- United Kingdom

- /

- Hospitality

- /

- AIM:NXQ

Discovering UK Penny Stocks: Devolver Digital And Two More Promising Picks

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 index closing lower due to weak trade data from China, highlighting global economic interdependencies. Despite these broader market pressures, investors can still find opportunities by exploring lesser-known stocks. Penny stocks, though an older term, remain relevant as they often represent smaller or newer companies that may offer significant growth potential when backed by strong financial health.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Croma Security Solutions Group (AIM:CSSG) | £0.855 | £11.77M | ✅ 3 ⚠️ 3 View Analysis > |

| Ultimate Products (LSE:ULTP) | £0.628 | £53.03M | ✅ 4 ⚠️ 3 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.83 | £292.14M | ✅ 5 ⚠️ 1 View Analysis > |

| Warpaint London (AIM:W7L) | £3.90 | £315.07M | ✅ 5 ⚠️ 3 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.735 | £422.08M | ✅ 4 ⚠️ 1 View Analysis > |

| Polar Capital Holdings (AIM:POLR) | £3.92 | £377.88M | ✅ 3 ⚠️ 2 View Analysis > |

| Cairn Homes (LSE:CRN) | £1.624 | £1.01B | ✅ 5 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £0.962 | £153.43M | ✅ 4 ⚠️ 2 View Analysis > |

| QinetiQ Group (LSE:QQ.) | £3.93 | £2.16B | ✅ 5 ⚠️ 1 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.345 | £37.33M | ✅ 5 ⚠️ 2 View Analysis > |

Click here to see the full list of 391 stocks from our UK Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Devolver Digital (AIM:DEVO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Devolver Digital Inc. is a video game developer and publisher for PC and mobile devices operating in the United States and internationally, with a market cap of £96.09 million.

Operations: Revenue segments for Devolver Digital Inc. are not reported.

Market Cap: £96.09M

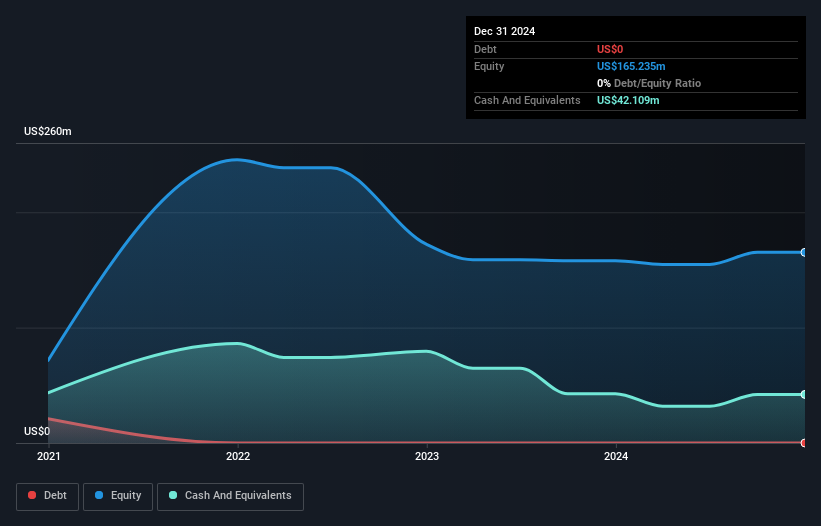

Devolver Digital, with a market cap of £96.09 million, is debt-free and has a strong cash position, covering both its short- and long-term liabilities. Although currently unprofitable with losses increasing over the past five years at 22.3% annually, it reported sales of US$104.78 million for 2024, an improvement from the previous year. The company forecasts earnings growth of 106.46% per year and expects single-digit revenue growth in 2025 as it executes its strategic plan to drive long-term success. Despite negative returns on equity (-3.85%), Devolver's stable weekly volatility suggests some stability in performance amidst challenges.

- Dive into the specifics of Devolver Digital here with our thorough balance sheet health report.

- Explore Devolver Digital's analyst forecasts in our growth report.

Intercede Group (AIM:IGP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Intercede Group plc is a cybersecurity company that develops and supplies identity and credential management software for digital trust across the United Kingdom, Europe, the United States, and internationally, with a market cap of £96.16 million.

Operations: The company generates £21.51 million in revenue from its Software & Programming segment.

Market Cap: £96.16M

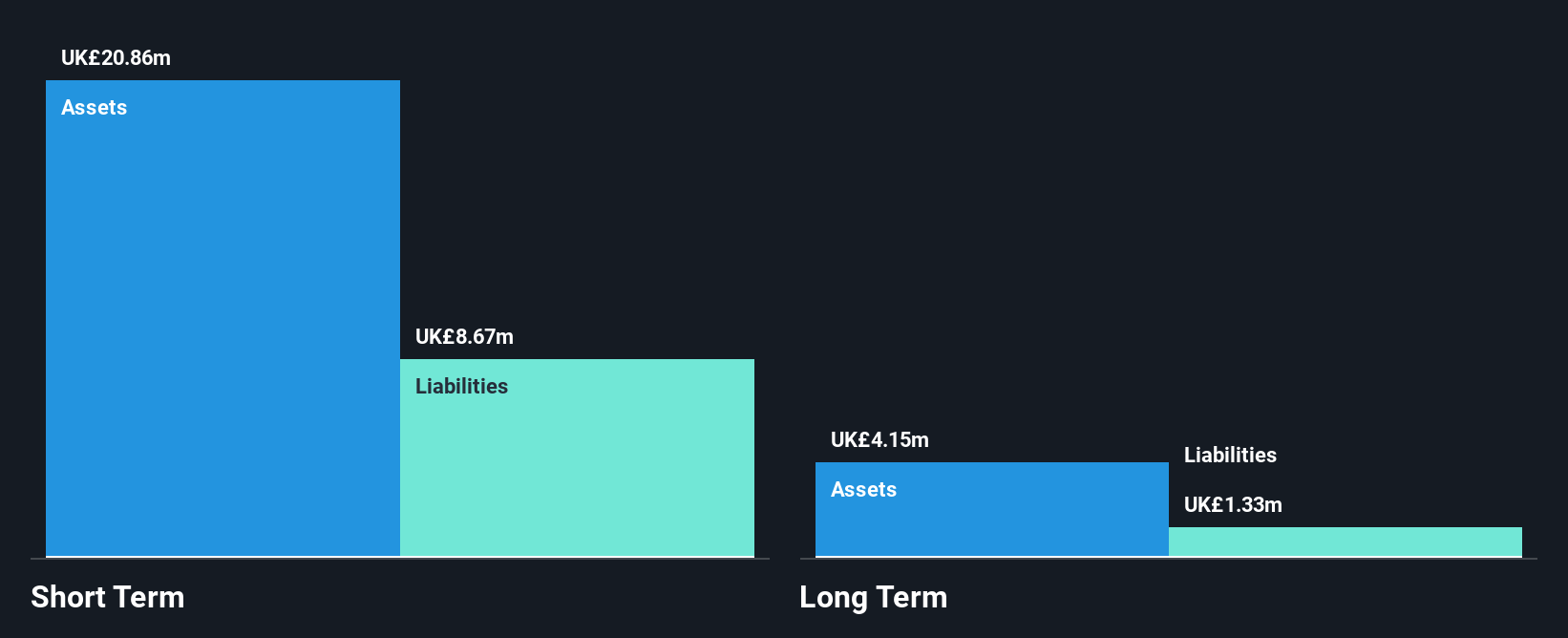

Intercede Group plc, with a market cap of £96.16 million, operates debt-free and maintains robust financial health, as evidenced by its short-term assets (£20.9M) surpassing both short- (£8.7M) and long-term liabilities (£1.3M). The company's earnings surged by 271.1% over the past year, significantly outpacing industry growth rates and reflecting high-quality earnings with an outstanding return on equity of 40.9%. Despite a revenue decline to approximately £17.7 million for fiscal 2025 due to an exceptional prior-year order, recurring revenues remain strong at £10.2 million, indicating stable business momentum across key regions like the US and Middle East.

- Navigate through the intricacies of Intercede Group with our comprehensive balance sheet health report here.

- Understand Intercede Group's earnings outlook by examining our growth report.

Nexteq (AIM:NXQ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Nexteq plc is a technology solution provider serving industrial markets across North America, Asia, Australia, the United Kingdom, Europe, and internationally with a market cap of £38.33 million.

Operations: Nexteq's revenue is derived from its Quixant segment, which generated $54.77 million, and its Densitron segment, contributing $31.91 million.

Market Cap: £38.33M

Nexteq plc, with a market cap of £38.33 million, has seen a challenging year with revenues falling to US$86.68 million and net income declining sharply to US$0.31 million from the previous year's US$10.9 million, largely due to a significant one-off loss of $3.5M impacting results. Despite this setback, Nexteq's financial position remains stable as its short-term assets of $63.4M exceed both short- and long-term liabilities significantly, while cash flow comfortably covers debt obligations at over 36 times the debt level. However, weak profit margins and an inexperienced management team pose potential concerns for future growth stability in the penny stock domain.

- Take a closer look at Nexteq's potential here in our financial health report.

- Gain insights into Nexteq's future direction by reviewing our growth report.

Turning Ideas Into Actions

- Investigate our full lineup of 391 UK Penny Stocks right here.

- Looking For Alternative Opportunities? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nexteq might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:NXQ

Nexteq

Operates as a technology solution provider to customers in industrial markets in North America, Asia, Australia, the United Kingdom, rest of Europe, and internationally.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives