Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that Experian plc (LON:EXPN) does use debt in its business. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Experian

How Much Debt Does Experian Carry?

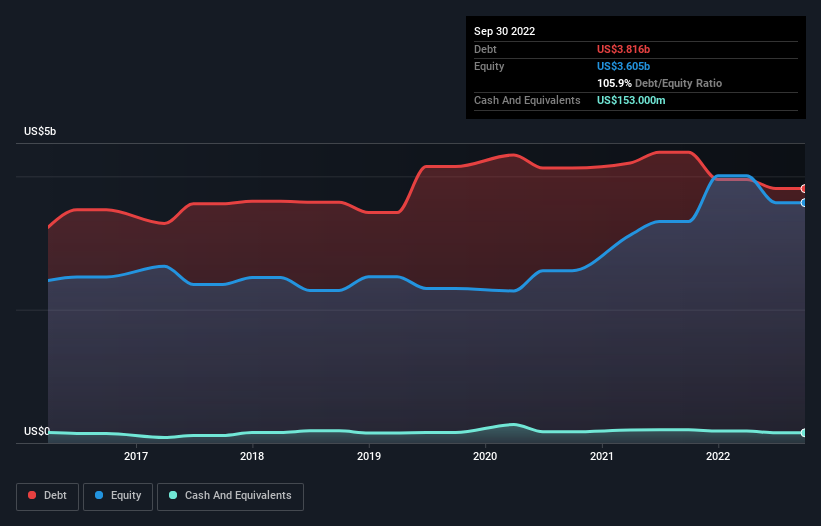

The image below, which you can click on for greater detail, shows that Experian had debt of US$3.82b at the end of September 2022, a reduction from US$4.36b over a year. However, it also had US$153.0m in cash, and so its net debt is US$3.66b.

How Strong Is Experian's Balance Sheet?

According to the last reported balance sheet, Experian had liabilities of US$2.07b due within 12 months, and liabilities of US$4.74b due beyond 12 months. On the other hand, it had cash of US$153.0m and US$1.41b worth of receivables due within a year. So it has liabilities totalling US$5.25b more than its cash and near-term receivables, combined.

Given Experian has a humongous market capitalization of US$29.4b, it's hard to believe these liabilities pose much threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Experian's net debt to EBITDA ratio of about 2.1 suggests only moderate use of debt. And its commanding EBIT of 27.8 times its interest expense, implies the debt load is as light as a peacock feather. Unfortunately, Experian saw its EBIT slide 3.7% in the last twelve months. If that earnings trend continues then its debt load will grow heavy like the heart of a polar bear watching its sole cub. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Experian's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. During the last three years, Experian generated free cash flow amounting to a very robust 85% of its EBIT, more than we'd expect. That positions it well to pay down debt if desirable to do so.

Our View

Happily, Experian's impressive interest cover implies it has the upper hand on its debt. But, on a more sombre note, we are a little concerned by its EBIT growth rate. Taking all this data into account, it seems to us that Experian takes a pretty sensible approach to debt. While that brings some risk, it can also enhance returns for shareholders. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. For instance, we've identified 1 warning sign for Experian that you should be aware of.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

Valuation is complex, but we're here to simplify it.

Discover if Experian might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:EXPN

Experian

Operates as a data and technology company in North America, Latin America, the United Kingdom, Ireland, Europe, the Middle East, Africa, and the Asia Pacific.

Average dividend payer with moderate growth potential.

Similar Companies

Market Insights

Community Narratives