- United Kingdom

- /

- Insurance

- /

- LSE:SAGA

UK Growth Companies With High Insider Ownership In December 2025

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, which continues to grapple with a sluggish recovery. In this environment of uncertainty, identifying growth companies with high insider ownership can be appealing as such firms often demonstrate strong alignment between management and shareholder interests, potentially providing stability amidst broader market volatility.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| SRT Marine Systems (AIM:SRT) | 16.3% | 57.8% |

| QinetiQ Group (LSE:QQ.) | 14.3% | 74.4% |

| Metals Exploration (AIM:MTL) | 10.4% | 88.2% |

| Manolete Partners (AIM:MANO) | 35.6% | 38.1% |

| Kainos Group (LSE:KNOS) | 23.8% | 23% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 27.9% | 21% |

| B90 Holdings (AIM:B90) | 21.3% | 157.2% |

| Anglo Asian Mining (AIM:AAZ) | 39.7% | 134.7% |

| Afentra (AIM:AET) | 37.7% | 38.2% |

| ActiveOps (AIM:AOM) | 19.5% | 102.9% |

Let's take a closer look at a couple of our picks from the screened companies.

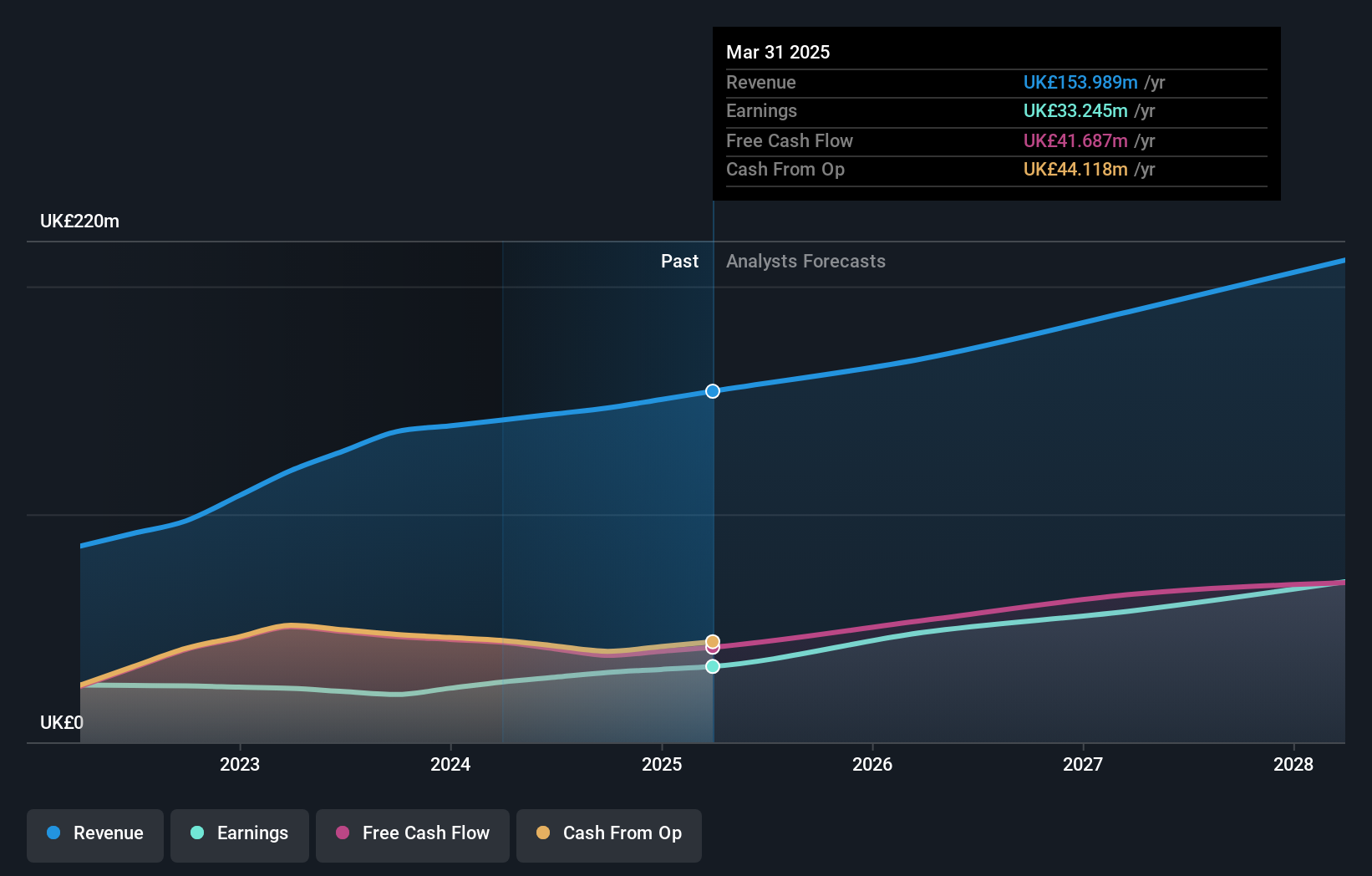

Foresight Group Holdings (LSE:FSG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Foresight Group Holdings Limited is an infrastructure and private equity manager operating in the United Kingdom, Italy, Luxembourg, Ireland, Spain, and Australia with a market cap of £465.29 million.

Operations: The company's revenue segments include Real Assets (£105.67 million), Private Equity (£47.43 million), and Foresight Capital Management (£9.22 million).

Insider Ownership: 34.8%

Earnings Growth Forecast: 18.5% p.a.

Foresight Group Holdings demonstrates strong growth potential with revenue forecasted to grow at 10% annually, outpacing the UK market. Earnings are expected to rise by 18.5% per year, exceeding market averages. The company reported significant earnings growth for H1 2026, with net income increasing from £12.65 million to £18.39 million year-over-year. Trading below fair value estimates and anticipated price increases suggest good relative value, though insider trading data is limited recently.

- Take a closer look at Foresight Group Holdings' potential here in our earnings growth report.

- In light of our recent valuation report, it seems possible that Foresight Group Holdings is trading behind its estimated value.

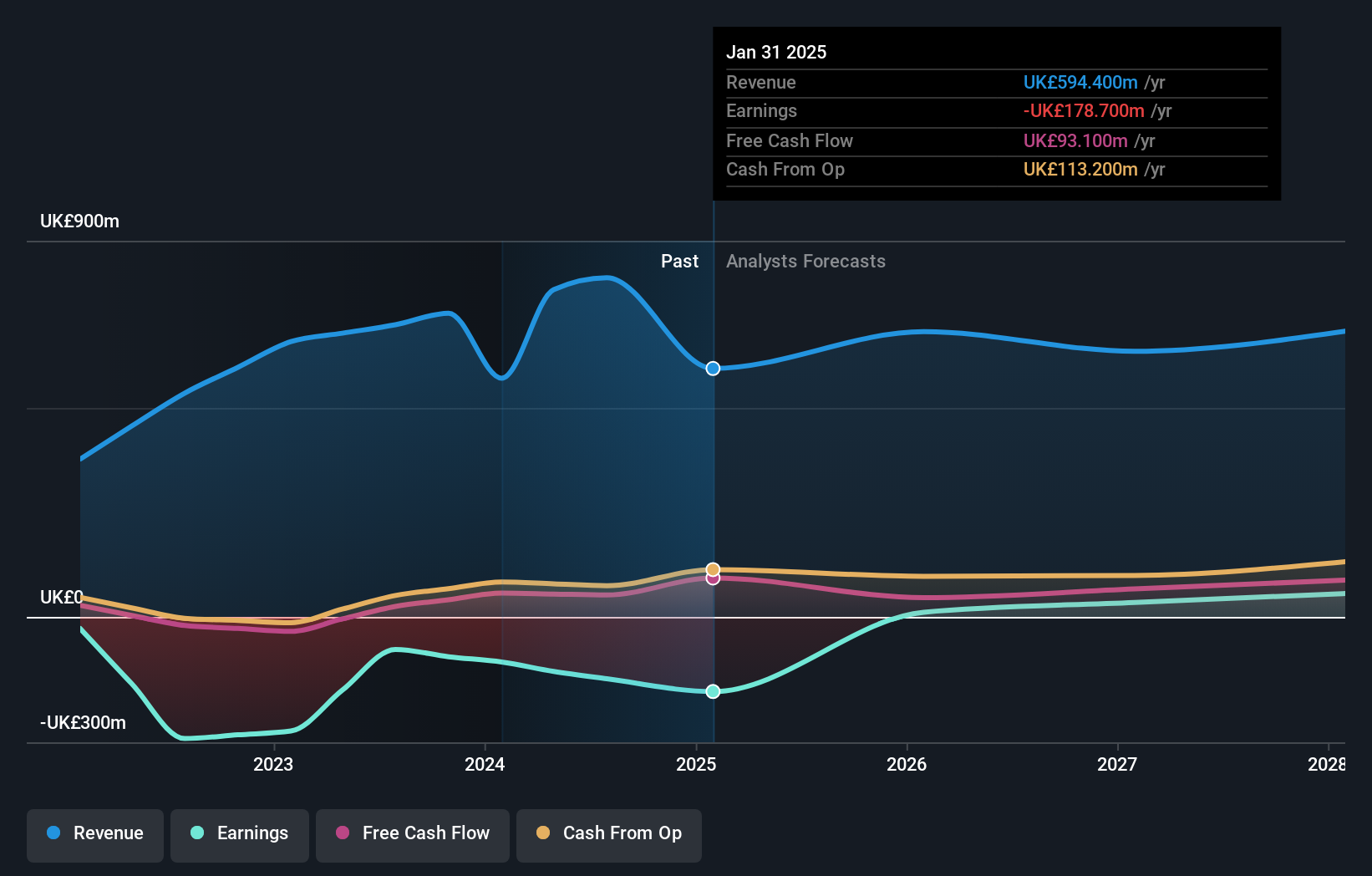

Saga (LSE:SAGA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Saga plc, along with its subsidiaries, offers package and cruise holidays, general insurance, and personal finance products and services in the United Kingdom with a market cap of £388.68 million.

Operations: The company's revenue streams consist of £475.50 million from travel, £26.70 million from home insurance broking, £54.80 million from motor insurance broking, and £41.40 million from other insurance broking services in the UK.

Insider Ownership: 36.9%

Earnings Growth Forecast: 102.4% p.a.

Saga plc's recent earnings report shows a significant reduction in net loss to £3.4 million from £106.1 million year-over-year, with basic earnings per share improving to £0.042 from a loss of £0.827. While revenue growth is modest at 3% annually, the company is expected to achieve profitability within three years, surpassing market averages for profit growth. Despite limited recent insider trading data, Saga trades at favorable value compared to industry peers and forecasts strong return on equity improvements.

- Navigate through the intricacies of Saga with our comprehensive analyst estimates report here.

- Our valuation report here indicates Saga may be undervalued.

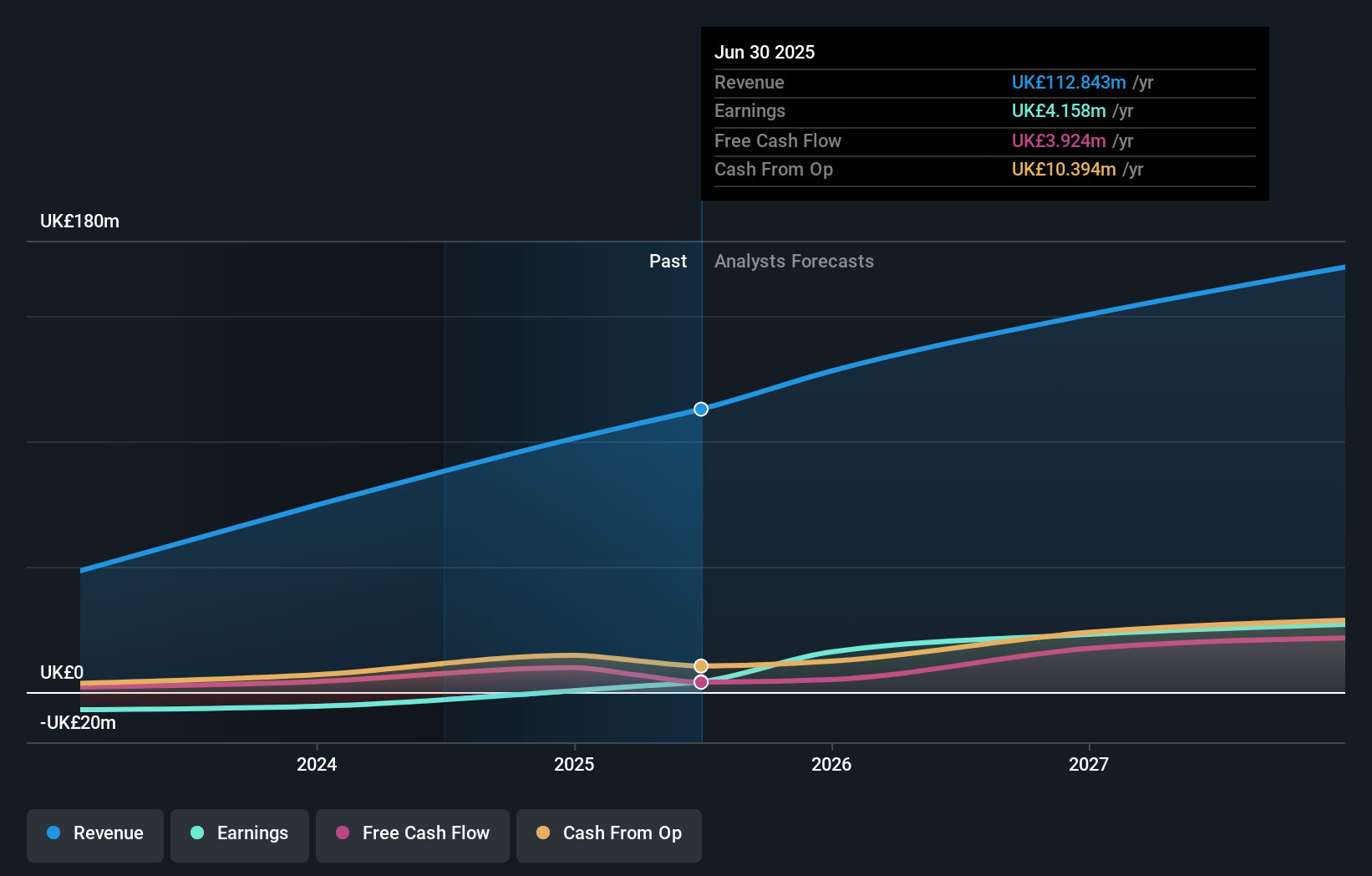

Beauty Tech Group (LSE:TBTG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Beauty Tech Group plc is an at-home beauty technology company operating in the United States, Canada, the United Kingdom, the European Union, and Asia with a market cap of £306.64 million.

Operations: The company's revenue segments include sales from its at-home beauty technology products and services across the United States, Canada, the United Kingdom, the European Union, and Asia.

Insider Ownership: 14.8%

Earnings Growth Forecast: 48% p.a.

Beauty Tech Group's recent IPO raised £106.52 million, with insiders showing confidence through substantial share purchases over the past three months. The company expects revenue to exceed £128 million for 2025, surpassing market expectations. Although interest payments are not well covered by earnings, Beauty Tech is trading at a discount to its estimated fair value and has just turned profitable. Earnings are forecasted to grow significantly at 48% annually, outpacing the UK market average.

- Get an in-depth perspective on Beauty Tech Group's performance by reading our analyst estimates report here.

- Our valuation report here indicates Beauty Tech Group may be overvalued.

Taking Advantage

- Unlock our comprehensive list of 54 Fast Growing UK Companies With High Insider Ownership by clicking here.

- Ready To Venture Into Other Investment Styles? Uncover 12 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:SAGA

Saga

Provides package and cruise holidays, general insurance, and personal finance products and services in the United Kingdom.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026