- United Kingdom

- /

- Hospitality

- /

- AIM:CPC

Some Shareholders May Object To A Pay Rise For The City Pub Group plc's (LON:CPC) CEO This Year

Performance at The City Pub Group plc (LON:CPC) has not been particularly rosy recently and shareholders will likely be holding CEO Rupert Clark and the board accountable for this. The next AGM coming up on 28 June 2021 will be a chance for shareholders to have their concerns addressed by the board, challenge management on company strategy and vote on resolutions such as executive remuneration, which may help change the company's future prospects. From our analysis below, we think CEO compensation looks appropriate for now.

View our latest analysis for City Pub Group

Comparing The City Pub Group plc's CEO Compensation With the industry

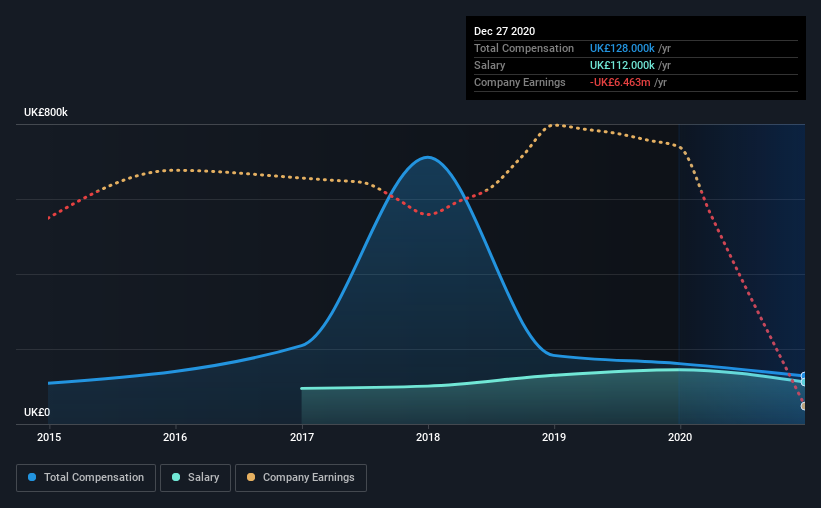

At the time of writing, our data shows that The City Pub Group plc has a market capitalization of UK£130m, and reported total annual CEO compensation of UK£128k for the year to December 2020. Notably, that's a decrease of 20% over the year before. We note that the salary portion, which stands at UK£112.0k constitutes the majority of total compensation received by the CEO.

On comparing similar companies from the same industry with market caps ranging from UK£72m to UK£287m, we found that the median CEO total compensation was UK£272k. That is to say, Rupert Clark is paid under the industry median. What's more, Rupert Clark holds UK£760k worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | UK£112k | UK£145k | 88% |

| Other | UK£16k | UK£16k | 13% |

| Total Compensation | UK£128k | UK£161k | 100% |

On an industry level, around 81% of total compensation represents salary and 19% is other remuneration. There isn't a significant difference between City Pub Group and the broader market, in terms of salary allocation in the overall compensation package. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

The City Pub Group plc's Growth

Over the last three years, The City Pub Group plc has shrunk its earnings per share by 62% per year. Its revenue is down 57% over the previous year.

The decline in EPS is a bit concerning. This is compounded by the fact revenue is actually down on last year. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has The City Pub Group plc Been A Good Investment?

With a total shareholder return of -43% over three years, The City Pub Group plc shareholders would by and large be disappointed. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

Along with the business performing poorly, shareholders have suffered with poor share price returns on their investments, suggesting that there's little to no chance of them being in favor of a CEO pay raise. At the upcoming AGM, they can question the management's plans and strategies to turn performance around and reassess their investment thesis in regards to the company.

If you think CEO compensation levels are interesting you will probably really like this free visualization of insider trading at City Pub Group.

Important note: City Pub Group is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you decide to trade City Pub Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:CPC

City Pub Group

The City Pub Group plc, together with its subsidiaries, owns, operates, and manages an estate of pubs.

Reasonable growth potential with questionable track record.

Market Insights

Community Narratives