- United Kingdom

- /

- Personal Products

- /

- AIM:W7L

Discovering Undiscovered Gems in the UK for October 2024

Reviewed by Simply Wall St

The United Kingdom's stock market has recently experienced some turbulence, with the FTSE 100 and FTSE 250 indices closing lower due to weak trade data from China, highlighting global economic challenges. In this environment, identifying promising small-cap stocks can be particularly rewarding as these companies often have unique growth potential and may not be as heavily impacted by broader market trends.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Andrews Sykes Group | NA | 2.15% | 4.93% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | 17.28% | 15.80% | ★★★★★★ |

| London Security | 0.22% | 10.13% | 7.75% | ★★★★★★ |

| Globaltrans Investment | 15.40% | 2.68% | 16.51% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| VH Global Sustainable Energy Opportunities | NA | 18.30% | 20.03% | ★★★★★★ |

| Kodal Minerals | NA | nan | 72.74% | ★★★★★★ |

| Rights and Issues Investment Trust | NA | -3.68% | -4.07% | ★★★★★★ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

| Goodwin | 52.21% | 9.26% | 13.12% | ★★★★★☆ |

Underneath we present a selection of stocks filtered out by our screen.

Warpaint London (AIM:W7L)

Simply Wall St Value Rating: ★★★★★★

Overview: Warpaint London PLC, along with its subsidiaries, is engaged in the production and sale of cosmetics, with a market capitalization of £430.69 million.

Operations: The company generates revenue primarily from its Own Brand segment, contributing £96.72 million, while the Close-Out segment adds £2.12 million.

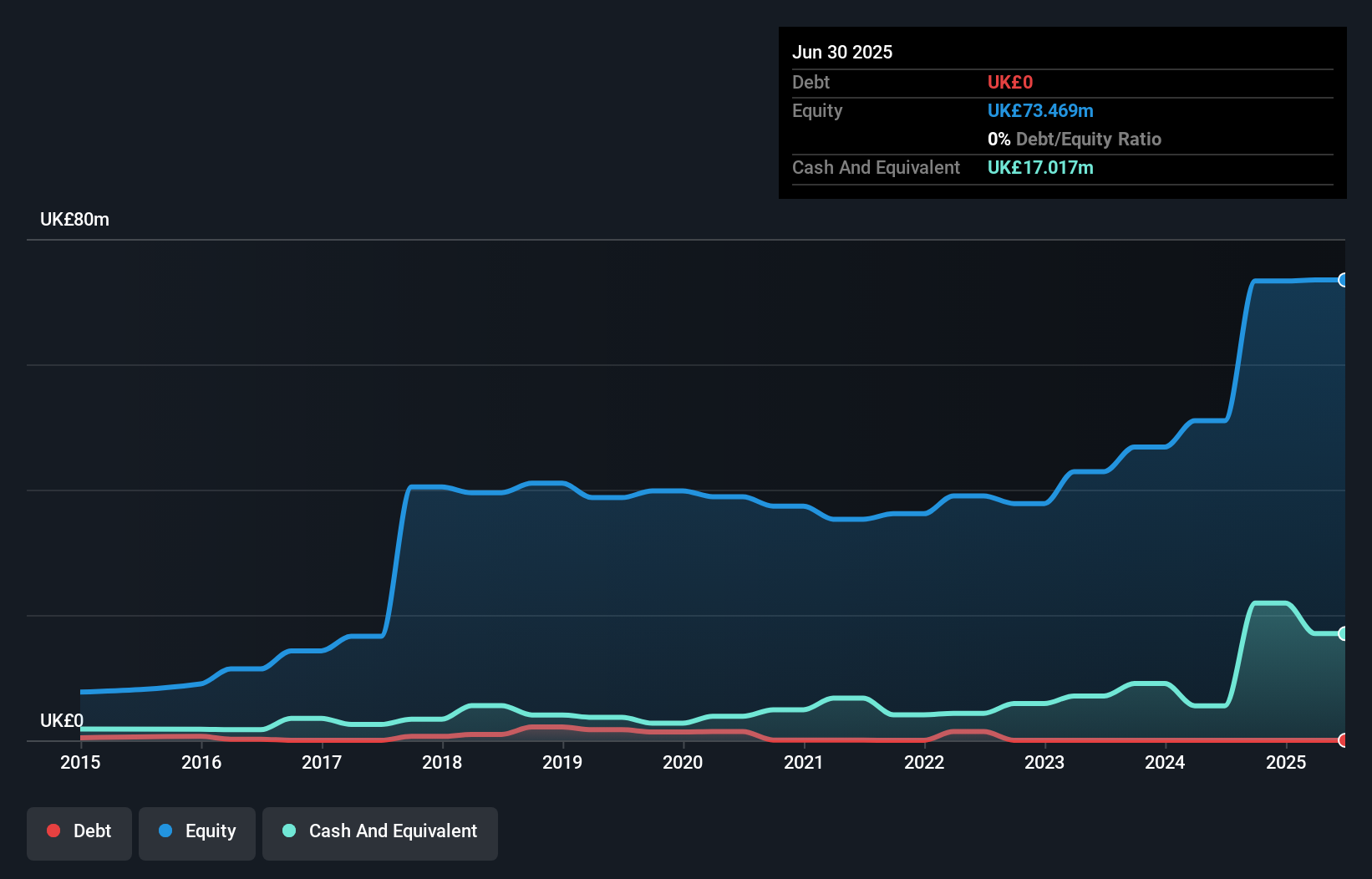

Warpaint London, a dynamic player in the personal products industry, has shown impressive growth with earnings surging 106.1% over the past year, outpacing the industry's 7%. The company is debt-free and boasts high-quality non-cash earnings. Recent financials highlight robust sales of £45.85 million for H1 2024, up from £36.69 million last year, with net income at £8.02 million compared to £4.78 million previously. Earnings per share increased to £0.10 from £0.06 a year ago, reflecting strong operational performance despite recent share price volatility over three months.

Yellow Cake (AIM:YCA)

Simply Wall St Value Rating: ★★★★★★

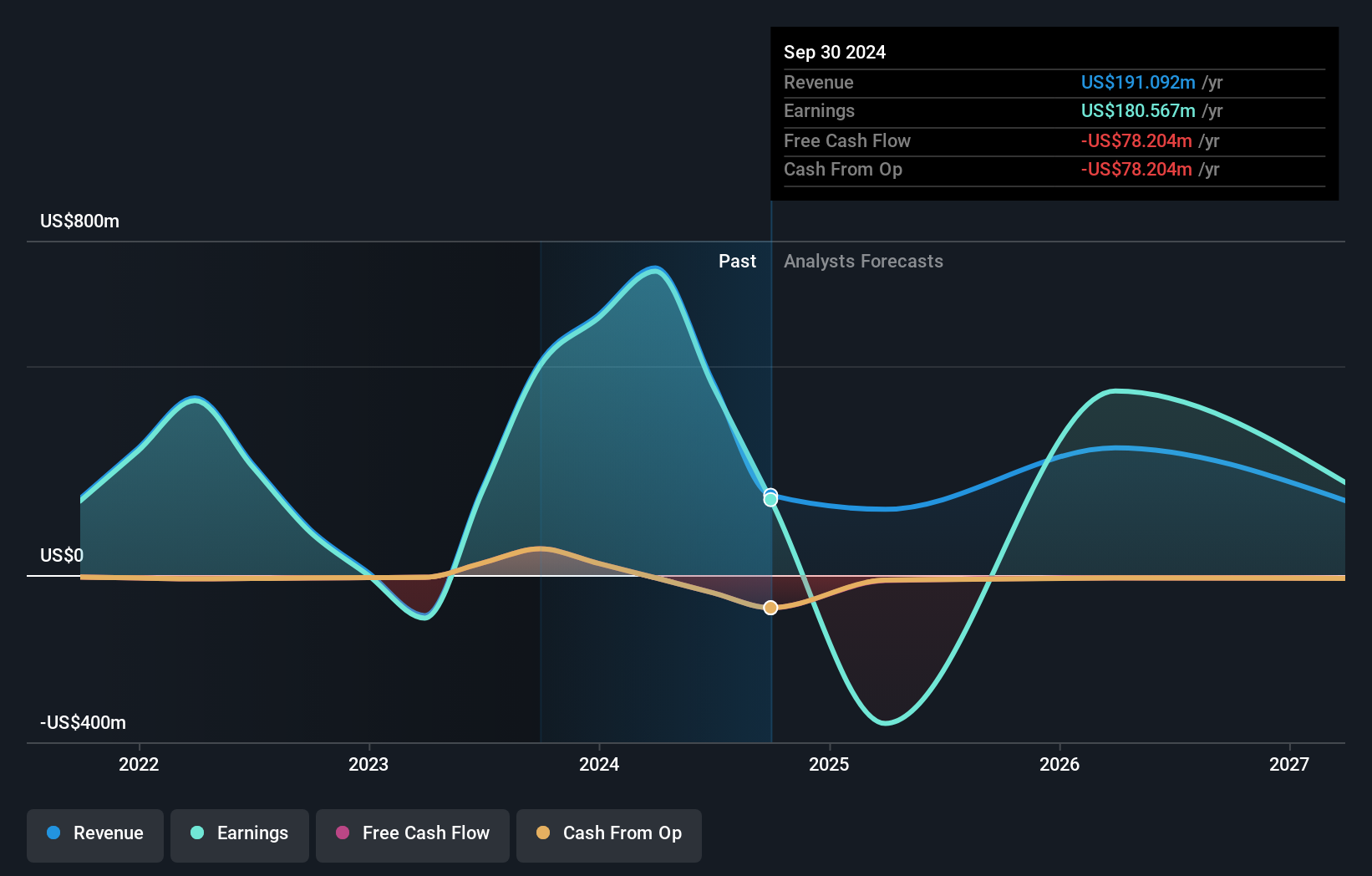

Overview: Yellow Cake plc operates in the uranium sector with a market cap of £1.29 billion.

Operations: The primary revenue stream is derived from holding U3O8 for long-term capital appreciation, amounting to $735.02 million.

Yellow Cake, a UK-based uranium company, stands out with its debt-free status and attractive valuation, trading at a price-to-earnings ratio of 2.3x against the UK market's 16.5x. Despite becoming profitable this year, future earnings are expected to decline by an average of 78% annually over the next three years. The company has demonstrated high-quality earnings with significant non-cash components and has not carried any debt for five years. While Yellow Cake seems well-positioned in its industry context due to these factors, potential investors should weigh the forecasted downturn in profitability when considering its prospects.

- Dive into the specifics of Yellow Cake here with our thorough health report.

Gain insights into Yellow Cake's past trends and performance with our Past report.

Cairn Homes (LSE:CRN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Cairn Homes plc is a holding company that operates as a home and community builder in Ireland, with a market capitalization of £1.11 billion.

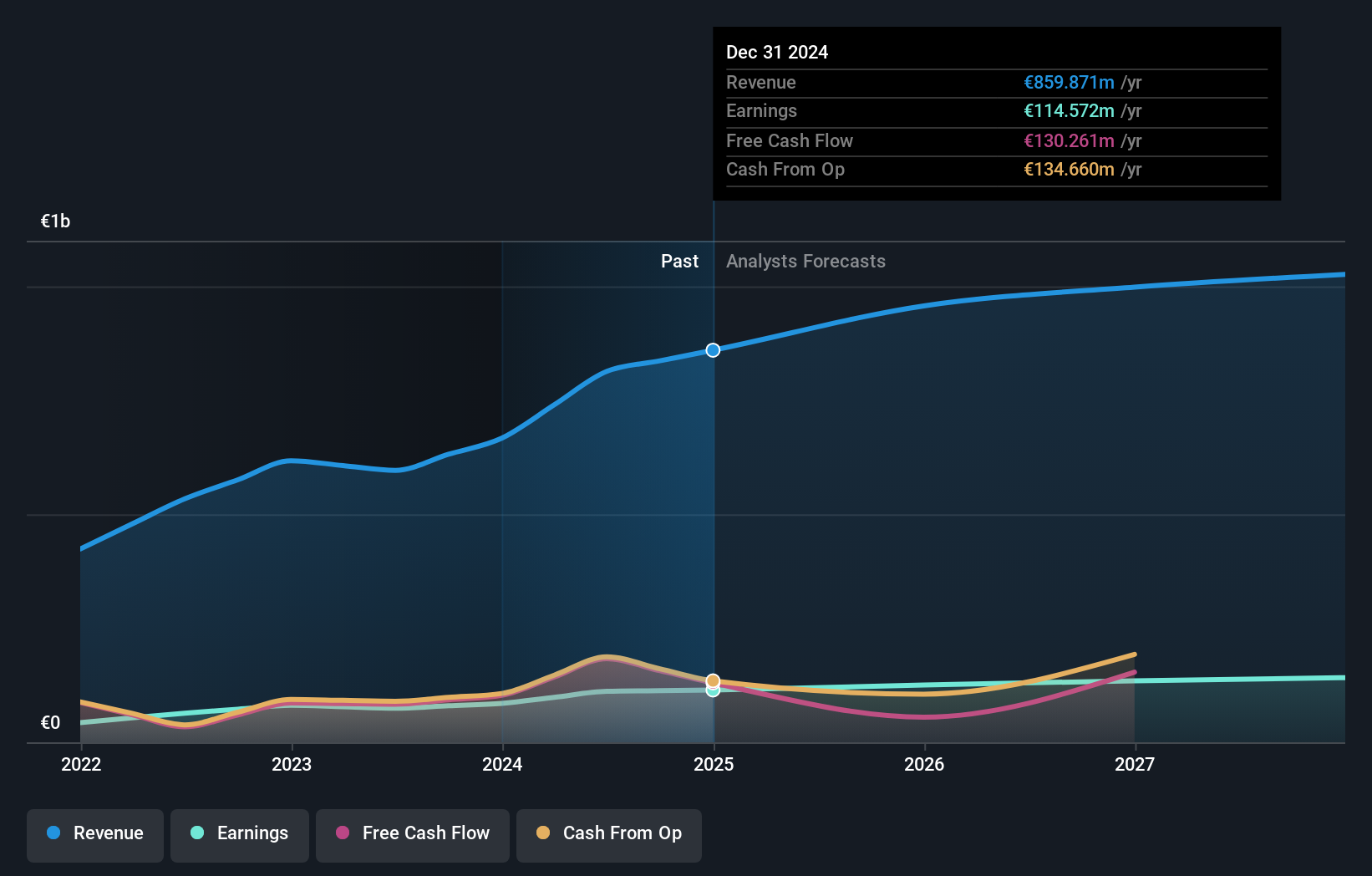

Operations: Cairn Homes generates revenue primarily from building and property development, amounting to €813.40 million. The company's financial performance is highlighted by a focus on this core segment, which significantly contributes to its overall earnings.

Cairn Homes, a smaller player in the UK market, showcases notable financial health with its price-to-earnings ratio at 11.9x, undercutting the broader UK market's 16.5x. Its earnings surged by 49.5% over the past year, outpacing the Consumer Durables sector's -22.5%. The company has been actively repurchasing shares; recently completing buybacks of over 56 million shares for €70 million since March 2023. Despite an increase in its debt-to-equity ratio from 31.3% to 39.1% over five years, Cairn maintains satisfactory net debt levels at just 20.7%, ensuring robust interest coverage with EBIT covering interest payments by a factor of nine and half times.

- Navigate through the intricacies of Cairn Homes with our comprehensive health report here.

Understand Cairn Homes' track record by examining our Past report.

Seize The Opportunity

- Unlock our comprehensive list of 81 UK Undiscovered Gems With Strong Fundamentals by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Warpaint London might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:W7L

Flawless balance sheet with solid track record.

Market Insights

Community Narratives