- United Kingdom

- /

- Consumer Durables

- /

- LSE:GLE

Exploring European Undervalued Small Caps With Insider Action In October 2025

Reviewed by Simply Wall St

In October 2025, the European markets have been buoyed by a rally in technology stocks and expectations for lower U.S. borrowing costs, with the pan-European STOXX Europe 600 Index reaching record levels. As investors navigate these dynamic conditions, identifying promising small-cap stocks often involves looking at those with strong fundamentals and potential insider activity that may signal confidence from within the company.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Cairn Homes | 12.1x | 1.5x | 31.00% | ★★★★★★ |

| BEWI | NA | 0.5x | 38.68% | ★★★★★☆ |

| Bytes Technology Group | 17.8x | 4.5x | 10.01% | ★★★★☆☆ |

| Speedy Hire | NA | 0.3x | 19.47% | ★★★★☆☆ |

| Social Housing REIT | NA | 6.8x | 35.93% | ★★★★☆☆ |

| Fastighets AB Trianon | 13.2x | 4.3x | -200.42% | ★★★★☆☆ |

| Nyab | 21.4x | 0.9x | 37.23% | ★★★☆☆☆ |

| Fevara | NA | 0.9x | 39.72% | ★★★☆☆☆ |

| Renold | 10.7x | 0.7x | -0.07% | ★★★☆☆☆ |

| FastPartner | 16.5x | 4.2x | -27.89% | ★★★☆☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

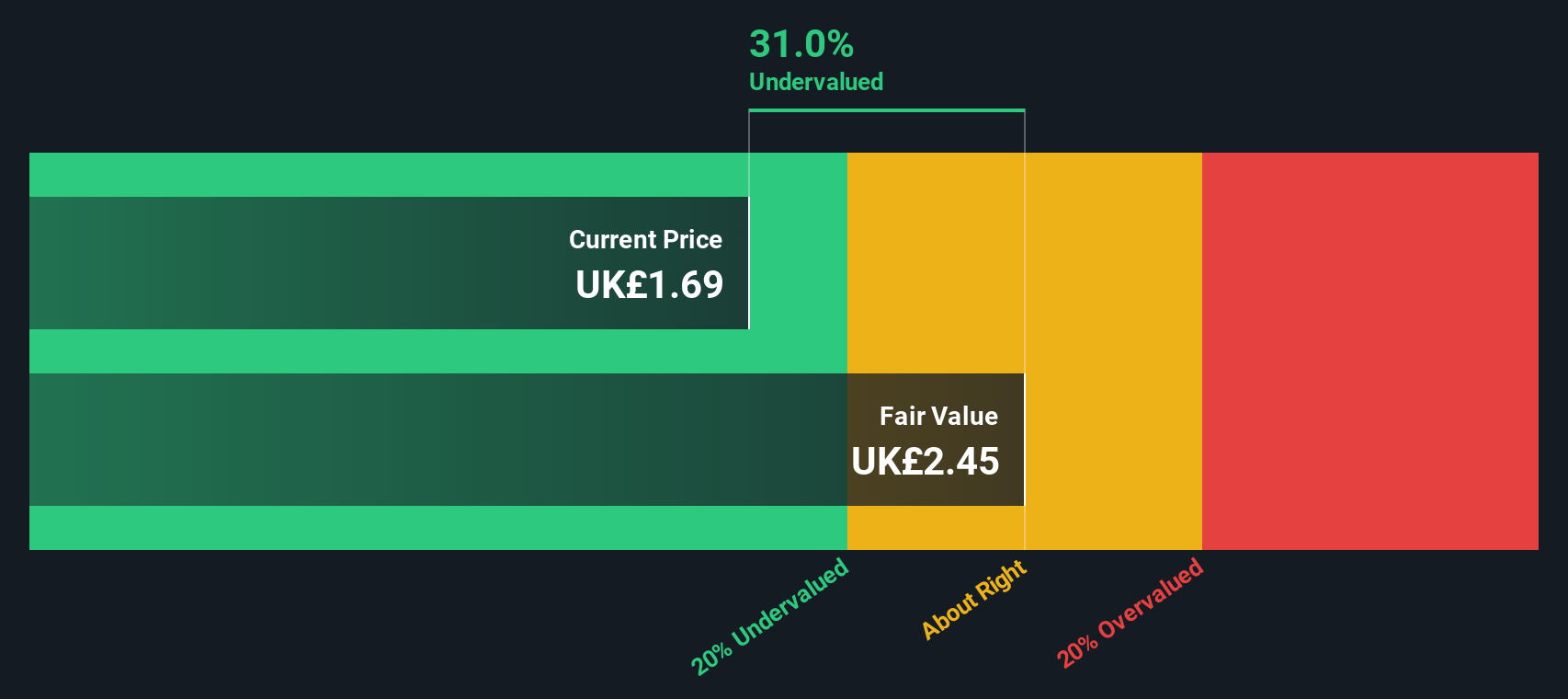

Nichols (AIM:NICL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Nichols is a company involved in the production and distribution of beverage products, with operations divided into packaged and out-of-home segments, and it has a market cap of £0.48 billion.

Operations: Nichols generates revenue primarily from its Packaged and Out of Home segments, with the former contributing significantly more. The company's cost structure includes notable expenses in Cost of Goods Sold (COGS) and Operating Expenses, impacting its profitability. A key financial trend is the fluctuation in net income margin, which has varied over time but showed positive figures recently, reaching 10.03% as of June 2025.

PE: 23.5x

Nichols, a smaller European company, recently reported half-year sales of £85.49 million, slightly up from the previous year's £83.98 million, while net income dipped to £8.53 million from £8.88 million. This business is expected to grow earnings by 16% annually despite relying entirely on external borrowing for funding, which carries higher risk compared to customer deposits. Insider confidence was shown through share purchases earlier this year, suggesting potential value recognition by those within the company.

- Navigate through the intricacies of Nichols with our comprehensive valuation report here.

Examine Nichols' past performance report to understand how it has performed in the past.

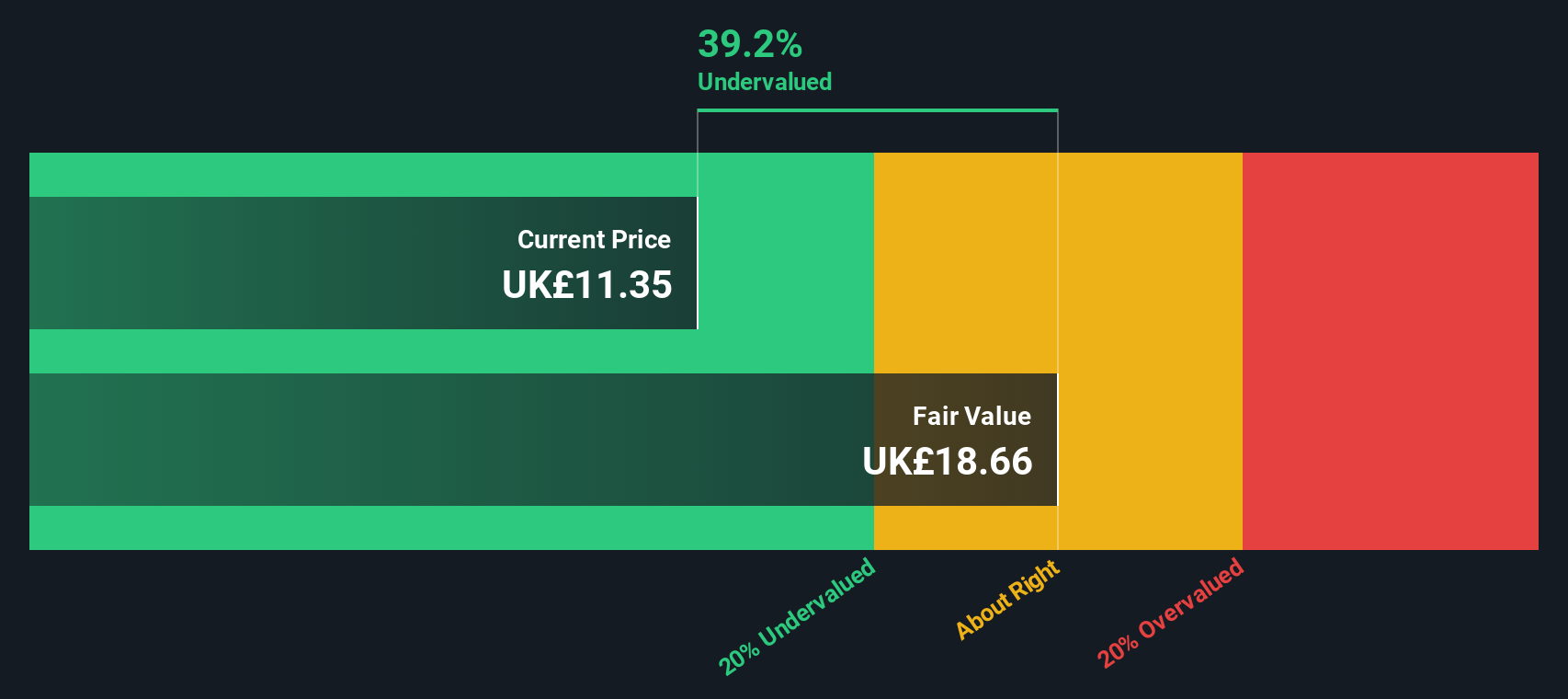

Cairn Homes (LSE:CRN)

Simply Wall St Value Rating: ★★★★★★

Overview: Cairn Homes is a leading Irish homebuilder focused on building and property development, with a market cap of €0.65 billion.

Operations: The company's primary revenue stream is from building and property development, with recent revenue reported at €778.20 million. Cost of goods sold (COGS) for the same period was €608.51 million, resulting in a gross profit of €169.70 million. The gross profit margin has shown an upward trend, reaching 21.81% in the latest period analyzed. Operating expenses were recorded at €38.43 million alongside non-operating expenses of €31.90 million, impacting overall profitability and net income figures.

PE: 12.1x

Cairn Homes, a smaller player in the European market, has caught attention due to its potential for value appreciation. Despite a drop in sales to €284.46 million and net income to €31.69 million for H1 2025 compared to last year, insider confidence is evident with recent stock purchases by company insiders. The firm declared an increased interim dividend of €0.041 per share on September 3, 2025, signaling financial stability amidst external borrowing challenges. Earnings are projected to grow annually by approximately 13%, suggesting promising future prospects despite current headwinds.

- Delve into the full analysis valuation report here for a deeper understanding of Cairn Homes.

Explore historical data to track Cairn Homes' performance over time in our Past section.

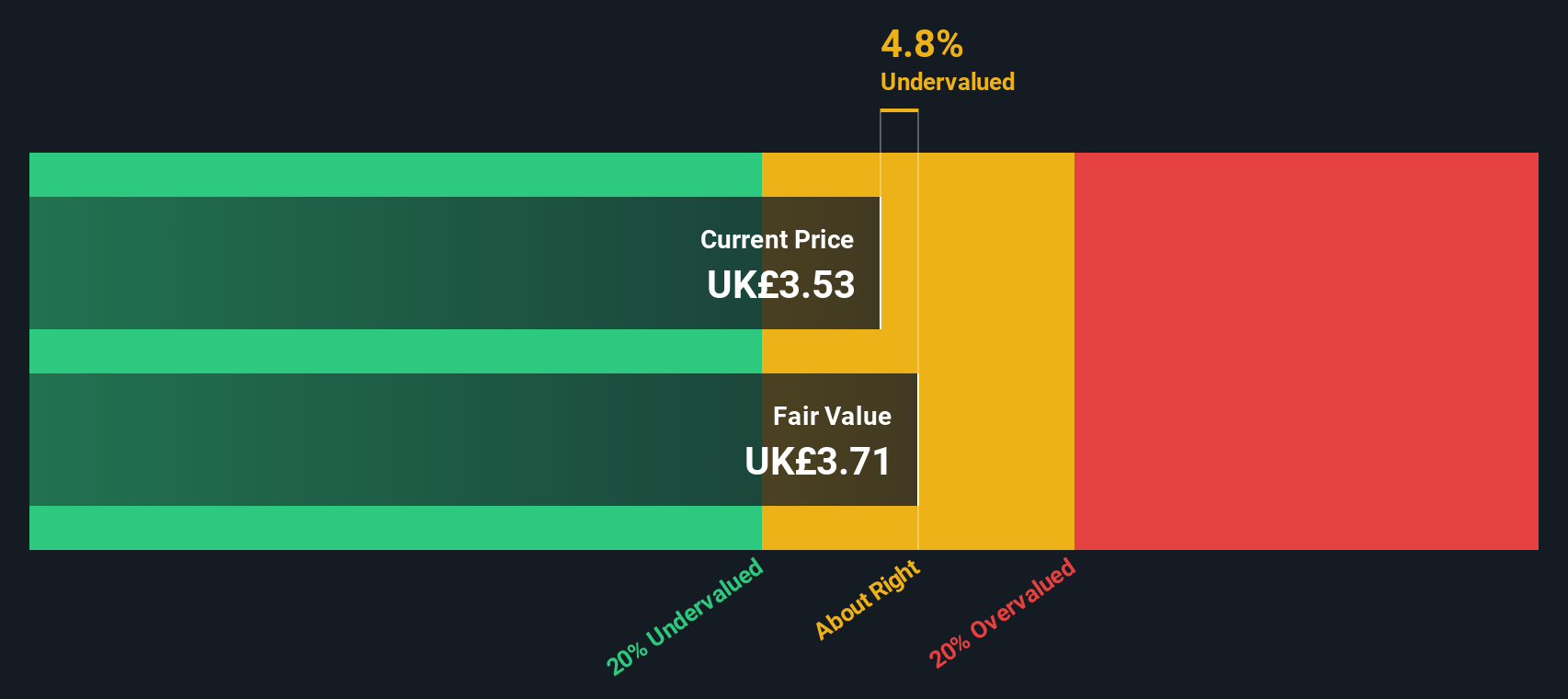

MJ Gleeson (LSE:GLE)

Simply Wall St Value Rating: ★★★★★☆

Overview: MJ Gleeson is a UK-based company primarily engaged in the development of affordable housing through its Gleeson Homes division and land promotion activities via its Gleeson Land segment, with a market cap of £0.37 billion.

Operations: Gleeson generates revenue primarily from Gleeson Homes (£348.25 million) and Gleeson Land (£17.57 million). The company has experienced fluctuations in its gross profit margin, with a recent figure of 22.73% as of June 2025, indicating changes in cost management or pricing strategies over time. Operating expenses have been significant, impacting net income margins which stood at 4.33% for the same period.

PE: 13.4x

MJ Gleeson, a smaller player in the European market, has shown insider confidence with recent share purchases. Despite relying on external borrowing for funding, which carries higher risk than customer deposits, they reported sales growth to £365.82 million for the year ending June 2025. However, net income dipped to £15.82 million from the previous year’s £19.31 million. Earnings are expected to grow at 19% annually, suggesting potential future value despite current financial challenges and leadership changes earlier this year.

- Click here to discover the nuances of MJ Gleeson with our detailed analytical valuation report.

Evaluate MJ Gleeson's historical performance by accessing our past performance report.

Make It Happen

- Dive into all 53 of the Undervalued European Small Caps With Insider Buying we have identified here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:GLE

MJ Gleeson

Engages in house building, and land promotion and sale businesses in the United Kingdom.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026