- United Kingdom

- /

- Capital Markets

- /

- LSE:AJAX

Diales And 2 Other UK Penny Stocks To Watch Closely

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 index experiencing declines due to weak trade data from China, highlighting global economic uncertainties. Despite these broader market pressures, investors often turn their attention to penny stocks for their potential to uncover hidden value and growth opportunities. While the term "penny stock" may seem outdated, these smaller or newer companies can still offer significant returns when backed by strong financials. In this context, we will explore three UK penny stocks worth watching closely for their potential in navigating current market conditions.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Begbies Traynor Group (AIM:BEG) | £0.938 | £149.49M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.98 | £480.06M | ★★★★★★ |

| Warpaint London (AIM:W7L) | £4.10 | £331.23M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.15 | £313.29M | ★★★★☆☆ |

| Foresight Group Holdings (LSE:FSG) | £4.04 | £459.09M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.235 | £842.18M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.25 | £160.52M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £4.16 | £79.34M | ★★★★☆☆ |

| Van Elle Holdings (AIM:VANL) | £0.38 | £41.12M | ★★★★★★ |

| QinetiQ Group (LSE:QQ.) | £4.026 | £2.24B | ★★★★★☆ |

Click here to see the full list of 444 stocks from our UK Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Diales (AIM:DIAL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Diales Plc, with a market cap of £11.79 million, offers consultancy services to the engineering and construction sectors through its subsidiaries.

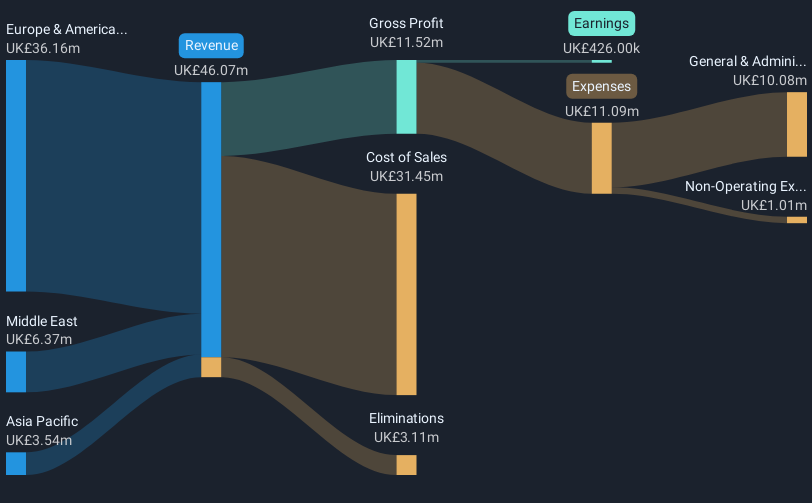

Operations: The company's revenue is derived from its operations in the Middle East (£6.37 million), Asia Pacific (£3.54 million), and Europe & Americas (£36.16 million).

Market Cap: £11.79M

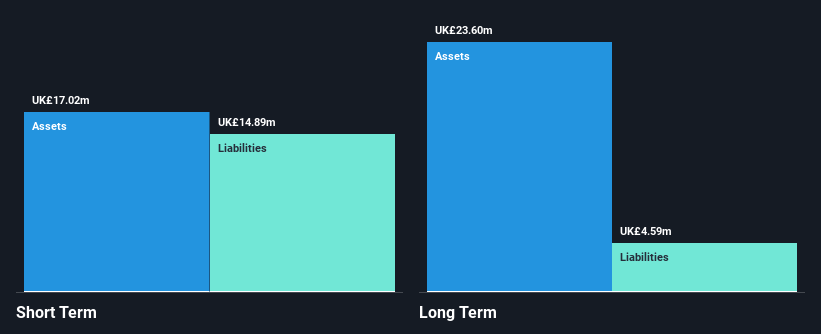

Diales Plc, with a market cap of £11.79 million, has demonstrated stability in its financial structure by being debt-free and maintaining short-term assets (£18.1M) that exceed both short-term (£8.4M) and long-term liabilities (£405K). Despite experiencing a significant earnings growth of 240.8% over the past year, largely surpassing industry averages, a large one-off loss impacted recent results. The company has also completed a share buyback program and proposed consistent dividends for 2024. However, with low return on equity (3%) and dividends not well covered by earnings or cash flows, potential investors should weigh these factors carefully.

- Navigate through the intricacies of Diales with our comprehensive balance sheet health report here.

- Gain insights into Diales' outlook and expected performance with our report on the company's earnings estimates.

Northern Bear (AIM:NTBR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Northern Bear PLC, with a market cap of £7.43 million, offers building and support services to various sectors including local authorities, housing associations, NHS trusts, universities, construction companies, and national house builders in Northern England and internationally.

Operations: The company's revenue is primarily generated from the United Kingdom, amounting to £69.37 million.

Market Cap: £7.43M

Northern Bear PLC, with a market cap of £7.43 million, shows mixed performance as a penny stock. The company has stable weekly volatility and trades at a good value compared to peers. Despite having high-quality earnings and satisfactory debt levels, recent negative earnings growth challenges its past 5-year profit increase trend of 18.6% annually. Short-term assets cover both short- and long-term liabilities effectively, though the return on equity is low at 7.2%. Recent board changes highlight potential strategic shifts as they seek to replace Director Tom Hayes following his resignation in December 2024.

- Jump into the full analysis health report here for a deeper understanding of Northern Bear.

- Learn about Northern Bear's future growth trajectory here.

Ajax Resources (LSE:AJAX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Ajax Resources Plc currently does not have significant operations and has a market cap of £1.40 million.

Operations: Ajax Resources Plc currently does not report any revenue segments.

Market Cap: £1.4M

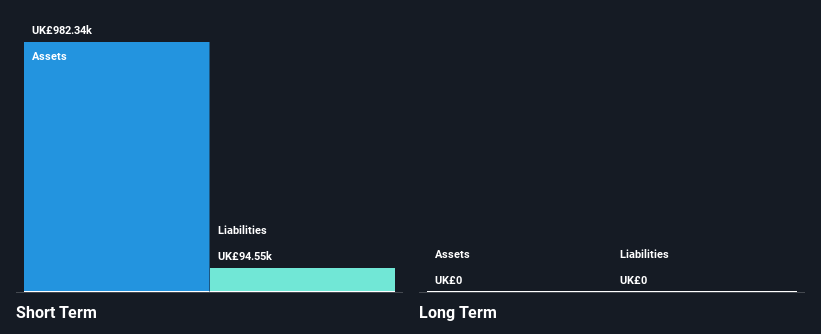

Ajax Resources Plc, with a market cap of £1.40 million, is a pre-revenue company currently unprofitable and debt-free. The company's short-term assets (£847.6K) comfortably exceed its short-term liabilities (£51.7K), providing financial stability despite its lack of significant operations or revenue streams. Ajax has sufficient cash runway for over two years, assuming free cash flow continues to decrease at historical rates. Recent earnings results show a reduced net loss compared to the previous year but remain negative overall, reflecting ongoing challenges in achieving profitability as it navigates its early-stage development phase without meaningful revenue generation.

- Click to explore a detailed breakdown of our findings in Ajax Resources' financial health report.

- Assess Ajax Resources' previous results with our detailed historical performance reports.

Next Steps

- Reveal the 444 hidden gems among our UK Penny Stocks screener with a single click here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:AJAX

Flawless balance sheet very low.

Market Insights

Community Narratives