- Netherlands

- /

- Capital Markets

- /

- ENXTAM:VLK

European Undervalued Small Caps With Insider Buying Opportunities

Reviewed by Simply Wall St

Amid cautious optimism in Europe, the pan-European STOXX Europe 600 Index saw a slight increase of 0.26%, as investors navigated the complexities of U.S. trade policy developments and efforts to resolve the Russia-Ukraine conflict. In this environment, identifying promising small-cap stocks often involves looking for companies that demonstrate resilience and potential for growth despite broader market challenges, making them intriguing opportunities for those monitoring insider buying trends.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Bytes Technology Group | 19.8x | 5.0x | 23.03% | ★★★★★★ |

| 4imprint Group | 16.7x | 1.4x | 33.78% | ★★★★★☆ |

| Speedy Hire | NA | 0.2x | 27.56% | ★★★★★☆ |

| Gamma Communications | 22.7x | 2.3x | 34.98% | ★★★★☆☆ |

| ABG Sundal Collier Holding | 12.0x | 1.9x | 21.36% | ★★★★☆☆ |

| Franchise Brands | 39.1x | 2.0x | 25.14% | ★★★★☆☆ |

| Optima Health | NA | 1.5x | 45.01% | ★★★★☆☆ |

| IAR Systems Group | 13.4x | 3.4x | -1.38% | ★★★☆☆☆ |

| CVS Group | 38.4x | 1.1x | 38.64% | ★★★☆☆☆ |

| Logistri Fastighets | 17.0x | 8.1x | 17.43% | ★★★☆☆☆ |

We'll examine a selection from our screener results.

Van Lanschot Kempen (ENXTAM:VLK)

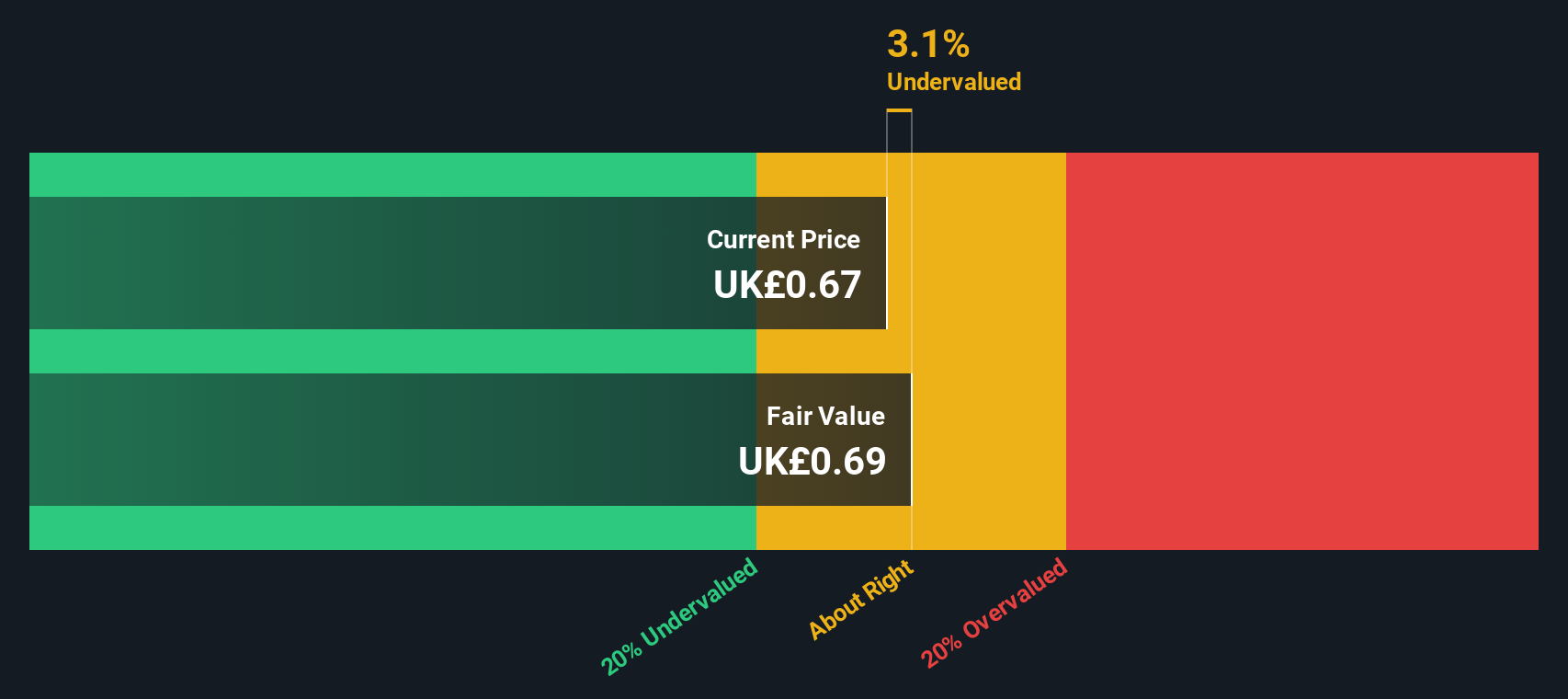

Simply Wall St Value Rating: ★★★☆☆☆

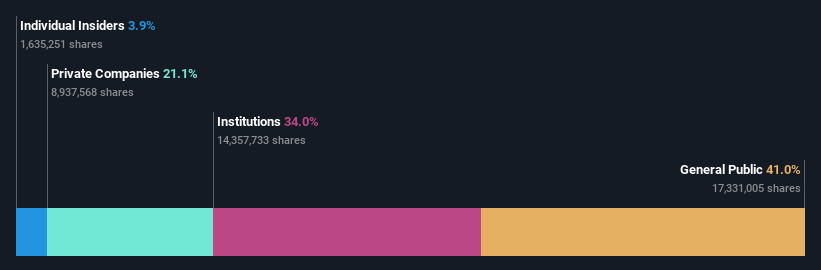

Overview: Van Lanschot Kempen is a Dutch financial institution specializing in private banking, asset management, and investment banking services with a market cap of approximately €1.51 billion.

Operations: The company generates revenue primarily through investment banking clients, with significant adjustments in its financial reporting. Operating expenses are dominated by general and administrative costs, which consistently contribute to a substantial portion of total expenses. Over the analyzed periods, the net income margin has shown variability, reaching as high as 22.22% and as low as 3.69%.

PE: 13.4x

Van Lanschot Kempen, a European financial services firm, recently showcased insider confidence with Arjan Huisman acquiring 4,690 shares worth €210,206. This activity aligns with their forecasted earnings growth of 6.71% annually. The company maintains a low bad loan allowance at 30%, indicating prudent risk management. Additionally, the appointment of Simon Grossenbacher as COO in Switzerland from February 2025 brings seasoned leadership to the table. These factors contribute to its appeal among undervalued stocks in Europe’s financial sector.

- Click to explore a detailed breakdown of our findings in Van Lanschot Kempen's valuation report.

Understand Van Lanschot Kempen's track record by examining our Past report.

Hays (LSE:HAS)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hays is a global recruitment company specializing in qualified, professional, and skilled recruitment services with a market capitalization of approximately £1.63 billion.

Operations: The company's revenue is primarily generated from its Qualified, Professional and Skilled Recruitment segment. Over the years, operating expenses have fluctuated, impacting net income margins. Notably, the gross profit margin showed a decline from 14.34% in late 2019 to 3.03% by the end of 2024.

PE: -79.3x

Hays, a recruitment firm in Europe, is navigating challenges with a decrease in net income to £3 million for the half year ending December 2024, down from £12.3 million the previous year. Despite this, insider confidence is evident as insiders have shown interest by purchasing shares recently. The company relies entirely on external borrowing for funding, which poses higher risks compared to customer deposits. Future earnings growth is anticipated at 86.71% annually, driven by strategic focus on Temp & Contracting sectors amid economic uncertainties.

Nivika Fastigheter (OM:NIVI B)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Nivika Fastigheter is a Swedish real estate company focused on the acquisition, development, and management of residential and commercial properties with a market capitalization of approximately SEK 5.85 billion.

Operations: Nivika Fastigheter's revenue growth is evident from SEK 83.50 million in 2016 to SEK 708.55 million by February 2025, with the gross profit margin showing a notable variation, reaching as high as 82.58% in August 2016 and settling around 71.60% in recent periods. The company's cost structure includes significant operating expenses and non-operating expenses, which have impacted net income margins over time, resulting in both positive and negative figures across different periods.

PE: 21.7x

Nivika Fastigheter recently reported earnings for the sixteen months ending December 2024, with sales at SEK 884 million and net income reaching SEK 200 million. Despite its reliance on higher-risk external borrowing, the company showcases insider confidence through Independent Board Member Hakan Eriksson's purchase of 75,000 shares valued at approximately SEK 2.8 million over a period of time. Earnings are projected to grow by over 36% annually, suggesting potential for future growth despite financial risks.

- Take a closer look at Nivika Fastigheter's potential here in our valuation report.

Evaluate Nivika Fastigheter's historical performance by accessing our past performance report.

Key Takeaways

- Delve into our full catalog of 51 Undervalued European Small Caps With Insider Buying here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Van Lanschot Kempen, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:VLK

Van Lanschot Kempen

Provides various financial services in the Netherlands, Belgium, and internationally.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives