- United Kingdom

- /

- Hospitality

- /

- AIM:MEX

Tortilla Mexican Grill plc's (LON:MEX) Shares Not Telling The Full Story

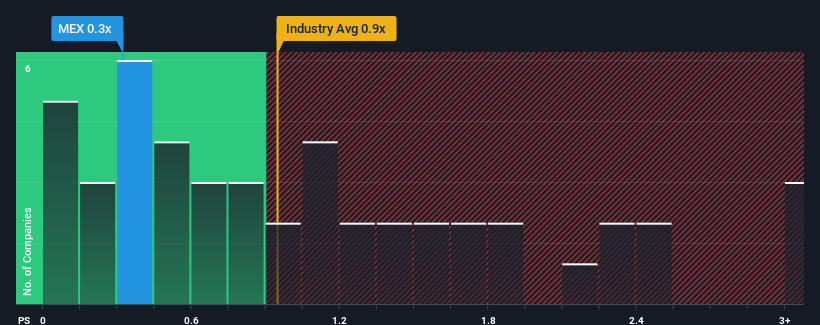

Tortilla Mexican Grill plc's (LON:MEX) price-to-sales (or "P/S") ratio of 0.3x may look like a pretty appealing investment opportunity when you consider close to half the companies in the Hospitality industry in the United Kingdom have P/S ratios greater than 0.9x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Tortilla Mexican Grill

How Has Tortilla Mexican Grill Performed Recently?

Recent revenue growth for Tortilla Mexican Grill has been in line with the industry. It might be that many expect the mediocre revenue performance to degrade, which has repressed the P/S ratio. Those who are bullish on Tortilla Mexican Grill will be hoping that this isn't the case.

Keen to find out how analysts think Tortilla Mexican Grill's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Tortilla Mexican Grill?

The only time you'd be truly comfortable seeing a P/S as low as Tortilla Mexican Grill's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a decent 14% gain to the company's revenues. Pleasingly, revenue has also lifted 145% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 11% each year over the next three years. That's shaping up to be materially higher than the 6.3% per year growth forecast for the broader industry.

In light of this, it's peculiar that Tortilla Mexican Grill's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Key Takeaway

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

A look at Tortilla Mexican Grill's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

Before you settle on your opinion, we've discovered 2 warning signs for Tortilla Mexican Grill that you should be aware of.

If you're unsure about the strength of Tortilla Mexican Grill's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Tortilla Mexican Grill might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:MEX

Tortilla Mexican Grill

Operates, manages, and franchises Mexican restaurants under the Tortilla, Chilango, and Fresh Burritos brands in France, the United Kingdom, and the Middle East.

Undervalued with high growth potential.

Market Insights

Community Narratives