- United Kingdom

- /

- Capital Markets

- /

- AIM:MTW

3 UK Growth Companies With Up To 24% Insider Ownership

Reviewed by Simply Wall St

As the UK market braces for key economic updates, including inflation data and the Bank of England's monetary policy meeting, investors are closely monitoring indicators that could sway market directions. Amidst these conditions, growth companies with high insider ownership in the UK present a unique appeal, as substantial insider stakes often signal confidence in the company’s future prospects from those who know it best.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Plant Health Care (AIM:PHC) | 26.4% | 121.3% |

| Petrofac (LSE:PFC) | 16.6% | 124.5% |

| Getech Group (AIM:GTC) | 17.3% | 86.1% |

| Gulf Keystone Petroleum (LSE:GKP) | 10.7% | 47.6% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 26.7% | 25.5% |

| Foresight Group Holdings (LSE:FSG) | 31.7% | 30.9% |

| Velocity Composites (AIM:VEL) | 28.5% | 143.4% |

| TEAM (AIM:TEAM) | 25.8% | 58.6% |

| Afentra (AIM:AET) | 38.3% | 64.4% |

| Mothercare (AIM:MTC) | 15.1% | 41.2% |

We're going to check out a few of the best picks from our screener tool.

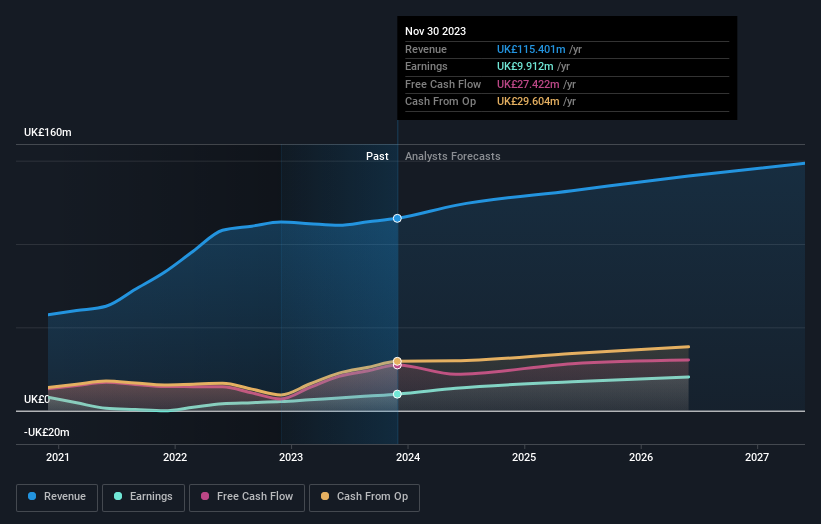

Mattioli Woods (AIM:MTW)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Mattioli Woods plc, a company based in the United Kingdom, specializes in wealth management and employee benefit services, with a market capitalization of approximately £411.54 million.

Operations: The company generates revenue through diverse segments, including Employee Benefits (£7.08 million), Property Management (£6.23 million), Investment and Asset Management (£53.14 million), Private Equity Asset Management (£22.94 million), and Pension Consultancy and Administration (£26.02 million).

Insider Ownership: 13%

Mattioli Woods, a UK-based company, demonstrates robust growth prospects with its earnings expected to increase by 26.7% annually over the next three years, outpacing the UK market's forecast of 13.1%. Despite high insider ownership ensuring aligned interests with shareholders, challenges persist as its dividend coverage is weak. Additionally, while revenue growth at 6.3% per year surpasses the broader UK market average of 3.6%, it remains below the high-growth benchmark of 20% per year.

- Click here to discover the nuances of Mattioli Woods with our detailed analytical future growth report.

- Upon reviewing our latest valuation report, Mattioli Woods' share price might be too optimistic.

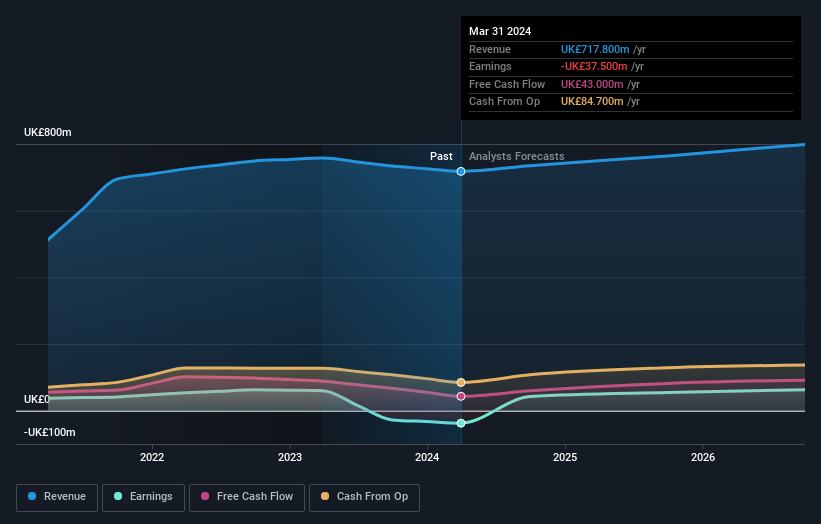

RWS Holdings (AIM:RWS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: RWS Holdings plc specializes in technology-enabled language, content, and intellectual property services with a market capitalization of approximately £0.72 billion.

Operations: The company generates revenue through various segments, including IP Services (£105.10 million), Language Services (£325.40 million), Regulated Industry (£149.40 million), and Language & Content Technology (L&CT) (£137.90 million).

Insider Ownership: 24.6%

RWS Holdings, a UK-based company, reported a decline in half-year sales to £350.3 million and net income to £11.1 million, reflecting challenges despite launching HAI, an innovative AI-powered translation platform aimed at enhancing global market access. The firm's revenue growth forecast of 4.2% annually exceeds the UK market average but remains modest compared to high-growth companies. Notably, RWS maintains a dividend increase amidst these conditions, signaling confidence in its financial health and future prospects.

- Delve into the full analysis future growth report here for a deeper understanding of RWS Holdings.

- Insights from our recent valuation report point to the potential undervaluation of RWS Holdings shares in the market.

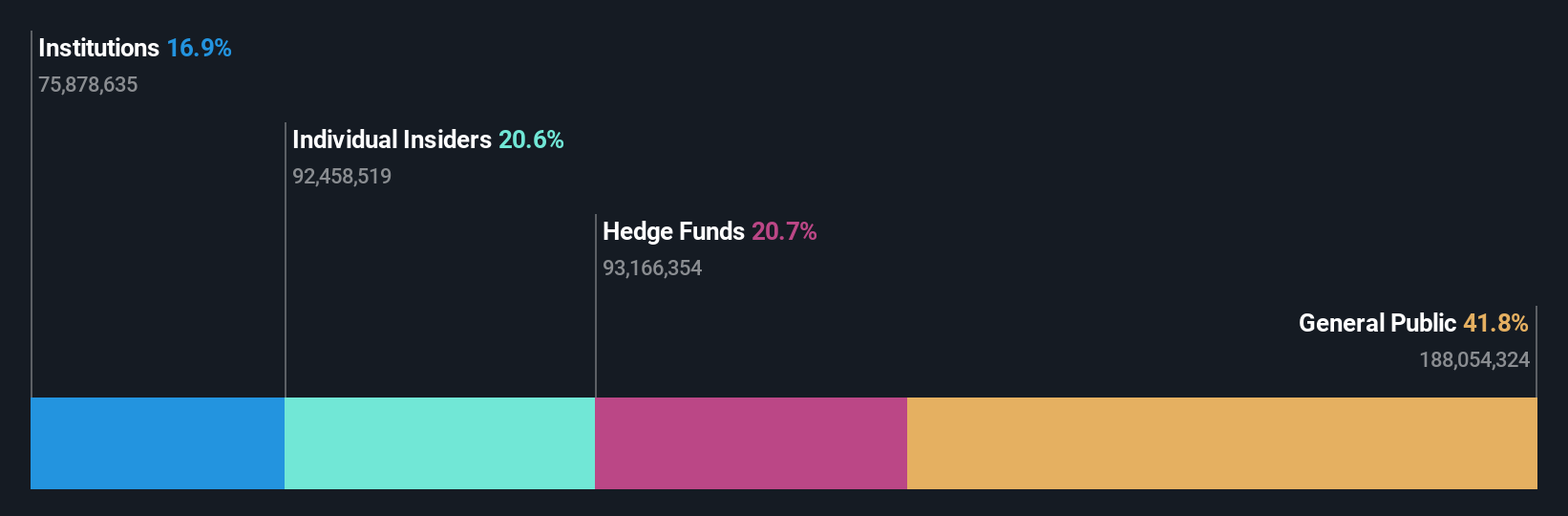

Evoke (LSE:EVOK)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Evoke plc operates an online betting and gaming business across the UK, Ireland, Italy, Spain, and other international markets with a market capitalization of approximately £373.91 million.

Operations: The company generates revenue through three primary segments: Retail (£535 million), UK&I Online (£658.50 million), and International (£517.40 million).

Insider Ownership: 20.1%

Evoke plc, recently rebranded from 888 Holdings, is poised for a turnaround with expected profitability within three years and a revenue growth forecast of 5% annually, outpacing the UK market's 3.6%. Despite challenges in covering interest payments with earnings, the company has maintained stable insider ownership and no substantial insider selling over the past three months. Recent strategic moves include a £400 million senior secured bond issue and leadership enhancements at their AGM to bolster governance and market position.

- Dive into the specifics of Evoke here with our thorough growth forecast report.

- In light of our recent valuation report, it seems possible that Evoke is trading behind its estimated value.

Summing It All Up

- Reveal the 65 hidden gems among our Fast Growing UK Companies With High Insider Ownership screener with a single click here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:MTW

Mattioli Woods

Provides wealth management and employee benefit services in the United Kingdom.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives