- United Kingdom

- /

- Hospitality

- /

- LSE:DOM

Should You Be Adding Domino's Pizza Group (LON:DOM) To Your Watchlist Today?

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Domino's Pizza Group (LON:DOM). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

View our latest analysis for Domino's Pizza Group

How Fast Is Domino's Pizza Group Growing?

As one of my mentors once told me, share price follows earnings per share (EPS). It's no surprise, then, that I like to invest in companies with EPS growth. Over the last three years, Domino's Pizza Group has grown EPS by 16% per year. That's a good rate of growth, if it can be sustained.

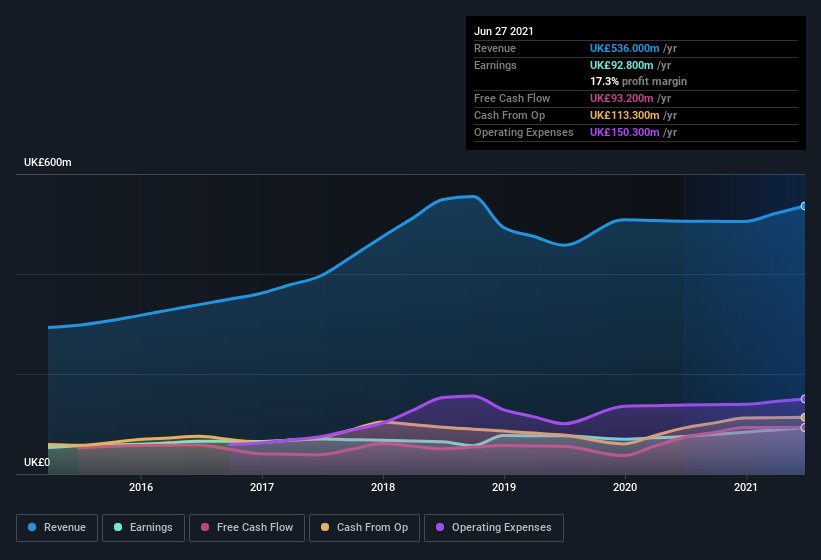

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. Domino's Pizza Group maintained stable EBIT margins over the last year, all while growing revenue 6.0% to UK£536m. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Domino's Pizza Group's future profits.

Are Domino's Pizza Group Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Not only did Domino's Pizza Group insiders refrain from selling stock during the year, but they also spent UK£61k buying it. That puts the company in a nice light, as it makes me think its leaders are feeling confident.

Is Domino's Pizza Group Worth Keeping An Eye On?

One important encouraging feature of Domino's Pizza Group is that it is growing profits. While some companies are struggling to grow EPS, Domino's Pizza Group seems free from that morose affliction. The cherry on top is the insider share purchases, which provide an extra impetus to keep and eye on this stock, at the very least. We don't want to rain on the parade too much, but we did also find 4 warning signs for Domino's Pizza Group (2 are significant!) that you need to be mindful of.

As a growth investor I do like to see insider buying. But Domino's Pizza Group isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:DOM

Domino's Pizza Group

Domino’s Pizza Group plc owns, operates, and franchises Domino’s Pizza stores in the United Kingdom and Ireland.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives