Stock Analysis

- United Kingdom

- /

- Oil and Gas

- /

- LSE:GKP

UK Exchange Highlights: Three Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

Amidst a backdrop of fluctuating global markets and specific challenges within the United Kingdom, such as potential regulatory changes and economic uncertainties, investors are closely watching the FTSE 100 and broader indices. In such an environment, growth companies with high insider ownership can offer a unique appeal, suggesting a level of confidence from those most familiar with the company's inner workings.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Plant Health Care (AIM:PHC) | 26.4% | 121.3% |

| Petrofac (LSE:PFC) | 16.6% | 124.5% |

| Getech Group (AIM:GTC) | 17.2% | 86.1% |

| Gulf Keystone Petroleum (LSE:GKP) | 10.7% | 47.6% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 26.7% | 25.5% |

| Velocity Composites (AIM:VEL) | 28.5% | 143.4% |

| TEAM (AIM:TEAM) | 25.8% | 58.6% |

| Judges Scientific (AIM:JDG) | 11.5% | 25.3% |

| Afentra (AIM:AET) | 38.3% | 64.4% |

| Mothercare (AIM:MTC) | 15.1% | 41.2% |

Let's take a closer look at a couple of our picks from the screened companies.

Loungers (AIM:LGRS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Loungers plc operates cafés, bars, and restaurants under the Lounge and Cosy Club brand names in England and Wales, with a market capitalization of approximately £293.83 million.

Operations: The company generates its revenue primarily from operating café bars and restaurants, totaling £310.80 million.

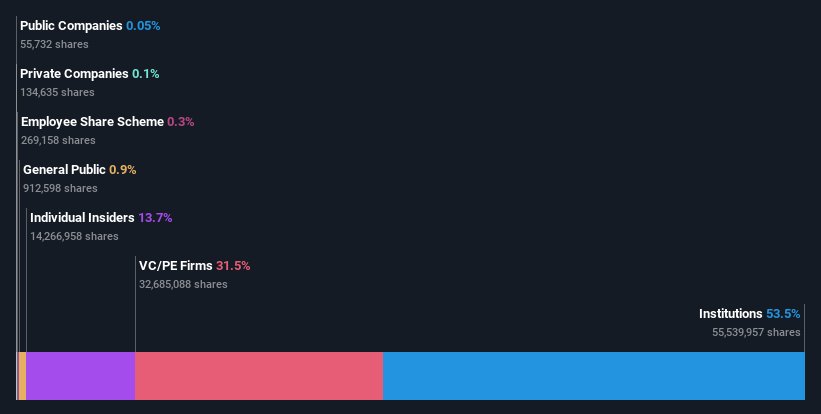

Insider Ownership: 13.9%

Earnings Growth Forecast: 31.4% p.a.

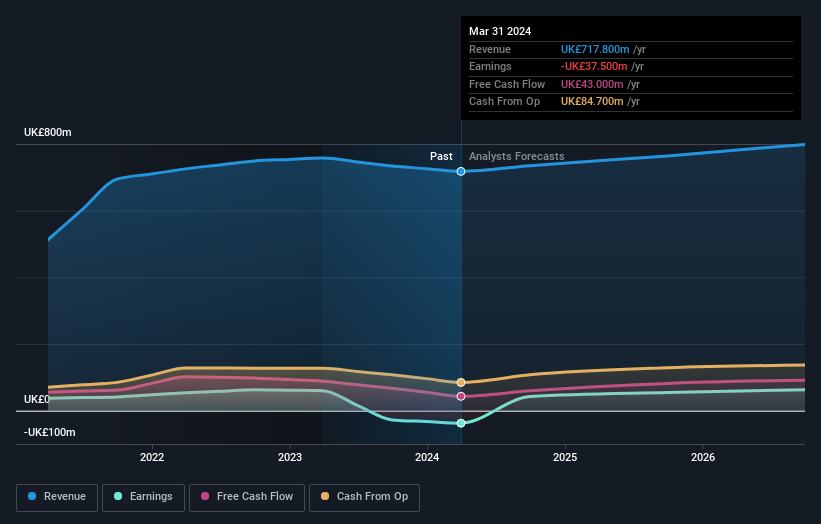

Loungers plc, a UK-based growth company with high insider ownership, reported a significant revenue increase to £353.5 million for FY 2024, up 24.7% year-over-year. Despite lower profit margins this year at 2.3%, compared to last year's 3.7%, earnings are expected to grow by an impressive 31.4% annually over the next three years, outpacing the UK market forecast of 13.1%. Recent executive changes aim to bolster this trajectory, with new appointments poised to leverage industry experience for continued expansion and operational excellence.

- Get an in-depth perspective on Loungers' performance by reading our analyst estimates report here.

- The valuation report we've compiled suggests that Loungers' current price could be quite moderate.

RWS Holdings (AIM:RWS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: RWS Holdings plc specializes in technology-enabled language, content, and intellectual property services with a market capitalization of approximately £726.31 million.

Operations: The firm specializes in offering services across technology-enabled language, content, and intellectual property sectors.

Insider Ownership: 24.6%

Earnings Growth Forecast: 67.4% p.a.

RWS Holdings plc, a UK-based company with substantial insider ownership, recently reported a decline in half-year sales to £350.3 million and net income to £11.1 million. Despite this, the firm is optimistic about future growth, evidenced by a slight dividend increase and the launch of HAI, an AI-powered translation platform aimed at global market entry facilitation. However, earnings coverage of dividends is weak and share price volatility remains high. The company anticipates stronger revenue in the latter half of 2024 following new product launches and strategic client agreements like that with Dell Technologies.

- Unlock comprehensive insights into our analysis of RWS Holdings stock in this growth report.

- In light of our recent valuation report, it seems possible that RWS Holdings is trading behind its estimated value.

Gulf Keystone Petroleum (LSE:GKP)

Simply Wall St Growth Rating: ★★★★★★

Overview: Gulf Keystone Petroleum Limited is a company focused on the exploration, development, and production of oil and gas in the Kurdistan Region of Iraq, with a market capitalization of approximately £287.49 million.

Operations: The company generates its revenue primarily from the exploration and production of oil and gas, totaling $123.51 million.

Insider Ownership: 10.7%

Earnings Growth Forecast: 47.6% p.a.

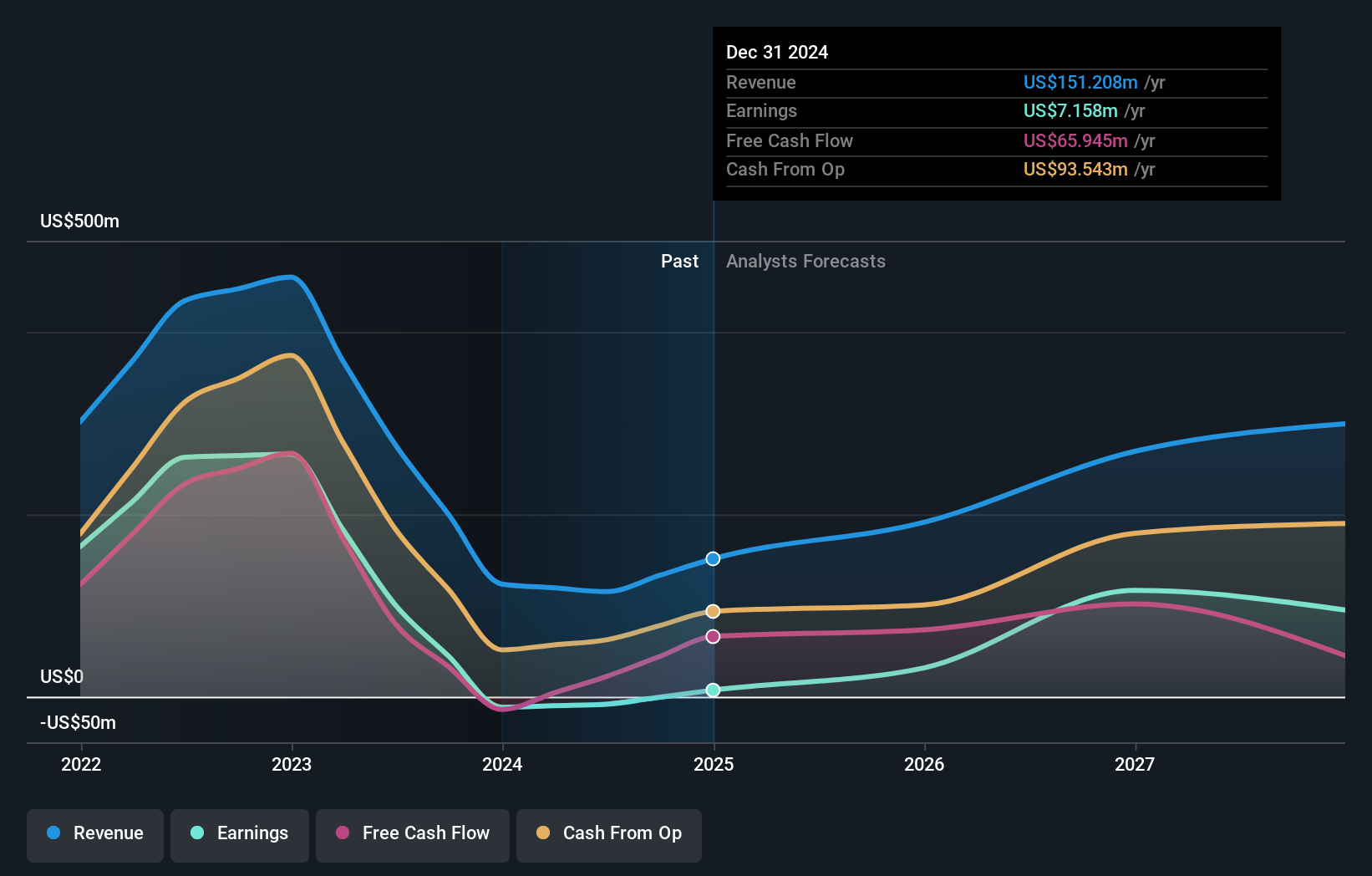

Gulf Keystone Petroleum, despite a highly volatile share price, is trading at 61% below its estimated fair value and has initiated a substantial share buyback program, signaling confidence by management. The company's revenue is expected to grow by 25.1% annually, outpacing the UK market forecast of 3.7%. Additionally, earnings are projected to surge by 47.61% per year as it moves towards profitability within the next three years. However, recent financials show a significant drop in sales and a shift from profit to a net loss of US$11.5 million last year.

- Click here to discover the nuances of Gulf Keystone Petroleum with our detailed analytical future growth report.

- Our comprehensive valuation report raises the possibility that Gulf Keystone Petroleum is priced higher than what may be justified by its financials.

Where To Now?

- Get an in-depth perspective on all 64 Fast Growing UK Companies With High Insider Ownership by using our screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Gulf Keystone Petroleum is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:GKP

Gulf Keystone Petroleum

Engages in the exploration, development, and production of oil and gas in the Kurdistan Region of Iraq.

Exceptional growth potential with mediocre balance sheet.