- United Kingdom

- /

- Consumer Finance

- /

- AIM:RFX

3 UK Penny Stocks With Market Caps Under £200M

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices slipping amid concerns over China's economic recovery. In such a climate, investors might turn their attention to penny stocks, which despite their somewhat outdated name, represent smaller or less-established companies that can offer significant value. By focusing on those with strong financials and clear growth potential, these stocks can present unique opportunities for those looking to explore promising investments in the UK market.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.245 | £845.83M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.335 | £431.14M | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £3.57 | £68.08M | ★★★★☆☆ |

| Serabi Gold (AIM:SRB) | £0.99 | £74.98M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.20 | £102.41M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.30 | £200.5M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.38 | £175.75M | ★★★★★☆ |

| Tristel (AIM:TSTL) | £4.20 | £200.31M | ★★★★★★ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.4125 | $239.8M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.48 | £365.3M | ★★★★★★ |

Click here to see the full list of 465 stocks from our UK Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Eckoh (AIM:ECK)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Eckoh plc, with a market cap of £153.61 million, offers customer engagement data and payment security solutions across the United Kingdom, the United States, Canada, Ireland, and internationally.

Operations: The company's revenue is derived from two main segments: North America, contributing £18 million, and the United Kingdom and Rest of World, contributing £19.20 million.

Market Cap: £153.61M

Eckoh plc, with a market cap of £153.61 million, operates in the customer engagement and payment security sectors. Despite negative earnings growth last year, Eckoh's earnings have grown by 11.3% annually over five years and are forecast to grow at 8.68% per year. The company is debt-free with stable profit margins, though it experienced a large one-off loss of £1.8 million recently. Eckoh has settled a patent dispute favorably, receiving £2.25 million in compensation. An acquisition deal valued at approximately £160 million is underway by Bridgepoint Advisers II Ltd, expected to complete in Q1 2025.

- Jump into the full analysis health report here for a deeper understanding of Eckoh.

- Gain insights into Eckoh's outlook and expected performance with our report on the company's earnings estimates.

Northern Bear (AIM:NTBR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Northern Bear PLC, with a market cap of £7.49 million, offers building and support services to various sectors including local authorities and construction companies in Northern England and internationally.

Operations: The company generates revenue primarily from its operations in the United Kingdom, amounting to £69.37 million.

Market Cap: £7.49M

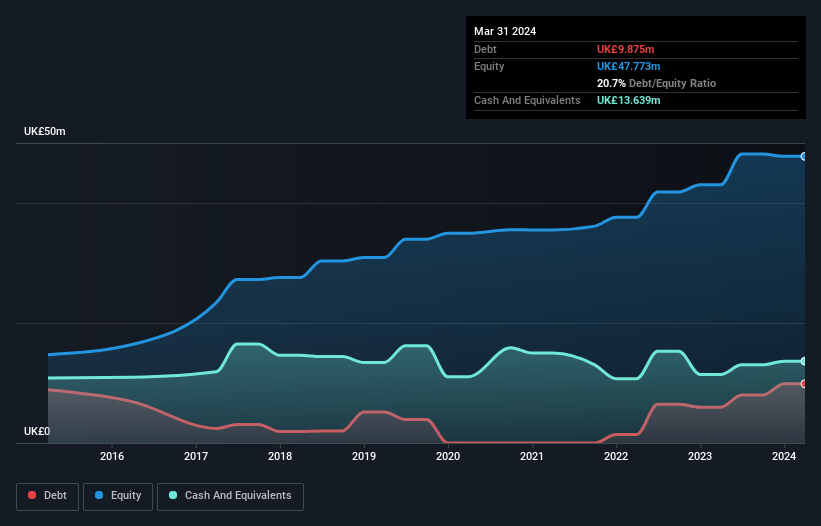

Northern Bear PLC, with a market cap of £7.49 million, reported half-year sales of £37.58 million and net income of £1.15 million, showing slight growth from the previous year. The company's seasoned management team contrasts with its inexperienced board. Trading at 62.8% below estimated fair value suggests potential for price appreciation, though low return on equity (7.2%) and negative earnings growth (-12%) present challenges. Despite increased debt-to-equity ratio over five years, debt is well-covered by cash flow (145%), indicating financial stability amidst fluctuating profit margins and an unstable dividend record.

- Dive into the specifics of Northern Bear here with our thorough balance sheet health report.

- Assess Northern Bear's future earnings estimates with our detailed growth reports.

Ramsdens Holdings (AIM:RFX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Ramsdens Holdings PLC provides diversified financial services in the United Kingdom and internationally, with a market cap of £72.41 million.

Operations: The company's revenue is generated from various segments, including Pawnbroking (£12.81 million), Retail Jewellery Sales (£33.68 million), Foreign Currency Margin (£14.31 million), Purchases of Precious Metals (£27.18 million), and Income from Other Financial Services (£0.60 million).

Market Cap: £72.41M

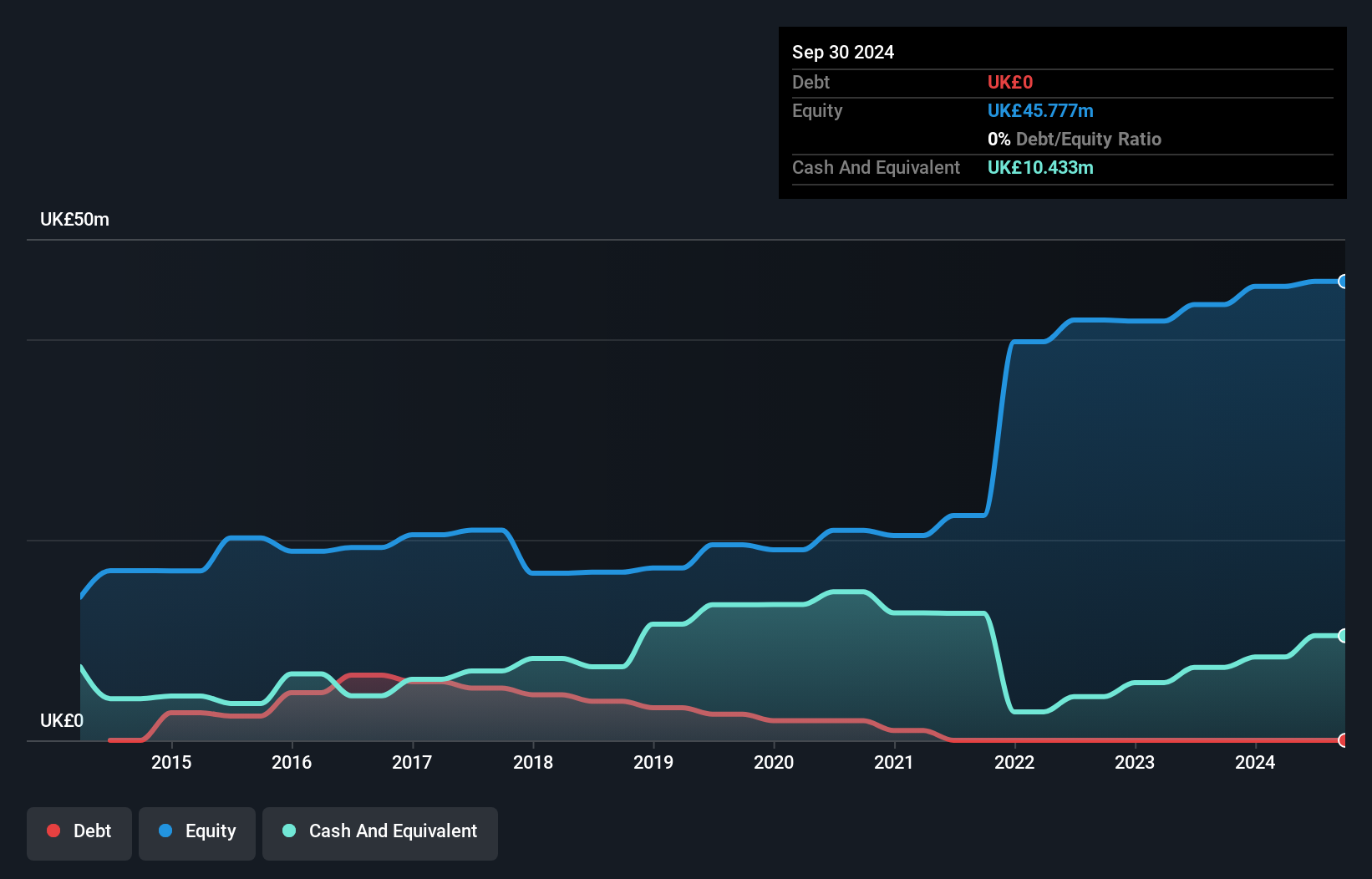

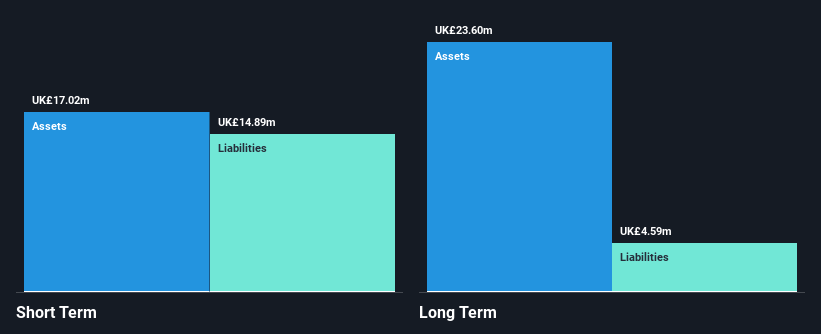

Ramsdens Holdings PLC, with a market cap of £72.41 million, demonstrates financial resilience through its diverse revenue streams, including retail jewellery sales (£33.68M) and pawnbroking (£12.81M). The company maintains a healthy balance sheet with short-term assets exceeding both short and long-term liabilities, and cash surpassing total debt. However, recent insider selling could indicate potential concerns among investors. While earnings have grown by 8.8% annually over five years, recent growth lags behind industry rates at just 1.4%. Despite trading below estimated fair value, Ramsdens faces challenges with low return on equity (16.3%) and unstable dividends amidst board changes.

- Click here and access our complete financial health analysis report to understand the dynamics of Ramsdens Holdings.

- Review our growth performance report to gain insights into Ramsdens Holdings' future.

Summing It All Up

- Embark on your investment journey to our 465 UK Penny Stocks selection here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:RFX

Ramsdens Holdings

Engages in the provision of diversified financial services in the United Kingdom and internationally.

Excellent balance sheet slight.