- United Kingdom

- /

- Insurance

- /

- LSE:CRE

October 2025's Promising UK Penny Stocks

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 recently experienced a downturn, influenced by weak trade data from China, which has impacted companies heavily tied to the Chinese market. Despite these broader market challenges, investors often find potential in penny stocks—an investment area that remains relevant for those seeking growth opportunities in smaller or newer companies. By focusing on penny stocks with strong financial health and growth potential, investors can uncover opportunities that might offer both stability and upside in uncertain times.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.695 | £525.64M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.20 | £177.73M | ✅ 4 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £0.74 | £11.17M | ✅ 2 ⚠️ 2 View Analysis > |

| Northern Bear (AIM:NTBR) | £1.08 | £14.86M | ✅ 4 ⚠️ 2 View Analysis > |

| System1 Group (AIM:SYS1) | £2.40 | £30.45M | ✅ 3 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.55 | $319.73M | ✅ 4 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.50 | £256.58M | ✅ 4 ⚠️ 1 View Analysis > |

| Spectra Systems (AIM:SPSY) | £1.51 | £72.93M | ✅ 3 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.10 | £175.56M | ✅ 4 ⚠️ 2 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.785 | £10.81M | ✅ 3 ⚠️ 4 View Analysis > |

Click here to see the full list of 295 stocks from our UK Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

RWS Holdings (AIM:RWS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: RWS Holdings plc offers technology-enabled language, content, and intellectual property services globally, with a market capitalization of £340.19 million.

Operations: The company's revenue is derived from four segments: IP Services (£98.2 million), Language Services (£329 million), Regulated Industries (£140.3 million), and Language & Content Technology (£144.7 million).

Market Cap: £340.19M

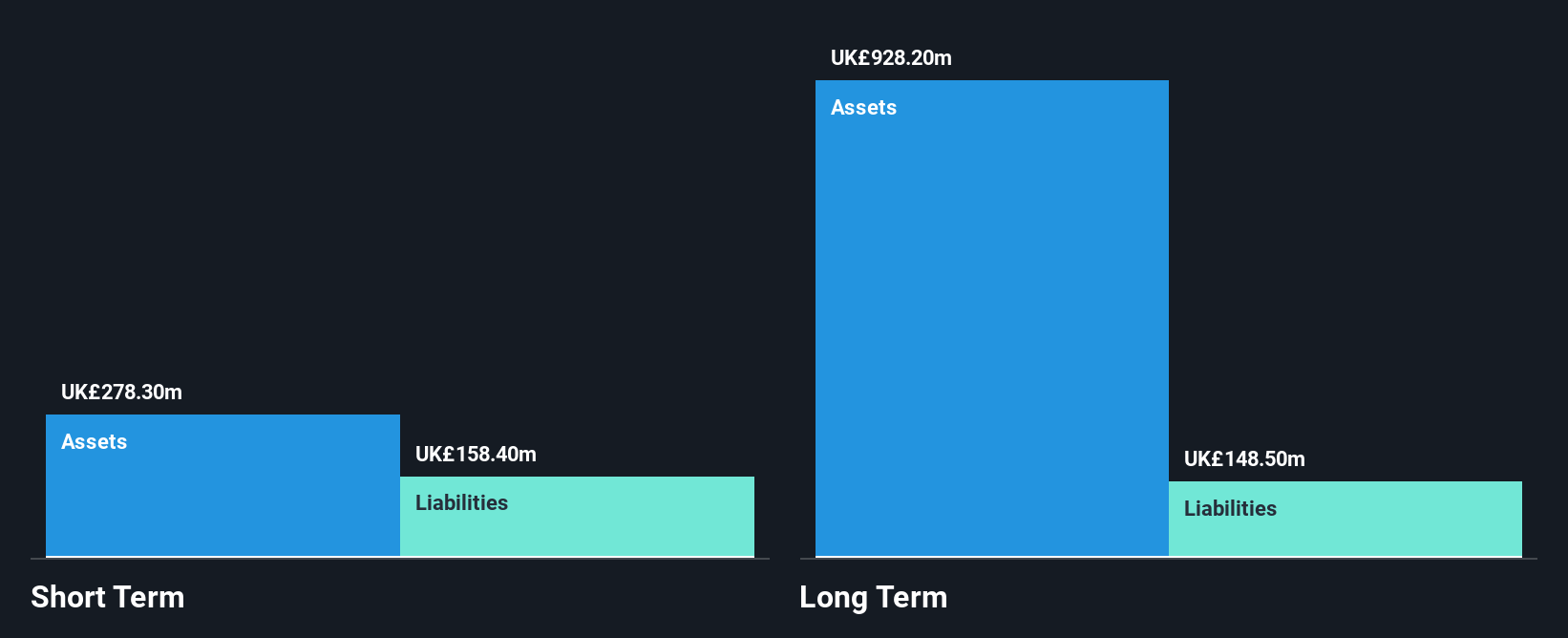

RWS Holdings plc, with a market cap of £340.19 million, has recently become profitable, though it faced a significant one-off loss impacting its latest financial results. The company trades at 75.2% below its estimated fair value and is considered to have good relative value compared to peers. Its short-term assets exceed both short and long-term liabilities, indicating solid liquidity management. Debt levels are satisfactory with interest well covered by EBIT. Despite a low return on equity of 2.9%, the company's earnings are forecasted to grow significantly at 27.72% annually, supported by strategic investments in AI-powered media localization under new leadership appointments in Los Angeles.

- Unlock comprehensive insights into our analysis of RWS Holdings stock in this financial health report.

- Understand RWS Holdings' earnings outlook by examining our growth report.

Auction Technology Group (LSE:ATG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Auction Technology Group plc operates online auction marketplaces across the United Kingdom, North America, and Germany with a market cap of £373.11 million.

Operations: The company's revenue is primarily derived from its Auction Services segment, generating $8.04 million, and its Arts and Antiques (A&A) and Industrial and Commercial (I&C) segments, contributing $91.86 million and $73.58 million respectively.

Market Cap: £373.11M

Auction Technology Group plc, with a market cap of £373.11 million, has demonstrated strong financial health by achieving profitability and maintaining satisfactory debt levels, evidenced by a net debt to equity ratio of 15.7%. The company's earnings have grown significantly over the past year at 90%, outpacing the industry average. Despite high quality earnings and stable weekly volatility at 8%, its short-term assets cover only short-term liabilities, not long-term ones. Recently dropped from several FTSE indices, it remains undervalued trading at 62.2% below estimated fair value while revenue is forecasted to grow annually by 17.46%.

- Click here to discover the nuances of Auction Technology Group with our detailed analytical financial health report.

- Evaluate Auction Technology Group's prospects by accessing our earnings growth report.

Conduit Holdings (LSE:CRE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Conduit Holdings Limited, with a market cap of £552.39 million, operates globally through its subsidiary by offering reinsurance products and services.

Operations: The company generates revenue through its three main segments: Property ($343.4 million), Casualty ($184.7 million), and Specialty ($166.6 million).

Market Cap: £552.39M

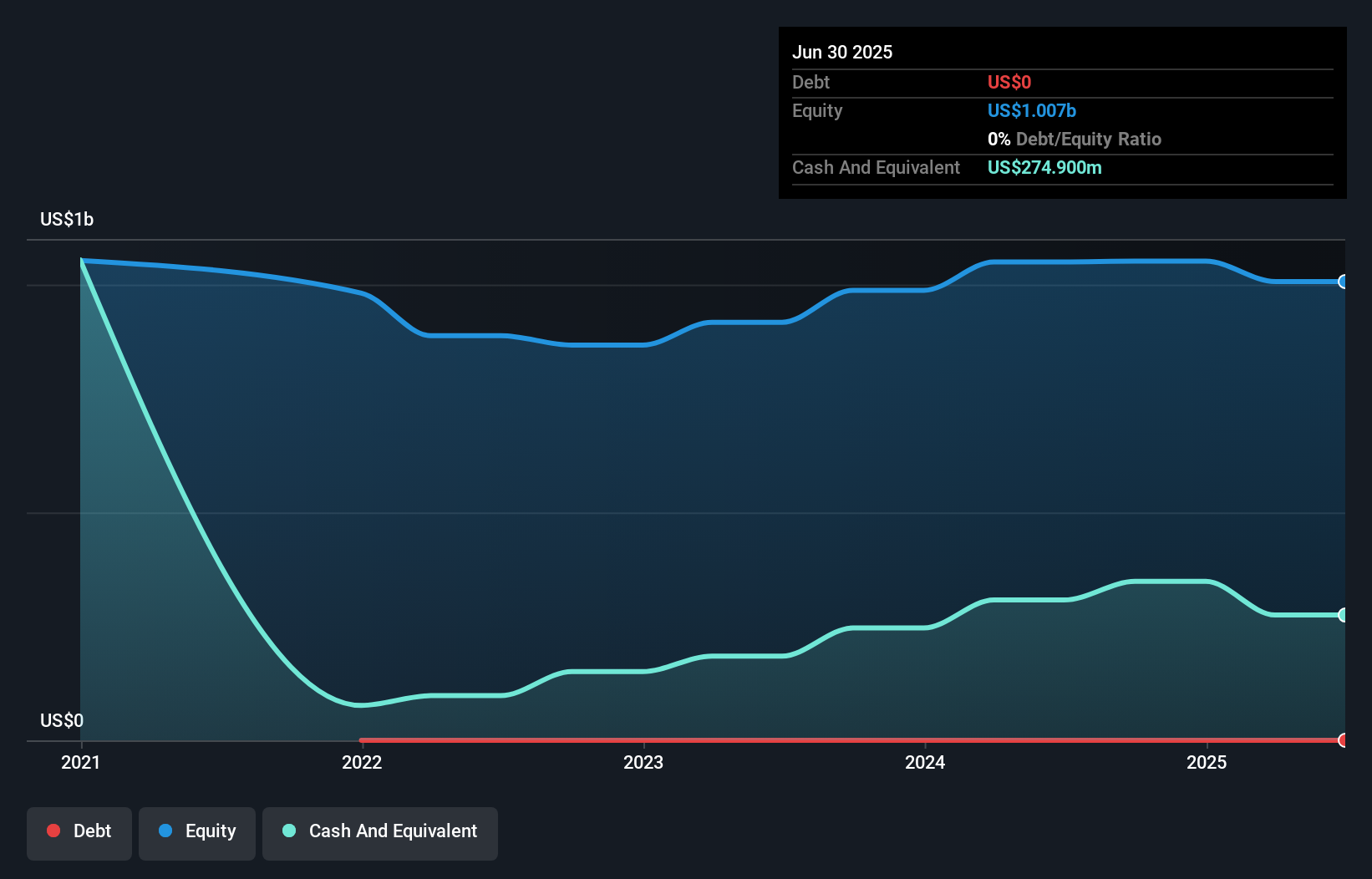

Conduit Holdings Limited, with a market cap of £552.39 million, faces challenges despite being debt-free and having an experienced board. The company reported a net loss of US$13.5 million for the half year ended June 30, 2025, contrasting with last year's net income of US$98.1 million. Its interim dividend of $0.18 per share raises concerns about sustainability given its low return on equity (1.4%) and negative earnings growth over the past year (-93.3%). Investor activism has emerged as Richard Bernstein pushes for a potential sale to improve shareholder value amidst volatile share prices and undervaluation concerns.

- Click here and access our complete financial health analysis report to understand the dynamics of Conduit Holdings.

- Learn about Conduit Holdings' future growth trajectory here.

Seize The Opportunity

- Dive into all 295 of the UK Penny Stocks we have identified here.

- Searching for a Fresh Perspective? The end of cancer? These 27 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:CRE

Conduit Holdings

Through its subsidiary, provides reinsurance products and services worldwide.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives