- United Kingdom

- /

- Professional Services

- /

- AIM:RWS

RWS Holdings And 2 Other Promising Penny Stocks On UK Exchange

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines influenced by weak trade data from China. Amidst these broader market dynamics, investors often turn their attention to penny stocks—an investment area that continues to intrigue despite its somewhat outdated moniker. These stocks, typically representing smaller or newer companies, can provide unique opportunities for growth at lower price points when backed by strong fundamentals and financial stability.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Tristel (AIM:TSTL) | £3.85 | £176.31M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.255 | £304.09M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.95 | £474.22M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.11 | £800.61M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.08 | £405.78M | ★★★★☆☆ |

| Supreme (AIM:SUP) | £1.46 | £167.92M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.452 | £219.31M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.53 | £187.85M | ★★★★★☆ |

| Impax Asset Management Group (AIM:IPX) | £3.66 | £468.35M | ★★★★★★ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.4825 | $276.13M | ★★★★★★ |

Click here to see the full list of 472 stocks from our UK Penny Stocks screener.

We'll examine a selection from our screener results.

RWS Holdings (AIM:RWS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: RWS Holdings plc offers technology-enabled language, content, and intellectual property services with a market cap of £571.47 million.

Operations: The company's revenue is derived from four main segments: IP Services (£105.1 million), Language Services (£325.4 million), Regulated Industry (£149.4 million), and Language & Content Technology (£137.9 million).

Market Cap: £571.47M

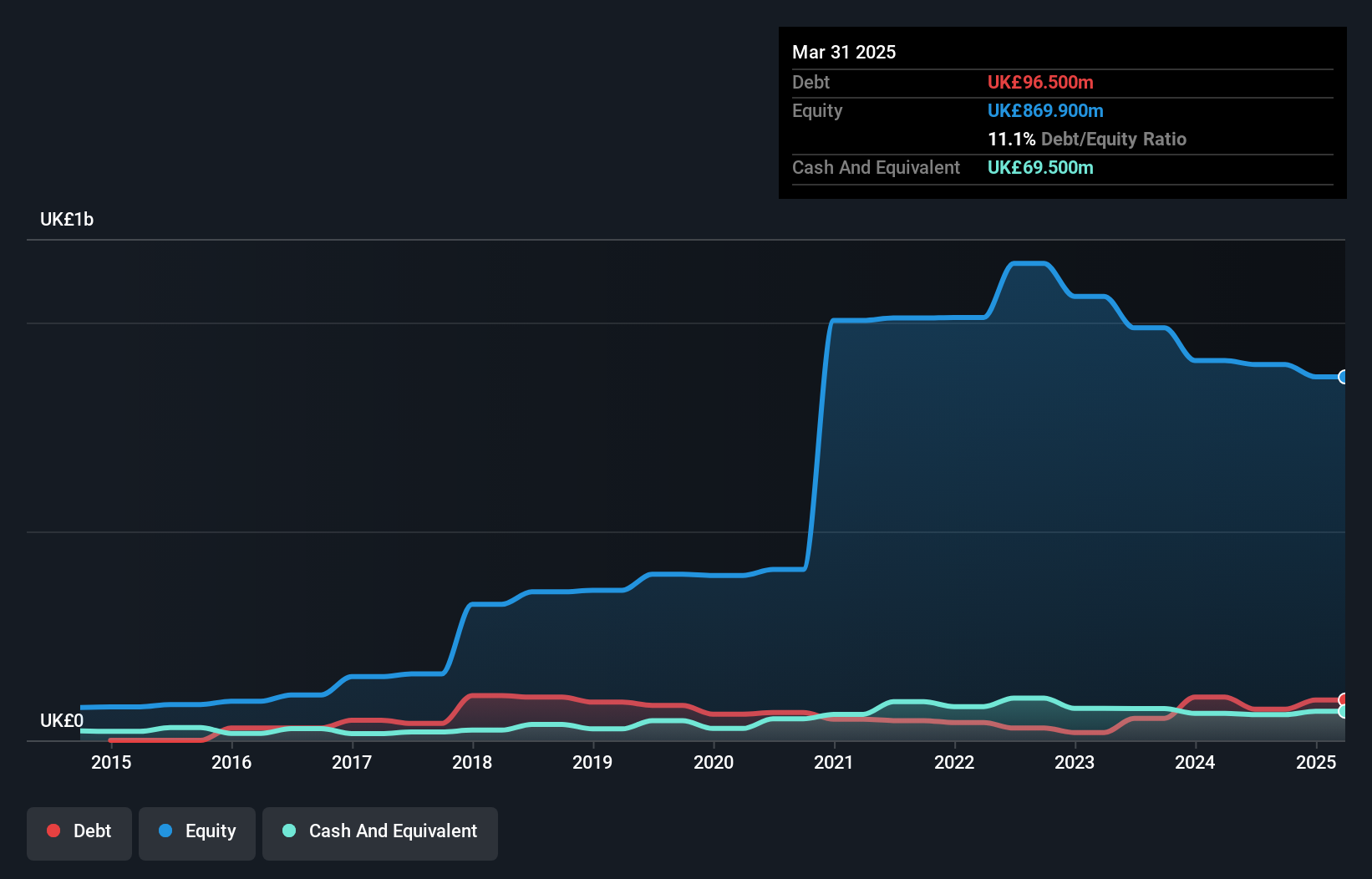

RWS Holdings, with a market cap of £571.47 million, operates across four revenue segments but remains unprofitable. Despite this, the company's short-term assets cover both its short and long-term liabilities, and its debt is well managed with operating cash flow covering 81.8% of it. The stock trades significantly below estimated fair value and analysts anticipate substantial price growth potential. Recent executive changes include Jacqui Taylor as Chief People Officer and Mark Lawyer leading Regulated Industries & Linguistic AI, indicating a strategic focus on human resources and AI development to enhance operational efficiency and client solutions.

- Dive into the specifics of RWS Holdings here with our thorough balance sheet health report.

- Examine RWS Holdings' earnings growth report to understand how analysts expect it to perform.

Dr. Martens (LSE:DOCS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Dr. Martens plc designs, develops, procures, markets, sells, and distributes footwear under the Dr. Martens brand and has a market cap of approximately £547.97 million.

Operations: The company generates revenue primarily from its footwear segment, which accounted for £877.10 million.

Market Cap: £547.97M

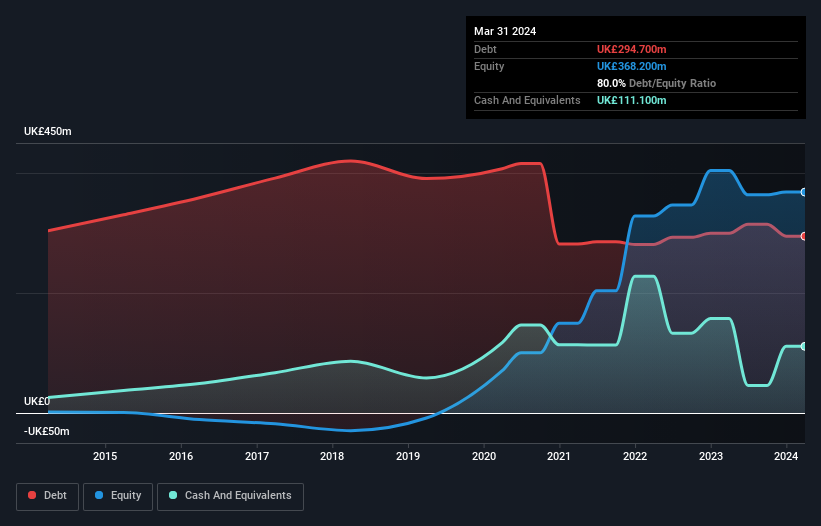

Dr. Martens, with a market cap of £547.97 million, primarily generates revenue from its footwear segment (£877.10 million). The company has experienced high quality past earnings but faced negative earnings growth over the past year, contributing to lower profit margins (7.9%) compared to last year's 12.9%. Despite this, Dr. Martens' short-term assets exceed both short and long-term liabilities, indicating financial stability in covering obligations. The stock trades significantly below estimated fair value and is expected to see moderate earnings growth of 5.68% annually; however, it maintains a high net debt-to-equity ratio (49.9%), suggesting elevated leverage concerns.

- Click here to discover the nuances of Dr. Martens with our detailed analytical financial health report.

- Explore Dr. Martens' analyst forecasts in our growth report.

Watches of Switzerland Group (LSE:WOSG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Watches of Switzerland Group PLC is a retailer specializing in luxury watches and jewelry across the United Kingdom, Europe, and the United States with a market cap of £1.09 billion.

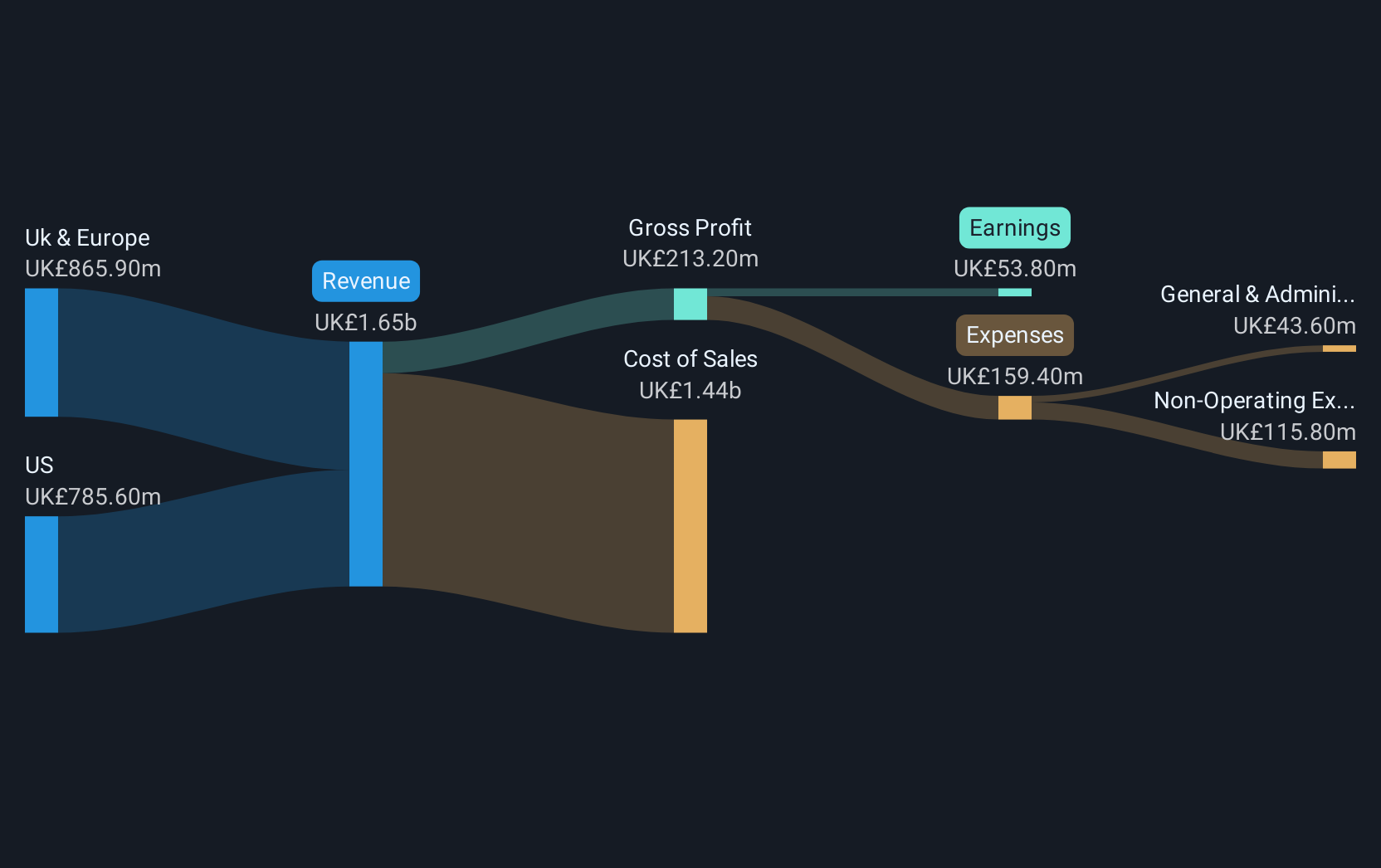

Operations: The company's revenue is derived from two main geographical segments: £691.8 million from the United States and £846.1 million from the UK and Europe.

Market Cap: £1.09B

Watches of Switzerland Group, with a market cap of £1.09 billion, trades at 47% below its estimated fair value, presenting potential undervaluation. Despite significant profit growth over the past five years, recent earnings have declined by 51.4%, impacting profit margins which dropped to 3.8% from last year's 7.9%. The company has reduced its debt-to-equity ratio significantly and now holds more cash than total debt, indicating improved financial health. Short-term assets exceed both short and long-term liabilities, ensuring coverage of obligations. Earnings are forecasted to grow annually by 20.48%, though recent volatility remains high compared to peers.

- Unlock comprehensive insights into our analysis of Watches of Switzerland Group stock in this financial health report.

- Gain insights into Watches of Switzerland Group's outlook and expected performance with our report on the company's earnings estimates.

Next Steps

- Discover the full array of 472 UK Penny Stocks right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:RWS

RWS Holdings

Provides technology-enabled language, content, and intellectual property (IP) services in the United Kingdom, Continental Europe, the United States, and internationally.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives