- United Kingdom

- /

- Metals and Mining

- /

- LSE:CGS

3 UK Penny Stocks With Market Caps Under £600M

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weaker trade data from China, highlighting global economic interdependencies. In such a climate, investors often seek opportunities in smaller or newer companies that are perceived as undervalued yet possess strong financial underpinnings. Penny stocks, despite their somewhat outdated moniker, continue to attract attention for their potential to offer affordability and growth when backed by robust financial health.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Polar Capital Holdings (AIM:POLR) | £4.995 | £481.5M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.79 | £431.2M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.934 | £148.85M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.195 | £827.11M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.24 | £159.81M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £4.43 | £84.49M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £3.195 | £317.76M | ★★★★☆☆ |

| Van Elle Holdings (AIM:VANL) | £0.38 | £41.12M | ★★★★★★ |

| QinetiQ Group (LSE:QQ.) | £3.61 | £2.01B | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.435 | £182.75M | ★★★★★☆ |

Click here to see the full list of 446 stocks from our UK Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Made Tech Group (AIM:MTEC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Made Tech Group Plc offers digital, data, and technology services to the UK public sector and has a market cap of £45.62 million.

Operations: Made Tech Group Plc has not reported any specific revenue segments.

Market Cap: £45.62M

Made Tech Group Plc, with a market cap of £45.62 million, has shown positive momentum in its recent financial performance. For the half year ended November 2024, the company reported sales of £21.75 million and achieved a net income of £0.235 million, reversing from a net loss the previous year. Despite being unprofitable over past years with earnings declining by 39.2% annually, Made Tech maintains more cash than debt and has a stable cash runway exceeding three years due to positive free cash flow trends. Recent board changes include Stephen Lake's appointment as an independent Non-Executive Director, bringing extensive digital sector experience to support growth strategies.

- Get an in-depth perspective on Made Tech Group's performance by reading our balance sheet health report here.

- Learn about Made Tech Group's future growth trajectory here.

RWS Holdings (AIM:RWS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: RWS Holdings plc offers technology-enabled language, content, and intellectual property services across the UK, Continental Europe, the US, and internationally with a market cap of £511.03 million.

Operations: The company generates revenue from four main segments: IP Services (£102.3 million), Language Services (£327.1 million), Regulated Industry (£146.5 million), and Language & Content Technology (£142.3 million).

Market Cap: £511.03M

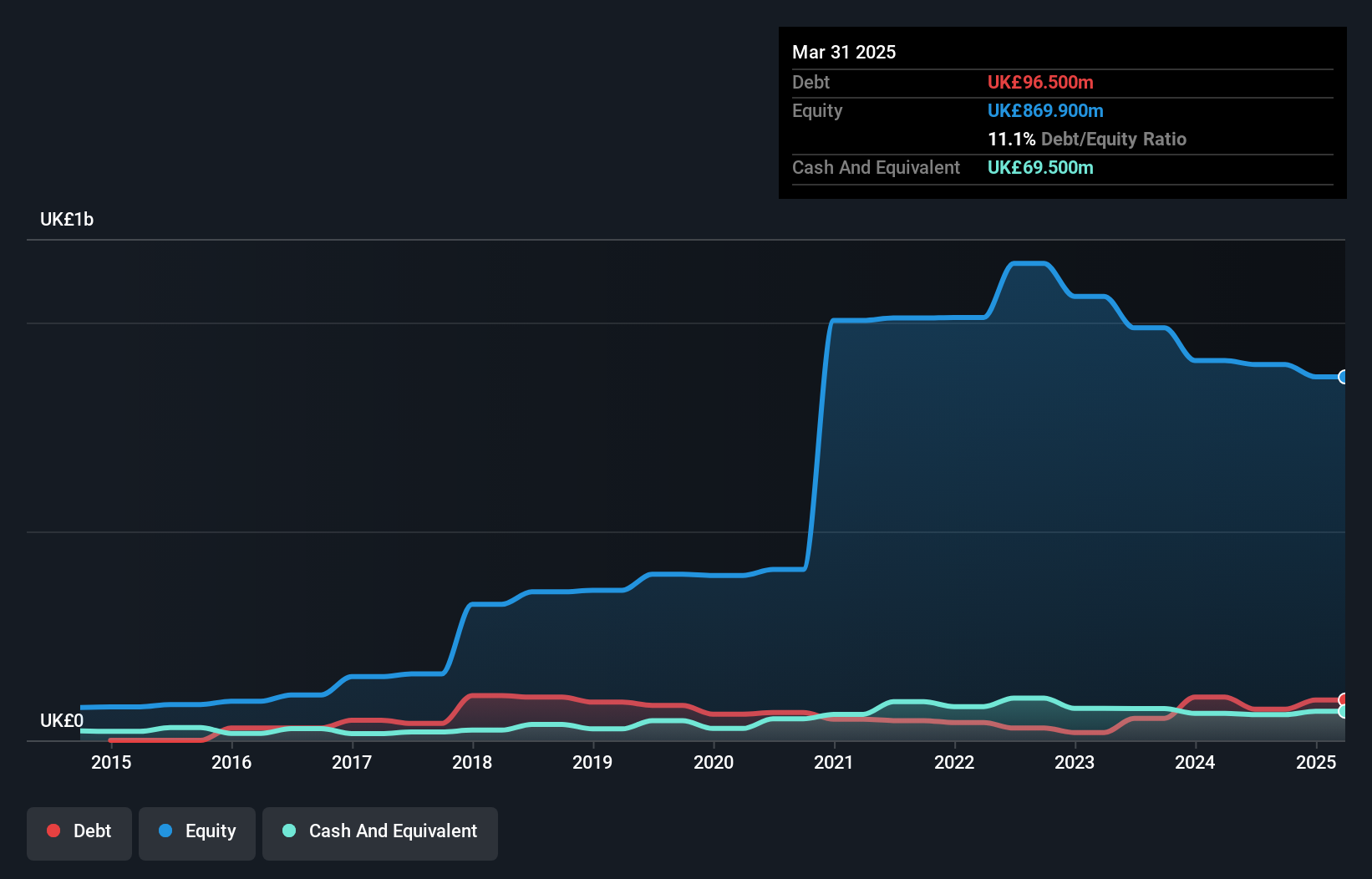

RWS Holdings, with a market cap of £511.03 million, has transitioned to profitability over the past year, reporting sales of £718.2 million and net income of £47.5 million for the year ending September 2024. The company operates across four revenue-generating segments and recently enhanced its Tridion Sites platform with new features to strengthen digital content management capabilities. Despite a large one-off loss affecting recent results, RWS's debt levels have decreased significantly, and short-term assets exceed liabilities comfortably. However, its dividend yield is not well covered by earnings or free cash flow, indicating potential sustainability concerns.

- Take a closer look at RWS Holdings' potential here in our financial health report.

- Gain insights into RWS Holdings' future direction by reviewing our growth report.

Castings (LSE:CGS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Castings P.L.C. is involved in iron casting and machining operations across the UK, Europe, the Americas, and internationally, with a market cap of £122.12 million.

Operations: The company generates revenue through its Foundry Operations, which contribute £225.67 million, and Machining Operations, adding £35.57 million.

Market Cap: £122.12M

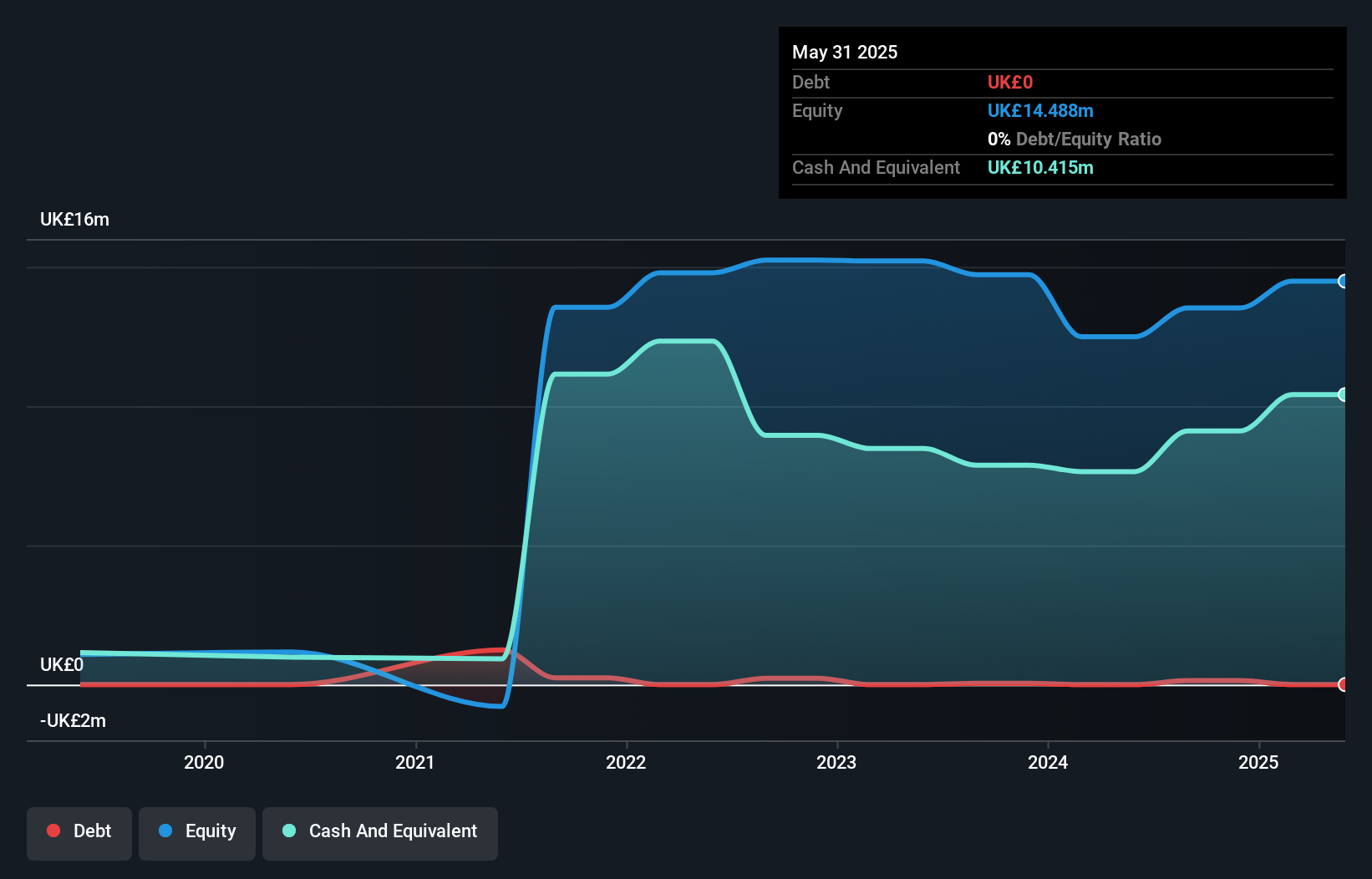

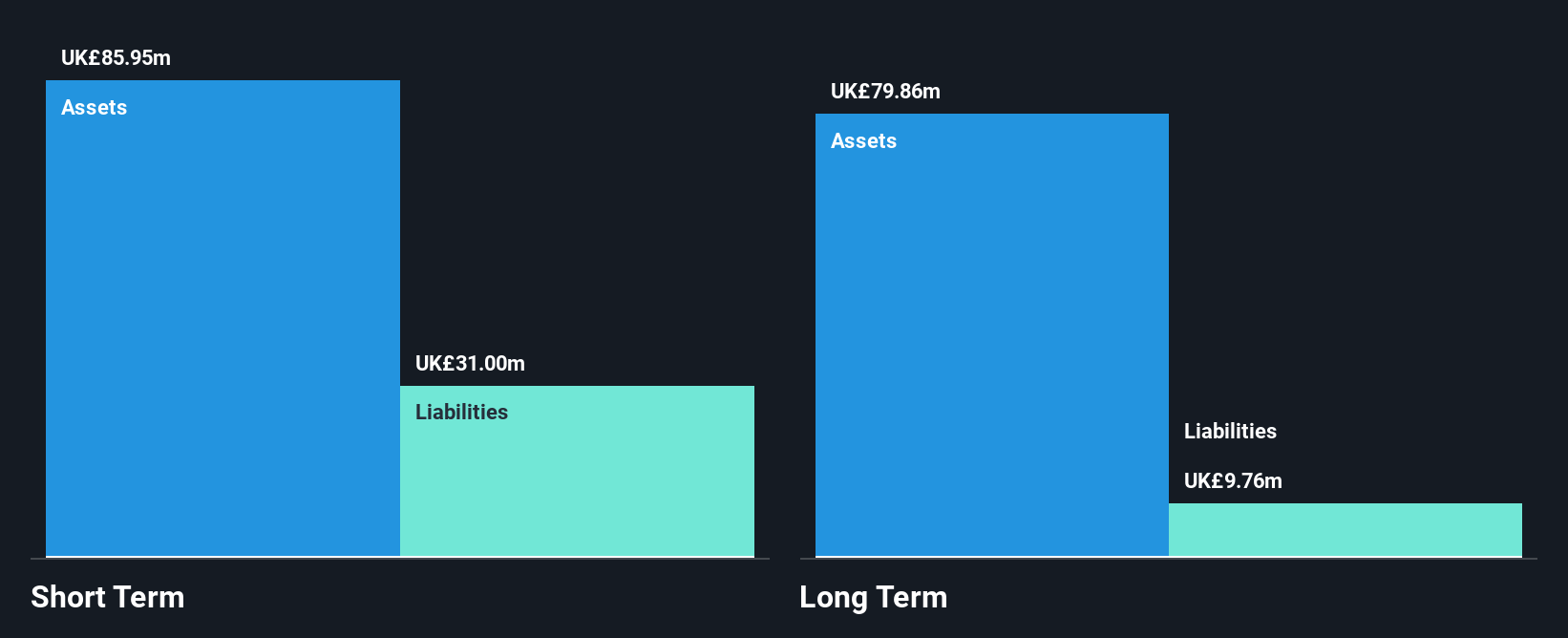

Castings P.L.C., with a market cap of £122.12 million, operates debt-free and has not diluted shareholders recently. The company reported half-year sales of £89.18 million, down from the previous year's £111.33 million, and net income decreased to £3.07 million from £7.69 million year-over-year, reflecting a challenging period for earnings growth which declined by 21.6%. Despite this, Castings announced an increased interim dividend of 4.21 pence per share amid concerns over dividend sustainability due to insufficient free cash flow coverage and low return on equity at 9.5%. The company's short-term assets exceed both its long-term liabilities and short-term liabilities significantly.

- Dive into the specifics of Castings here with our thorough balance sheet health report.

- Evaluate Castings' prospects by accessing our earnings growth report.

Turning Ideas Into Actions

- Get an in-depth perspective on all 446 UK Penny Stocks by using our screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:CGS

Castings

Engages in the iron casting and machining activities in the United Kingdom, Germany, Sweden, the Netherlands, rest of Europe, North and South America, and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives