- United Kingdom

- /

- Aerospace & Defense

- /

- LSE:BAB

Is Babcock International Group PLC (LON:BAB) A Good Fit For Your Dividend Portfolio?

Today we'll take a closer look at Babcock International Group PLC (LON:BAB) from a dividend investor's perspective. Owning a strong business and reinvesting the dividends is widely seen as an attractive way of growing your wealth. If you are hoping to live on your dividends, it's important to be more stringent with your investments than the average punter. Regular readers know we like to apply the same approach to each dividend stock, and we hope you'll find our analysis useful.

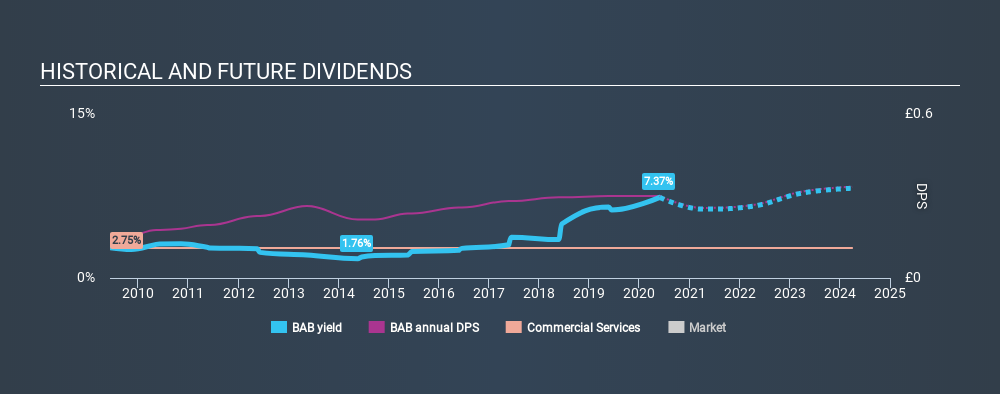

A high yield and a long history of paying dividends is an appealing combination for Babcock International Group. It would not be a surprise to discover that many investors buy it for the dividends. There are a few simple ways to reduce the risks of buying Babcock International Group for its dividend, and we'll go through these below.

Explore this interactive chart for our latest analysis on Babcock International Group!

Payout ratios

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Comparing dividend payments to a company's net profit after tax is a simple way of reality-checking whether a dividend is sustainable. In the last year, Babcock International Group paid out 56% of its profit as dividends. This is a fairly normal payout ratio among most businesses. It allows a higher dividend to be paid to shareholders, but does limit the capital retained in the business - which could be good or bad.

In addition to comparing dividends against profits, we should inspect whether the company generated enough cash to pay its dividend. Babcock International Group paid out 178% of its free cash flow last year, suggesting the dividend is poorly covered by cash flow. Paying out such a high percentage of cash flow suggests that the dividend was funded from either cash at bank or by borrowing, neither of which is desirable over the long term. Babcock International Group paid out less in dividends than it reported in profits, but unfortunately it didn't generate enough free cash flow to cover the dividend. Cash is king, as they say, and were Babcock International Group to repeatedly pay dividends that aren't well covered by cashflow, we would consider this a warning sign.

Is Babcock International Group's Balance Sheet Risky?

As Babcock International Group has a meaningful amount of debt, we need to check its balance sheet to see if the company might have debt risks. A quick check of its financial situation can be done with two ratios: net debt divided by EBITDA (earnings before interest, tax, depreciation and amortisation), and net interest cover. Net debt to EBITDA is a measure of a company's total debt. Net interest cover measures the ability to meet interest payments. Essentially we check that a) the company does not have too much debt, and b) that it can afford to pay the interest. With net debt of 2.49 times its EBITDA, Babcock International Group's debt burden is within a normal range for most listed companies.

Net interest cover can be calculated by dividing earnings before interest and tax (EBIT) by the company's net interest expense. Net interest cover of 7.61 times its interest expense appears reasonable for Babcock International Group, although we're conscious that even high interest cover doesn't make a company bulletproof.

We update our data on Babcock International Group every 24 hours, so you can always get our latest analysis of its financial health, here.

Dividend Volatility

Before buying a stock for its income, we want to see if the dividends have been stable in the past, and if the company has a track record of maintaining its dividend. For the purpose of this article, we only scrutinise the last decade of Babcock International Group's dividend payments. During this period the dividend has been stable, which could imply the business could have relatively consistent earnings power. During the past ten-year period, the first annual payment was UK£0.14 in 2010, compared to UK£0.30 last year. Dividends per share have grown at approximately 7.6% per year over this time.

Businesses that can grow their dividends at a decent rate and maintain a stable payout can generate substantial wealth for shareholders over the long term.

Dividend Growth Potential

While dividend payments have been relatively reliable, it would also be nice if earnings per share (EPS) were growing, as this is essential to maintaining the dividend's purchasing power over the long term. Babcock International Group has grown its earnings per share at 3.9% per annum over the past five years. 3.9% per annum is not a particularly high rate of growth, which we find curious. When a business is not growing, it often makes more sense to pay higher dividends to shareholders rather than retain the cash with no way to utilise it.

Conclusion

To summarise, shareholders should always check that Babcock International Group's dividends are affordable, that its dividend payments are relatively stable, and that it has decent prospects for growing its earnings and dividend. First, the company has a payout ratio that was within an average range for most dividend stocks, but it paid out virtually all of its generated cash flow. Earnings growth has been limited, but we like that the dividend payments have been fairly consistent. In sum, we find it hard to get excited about Babcock International Group from a dividend perspective. It's not that we think it's a bad business; just that there are other companies that perform better on these criteria.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. However, there are other things to consider for investors when analysing stock performance. As an example, we've identified 1 warning sign for Babcock International Group that you should be aware of before investing.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About LSE:BAB

Babcock International Group

Engages in the design, development, manufacture, and integration of specialist systems for aerospace, defense, and security in the United Kingdom, rest of Europe, Africa, North America, Australasia, and internationally.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives