- United Kingdom

- /

- Hospitality

- /

- AIM:NXQ

If EPS Growth Is Important To You, Nexteq (LON:NXQ) Presents An Opportunity

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

In contrast to all that, many investors prefer to focus on companies like Nexteq (LON:NXQ), which has not only revenues, but also profits. While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

See our latest analysis for Nexteq

How Quickly Is Nexteq Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That means EPS growth is considered a real positive by most successful long-term investors. Nexteq managed to grow EPS by 9.7% per year, over three years. That's a pretty good rate, if the company can sustain it.

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. The good news is that Nexteq is growing revenues, and EBIT margins improved by 2.5 percentage points to 7.5%, over the last year. Both of which are great metrics to check off for potential growth.

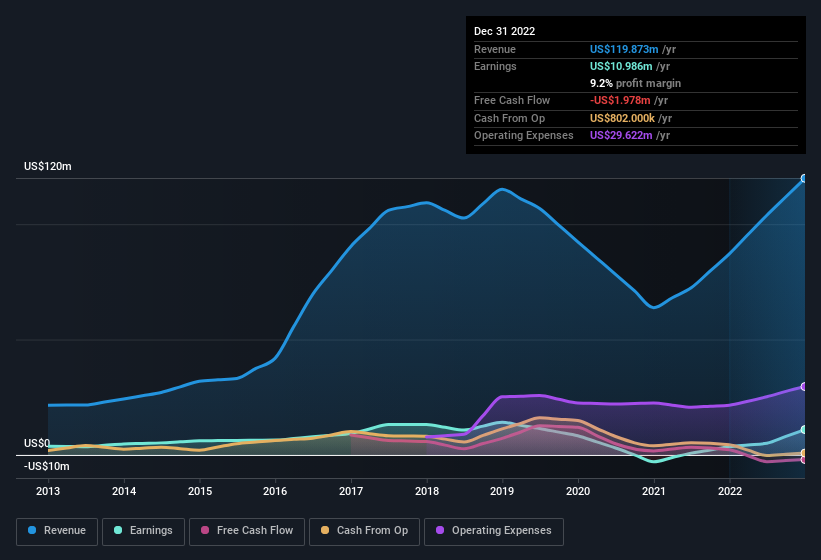

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

Since Nexteq is no giant, with a market capitalisation of UK£95m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Nexteq Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

We note that Nexteq insiders spent US$44k on stock, over the last year; in contrast, we didn't see any selling. That paints the company in a nice light, as it signals that its leaders are feeling confident in where the company is heading. Zooming in, we can see that the biggest insider purchase was by Independent Non-Executive Director Duncan Penny for UK£35k worth of shares, at about UK£1.72 per share.

On top of the insider buying, we can also see that Nexteq insiders own a large chunk of the company. Owning 37% of the company, insiders have plenty riding on the performance of the the share price. This should be a welcoming sign for investors because it suggests that the people making the decisions are also impacted by their choices. In terms of absolute value, insiders have US$35m invested in the business, at the current share price. That's nothing to sneeze at!

Is Nexteq Worth Keeping An Eye On?

As previously touched on, Nexteq is a growing business, which is encouraging. Better yet, insiders are significant shareholders, and have been buying more shares. That should do plenty in prompting budding investors to undertake a bit more research - or even adding the company to their watchlists. However, before you get too excited we've discovered 2 warning signs for Nexteq that you should be aware of.

Keen growth investors love to see insider buying. Thankfully, Nexteq isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Nexteq might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:NXQ

Nexteq

Operates as a technology solution provider to customers in industrial markets in North America, Asia, Australia, the United Kingdom, rest of Europe, and internationally.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.