- United Kingdom

- /

- Consumer Durables

- /

- AIM:VCP

Improved Revenues Required Before Victoria PLC (LON:VCP) Stock's 187% Jump Looks Justified

Those holding Victoria PLC (LON:VCP) shares would be relieved that the share price has rebounded 187% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 57% share price drop in the last twelve months.

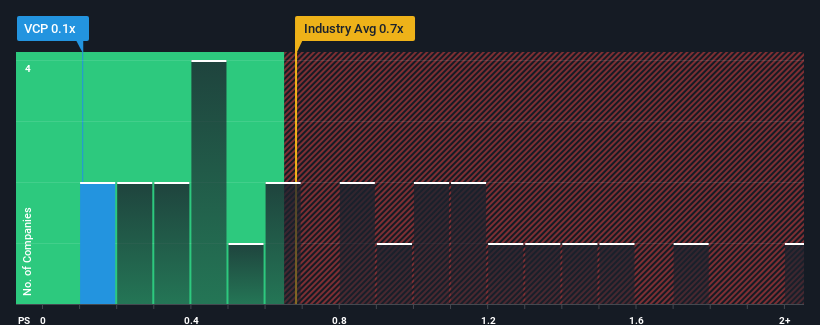

In spite of the firm bounce in price, given about half the companies operating in the United Kingdom's Consumer Durables industry have price-to-sales ratios (or "P/S") above 0.7x, you may still consider Victoria as an attractive investment with its 0.1x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Victoria

How Has Victoria Performed Recently?

Recent times have been more advantageous for Victoria as its revenue hasn't fallen as much as the rest of the industry. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. You'd much rather the company continue improving its revenue if you still believe in the business. But at the very least, you'd be hoping that revenue doesn't fall off a cliff completely if your plan is to pick up some stock while it's out of favour.

Keen to find out how analysts think Victoria's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

Victoria's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 8.7%. Even so, admirably revenue has lifted 44% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue growth is heading into negative territory, declining 2.8% over the next year. With the industry predicted to deliver 11% growth, that's a disappointing outcome.

With this in consideration, we find it intriguing that Victoria's P/S is closely matching its industry peers. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Final Word

The latest share price surge wasn't enough to lift Victoria's P/S close to the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that Victoria's P/S is on the lower end of the spectrum. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

It is also worth noting that we have found 2 warning signs for Victoria that you need to take into consideration.

If these risks are making you reconsider your opinion on Victoria, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:VCP

Victoria

Designs, manufactures, and distributes flooring products primarily in the United Kingdom, Italy, Belgium, Spain, Australia, the Netherlands, Turkey, France, Ireland, Portugal, and the United States.

Undervalued slight.

Similar Companies

Market Insights

Community Narratives