- United Kingdom

- /

- Consumer Durables

- /

- LSE:CRST

Investors Could Be Concerned With Crest Nicholson Holdings' (LON:CRST) Returns On Capital

When it comes to investing, there are some useful financial metrics that can warn us when a business is potentially in trouble. A business that's potentially in decline often shows two trends, a return on capital employed (ROCE) that's declining, and a base of capital employed that's also declining. This indicates the company is producing less profit from its investments and its total assets are decreasing. In light of that, from a first glance at Crest Nicholson Holdings (LON:CRST), we've spotted some signs that it could be struggling, so let's investigate.

Return On Capital Employed (ROCE): What Is It?

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. To calculate this metric for Crest Nicholson Holdings, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

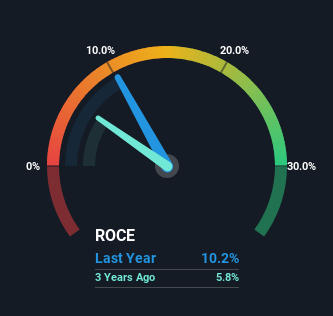

0.10 = UK£111m ÷ (UK£1.5b - UK£371m) (Based on the trailing twelve months to April 2023).

So, Crest Nicholson Holdings has an ROCE of 10%. That's a relatively normal return on capital, and it's around the 11% generated by the Consumer Durables industry.

View our latest analysis for Crest Nicholson Holdings

Above you can see how the current ROCE for Crest Nicholson Holdings compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like, you can check out the forecasts from the analysts covering Crest Nicholson Holdings here for free.

So How Is Crest Nicholson Holdings' ROCE Trending?

We are a bit worried about the trend of returns on capital at Crest Nicholson Holdings. About five years ago, returns on capital were 18%, however they're now substantially lower than that as we saw above. Meanwhile, capital employed in the business has stayed roughly the flat over the period. Since returns are falling and the business has the same amount of assets employed, this can suggest it's a mature business that hasn't had much growth in the last five years. If these trends continue, we wouldn't expect Crest Nicholson Holdings to turn into a multi-bagger.

In Conclusion...

All in all, the lower returns from the same amount of capital employed aren't exactly signs of a compounding machine. It should come as no surprise then that the stock has fallen 26% over the last five years, so it looks like investors are recognizing these changes. With underlying trends that aren't great in these areas, we'd consider looking elsewhere.

If you want to know some of the risks facing Crest Nicholson Holdings we've found 3 warning signs (2 make us uncomfortable!) that you should be aware of before investing here.

While Crest Nicholson Holdings isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:CRST

Crest Nicholson Holdings

Engages in building residential homes in the United Kingdom.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026