- United Kingdom

- /

- Capital Markets

- /

- LSE:AJAX

Robinson And 2 Other UK Penny Stocks To Watch

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines following weak trade data from China, highlighting global economic uncertainties. In such a climate, investors often seek stocks that offer both affordability and potential growth. Penny stocks, although an older term, remain relevant as they represent smaller or newer companies that can provide these opportunities when backed by strong financials.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Secure Trust Bank (LSE:STB) | £3.49 | £66.56M | ★★★★☆☆ |

| Begbies Traynor Group (AIM:BEG) | £0.95 | £149.86M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.885 | £185.28M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.085 | £785.55M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.16 | £99.11M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.288 | £198.65M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £4.225 | £420.2M | ★★★★☆☆ |

| Serabi Gold (AIM:SRB) | £1.18 | £89.37M | ★★★★★★ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.437 | $254.04M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.375 | £175.11M | ★★★★★☆ |

Click here to see the full list of 467 stocks from our UK Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Robinson (AIM:RBN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Robinson plc manufactures and sells plastic and paperboard packaging products across the United Kingdom, Poland, Denmark, Holland, Hungary, Belgium, and internationally with a market cap of £17.17 million.

Operations: The company's revenue of £52.46 million is generated from its plastic and paperboard packaging segment.

Market Cap: £17.17M

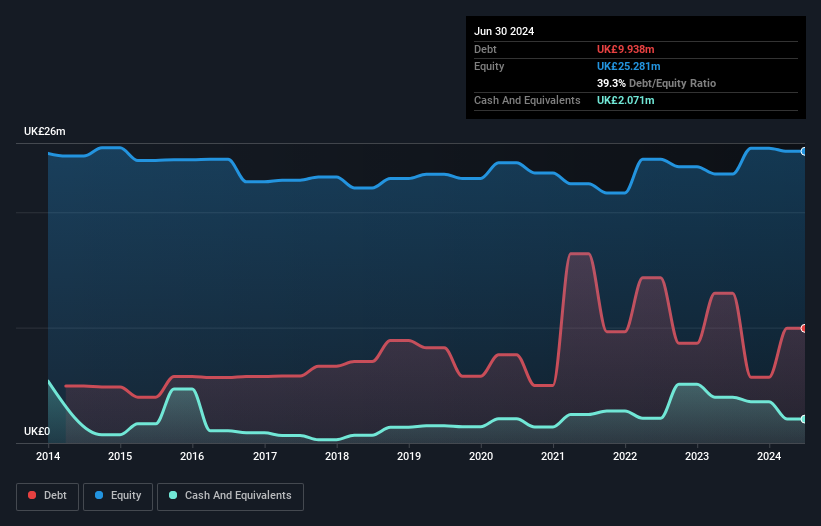

Robinson plc, with a market cap of £17.17 million, has shown recent profitability but faces challenges such as low return on equity at 2.1% and interest payments not well covered by EBIT (2.4x). Despite these concerns, the company maintains a satisfactory net debt to equity ratio of 31.1% and strong asset coverage for both short- and long-term liabilities. The board's experience is notable with an average tenure of 7.6 years, although management tenure data is insufficient. Earnings are forecasted to grow significantly at 74.05% annually, though past five-year earnings have declined by 24.4%.

- Click here to discover the nuances of Robinson with our detailed analytical financial health report.

- Explore Robinson's analyst forecasts in our growth report.

Tandem Group (AIM:TND)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Tandem Group plc is involved in the design, development, distribution, and retail of sports, leisure, and mobility products in the United Kingdom with a market cap of £8.89 million.

Operations: Tandem Group plc has not reported any specific revenue segments.

Market Cap: £8.89M

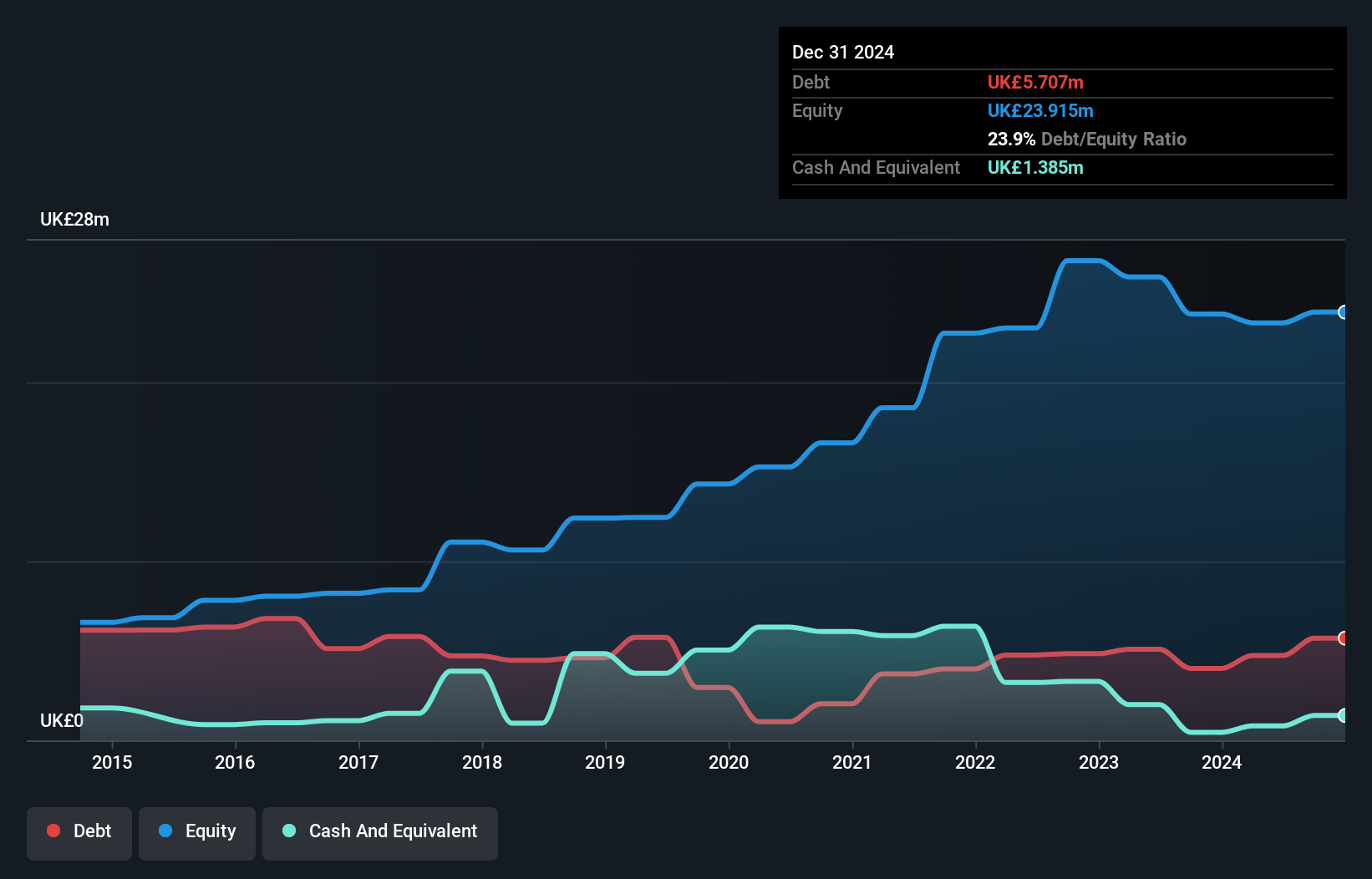

Tandem Group plc, with a market cap of £8.89 million, remains unprofitable despite generating GBP 9.79 million in sales for the first half of 2024, slightly up from the previous year. The company has managed to reduce its net loss to GBP 0.607 million compared to GBP 0.958 million last year, indicating some improvement in financial performance. Tandem's debt management is prudent with a satisfactory net debt to equity ratio of 16.9% and strong short-term asset coverage over liabilities (£12.6M vs £6.5M). Recent board changes include the appointment of Simon Bragg as non-executive director, bringing extensive financial expertise and governance experience.

- Dive into the specifics of Tandem Group here with our thorough balance sheet health report.

- Gain insights into Tandem Group's past trends and performance with our report on the company's historical track record.

Ajax Resources (LSE:AJAX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Ajax Resources Plc currently does not have significant operations and has a market cap of £1.40 million.

Operations: Ajax Resources Plc has not reported any revenue segments.

Market Cap: £1.4M

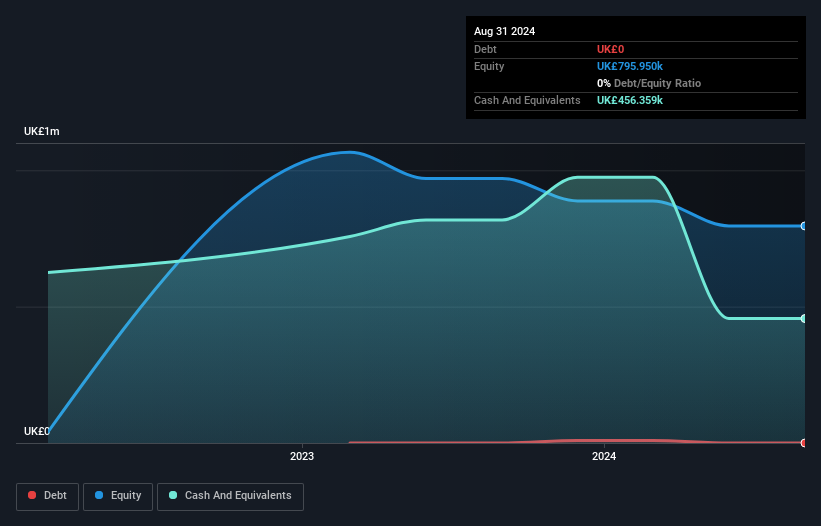

Ajax Resources Plc, with a market cap of £1.40 million, is currently pre-revenue and unprofitable, reporting a net loss of GBP 0.084 million for the half year ended August 2024. The company benefits from having no debt and sufficient cash runway for over two years, providing financial stability despite its lack of revenue generation. Recent strategic changes include appointing Richard Heywood as Executive Director to focus on business development opportunities, leveraging his experience in metal trading and financial services. Additionally, Ajax has appointed RPG Crouch Chapman LLP as its new statutory auditor without any noted concerns from the previous auditor.

- Jump into the full analysis health report here for a deeper understanding of Ajax Resources.

- Examine Ajax Resources' past performance report to understand how it has performed in prior years.

Turning Ideas Into Actions

- Access the full spectrum of 467 UK Penny Stocks by clicking on this link.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:AJAX

Flawless balance sheet very low.