- United Kingdom

- /

- Food and Staples Retail

- /

- LSE:MCLS

Further weakness as McColl's Retail Group (LON:MCLS) drops 37% this week, taking five-year losses to 85%

Some stocks are best avoided. We really hate to see fellow investors lose their hard-earned money. Imagine if you held McColl's Retail Group plc (LON:MCLS) for half a decade as the share price tanked 87%. And we doubt long term believers are the only worried holders, since the stock price has declined 30% over the last twelve months. The falls have accelerated recently, with the share price down 41% in the last three months. We note that the company has reported results fairly recently; and the market is hardly delighted. You can check out the latest numbers in our company report. While a drop like that is definitely a body blow, money isn't as important as health and happiness.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

See our latest analysis for McColl's Retail Group

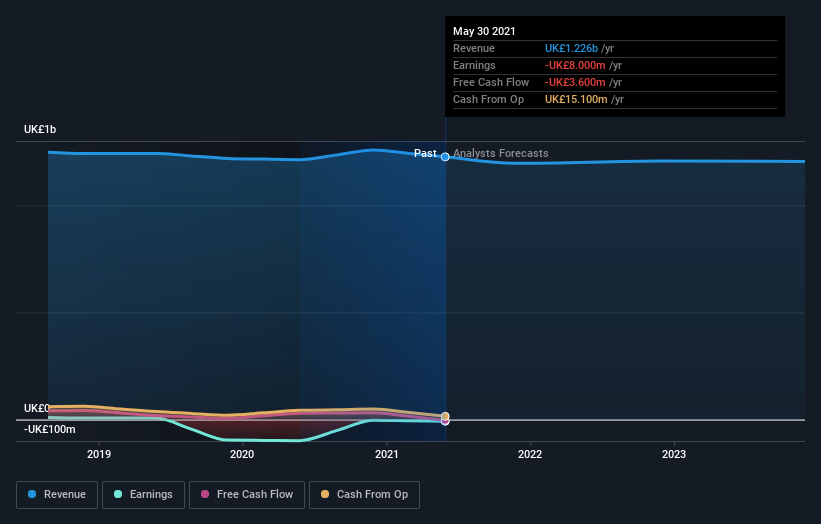

McColl's Retail Group isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over five years, McColl's Retail Group grew its revenue at 5.5% per year. That's not a very high growth rate considering it doesn't make profits. It's not so sure that share price crash of 13% per year is completely deserved, but the market is doubtless disappointed. We'd be pretty cautious about this one, although the sell-off may be too severe. A company like this generally needs to produce profits before it can find favour with new investors.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

This free interactive report on McColl's Retail Group's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Investors in McColl's Retail Group had a tough year, with a total loss of 30%, against a market gain of about 27%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, longer term shareholders are suffering worse, given the loss of 13% doled out over the last five years. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that McColl's Retail Group is showing 4 warning signs in our investment analysis , and 2 of those can't be ignored...

Of course McColl's Retail Group may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

If you decide to trade McColl's Retail Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About LSE:MCLS

McColl's Retail Group

McColl's Retail Group plc operates as a neighbourhood retailer in the United Kingdom.

Weak fundamentals or lack of information.

Market Insights

Community Narratives