- United Kingdom

- /

- Consumer Durables

- /

- LSE:BTRW

Barratt Developments plc's (LON:BDEV) Stock Is Going Strong: Have Financials A Role To Play?

Barratt Developments (LON:BDEV) has had a great run on the share market with its stock up by a significant 15% over the last three months. We wonder if and what role the company's financials play in that price change as a company's long-term fundamentals usually dictate market outcomes. Specifically, we decided to study Barratt Developments' ROE in this article.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

See our latest analysis for Barratt Developments

How Do You Calculate Return On Equity?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Barratt Developments is:

7.8% = UK£406m ÷ UK£5.2b (Based on the trailing twelve months to December 2020).

The 'return' is the yearly profit. That means that for every £1 worth of shareholders' equity, the company generated £0.08 in profit.

What Is The Relationship Between ROE And Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

A Side By Side comparison of Barratt Developments' Earnings Growth And 7.8% ROE

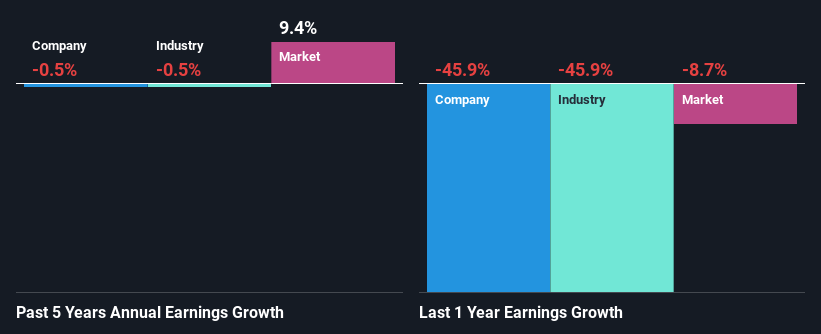

At first glance, Barratt Developments' ROE doesn't look very promising. However, the fact that the company's ROE is higher than the average industry ROE of 5.4%, is definitely interesting. Still, Barratt Developments has seen a flat net income growth over the past five years. Remember, the company's ROE is a bit low to begin with, just that it is higher than the industry average. So that could be one of the factors that are causing earnings growth to stay flat.

From the 0.5% decline reported by the industry in the same period, we infer that Barratt Developments and its industry are both shrinking at a similar rate.

Earnings growth is an important metric to consider when valuing a stock. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. If you're wondering about Barratt Developments''s valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is Barratt Developments Making Efficient Use Of Its Profits?

Despite having a moderate three-year median payout ratio of 39% (meaning the company retains61% of profits) in the last three-year period, Barratt Developments' earnings growth was more or les flat. So there might be other factors at play here which could potentially be hampering growth. For example, the business has faced some headwinds.

Moreover, Barratt Developments has been paying dividends for eight years, which is a considerable amount of time, suggesting that management must have perceived that the shareholders prefer dividends over earnings growth. Our latest analyst data shows that the future payout ratio of the company is expected to rise to 59% over the next three years. Regardless, the future ROE for Barratt Developments is speculated to rise to 13% despite the anticipated increase in the payout ratio. There could probably be other factors that could be driving the future growth in the ROE.

Summary

On the whole, we do feel that Barratt Developments has some positive attributes. Yet, the low earnings growth is a bit concerning, especially given that the company has a respectable rate of return and is reinvesting a huge portion of its profits. By the looks of it, there could be some other factors, not necessarily in control of the business, that's preventing growth. With that said, we studied the latest analyst forecasts and found that while the company has shrunk its earnings in the past, analysts expect its earnings to grow in the future. Are these analysts expectations based on the broad expectations for the industry, or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

When trading Barratt Developments or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Barratt Redrow might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About LSE:BTRW

Barratt Redrow

Engages in the housebuilding business in the United Kingdom.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

Nova Ljubljanska Banka d.d. future looks bright with a profit margin change of 38%

Viohalco S.A. (VIO.AT): Greece's Leading Integrated Metals Processor

M&A machine with a relentless focus on operational excellence

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Undervalued Key Player in Magnets/Rare Earth

Trending Discussion

I'm exiting the positions at great return! WRLG got great competent management. But, 100k oz gold too small in today environment. They might looking for M/A opportunity in the future, or they might get take over by Aris Mining, I don't know. But, Frank Giustra stated he's believed in multi-assets, so that's my speculation. Anyhow, I want to be aggressive in today's gold price. I'm buying Lahontan Gold LG with this as exchange. Higher upside, more leverage. WRLG CEO is BOD's of LG, that's something. This will be my last update on WRLG, good luck!