- United Kingdom

- /

- Consumer Durables

- /

- LSE:VTY

3 UK Stocks That May Be Priced Below Estimated Value In April 2025

Reviewed by Simply Wall St

As the United Kingdom's FTSE 100 index faces downward pressure due to weak trade data from China, investors are closely monitoring market conditions and global economic influences. In such a climate, identifying stocks that may be undervalued can offer potential opportunities for those looking to navigate these challenging times effectively.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| ASA International Group (LSE:ASAI) | £0.79 | £1.51 | 47.8% |

| Savills (LSE:SVS) | £8.79 | £16.05 | 45.2% |

| Gooch & Housego (AIM:GHH) | £3.70 | £7.21 | 48.7% |

| Deliveroo (LSE:ROO) | £1.131 | £2.25 | 49.8% |

| Franchise Brands (AIM:FRAN) | £1.35 | £2.48 | 45.6% |

| Watches of Switzerland Group (LSE:WOSG) | £3.276 | £6.03 | 45.7% |

| Vanquis Banking Group (LSE:VANQ) | £0.541 | £1.02 | 46.9% |

| CVS Group (AIM:CVSG) | £9.22 | £18.31 | 49.6% |

| Fintel (AIM:FNTL) | £2.16 | £4.23 | 48.9% |

| Optima Health (AIM:OPT) | £1.61 | £3.07 | 47.6% |

Let's uncover some gems from our specialized screener.

GB Group (AIM:GBG)

Overview: GB Group plc, with a market cap of £614 million, offers identity data intelligence products and services across the United Kingdom, the United States, Australia, and other international markets.

Operations: The company's revenue is derived from three primary segments: Fraud (£38.14 million), Identity (£159.78 million), and Location (£83.94 million).

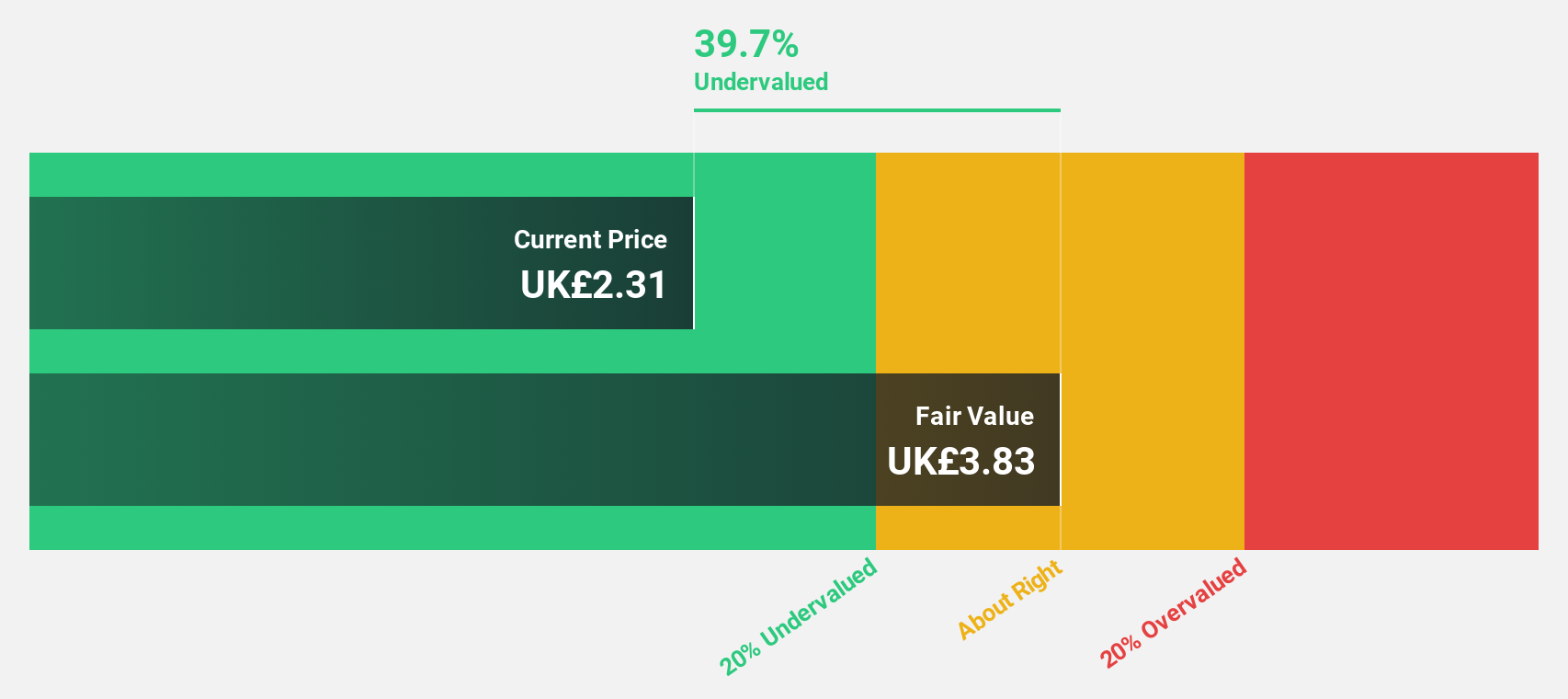

Estimated Discount To Fair Value: 38.7%

GB Group, trading at £2.44, is significantly undervalued based on discounted cash flow analysis with a fair value estimate of £3.98. Despite recent one-off items impacting results, the company has turned profitable and is expected to see substantial earnings growth of 38.9% annually over the next three years, outpacing UK market averages. However, its forecasted return on equity remains low at 3.7%. Revenue growth is projected at 6.8% per year, above the UK market rate.

- According our earnings growth report, there's an indication that GB Group might be ready to expand.

- Navigate through the intricacies of GB Group with our comprehensive financial health report here.

Applied Nutrition (LSE:APN)

Overview: Applied Nutrition Plc manufactures, wholesales, and retails sports nutritional products in the United Kingdom and internationally, with a market cap of £280 million.

Operations: Applied Nutrition Plc generates revenue through the manufacture, wholesale, and retail of sports nutritional products both domestically and internationally.

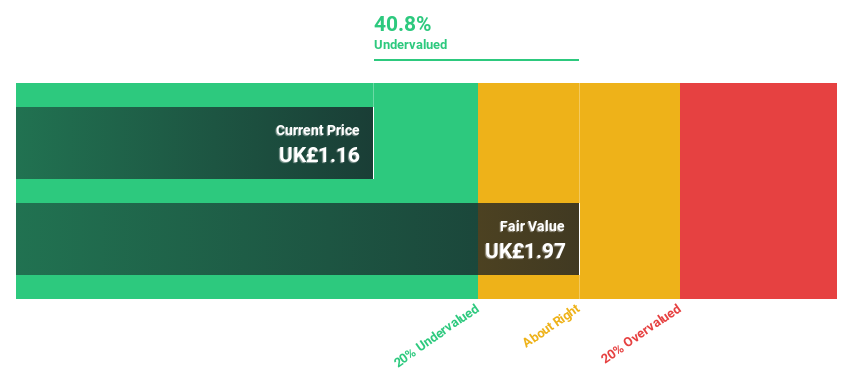

Estimated Discount To Fair Value: 43.4%

Applied Nutrition, trading at £1.12, is considerably undervalued with a fair value estimate of £1.98 based on discounted cash flow analysis. Despite a recent dip in net income to £8.9 million for the half year ending January 2025, the company's earnings are projected to grow annually by 15.7%, outpacing the UK market average of 14%. Revenue growth is forecast at 11.9% per year, also exceeding market expectations.

- In light of our recent growth report, it seems possible that Applied Nutrition's financial performance will exceed current levels.

- Click here and access our complete balance sheet health report to understand the dynamics of Applied Nutrition.

Vistry Group (LSE:VTY)

Overview: Vistry Group PLC, with a market cap of £1.68 billion, operates in the United Kingdom providing housing solutions through its subsidiaries.

Operations: The company generates revenue of £3.78 billion from its Home Builders segment, which includes both residential and commercial projects in the UK.

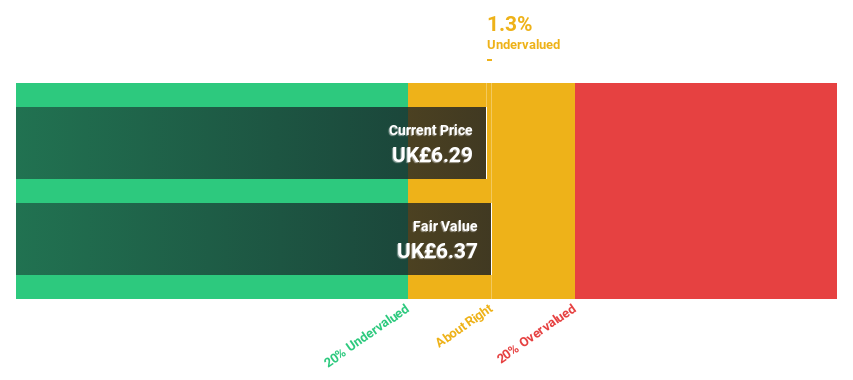

Estimated Discount To Fair Value: 14.6%

Vistry Group, trading at £5.11, is undervalued compared to its fair value estimate of £5.98 based on discounted cash flow analysis. Despite a drop in net income to £74.5 million for 2024 from £215 million the previous year, earnings are expected to grow significantly at 33.1% annually over the next three years, surpassing UK market growth rates. Recent share buybacks totaling £38.1 million may support future stock performance amidst high volatility concerns.

- Our earnings growth report unveils the potential for significant increases in Vistry Group's future results.

- Click to explore a detailed breakdown of our findings in Vistry Group's balance sheet health report.

Summing It All Up

- Delve into our full catalog of 52 Undervalued UK Stocks Based On Cash Flows here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Vistry Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:VTY

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives