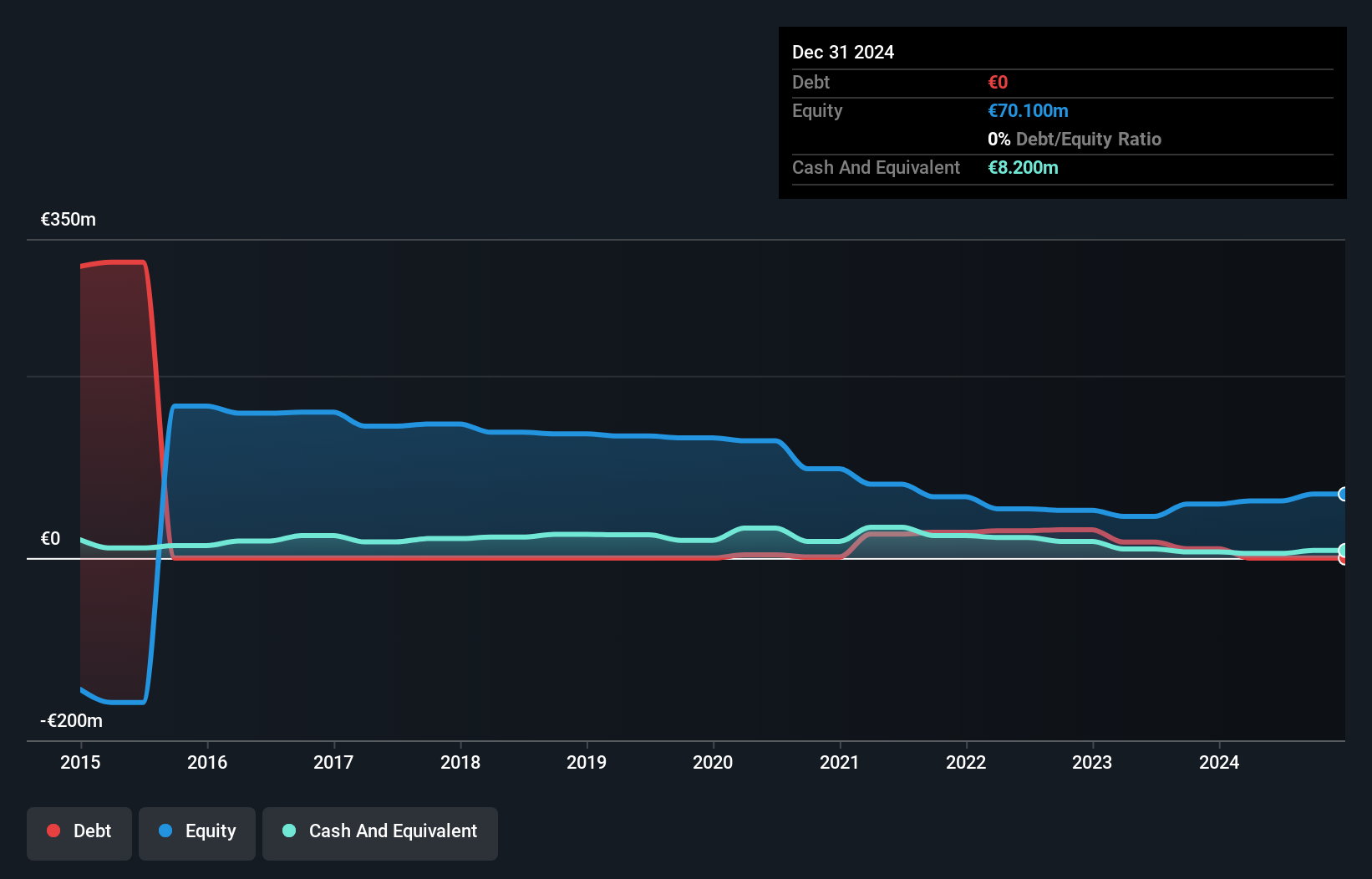

Hostelworld Group, with a market cap of £141.73 million, has shown resilience despite recent challenges. The company reported half-year sales of €46.7 million but saw a decline in net income to €1.1 million from the previous year. While its profit margins have decreased and earnings growth was negative last year, Hostelworld is debt-free and maintains an experienced management team with an average tenure of 3.5 years. The firm is actively pursuing acquisitions to bolster growth and recently reinstated a progressive dividend policy alongside a share buyback program, reflecting confidence in its financial strategy amidst market volatility.

- Jump into the full analysis health report here for a deeper understanding of Hostelworld Group.

- Learn about Hostelworld Group's future growth trajectory here.

Pharos Energy (LSE:PHAR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Pharos Energy plc is an independent energy company engaged in the exploration, development, and production of oil and gas properties in Vietnam and Egypt, with a market cap of £89.78 million.

Operations: The company's revenue is derived from its operations in Egypt, contributing $20.7 million, and Southeast Asia, generating $115.4 million.

Market Cap: £89.78M

Pharos Energy, with a market cap of £89.78 million, has recently become profitable and is trading at a good value compared to its peers. The company operates without debt, simplifying financial management and eliminating interest payment concerns. However, its short-term assets of $74 million fall short of covering long-term liabilities totaling $118.8 million. Recent developments include the appointment of João Saraiva e Silva as Non-Executive Chair and a two-year extension for exploration in Vietnam's Blocks 125 & 126. Despite an unstable dividend history, Pharos declared a final dividend for 2024, signaling confidence in future prospects.

- Get an in-depth perspective on Pharos Energy's performance by reading our balance sheet health report here.

- Review our growth performance report to gain insights into Pharos Energy's future.

Seize The Opportunity

- Get an in-depth perspective on all 298 UK Penny Stocks by using our screener here.

- Ready To Venture Into Other Investment Styles? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hostelworld Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:HSW

Hostelworld Group

Operates as an online travel agent focused on the hostel market worldwide.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives