- United Kingdom

- /

- Hospitality

- /

- LSE:DOM

If You Like EPS Growth Then Check Out Domino's Pizza Group (LON:DOM) Before It's Too Late

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

So if you're like me, you might be more interested in profitable, growing companies, like Domino's Pizza Group (LON:DOM). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

See our latest analysis for Domino's Pizza Group

How Quickly Is Domino's Pizza Group Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. That means EPS growth is considered a real positive by most successful long-term investors. Over the last three years, Domino's Pizza Group has grown EPS by 8.8% per year. That growth rate is fairly good, assuming the company can keep it up.

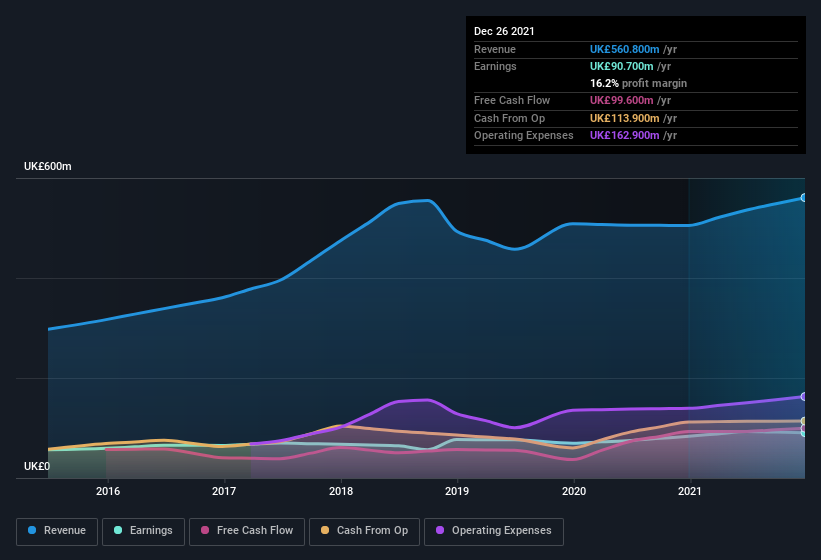

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. Domino's Pizza Group maintained stable EBIT margins over the last year, all while growing revenue 11% to UK£561m. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Fortunately, we've got access to analyst forecasts of Domino's Pizza Group's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Domino's Pizza Group Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Like a sturdy phalanx Domino's Pizza Group insiders have stood united by refusing to sell shares over the last year. But my excitement comes from the UK£53k that CEO & Director Dominic Paul spent buying shares (at an average price of about UK£3.81).

Should You Add Domino's Pizza Group To Your Watchlist?

One positive for Domino's Pizza Group is that it is growing EPS. That's nice to see. While some companies are struggling to grow EPS, Domino's Pizza Group seems free from that morose affliction. The cherry on top is that we have an insider buying shares. That encourages me further to keep an eye on this stock. We don't want to rain on the parade too much, but we did also find 4 warning signs for Domino's Pizza Group (1 is significant!) that you need to be mindful of.

The good news is that Domino's Pizza Group is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:DOM

Domino's Pizza Group

Domino’s Pizza Group plc owns, operates, and franchises Domino’s Pizza stores.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives