- United Kingdom

- /

- Professional Services

- /

- AIM:RBGP

A Piece Of The Puzzle Missing From RBG Holdings plc's (LON:RBGP) Share Price

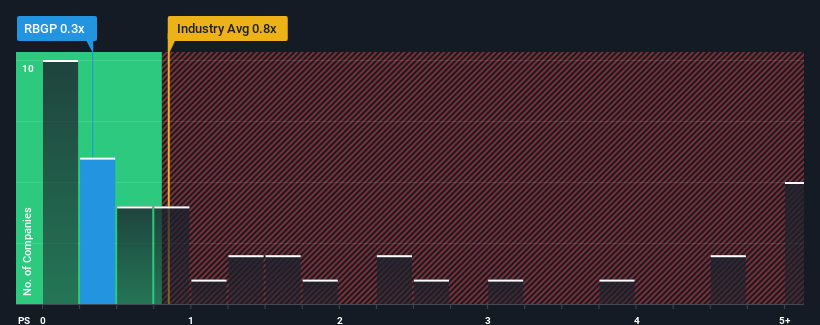

RBG Holdings plc's (LON:RBGP) price-to-sales (or "P/S") ratio of 0.3x might make it look like a buy right now compared to the Professional Services industry in the United Kingdom, where around half of the companies have P/S ratios above 0.8x and even P/S above 3x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for RBG Holdings

How RBG Holdings Has Been Performing

RBG Holdings could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on RBG Holdings.Do Revenue Forecasts Match The Low P/S Ratio?

RBG Holdings' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 24%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 63% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 15% as estimated by the only analyst watching the company. With the industry only predicted to deliver 6.0%, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that RBG Holdings' P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Bottom Line On RBG Holdings' P/S

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

A look at RBG Holdings' revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

Before you settle on your opinion, we've discovered 5 warning signs for RBG Holdings (2 are potentially serious!) that you should be aware of.

If you're unsure about the strength of RBG Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:RBGP

RBG Holdings

Provides legal and professional services to companies, banks, entrepreneurs, and individuals in the United Kingdom, Europe, North America, and internationally.

Undervalued moderate.

Market Insights

Community Narratives