- United Kingdom

- /

- Luxury

- /

- LSE:DOCS

RWS Holdings And 2 More UK Penny Stocks With Promising Potential

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 index experiencing declines amid weak trade data from China, highlighting global economic uncertainties. Despite these broader market pressures, there remains potential in specific investment areas like penny stocks. Though often associated with speculative trading, penny stocks can still present valuable opportunities when backed by solid financials and growth potential.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.225 | £838.3M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.205 | £418.21M | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £3.59 | £68.47M | ★★★★☆☆ |

| Serabi Gold (AIM:SRB) | £0.89 | £67.4M | ★★★★★★ |

| Supreme (AIM:SUP) | £1.74 | £202.9M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.2525 | £106.89M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.284 | £198.03M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.325 | £168.74M | ★★★★★☆ |

| Impax Asset Management Group (AIM:IPX) | £3.335 | £426.76M | ★★★★★★ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.40 | $232.53M | ★★★★★★ |

Click here to see the full list of 464 stocks from our UK Penny Stocks screener.

Let's review some notable picks from our screened stocks.

RWS Holdings (AIM:RWS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: RWS Holdings plc offers technology-enabled language, content, and intellectual property services with a market cap of £554.51 million.

Operations: The company's revenue is derived from four primary segments: IP Services (£105.1 million), Language Services (£325.4 million), Regulated Industry (£149.4 million), and Language & Content Technology (£137.9 million).

Market Cap: £554.51M

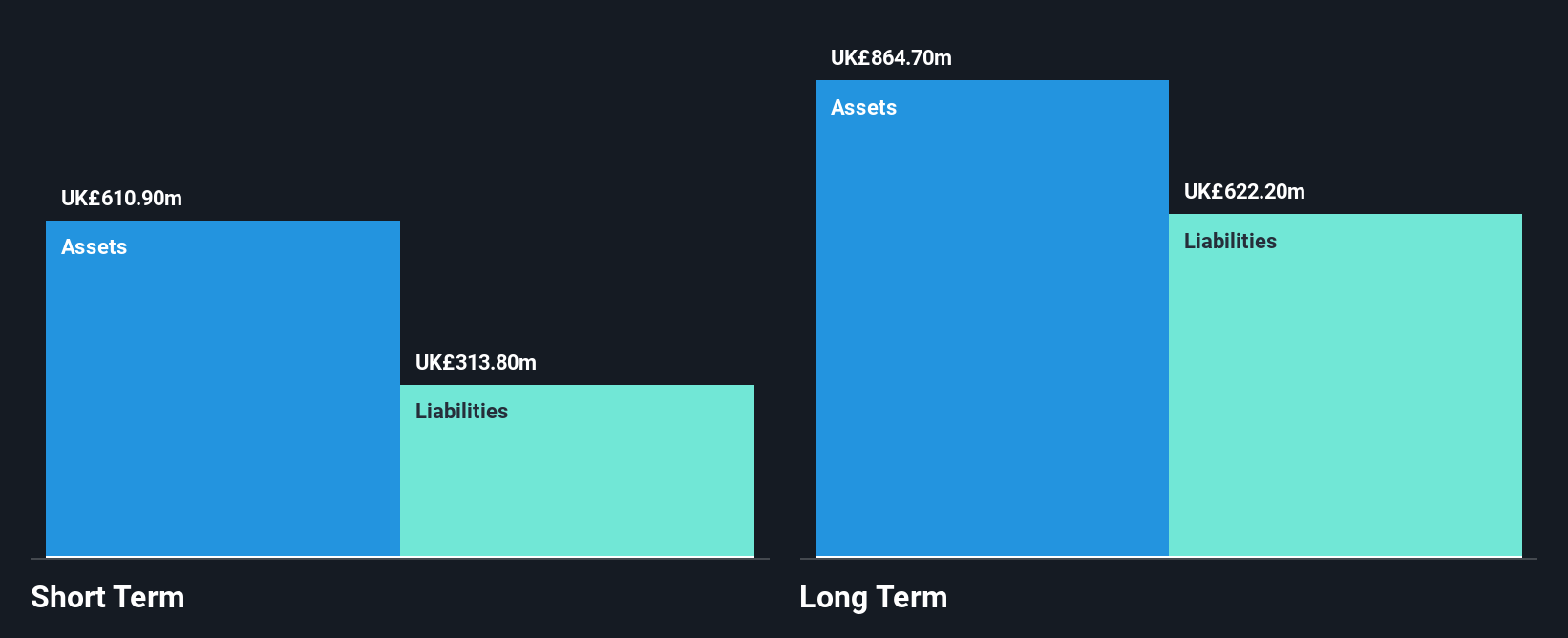

RWS Holdings plc, with a market cap of £554.51 million, is navigating challenges as it remains unprofitable and has seen losses increase by 22% annually over the past five years. Despite this, its short-term assets comfortably exceed both its long-term and short-term liabilities. The company’s debt is well covered by operating cash flow, and interest payments are manageable with EBIT coverage at 16.8 times. Recent executive changes aim to bolster strategic growth in AI solutions for regulated industries. Analysts project a significant potential upside in stock price, although share price volatility remains high compared to UK peers.

- Click here and access our complete financial health analysis report to understand the dynamics of RWS Holdings.

- Assess RWS Holdings' future earnings estimates with our detailed growth reports.

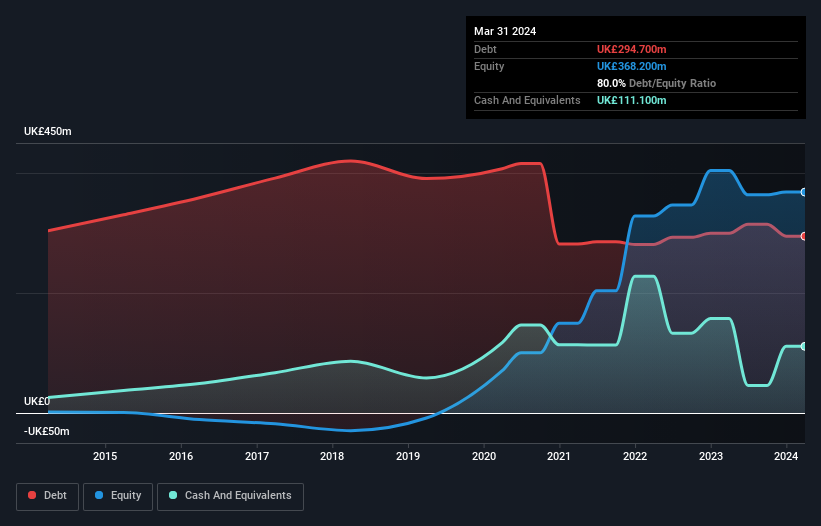

Dr. Martens (LSE:DOCS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Dr. Martens plc designs, develops, procures, markets, sells, and distributes footwear under the Dr. Martens brand and has a market cap of approximately £577.37 million.

Operations: The company generates revenue primarily from its footwear segment, which amounted to £877.1 million.

Market Cap: £577.37M

Dr. Martens plc, with a market cap of £577.37 million, faces challenges as its earnings growth has been negative over the past year and profit margins have declined to 7.9% from 12.9%. Despite this, the company shows financial resilience with short-term assets exceeding both short and long-term liabilities, and debt well covered by operating cash flow at 57%. The stock trades below its estimated fair value by 35.9%, suggesting potential undervaluation compared to peers. While analysts anticipate a price increase of nearly 26%, high volatility persists in the share price over recent months.

- Get an in-depth perspective on Dr. Martens' performance by reading our balance sheet health report here.

- Evaluate Dr. Martens' prospects by accessing our earnings growth report.

Watches of Switzerland Group (LSE:WOSG)

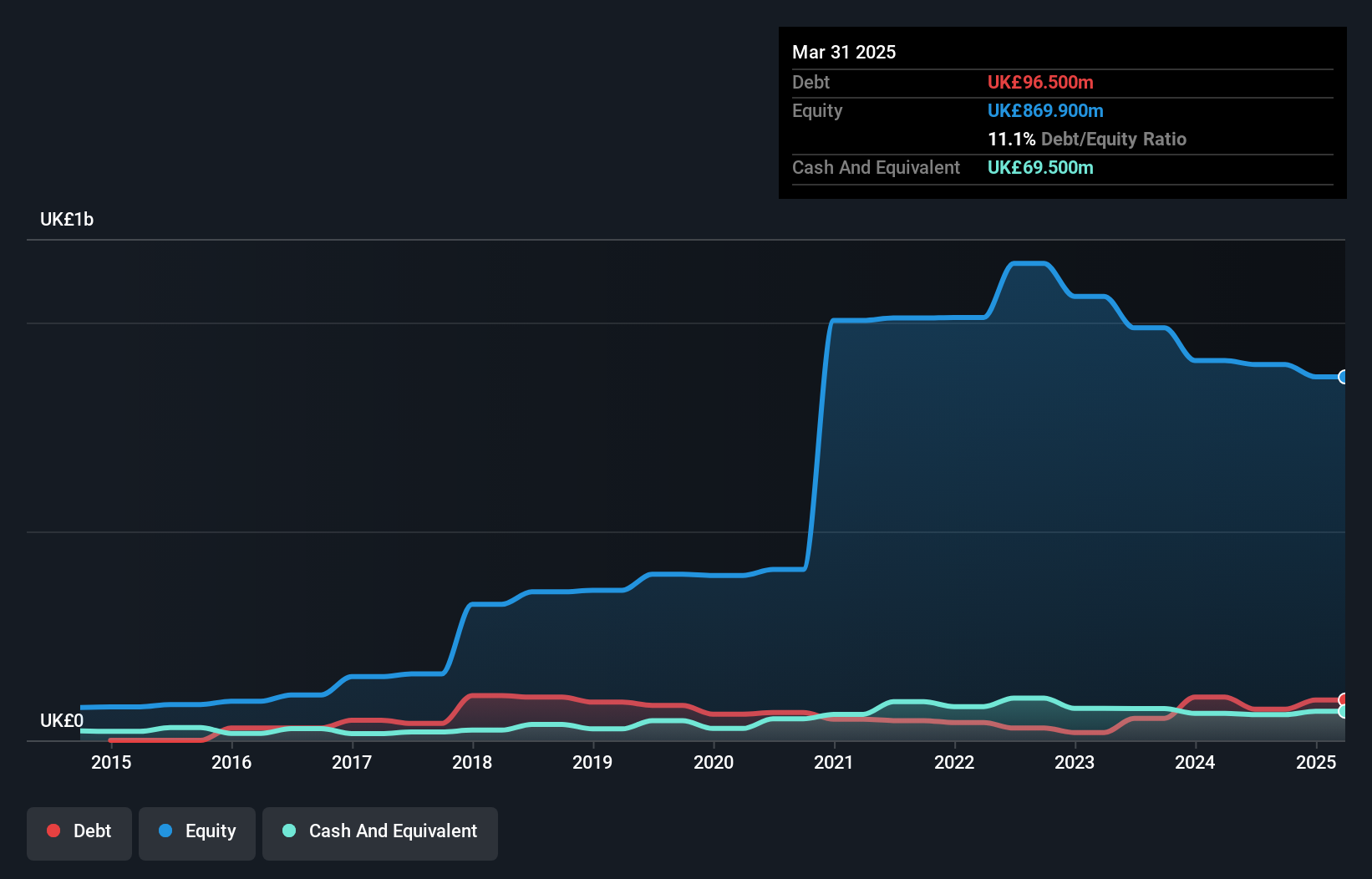

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Watches of Switzerland Group PLC is a retailer specializing in luxury watches and jewelry across the United Kingdom, Europe, and the United States, with a market cap of £1.13 billion.

Operations: The company's revenue is derived from two primary segments: £691.8 million from the US and £846.1 million from the UK & Europe.

Market Cap: £1.13B

Watches of Switzerland Group, with a market cap of £1.13 billion, faces mixed financial signals. Despite significant earnings growth over five years, recent performance shows negative earnings growth and reduced profit margins at 3.8%, down from 7.9%. The company benefits from strong liquidity, with short-term assets exceeding liabilities and debt well covered by operating cash flow at 168.8%. Its debt level has improved significantly over the past five years. Trading at nearly half its estimated fair value indicates potential undervaluation, though a large one-off loss of £33.2 million has impacted recent results, adding caution to its outlook.

- Click to explore a detailed breakdown of our findings in Watches of Switzerland Group's financial health report.

- Understand Watches of Switzerland Group's earnings outlook by examining our growth report.

Next Steps

- Access the full spectrum of 464 UK Penny Stocks by clicking on this link.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:DOCS

Dr. Martens

Designs, develops, procures, markets, sells, and distributes footwear under the Dr.

Reasonable growth potential with adequate balance sheet.