Even when a business is losing money, it's possible for shareholders to make money if they buy a good business at the right price. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. But while the successes are well known, investors should not ignore the very many unprofitable companies that simply burn through all their cash and collapse.

So, the natural question for Sosandar (LON:SOS) shareholders is whether they should be concerned by its rate of cash burn. In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. We'll start by comparing its cash burn with its cash reserves in order to calculate its cash runway.

Check out our latest analysis for Sosandar

How Long Is Sosandar's Cash Runway?

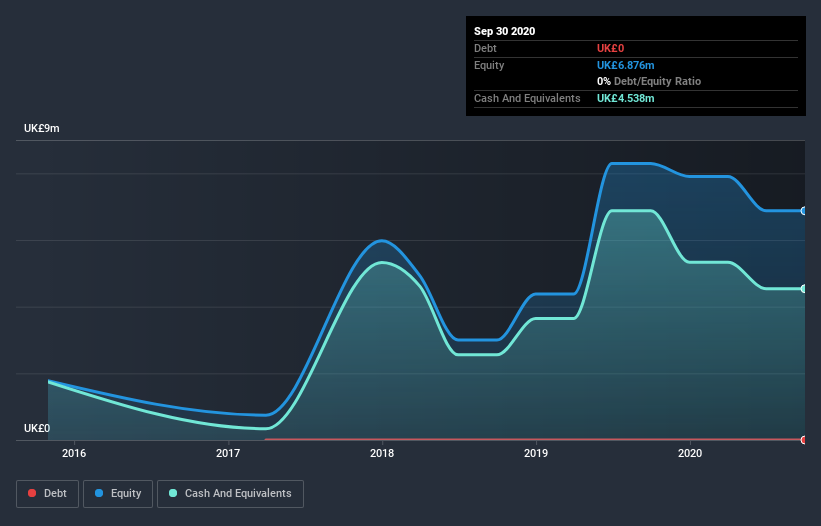

You can calculate a company's cash runway by dividing the amount of cash it has by the rate at which it is spending that cash. As at September 2020, Sosandar had cash of UK£4.5m and such minimal debt that we can ignore it for the purposes of this analysis. Looking at the last year, the company burnt through UK£6.6m. So it had a cash runway of approximately 8 months from September 2020. To be frank, this kind of short runway puts us on edge, as it indicates the company must reduce its cash burn significantly, or else raise cash imminently. Depicted below, you can see how its cash holdings have changed over time.

How Well Is Sosandar Growing?

Some investors might find it troubling that Sosandar is actually increasing its cash burn, which is up 26% in the last year. Having said that, it's revenue is up a very solid 94% in the last year, so there's plenty of reason to believe in the growth story. The company needs to keep up that growth, if it is to really please shareholders. It seems to be growing nicely. Of course, we've only taken a quick look at the stock's growth metrics, here. This graph of historic revenue growth shows how Sosandar is building its business over time.

How Easily Can Sosandar Raise Cash?

Even though it seems like Sosandar is developing its business nicely, we still like to consider how easily it could raise more money to accelerate growth. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. Commonly, a business will sell new shares in itself to raise cash and drive growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Sosandar's cash burn of UK£6.6m is about 18% of its UK£36m market capitalisation. Given that situation, it's fair to say the company wouldn't have much trouble raising more cash for growth, but shareholders would be somewhat diluted.

So, Should We Worry About Sosandar's Cash Burn?

Even though its cash runway makes us a little nervous, we are compelled to mention that we thought Sosandar's revenue growth was relatively promising. We don't think its cash burn is particularly problematic, but after considering the range of factors in this article, we do think shareholders should be monitoring how it changes over time. On another note, Sosandar has 4 warning signs (and 2 which are a bit concerning) we think you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies insiders are buying, and this list of stocks growth stocks (according to analyst forecasts)

If you’re looking to trade Sosandar, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:SOS

Sosandar

Engages in the manufacture and distribution of clothing products in the United Kingdom and internationally.

Flawless balance sheet and slightly overvalued.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026