- United Kingdom

- /

- Consumer Durables

- /

- LSE:VID

3 UK Stocks That May Be Trading Below Estimated Value In October 2024

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 index closing lower due to weak trade data from China, highlighting concerns about global economic recovery and its impact on UK companies. Despite these broader market pressures, certain stocks may be trading below their estimated value, presenting potential opportunities for investors who are mindful of current economic conditions and seeking undervalued assets.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| GlobalData (AIM:DATA) | £2.03 | £3.72 | 45.4% |

| Tracsis (AIM:TRCS) | £5.30 | £10.00 | 47% |

| Franchise Brands (AIM:FRAN) | £1.455 | £2.63 | 44.8% |

| JD Sports Fashion (LSE:JD.) | £1.4245 | £2.79 | 48.9% |

| Redcentric (AIM:RCN) | £1.315 | £2.44 | 46% |

| Foxtons Group (LSE:FOXT) | £0.628 | £1.19 | 47.4% |

| Videndum (LSE:VID) | £2.50 | £4.56 | 45.2% |

| SysGroup (AIM:SYS) | £0.335 | £0.65 | 48.6% |

| Hochschild Mining (LSE:HOC) | £1.846 | £3.55 | 48% |

| BATM Advanced Communications (LSE:BVC) | £0.194 | £0.37 | 47.3% |

We're going to check out a few of the best picks from our screener tool.

Victorian Plumbing Group (AIM:VIC)

Overview: Victorian Plumbing Group plc is an online retailer specializing in bathroom products and accessories in the United Kingdom, with a market cap of £341.98 million.

Operations: The company's revenue primarily comes from its online retail segment, which generated £282.90 million.

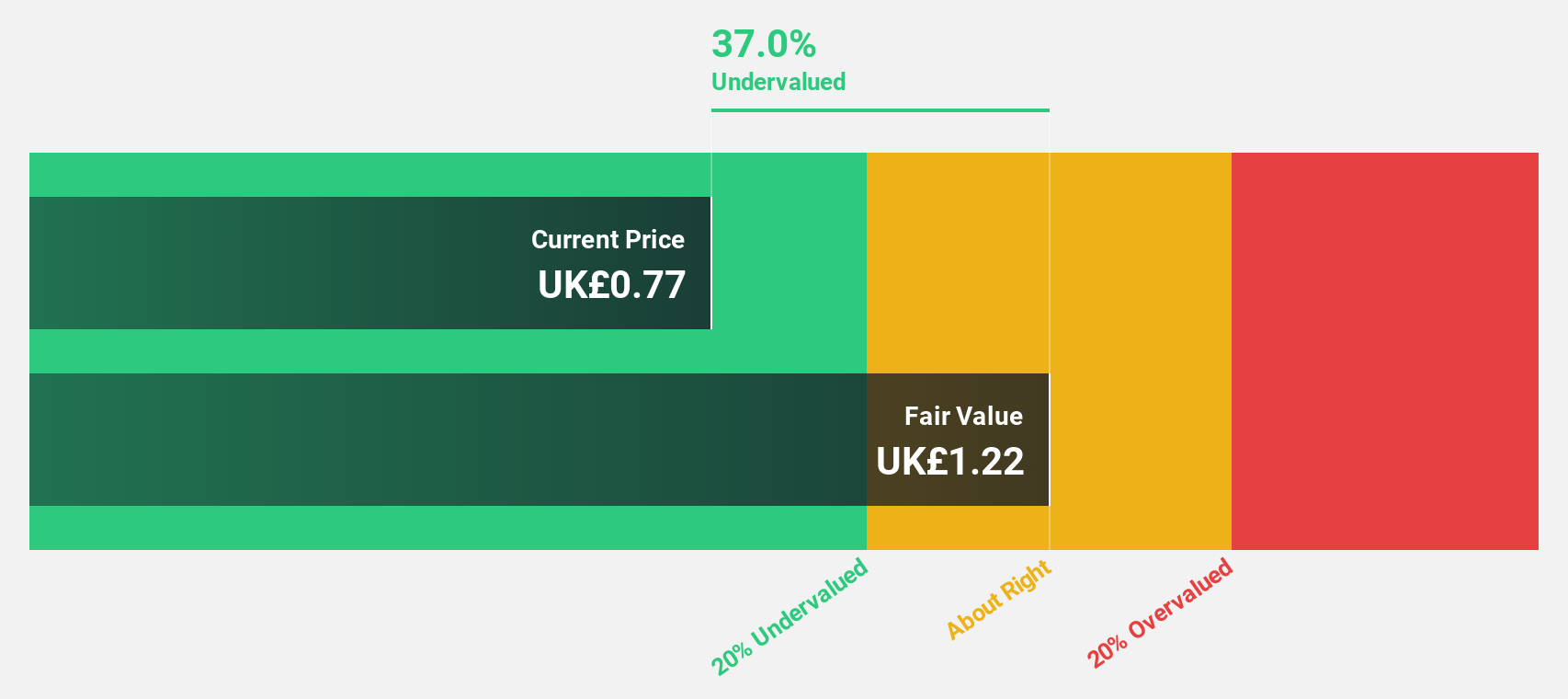

Estimated Discount To Fair Value: 43.6%

Victorian Plumbing Group is trading at £1.05, significantly below its estimated fair value of £1.86, highlighting its potential undervaluation based on cash flows. Despite recent insider selling, the company shows strong earnings growth prospects with a forecasted annual profit increase of 33.9%, surpassing the UK market average. However, while revenue growth is expected to be slower than 20% annually, it still exceeds the broader market's rate of 3.7%.

- Our expertly prepared growth report on Victorian Plumbing Group implies its future financial outlook may be stronger than recent results.

- Take a closer look at Victorian Plumbing Group's balance sheet health here in our report.

Henry Boot (LSE:BOOT)

Overview: Henry Boot PLC operates in the United Kingdom, focusing on property investment and development, land promotion, and construction activities, with a market cap of £314.02 million.

Operations: The company generates revenue through three main segments: Property Investment and Development (£170.56 million), Construction (£87.90 million), and Land Promotion (£28.37 million).

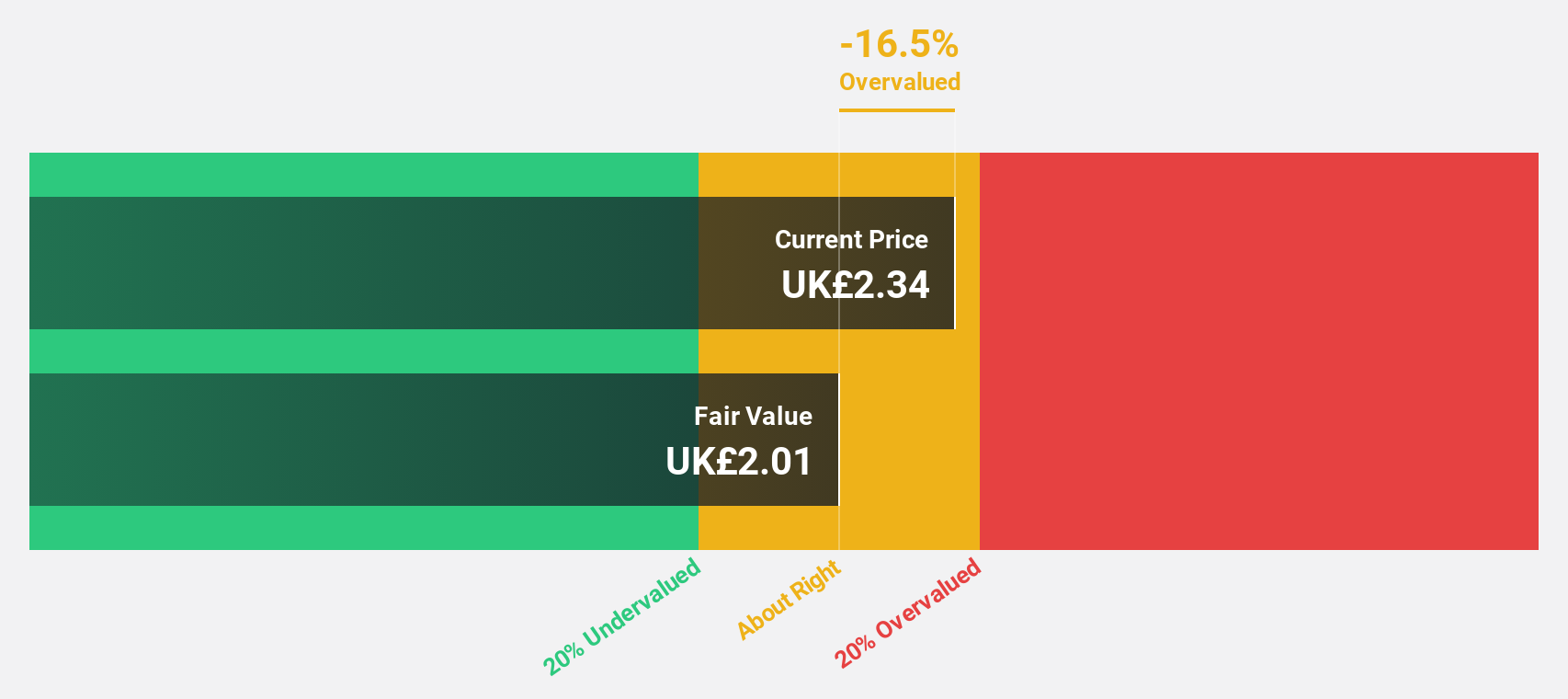

Estimated Discount To Fair Value: 19.7%

Henry Boot is trading at £2.35, slightly below its estimated fair value of £2.93, suggesting potential undervaluation based on cash flows. Despite a challenging first half in 2024 with decreased sales and net income, the company anticipates significant earnings growth of 25.5% annually, outpacing the UK market average. Recent business expansions in industrial and logistics sectors reflect strategic growth initiatives, although dividend coverage by free cash flows remains weak at present levels.

- The analysis detailed in our Henry Boot growth report hints at robust future financial performance.

- Get an in-depth perspective on Henry Boot's balance sheet by reading our health report here.

Videndum (LSE:VID)

Overview: Videndum Plc designs, manufactures, and distributes products and services for content capture and sharing across broadcast, cinematic, video, photographic, and smartphone applications globally with a market cap of £235.47 million.

Operations: The company's revenue is derived from three main segments: Media Solutions (£144.70 million), Creative Solutions (£54.90 million), and Production Solutions (£98 million).

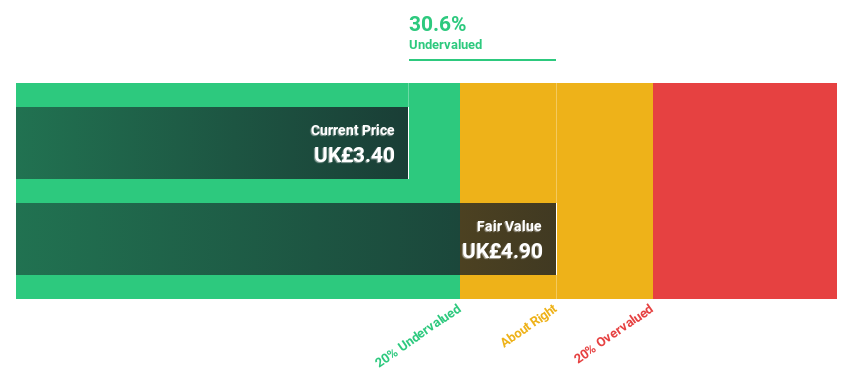

Estimated Discount To Fair Value: 45.2%

Videndum is trading at £2.50, significantly below its estimated fair value of £4.56, highlighting potential undervaluation based on cash flows despite recent earnings challenges. The company reported a net loss for H1 2024 but reduced losses compared to the previous year. With revenue expected to grow at 8.9% annually and profitability anticipated within three years, Videndum's forecasted growth surpasses the UK market average, though recent index exclusion and shareholder dilution present concerns.

- Upon reviewing our latest growth report, Videndum's projected financial performance appears quite optimistic.

- Click to explore a detailed breakdown of our findings in Videndum's balance sheet health report.

Seize The Opportunity

- Discover the full array of 58 Undervalued UK Stocks Based On Cash Flows right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:VID

Videndum

Designs, manufactures, and distributes products and services that enable end users to capture and share content for the broadcast, cinematic, video, photographic, and smartphone applications worldwide.

Undervalued with reasonable growth potential.